- Home

- »

- Advanced Interior Materials

- »

-

U.S. Hand Protection Equipment Market Size, Report, 2030GVR Report cover

![U.S. Hand Protection Equipment Market Size, Share & Trends Report]()

U.S. Hand Protection Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Product, By Raw Material (Natural Rubber/latex, Nitrile Gloves), By End-use (Construction, Manufacturing, Oil & Gas), And Segment Forecasts

- Report ID: GVR-4-68040-403-6

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

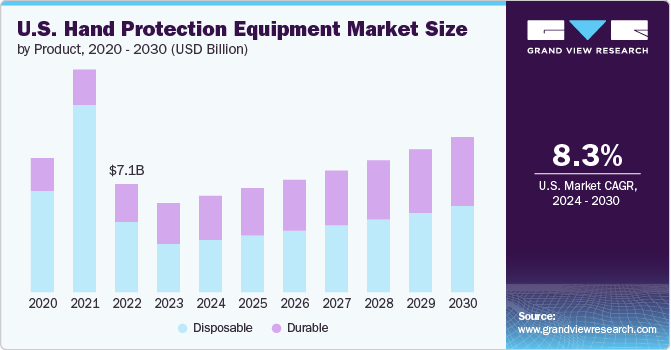

The U.S. hand protection equipment market size was estimated at USD 5.8 billion in 2023 and is projected to grow at a CAGR of 8.3% from 2024 to 2030. As healthcare systems expand and modernize, there is a growing emphasis on enhancing safety standards and providing high-quality protective gear to healthcare workers. Hospitals and clinics are upgrading their hand protection solutions to comply with stricter safety regulations and ensure the well-being of their staff. This trend is reflected in the growing adoption of specialized gloves made from materials that offer improved durability, dexterity, and protection.

The surge in industrialization across the U.S. is significantly boosting the demand for hand protection equipment. As industries expand and modernize, workplaces are increasingly exposed to various hazards, including chemical, mechanical, and thermal risks. This heightened exposure drives the need for advanced hand protection solutions that can mitigate these risks and ensure worker safety.

Market Concentration & Characteristics

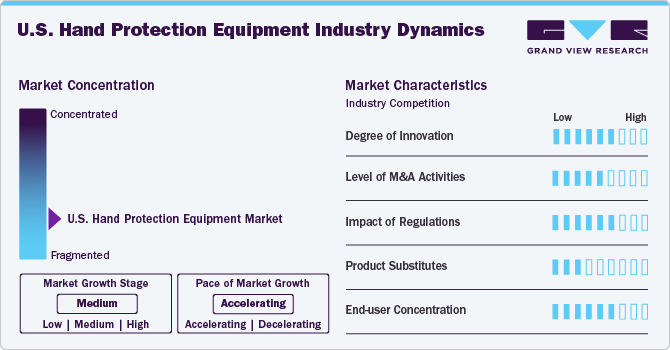

The U.S. market is highly fragmented. It has experienced significant shifts in end-user concentration, with increasing emphasis on both industrial and consumer segments. As safety regulations tighten and awareness of hand injury prevention rises, there is a marked increase in the adoption of hand protection solutions across various sectors. Industrial and manufacturing segments continue to be substantial contributors. This demand is driven by heightened safety consciousness and an expanding range of hand protection options tailored to diverse activities and environments. Manufacturers are responding by developing specialized gloves that cater to different applications.

Moreover, the focus on product differentiation and innovation has intensified. Companies are increasingly investing in the development of advanced materials and technologies to offer specialized solutions beyond traditional gloves. This trend includes the introduction of high-performance materials, ergonomic designs, and smart gloves equipped with sensors and connectivity features. The fragmentation of the market drives a competitive landscape where numerous players strive to carve out niches by offering unique and tailored hand protection solutions. This dynamic fosters a more innovative market environment, addressing specific consumer and industry needs.

The market is also navigating an environment of increasing regulatory scrutiny, with stringent safety standards and guidelines being enforced to ensure product efficacy and protection. These regulations emphasize the importance of product performance, durability, and compliance with safety norms. As the demand for hand protection equipment grows, adherence to these regulatory frameworks becomes crucial, influencing product development and market strategies. Industry players are proactively engaging with regulatory bodies, focusing on compliance to enhance consumer trust, drive innovation, and contribute to a safer and more responsible hand protection market.

Drivers, Opportunities & Restraints

The increasing prevalence of multiple chronic conditions among individuals aged between 65 and 74 significantly drives the demand for hand protection equipment in the U.S. As the aging population experiences higher rates of chronic illnesses such as diabetes, arthritis, and cardiovascular diseases, there is a growing need for enhanced safety and hygiene measures in the healthcare industry.

The growth of the hand protection equipment industry in the U.S. is expected to be restrained by the increase in automation and implementation of artificial intelligence (AI) in the industrial sector of the country over the forecast period. The increasing use of robots and AI and the surging automation of industrial processes are expected to impact workforce requirements in different industries. With the increasing automation in industries, the workforce is anticipated to reduce in the U.S. in the coming years. This is expected to eventually impact the demand for hand protection equipment for industrial use in the country.

The high penetration rate of e-commerce is especially significant in the hand protection equipment market in the U.S. as it indicates a strong demand for this equipment and a well-established online shopping infrastructure supporting the health and safety industry in the country. Manufacturers are collaborating with online retailers such as Amazon and Alibaba to supply bulk hand protection equipment to hospitals and individual consumers. Given this trend, the hand protection equipment market is expected to continue growing in the U.S. in the coming years benefiting from the robust e-commerce environment in the country.

Product Insights

“The demand for the disposable segment is expected to grow at a significant CAGR of 8.7% from 2024 to 2030 in terms of revenue”

Disposable gloves are an essential component in promoting hygiene and safety across a wide array of industries owing to their single-use design, which helps prevent cross-contamination and the spread of infectious agents. In addition to the burgeoning demand for these gloves from the healthcare sector, segment growth is fostered through the emphasis on safety and health requirements in industries such as the automotive industry, food & beverage, personal care services, and others.

The durable segment held 45.7% of the global revenue share in 2023. The segment is expected to witness significant growth over the forecast period due to their greater thickness than single-use gloves which extends their lifespan and superior resistance against tearing, ensuring more effective protection in rigorous work environments.

End-use Insights

“The growth of the healthcare segment is expected to grow at a significant CAGR of 9.1% from 2024 to 2030 in terms of revenue”

The rising healthcare investments in the U.S. in recent years have significantly impacted the demand for hand protection equipment in the country. This increase in healthcare investments in the U.S. is largely influenced by ongoing advancements in medical technologies, aging population requiring enhanced medical services, and surging awareness among the masses about health and safety standards due to the COVID-19 pandemic. Moreover, the implementation of stringent regulations by the Occupational Safety and Health Administration in the U.S. to ensure worker safety in healthcare settings further drives the demand for hand protection equipment in the country.

The manufacturing segment accounted for 9.6% in 2023 and is expected to expand at a considerable pace over the forecast period. The growth of the market in the U.S. is anticipated to be supported by enhanced standardization and rigorous inspections in the manufacturing industry. Noncompliance carries significant consequences, which are expected to further bolster the market expansion.

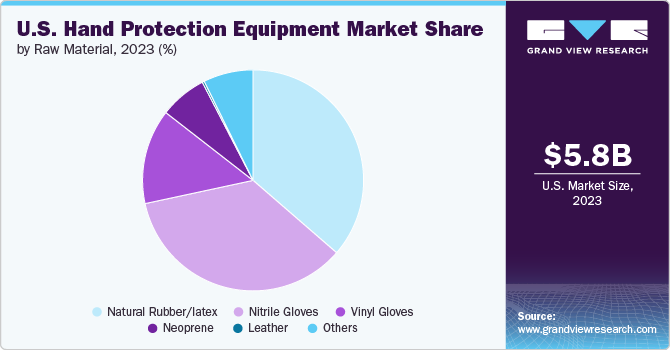

Raw Material Insights

“The growth of the nitrile gloves segment is expected to grow at a significant CAGR of 9.5% from 2024 to 2030 in terms of revenue”

The demand for nitrile gloves in the U.S. is projected to rise significantly, driven by their increasing use in the construction, manufacturing, chemicals, mining, and oil & gas sectors. Nitrile reusable gloves are expected to see growth due to their superior resistance to punctures and chemicals compared to reusable gloves made from vinyl and latex, which is likely to enhance the nitrile gloves segment in the coming years.

The natural rubber/latex segment accounted for 28.7% in 2023 and is expected to expand at a considerable pace over the forecast period. The combination of the elasticity and the strength of these gloves makes them highly tear and puncture resistant. Additionally, their waterproof and chemical-resistant nature makes them effective in safeguarding the hands of wearers from biological hazards, such as bacteria and viruses, as well as bodily fluids. They also protect wearers against water-based chemicals and are commonly used while handling cleaning agents, such as detergents and alcohol. These attributes make latex gloves a highly sought-after option for use by healthcare providers, as well as in surgical and medical settings, dental care & hygiene applications, cleaning tasks, and laboratories.

Key U.S. Hand Protection Equipment Company Insights

Some of the key players operating in the U.S. hand protection equipment market include The Glove Company., Superior Glove, and the Globus Group.

-

The Glove Company is a manufacturer and distributor of gloves, producing both disposable and durable options. The company has distribution and production facilities in Australia, the U.S., Germany, the UK, and New Zealand. It manufactures nitrile and vinyl disposable gloves that are utilized in the automotive, chemical, mining, coating, and industrial safety sectors. Additionally, the company produces single-use gloves under the brand names TGC, Black Rocket, and iSense. It operates 167 glove production lines and holds 98 registered trademarks.

-

Superior Glove is a manufacturer and supplier of work gloves. It has four manufacturing facilities. The company operates offices in Canada, the U.S., Mexico, and Europe. It provides durable as well as disposable gloves. It produces nitrile gloves under the brand name KeepKleen Chemstop, and North Sea for use in automotive, paint, food handling, and janitorial industries. Further, the company’s production facilities are spread across the U.S., Mexico, and Central America. Moreover, the company opened a new plant in Cortes, Honduras, in 2018.

-

The Globus Group is a provider and manufacturer of personal protection gear and is dedicated to delivering cutting-edge and eco-friendly safety solutions. Its product range includes hand, eye, head, and hearing protection, along with respiratory system protection and protective clothing. Moreover, it supplies top-tier health and safety products to a wide array of sectors. With a global footprint and a dedication to innovations, the company has expanded its diverse product line to cater to the global personal protection requirements. The company has a significant market presence in over 98 countries and operates manufacturing facilities in 3 countries.

Key U.S. Hand Protection Equipment Companies:

- The Glove Company

- SHOWA Group

- Superior Glove

- MCR Safety

- United Glove

- Ansell Ltd.

- The Globus Group

- Delta Plus Group

- Top Glove Corporation Bhd

- Hartalega Holdings Berhad

Recent Developments

-

In May 2022, Globus Group introduced disposable gloves, which are marketed under the medical-grade Hakia and industrial-grade Skytec labels. These gloves are tailored for a wide array of uses across healthcare facilities, the food industry, laboratories, and automotive manufacturing plants, thereby ensuring specialized hand protection for each application.

-

In April 2024, Ansell Ltd. announced its entry into a binding agreement to acquire the 100% assets that constitute Clark’s Personal Protective Equipment business (KCPPE) for USD 640.0 million. This strategy is expected to be complete by September 2024. With this strategy, the company is likely to improve its sales of specialist products designed for cleanroom applications.

U.S. Hand Protection Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.2 billion

Revenue forecast in 2030

USD 10.1 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in million pieces, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, raw material, end-use

Key companies profiled

The Glove Company, SHOWA Group, Superior Glove, MCR Safety, United Glove, Ansell Ltd., The Globus Group, Delta Plus Group, Top Glove Corporation Bhd, and Hartalega Holdings Berhad.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hand Protection Equipment Market Report Segmentation

This report forecasts volume & revenue growth at a country level and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hand protection equipment market report on the basis of product, raw material, and end-use.

-

Product Outlook (Volume, Million Pieces; Revenue, USD Million, 2018 - 2030)

-

Disposable

-

Durable

-

-

Raw Material Outlook (Volume, Million Pieces; Revenue, USD Million, 2018 - 2030)

-

Natural Rubber/Latex

-

Nitrile Gloves

-

Neoprene

-

Vinyl Gloves

-

Leather

-

Others

-

-

End-use Outlook (Volume, Million Pieces; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Manufacturing

-

Oil & Gas

-

Chemicals

-

Food

-

Pharmaceuticals

-

Healthcare

-

Transportation

-

Mining

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. hand protection equipment market size was estimated at USD 5.8 billion in 2023 and is expected to reach USD 6.2 billion in 2024.

b. The U.S. hand protection equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030, reaching USD 10.1 billion by 2030.

b. The disposable segment accounted for the largest revenue share in 2023 fueled by the demand for disposable gloves made of latex, nitrile, and vinyl has surged since the pandemic due to increased awareness regarding better hygiene standards and the growing healthcare infrastructure in the U.S. Furthermore, risks related to on-the-job transmission of bloodborne pathogens and germs in healthcare facilities have resulted in increased adoption of gloves.

b. Some of the key players operating in the U.S. hand protection equipment market includeThe Glove Company, SHOWA Group, Superior Glove, MCR Safety, United Glove, Ansell Ltd., The Globus Group, Delta Plus Group, Top Glove Corporation Bhd, and Hartalega Holdings Berhad.

b. The U.S. hand protection equipment market is driven by the rising awareness among industry players regarding the significance of safety and security in workplaces. This level of awareness is attributed to strict regulations and substantial expenses linked to workplace hazards, both of which are expected to drive market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.