- Home

- »

- Electronic & Electrical

- »

-

U.S. Hair Dryer Market Size, Share & Growth, Report, 2030GVR Report cover

![U.S. Hair Dryer Market Size, Share & Trends Report]()

U.S. Hair Dryer Market Size, Share & Trends Analysis Report By Product (Corded, Cordless), By Application (Professional, Individual), By Distribution Channel (Online, Offline), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-207-5

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Hair Dryer Market Size & Trends

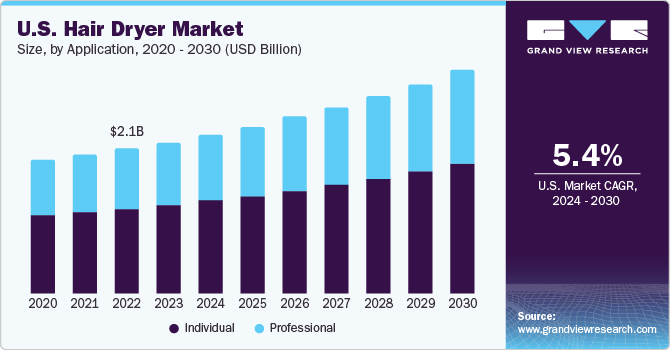

The U.S. hair dryer market size was estimated at USD 2.24 billion in 2023 and is expected to grow at a CAGR of 5.4% from 2024 to 2030. Rising standards of living and augmented prominence on physical appearance is among the key factors boosting the market growth. Changing fashion trends in hair care as well as in styling, paired with surging hair styling trends displayed in cinema and on fashion runways, are substantially affecting the sales of hair dryers positively in the U.S., across all age groups.

Growing number of professional salons in the U.S. is anticipated to be the prime cause that will drive the sales of hair dryers in the upcoming period. In addition, increasing cognizance regarding personal grooming is thrusting the demand for such dryers. Pioneering salon chains are making hefty investments to boost their customer base, and numerous salons are inclining towards professional hair appliances, comprising hair dryers. Therefore, the growing number of professional salons, especially in the U.S., is anticipated to assist with the growth of the market over the forecast period.

Moreover, an augmented amount of expenditure by customers in salon setting and on hair styling tools, is projected to present novel opportunities for market growth. With the surging usage of social media, beauty trends have evolved massively, which has resulted in a surge in demand for hair dryers. As per the Philips Global Beauty Index 2019, roughly 76% of women utilized a hair dryer on daily basis. Similar trends are likely to result in the high usage of hair dryers by women customers in specific.

Hair styling tools manufacturers are actively unveiling advanced technologies to enhance the efficiency & safety of the appliance, and complete customer experience. Companies are introducing new products equipped with numerous high-tech characteristics to fulfil the growing demand for smart appliances. Few hair blowers possess smart features, such as automatic shut-off, heat sensors, as well as Bluetooth connectivity to regulate their settings via mobile applications. Moreover, advanced hair blowers let customers modify the heat and speed settings according to their hair type and preferred styles. These reasons are projected to boost the market growth. For instance, in July 2020, Tineco, extended its business into the beauty segment by introducing the MODA ONE, the next generation of smart hair blowers.

In latest times, popular culture, comprising music makers, cinema stars, athletes, and other social media influencers have significantly swayed users. They keep a tab of what these stars are seen wearing in popular movies, television series, online fashion & music videos, as well as fashion magazines. The alteration in consumer fashion trends is predicted to boost the demand for hair blowers.Furthermore, easy and low-maintenance hairstyles have become the latest fashion trend. Thus, users are inclining towards hairstyles that give a polished look without needing extensive time to create.

Market Concentration & Characteristics

The U.S. hair dryer market is fragmented in nature and is characterized by the presence of a few established players. These players account for a considerable market share and have a strong presence across the globe, including the U.S. The hair dryer market also comprises small- and medium-sized local players who offer a selected range of products at much cheaper rates and mainly serve regional customers. Global brands face tough competition from these players since smaller players have a better grasp and reach in regional or country markets.

The impact of major players on the hair dryer market is quite high as a majority of them have vast distribution networks to reach out to a large customer base. However, the majority of the new companies in the market are focusing on introducing new and innovative products to address the evolving needs of customers and to gain a competitive edge over other players.

The degree of innovation is medium as various technologies such as nanoe technology, have already been introduced in the market and leave not much scope for further innovation. Companies have to adhere to the regulations imposed by regulatory bodies to ensure and maintain quality and safety standards.

Product Insights

The corded hair dryer held the market share of 83.1% in 2023. Preferably, corded hair dryers are used in households and professional settings, except if they are being utilized while commuting or other intensions where portability is essential. Corded hair dryers are more powerful in comparison with the cordless ones and hold the ability to dry hair quicker. They also have enhanced airflow and heat settings, owing to which consumers prefer them.

On the contrary, the cordless product segment is expected to grow at a CAGR of 5.7% during the forecast period. Some consumers prefer cordless hair dryers as they are transportable, lightweight, and effortless to use. They are majorly favored while traveling as they are easy to move around and do not need power outlets because they are battery-powered. These factors are boosting the demand for cordless hair dryers.

Nevertheless, a cordless hair dryer does not hold as much power as a corded one, as batteries power it, leading to weak airflow and lower heat settings. This results in extended duration for the hair to dry fully. Also, cordless hair dryers function on shorter durations, as their battery life is restricted. Consequently, cordless hair dryers cannot be substituted with standard corded hair dryers, except in specific circumstances, such as places with poor electricity supply.

Application Insights

The individual usage of the hair dryer dominated the market in terms of revenue in 2023. The usage of hair dryers has become common in established countries-and usually in urban households. Growing urbanization across the globe has contributed to the rising sales of hair dryers for personal use. As per the data published by the World Bank, the global urban population grew from 3.57 billion in 2010 to 4.36 billion in 2020. This also means population in the U.S. grew as well leading to extended demand for product from the country.

Social media plays a crucial part in increasing beauty standards, and this has triggered an augmented demand for personal care products such as hair dryers. Social media platforms such as TikTok are boosting the sales of hair dryers, as several young customers are purchasing hairstyling and beauty products after viewing the video tutorials and reviews by top beauty influencers. Such social media platforms act as brand engagement and marketing tools for hair dryer companies, thus leading to augmented product penetration.

The professional segment is expected to register highest growth during the forecast period of 2024 to 2030. With the growth in disposable incomes and enhanced beauty standards in current times, the trend of going to hair salons for hair styling has been rising since last couple of years and hair salons are registering an increased pace in terms of business. This has powered the demand for professional hair dryers. As per the U.S. Bureau of Labor Statistics, there were 622,700 barbers, hairstylists, and cosmetologists in the U.S. in 2020.

Distribution Channel Insights

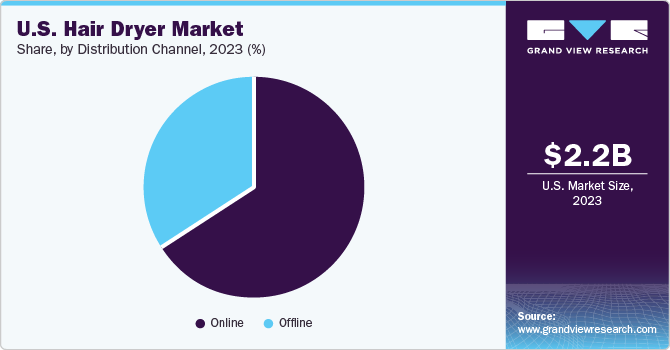

Online sales accounted for the market share of over 70% in 2023. Since the commencement of the COVID-19 pandemic, the demand for hair dryers from e-commerce platforms augmented as physical stores stayed closed for limited duration. Even after the impact of the pandemic decreased, people were unwilling to visit these salons, which creates positive picture for online channels. As consumers gradually began depending on online platforms for buying hair dryers, the demand from e-commerce platforms gained major hike. Moreover, the busy schedules of the today’s world has prompted in consumers seeking time-saving alternatives, while buying products such as hair dryers, thereby enticing more consumers toward online purchases. Coupled with the accessibility of an extended series of hair dryers, consumers often rely on reviews for the product available on e-commerce platforms, which assists them in making a purchase decision.

The offline segment is expected to grow at a CAGR of 4.3% from 2024 to 2030. The offline channel is the most broadly used channel for purchasing a hair dryer. Offline stores provide consumers with the selection of testing the operations of a product before actually landing on buying decision. Hair dryers from offline channels are usually bought from electronics retail stores or beauty & cosmetic stores.

Key Hair Dryer Company Insights

The key companies operating in the market hold a significant market share and display a sturdy presence in the U.S. and across the globe. It also consists small- and medium-sized local companies who provide a particular range of products at comparatively cheaper prices and primarily cater to regional consumers. Global brands face strong competition from these companies since smaller players have an enhanced grasp and influence in regional or country-based markets.

Some key players present in the market include:

-

Panasonic Holdings Corporation - Following its incorporation, it quickly managed to expand into several other electrical product lines including irons, radios, phonographs, and light bulbs. Over the years, the company has added a range of microwaves, air conditioners, beauty styling products, and VHS recorders. The company offers a range of products including heating and cooling solutions, home appliances, smart life networks, commercial refrigeration & food equipment and devices. Under the home appliances range, Panasonic has refrigerators, washing machines, vacuum cleaners, microwaves, hair dryers, cooking equipment, rice cookers, and nanoe devices. In many foreign markets, including Asia, Europe, and North America, the company has several manufacturing and sales subsidiaries. The company earns the majority of its revenue from international markets, including those in Europe and North America.

-

Dyson Limited - Dyson Limited’s research design and development center is also headquartered in Malmesbury, England. It is one of the leading technology manufacturers and marketers of household appliances such as vacuum cleaners, hair dryers, hair stylers, air purifiers, bladeless technology fans, and heaters. Dyson Limited has manufacturing locations in countries such as Malaysia, Singapore, the U.K., and the U.S. and serves customers in over 80 countries around the world. Recently, the company has invested in a facility in Singapore for manufacturing Dyson’s digital motor.

Some emerging players operating in the market are:

-

Ghd Hair (Jemella Ltd) - It is a famous leading haircare brand and manufacturer of hair care products. Ghd Hair has an extensive hair product portfolio with products like hair straighteners, hot brushes, hair dryers, curlers, hair brushes, and hair styling products. The company has launched some of the best tools in the hair styling industry, including the Helios hairdryer and curve thin wand. The company also offers the personalization of hair dryers to its users. The company’s products have been used by top celebrities like Anne Hathaway and Sydney Sweeney to achieve their runway looks. The company’s products are sold in around 50,000 salons around the world.

-

Braun GmbH (A brand of Procter & Gamble) - It is a leading manufacturer, well known for its electric shavers, hair stylers, and record players. Braun was acquired by Procter & Gamble in 2005. Before that, it was a fully-owned subsidiary of The Gillette Company. Braun offers an extensive range of product categories, such as Shaving and Grooming, Oral Care, Beauty Care, Clock and Watches, Health and Wellness, and Beauty care. Under the beauty care segment, the company has hair dryers and epilation devices. Braun's reputation has been strongly linked to hair dryers for a very long time. The business' hair care segment has consistently kept up with the most recent hair fashion trends. It has produced hair straighteners, curlers, and dryer attachments to obtain smoother hair, add more volume, or form curls. Braun's Satin Hair Brush, which uses static-reducing ion technology, is one of its most recent hair care innovations.

Key Hair Dryer Companies:

- Conair LLC

- Panasonic Holdings Corporation

- Koninklijke Philips N.V.

- Dyson Limited

- Tescom Co., Ltd.(Tescom Denki Co., Ltd)

- Spectrum Brands, Inc.

- Revlon Inc.

- Ghd Hair (Jemella Ltd)

- Harry Josh Pro Tools

- Braun GmbH (A brand of Procter & Gamble)

Recent Developments

-

In June 2022, Dyson unveiled an updated type of the Dyson Airwrap. Various alterations and inclusions are made to the styling tool; it is well-suited with diverse hair categories and textures and comprises an assortment of attachments. Customers of the airwrap can wave, curl, smoothen, as well as dry their hair with minimal heat usage owing to the usage of a speedy and high-pressure motor, which also lessens the duration of the styling procedure.

-

In July 2021, Realme TechLife collaborated with Dizo Lifestyle launched a Realme trimmer series as well as a white Realme hair dryer in India. The hair dryer works at temperatures under 55 degrees. It possesses features such as four physical buttons, involving the off, cold air, and soft air options. Inlet mesh, nylon mesh, and an air inlet grills are also comprised with the dryer.

U.S. Hair Dryer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.35 billion

Revenue forecast in 2030

USD 3.31 billion

Growth rate

CAGR of 5.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, distribution channel

Country scope

U.S.

Key companies profiled

Conair LLC; Panasonic Holdings Corporation; Koninklijke Philips N.V.; Dyson Limited; Tescom Co., Ltd. (Tescom Denki Co., Ltd); Spectrum Brands Inc.; Revlon Inc.; Ghd Hair (Jemella Ltd); Harry Josh Pro Tools; Braun GmbH (A brand of Procter & Gamble)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Hair Dryer Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. hair dryer market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Corded

-

Cordless

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Professional

-

Individual

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Online

-

Offline

-

Frequently Asked Questions About This Report

b. The U.S. hair dryer market size was estimated at USD 2.24 billion in 2023 and is expected to reach USD 2.35 billion in 2024.

b. The U.S. hair dryer market is expected to grow at a compound annual growth rate of 5.4% from 2024 to 2030 to reach USD 3.31 million by 2030.

b. Corded hair dryers dominated the U.S. hair dryer market with a share of more than 83% in 2023. Preferably, corded hair dryers are used in households and professional settings, except if they are being utilized while commuting or other intentions where portability is essential.

b. Some key players operating in the U.S. hair dryer market include Conair LLC; Panasonic Holdings Corporation; Koninklijke Philips N.V.; Dyson Limited; Tescom Co., Ltd. (Tescom Denki Co., Ltd); Spectrum Brands Inc.; Revlon Inc.; Ghd Hair (Jemella Ltd); Harry Josh Pro Tools; Braun GmbH (A brand of Procter & Gamble)

b. Key factors that are driving the U.S. hair dryer market growth include the rising standards of living and augmented prominence on physical appearance is among the key factors boosting the market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."