U.S. Gypsum Board Market Size & Trends

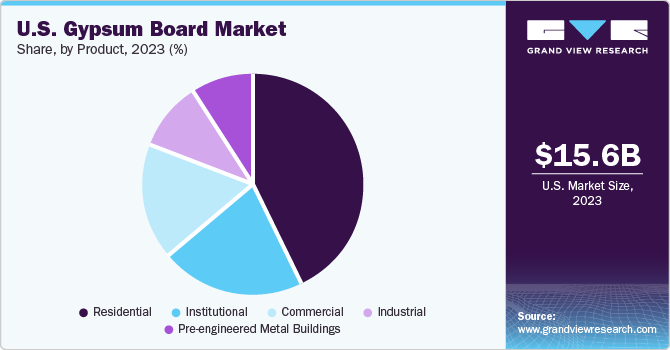

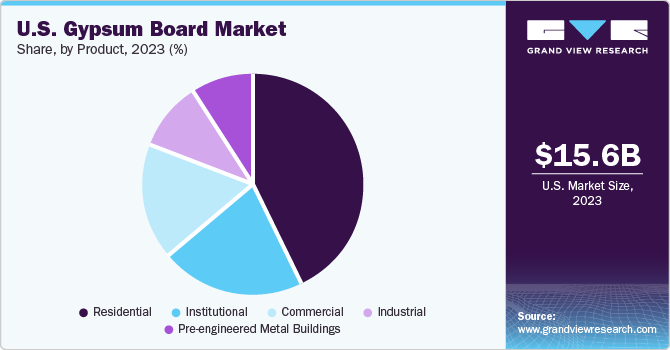

The U.S. gypsum board market size was estimated at USD 15.6 billion in 2023 and is projected to grow at a CAGR of 9.1% from 2024 to 2030. This growth can be attributed to the booming construction industry, particularly in the residential sector, fueled by a growing population and urbanization trends. In addition, the increasing adoption of sustainable building materials in line with environmental regulations is propelling the demand for gypsum boards. Technological advancements leading to the production of high-performance gypsum boards, coupled with the rising consumer awareness about the benefits of these boards, such as durability, sound insulation, and fire resistance, are further contributing to the market growth.

The U.S. gypsum board market accounted for a share of 27.9% of the global gypsum board market revenue in 2023.Regulations play a pivotal role in shaping the U.S. gypsum board market. For instance, gypsum board is manufactured to the consensus standard ASTM C1396, referenced in building codes, such as the International Building Code, International Residential Code, and the National Fire Protection Association (NFPA) NFPA 5000: Building Construction and Safety Code. In addition, all drywall currently offered for sale must meet the labeling provisions in ASTM C1264-11. Furthermore, drywall manufactured or imported on or after July 22, 2015, must comply with the sulfur content limits of ASTM C1396-14a. These regulations, related to building codes, environmental standards, and safety requirements, significantly impact manufacturing processes, product specifications, and market access.

Product Insights

The wallboard segment held a share of 49.5% in 2023. Wallboards, also known as drywall, are extensively used in residential and commercial construction due to their cost-effectiveness, ease of installation, and adaptability to various finishes. The demand for wallboards is particularly high in the residential sector, driven by the robust housing market and the trend towards urbanization. Furthermore, the increasing renovation and remodeling activities in the U.S. are contributing to the growth of this segment. The versatility of wallboards, which can be used for walls, ceilings, and partitions, coupled with their fire-resistant properties, makes them a preferred choice in the construction industry.

The pre-decorated board segment is projected to grow at a CAGR of 10.2% from 2024 to 2030. Pre-decorated boards, which come with a factory-applied finish, offer significant time and cost savings as they eliminate the need for painting or wallpapering after installation. This feature makes them particularly attractive for commercial applications where quick turnaround times are crucial. In addition, the growing consumer preference for aesthetically pleasing interiors is driving the demand for pre-decorated boards. The availability of these boards in various designs, colors, and textures allows for greater customization, catering to consumers' diverse tastes and preferences. Thus, the pre-decorated board segment is poised for substantial growth in the coming years.

Application Insights

The residential application segment held the largest revenue share of 42.8% in 2023. The residential sector’s dominance can be attributed to the robust growth in the housing market, driven by factors, such as population growth, urbanization, and low mortgage rates. Gypsum boards are extensively used in residential construction due to their cost-effectiveness, ease of installation, and adaptability to various finishes. Furthermore, the trend of sustainable construction drives the demand for gypsum boards in the residential sector, given their environmental benefits, such as improved indoor air quality and energy efficiency.

The pre-engineered buildings application segment is projected to grow at the second-fastest CAGR of 9.6% from 2024 to 2030. Pre-engineered buildings, which are custom-designed to meet the specific requirements of the end-user, are gaining popularity due to their cost and time efficiency, flexibility, and durability. Gypsum boards in these buildings enhance their fire resistance, sound insulation, and thermal performance. Furthermore, the rising demand for pre-engineered buildings in sectors, such as warehousing, industrial, and commercial, due to their quick and efficient construction is expected to drive the growth of this segment.

Key U.S. Gypsum Board Company Insights

Some of the key players operating in the market include Georgia-Pacific, Saint Gobain, Etex Group, and American Gypsum Company:

-

Saint-Gobain provides a comprehensive portfolio of gypsum building materials, including standard wallboard alongside specialized options for fire resistance, weight reduction, noise dampening, air quality improvement, and mold/moisture resilience

-

Georgia-Pacific LLC is another key manufacturer in the market and has been developing high-quality gypsum building products since 1965

Key U.S. Gypsum Board Companies:

- Saint Gobain

- Georgia-Pacific LLC

- USGKnauf

- Etex Group

- American Gypsum Company LLC

- Holcim Ltd

- National Gypsum Services Company

- Osman Group

- Pabco Building Products LLC

- VANS Gypsum Pvt. Ltd.

Recent Developments

-

In September 2023, Beneficial Reuse Management, LLC acquired USA Gypsum, LLC, which is expected to maintain its independent operations and industry-leading drywall recycling processes

-

In November 2023, Saint-Gobain North America committed USD 235 million over the next two years to significantly expand and modernize its CertainTeed gypsum plant in Palatka, Florida, enhancing production capacity and energy efficiency

-

In October 2023, Georgia-Pacific inaugurated a new gypsum wallboard facility in Sweetwater, Texas, expanding its ability to serve the construction sector across residential, commercial, and industrial segments within the state

U.S. Gypsum Board Market Report Scope

|

Report Attribute

|

Details

|

|

Revenue forecast in 2030

|

USD 28.7 billion

|

|

Growth rate

|

CAGR of 9.1% from 2024 to 2030

|

|

Base year for estimation

|

2023

|

|

Historical data

|

2018 - 2022

|

|

Forecast period

|

2024 - 2030

|

|

Quantitative units

|

Volume in million square meters, revenue in USD million/billion, and CAGR from 2024 to 2030

|

|

Report coverage

|

Volume & revenue forecast, competitive landscape, growth factors, trends

|

|

Segments covered

|

Product, application

|

|

Key companies profiled

|

Saint Gobain, Georgia-Pacific LLC; USGKnauf; Etex Group; American Gypsum Company LLC; Holcim Ltd.; National Gypsum Services Company; Osman Group; Pabco Building Products LLC; VANS Gypsum Pvt. Ltd.

|

|

Customization scope

|

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

U.S. Gypsum Board Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. gypsum board market report based on product, and application:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)

-

Wallboard

-

Ceiling Board

-

Pre-decorated Board

-

Others

-

Application Outlook (Volume, Million Square Meters; Revenue, USD Billion, 2018 - 2030)