- Home

- »

- Beauty & Personal Care

- »

-

U.S. Hand Sanitizer Market Size, Industry Report, 2030GVR Report cover

![U.S. Hand Sanitizer Market Size, Share & Trends Report]()

U.S. Hand Sanitizer Market Size, Share & Trends Analysis Report By Product (Gel, Foam, Liquid, Spray, Wipes), By Distribution Channel (Hypermarket & Supermarket, Convenience Store), And Segment Forecast, 2024 - 2030

- Report ID: GVR-4-68040-307-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Hand Sanitizer Market Size & Trends

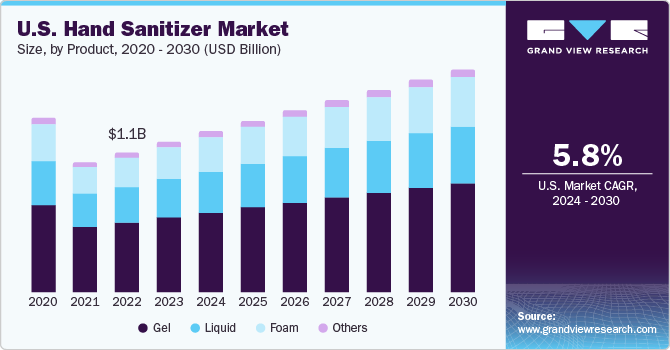

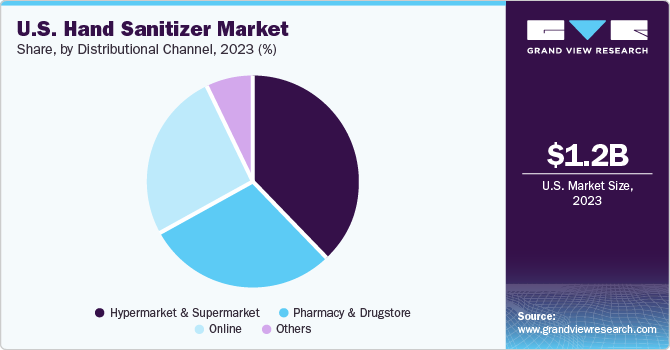

The U.S. hand sanitizer market size was estimated at USD 1.2 billion in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The growth of the U.S. market is attributed to the growing consumer awareness regarding personal hygiene and safety. The nation has witnessed several public health emergencies such as SARS, H5N1 Avian influenza, swine flu, and COVID-19.

The U.S. hand sanitizer market accounted for a share of 17.3% of the global hand sanitizer market in 2023. The U.S. comprises several market players with high penetration of different forms of hand sanitizers such as gel-based, foam-based, sprays, and wipes. The U.S. dominated the market since consumers in the country are spending more on personal care and hygiene products. Lately, the use of natural ingredients in hand sanitizers has been increasing in the country. Furthermore, due to the COVID-19 pandemic, alcohol-based hand sanitizers witnessed tremendous demand in the region.

The product demand has witnessed a surge as health organizations and governments advised people to use hand sanitizer to curb the spread of the coronavirus. Producers of sanitizers, including GOJO Industries, Inc., ramped up their production capacity in 2020 to meet the demand.

Product Insights

The gel-based hand sanitizer segment held the largest market share of 49.6% in 2023. Gel hand sanitizer is easier to carry and dispense for households. It is also a convenient on-the-go option as it is easier to squeeze the gel sanitizer from the container without dripping. Furthermore, gel slows the evaporation of alcohol and ensures that the user has time to cover their hands with hand sanitizer.

The foam-based hand sanitizer is expected to grow at a CAGR of 6.1% over the forecast period. Foam-based products are often considered economical and safe in commercial places, particularly in schools, universities, colleges, and the hospitality sector. These products easily penetrate the skin and last for a longer time. It provides the convenience of saving time with its easy application.

Distribution Channel Insights

The hypermarket & supermarket segment held the largest market share of 38.4% in 2023. These retailers witnessed significant demand during the coronavirus outbreak. For instance, H-E-B, a Texas-based grocery store chain, started restricting the sales of hand soap and hand sanitizer. Consumers were limited to four bottles each of hand sanitizer and hand soap per visit.

Sales of hand sanitizer through online channels are expected to grow at a CAGR of 6.0% over the forecast period. The major factor contributing to the growth of this segment is the rising number of companies making efforts to cater to consumer needs for a wide range of products through online channels. The availability of free home-delivery services by major brands is the key reason why consumers prefer the online channel.

Key U.S. Hand Sanitizer Company Insights

Market players are using different expansion strategies like partnerships and launching new products to stay competitive.

Key U.S. Hand Sanitizer Companies:

- Reckitt Benckiser Group plc

- Henkel AG and Company

- Unilever

- Best Sanitizers, Inc.

- Procter and Gamble

- The Himalaya Drug Company

- GOJO Industries, Inc.

- Vi-Jon

- Chattem, Inc.

- Kutol

Recent Developments

-

In March 2022, PURELL launched a new hand sanitizer Advanced Hand Sanitizer 2in1 Moisturizing Foam and Advanced Hand Sanitizer Naturals Foam and PURELL.

-

In May 2020, The Himalaya Drug Company collaborated with 82.5 Communications, Ogilvy’s India-specific creative ad agency, to raise awareness about the importance of hand hygiene and social distancing during the coronavirus pandemic. The collaborative team launched a digital film #ThePurestGreeting, which encouraged people to opt for the ancient-Indian tradition of Namaste as a form of greeting instead of shaking hands or hugging. The film also helped bring focus to Himalaya’s Pure Hands portfolio of hand sanitizers.

-

In March 2020, Henkel AG & Co. initiated a global solidarity program to aid employees, customers, and communities impacted by the ongoing pandemic. The program includes producing disinfectants at Henkel production sites and donating 2 million euros to the World Health Organization, the United Nations Foundation COVID-19 fund, and other selected organizations.

U.S. Hand Sanitizer Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 1.8 billion

Growth rate

CAGR of 5.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel

Country scope

U.S.

Key companies profiled

Reckitt Benckiser Group plc; Henkel AG and Company; Unilever; Best Sanitizers, Inc.; Procter and Gamble; The Himalaya Drug Company; GOJO Industries, Inc.; Vi-Jon; Chattem, Inc.; Kutol

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hand Sanitizer Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hand sanitizer market report based on product, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gel

-

Foam

-

Liquid

-

Spray

-

Wipes

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarket & Supermarket

-

Pharmacy & Drugstore

-

Convenience Store

-

Online

-

Others

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."