- Home

- »

- Medical Devices

- »

-

U.S. Health Sensors Market Size, Industry Report, 2030GVR Report cover

![U.S. Health Sensors Market Size, Share & Trends Report]()

U.S. Health Sensors Market Size, Share & Trends Analysis Report By Product (Hand Held Diagnostic Sensors, Wearable Sensors), By Application (Chronic Illness & At-risk Monitoring, Wellness Monitoring), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-285-8

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Health Sensors Market Size & Trends

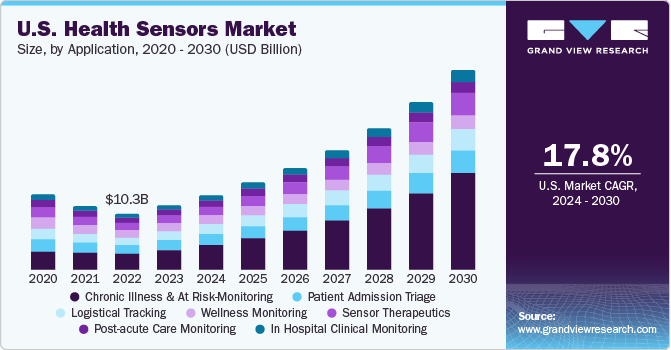

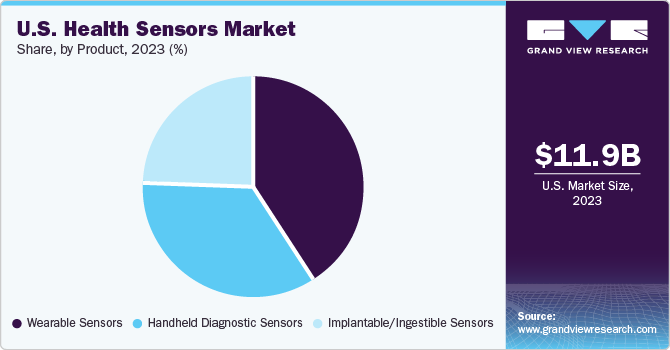

The U.S. health sensors market size was estimated at USD 11.87 billion in 2023 and is projected to grow at a CAGR of 17.8% from 2024 to 2030.The rise of chronic diseases in the U.S. is driving the demand for health sensors in the market. As per the data from Centers for Disease Control and Prevention (CDC), heart disease, cancer, and diabetes are among the most common causes of death and disability in the country. These chronic conditions need continuous monitoring and management, leading to an increased demand for health sensors.

The growing geriatric population in the U.S. is another driver of the market. The elderly population is more susceptible to chronic diseases, disabilities, and other health conditions that require continuous monitoring. As a result, there is a growing demand for health sensors that can monitor vital signs, track medication intake, and detect falls or other emergencies. The growth of the market is also being driven by the growing awareness of health and wellness among consumers. According to the Population Reference Bureau projections for 2050, the number of Americans aged 65 and older is expected to increase significantly from 58 million in 2022 to 82 million, marking a 47% rise and resulting in this demographic constituting 23% of the total population, up from 17%. This shift reflects the aging pattern in the U.S., demonstrated by the median age rising from 30.0 to 38.9 between 1980 and 2022, with around one-third of states having a median age surpassing 40 in 2022, particularly led by Maine (44.8) and New Hampshire (43.3).

Government initiatives and regulations are also driving the demand for health sensors. The Affordable Care Act (ACA) has incentivized healthcare providers to adopt remote patient monitoring systems that can improve patient outcomes and reduce healthcare costs. Moreover, the Food and Drug Administration (FDA) has established regulatory guidelines for health sensors that ensure their safety and effectiveness. These initiatives have created afavorable environment for the growth of the market.

Market Concentration & Characteristics

The industry stage growth is high and the pace of the industry growth is high. The health sensors market in the U.S. is characterized by a high degree of innovation owing to the continuous advancements in technology, coupled with the increasing demand for more efficient and accurate health monitoring solutions. Medtronic’s MiniMed 670G System is a prime example of innovation in the market. This HCL system automatically adjusts insulin delivery based on glucose levels, providing greater freedom and flexibility for people with type 1 diabetes.

The level of mergers & acquisitions (M&A) activity in the industry is moderate owing to the technological advancements and the need for companies to gain a competitive edge. For instance, in August 2023, TracPatch Health, LLC acquired assets from TracPatch Health, Inc., with debt restructuring assistance from Granger Capital. Under new ownership, they continue to offer innovative surface-sensor remote patient monitoring devices for musculoskeletal health, enabling surgeons to remotely monitor recovery progress and facilitate evidence-based medicine through continuous communication between patients and healthcare providers.

The impact of regulations in the industry is moderate. The industry is constantly adapting to the evolving regulatory landscape and finding ways to streamline the regulatory process while upholding the safety standards. The enforcement of rigorous regulations by the Medical Device Regulation (MDR) 2017/745 aims to introduce stricter requirements for the placement and distribution of medical devices to enhance clinical safety and improve traceability. This regulation mirrors the regulatory framework in the U.S. overseen by the FDA.

The industry exhibits a high concentration of end users, primarily driven by the diverse needs and preferences of the healthcare providers such as hospitals, clinics, and diagnostic centers, as well as individuals who use wearable health devices for personal health monitoring. For instance, in June 2023, STAT Health Informatics, Inc. launched a 24/7 in-ear wearable device to improve general wellness. This innovative product measures blood flow to the head, assisting in understanding physiological changes upon standing. It addresses symptoms such as brain fog, dizziness, fainting, headaches, and fatigue, commonly experienced in conditions such as Long COVID, postural orthostatic tachycardia syndrome, and myalgic encephalomyelitis/chronic fatigue syndrome, affecting over 13 million Americans.

Similarly, the surge in people's interest in monitoring and recording health-related information is a major factor expected to drive the market growth. This trend, propelled by the personal informatics movement, gained momentum with the introduction of mobile apps facilitating easy tracking of metrics like daily miles run and calories consumed. At the 2023 Google I/O developer conference, Google Health Connect and MyFitnessPal, a widely recognized app for global nutrition and fitness tracking, announced an integration that allows individuals managing Type 1 and 2 diabetes to conveniently retrieve their glucose data from certain continuous glucose monitoring (CGM) tools directly within the MyFitnessPal application.

Product Insights

Based on product, wearable sensors segment accounted for a substantial market share of 35.1% in 2023. This is attributed to several factors, including growing awareness of health and wellness, advancements in technology, integration with smartphones and other devices, increased focus on remote patient monitoring, support from healthcare providers and insurance companies. In July 2023, Biostrap USA, LLC launched the Biostrap Kairos, an innovative wearable device measuring stress resilience and offering insights into heart rate variability (HRV), complemented by the Vital Science app. Suitable for placement on either the forearm or bicep, Kairos utilizes a metal-oxide-semiconductor optical sensor for capturing raw photoplethysmography (PPG) data. It enables sprecise computation of diverse biometrics such as active and resting heart rate, respiratory rate, HRV, beat-to-beat intervals, and sleep-related parameters.

The implantable/ingestiblesensors segment is expected to grow at the fastest CAGR during the forecast period due to its ability to provide continuous and real-time monitoring of various health parameters within the body. These sensors offer numerous advantages over traditional wearable sensors, such as enhanced accuracy, reduced risk of interference or detachment, and the ability to collect data from inside the body without causing discomfort to the user.

Furthermore, implantable sensors play a crucial role in the development of innovative healthcare solutions, such as implantable devices that can deliver targeted therapies or respond autonomously to changes in a patient’s condition. For instance, Avago Technologies Ltd has been at the forefront of developing implantable sensor technologies. The AFBR-S50MV680B sensor is designed to be implanted inside the human body to monitor various physiological parameters continuously and wirelessly transmit this data to external devices for real-time monitoring and analysis.

Application Insights

Based on application, chronic illness & at risk-monitoring accounted for the largest revenue share in 2023. The rising prevalence of chronic diseases, an aging population, and a growing emphasis on preventative healthcare are propelling the demand for health sensors in monitoring chronic conditions. As per the Centers for Disease Control and Prevention (CDC), there is at least one chronic disease in every six in ten Americans, and four in ten have two or more. This highlights the necessity for continuous monitoring and management, thus driving the demand for health sensors crucial in enabling real-time health parameter tracking and early deviation detection from normal levels.

The segment is also expected to grow at the fastest CAGR in the forecast period due to technological advancements that have made these sensors more accurate, user-friendly, and cost-effective.Innovations such as wearable devices, remote monitoring systems, and IoT-enabled sensors have revolutionized the way individuals can monitor their health status outside traditional healthcare settings. These advancements have not only improved the quality of care for patients with chronic conditions but have also empowered individuals to take charge of their health through continuous monitoring.

The integration of artificial intelligence (AI) and machine learning algorithms in health sensors has also contributed to their growing popularity. AI-powered health sensors can analyze data collected from patients and provide insights into potential health issues before they become critical. AI algorithms can detect patterns in glucose levels that may indicate an increased risk of diabetes-related complications, enabling healthcare providers to intervene early and prevent adverse outcomes. For instance, one prominent example of an AI algorithm used in the U.S. for this purpose is the GlucoMe platform. GlucoMe is an AI-powered diabetes management solution that incorporates predictive analytics to detect patterns in glucose levels.

Key U.S. Health Sensors Company Insights

Some of the key companies operating in the market include, Analog devices inc, First Sensors AG, GE Healthcare, Medtronic, and others.

-

Analog Devices Inc. offers advanced sensor solutions that cater to the growing demand for innovative healthcare technologies. The company’s health sensor products are known for their accuracy, reliability, and performance, making them ideal for medical devices, fitness trackers, and other healthcare applications. The company has been at the forefront of innovation in health sensors technology, leveraging its expertise in sensor design and semiconductor manufacturing. The company’s health sensors are designed to provide precise measurements of various vital signs and biometric data, enabling healthcare professionals to monitor patients’ health status more effectively.

-

First Sensors AG has made several key advancements in developed magnetic sensors specifically for implantable medical devices, such as pacemakers and cochlear implants. These sensors offer high accuracy and resolution while consuming minimal power, which is crucial for extending the battery life of these devices.

Key U.S. Health Sensors Companies:

- Analog Devices, Inc

- Avago Technologies Ltd.

- Danaher Corporation

- First Sensors AG

- GE Healthcare

- Honeywell International Inc.

- Koninklijke Philips N.V.

- Medtronic

- OMNIVISION

- Proteus Digital Health

- Sensirion AG

- Smith’s Medical Inc. (ICU Medical)

Recent Developments

-

In November 2023, DuPont Liveo Healthcare Solutions collaborated with STMicroelectronics to develop an innovative technology solution integrating FDA-cleared advanced wearable sensors for continuous monitoring of vital signs.

-

In August 2023, Health Sensor Platform 4.0 (HSP 4.0), the latest health sensor developed by Analog Devices Inc. won the Best of Sensors award for medtech in 2023. This cutting-edge technology integrates various health sensors and devices to monitor and track an individual’s health metrics in real-time and leverages advanced sensors, data analytics, and connectivity to provide users with valuable insights into their health status and trends.

-

In August 2021, Analog Devices acquired Maxim Integrated, enhancing its position in analog semiconductors. This strategic move significantly enhanced Analog Devices’ position in the analog semiconductor market, solidifying its presence as a key player in the health sensors industry.

U.S. Health Sensors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.76 billion

Revenue forecast in 2030

USD 36.71 billion

Growth rate

CAGR of 17.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Key companies profiled

Analog Devices, Inc; Avago Technologies Ltd.; Danaher Corporation; First Sensors AG; GE Healthcare; Honeywell International Inc.; Koninklijke Philips N.V.; Medtronic; OMNIVISION; Proteus Digital Health; Sensirion AG; Smith’s Medical Inc. (ICU Medical)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Health Sensors Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. health sensors market report based on product, application, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Handheld Diagnostic Sensors

-

Chronic Illness & At Risk-Monitoring

-

Patient Admission Triage

-

Logistical Tracking

-

In Hospital Clinical Monitoring

-

Post-acute Care Monitoring

-

-

Wearable Sensors

-

Disposable Wearable Sensors

-

Non-disposable Wearable Sensors

-

Wellness Monitoring

-

Chronic Illness & At Risk-Monitoring

-

Patient Admission Triage

-

Logistical Tracking

-

In Hospital Clinical Monitoring

-

Sensor Therapeutics

-

Post-acute Care Monitoring

-

-

-

Implantable/Ingestible Sensors

-

Wellness Monitoring

-

Chronic Illness & At Risk-Monitoring

-

Patient Admission Triage

-

In Hospital Clinical Monitoring

-

Sensor Therapeutics

-

Post-acute Care Monitoring

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Illness & At Risk-Monitoring

-

Wellness Monitoring

-

Patient Admission Triage

-

Logistical Tracking

-

In Hospital Clinical Monitoring

-

Sensor Therapeutics

-

Post-acute Care Monitoring

-

Home-based

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. health sensors market size was valued at USD 11.87 billion in 2023 and is expected to reach USD 13.76 billion in 2023.

b. The U.S. health sensors market is projected to grow at a compound annual growth rate (CAGR) of 17.8% from 2024 to 2030 to reach USD 36.71 billion by 2030.

b. Based on the product, the wearable sensors segment accounted for the largest market share with around 40% in 2023 owing to several factors, including growing awareness of health and wellness, advancements in technology, integration with smartphones and other devices, increased focus on remote patient monitoring, support from healthcare providers and insurance companies.

b. Some of the key companies operating in the U.S health sensors market include Analog Devices Inc, First Sensors AG, GE Healthcare, and Medtronic, among others.

b. The rise of chronic diseases in the U.S. is driving the demand for health sensors in the market. As per the CDC, heart disease, cancer, and diabetes are among the most common causes of death and disability in the U.S. These chronic conditions need continuous monitoring and management, leading to an increased demand for health sensors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."