- Home

- »

- Medical Devices

- »

-

U.S. Gynecological Devices Market, Industry Report, 2030GVR Report cover

![U.S. Gynecological Devices Market Size, Share & Trends Report]()

U.S. Gynecological Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Surgical Devices, Handheld Instruments, Diagnostic Imaging Devices,), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-280-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Gynecological Devices Market Trends

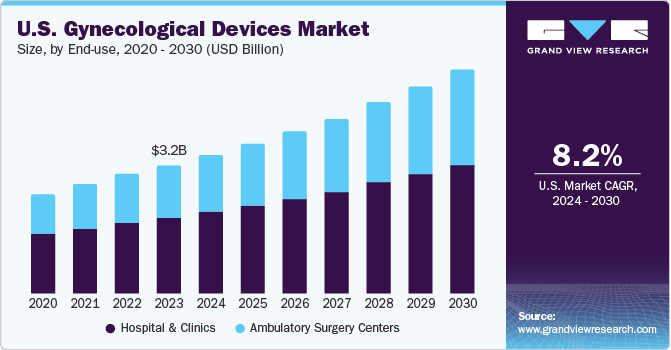

The U.S. gynecological devices market size was estimated to be around USD 3.25 billion in 2023 and is anticipated to grow at a CAGR of 8.2% over the forecast period. Growing advancements in gynecological devices, with a focus on improving the efficiency of minimally invasive procedures for surgeries, are driving the demand for these products. Moreover, increasing development of sophisticated imaging devices, including 3D endoscopes, is anticipated to be a significant factor propelling market growth.

The U.S. gynecological devices market accounted for a share of over 32% in the global gynecological devices market in 2023. Growing prevalence of gynecological disorders in the country is expected to propel the market growth during the forecast period. Conditions including endometriosis, Polycystic ovary syndrome (PCOS), adenomyosis, and uterine fibroids necessitate the need to visit gynecologists. According to the Office on Women's Health (OWH), approximately 500,000 women in the U.S. choose to undergo hysterectomy, making it the second most prevalent surgery among females.

The growing incidence of unintended pregnancies leads to unsafe abortions or other gynecological conditions, contributing to a rise in gynecological surgical volumes. Furthermore, the increasing frequency of surgical procedures like female sterilization, ablation, endoscopy, and laparoscopy, coupled with a rise in disposable product usage, is expected to drive demand for gynecological devices. Adoption of advanced and innovative technologies is also predicted to enhance product demand. For example, in November 2021, Hologic, Inc. revealed plans to introduce the Global Endometrial Ablation (GEA) device, NovaSure V5, at the American Association of Gynecologic Laparoscopists (AAGL). This updated device incorporates EndoForm technology and is designed to accommodate various anatomical and cervical canal variabilities.

Market Concentration & Characteristics

The industry growth stage is medium (CAGR: 5-10%) and pace of the growth depicts an accelerating trend. Growing awareness about the benefits of minimally invasive surgeries and laparoscopic procedures is anticipated to create opportunities for industry expansion. In addition, increasing healthcare expenditure in the U.S. also favors the entry of new players.

Key companies are investing in R&D to develop innovative products. Technological advancements in endoscopy devices, imaging systems, and other components are collectively aiding rise in demand for gynecological devices. These advancements include HD imaging, portability, and micro laparoscopy, which enable accurate diagnoses & treatment. For instance, development and introduction of medical robots to assist doctors is a key advancement in the field. These robots offer numerous benefits such as a 3D view of operating field, reduced blood loss & need for transfusion, early discharge from the hospital, with minimal scarring, and less trauma to the body as well as higher precision in the procedures.

The industry is witnessing an increasing number of merger & acquisition (M&A) and collaboration activities that are being undertaken by the prominent players. Several key U.S. gynecological devices companies are adopting these strategies to upgrade their portfolio. For instance, in May 2021, CooperSurgical acquired OBP Medical Corporation, a company that markets disposable vaginal speculums with integrated LED illumination.

The U.S. FDA classifies medical devices under three categories including Class I, Class II, and Class III. For the class I devices such as vaginal speculum, and others, general controls are laid to check safety and effectiveness of the medical device. For class II devices such as biopsy needles, and other, are approved by the 510(k) pathway which offers FDA clearance. In addition, clinical data and animal testing data are required to support substantial equivalence. For the class III device such as endometrial ablation devices, the premarket approval process and post-market surveillance data is required for the market approval of the devices as it sustains or supports human life.

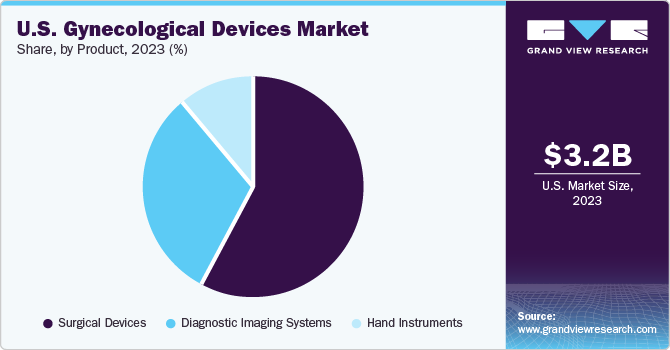

Product Insights

Surgical devices held the largest share of 58.4% in 2023. High usage of female contraceptives and endoscopic devices is anticipated to support the dominance of this segment. For instance, CooperSurgical reported a 26% increase in net sales for office and surgical products used by obstetricians/gynecologists in the hospitals. Moreover, the demand for easily available and highly durable surgical instruments has been rising due to the increasing surgical procedures volume globally.

The diagnostic imaging systems segment is expected to witness lucrative growth during the forecast period. The growth can be attributed to the rising number of intended and unintended pregnancies globally. Imaging systems such as ultrasound, computed tomography (CT), magnetic resonance imaging (MRI), and plain radiography are utilized to investigate and determine potential harmful conditions during pregnancy.

End Use Insights

The hospital & clinics segment held the largest market share of 59.1% in 2023. Hospitals offer superior care to patients and provide reimbursements for certain procedures, which are further contributing to segment growth. Furthermore, hospitals are currently advancing in terms of technology. Technologically advanced devices are being used extensively in hospitals to provide better treatment.

The ambulatory surgery center segment is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to affordability of treatments as compared to the high hospitalization costs associated with hospitals and clinics. As per the Nationwide Ambulatory Surgery Sample (NASS) database, gynecological surgeries such as hysterectomy, laparoscopic surgeries, oophorectomy, and others were among the most common major ambulatory surgeries performed in younger females in the U.S.

Key U.S. Gynecological Devices Company Insights

The market is fragmented in nature due to the presence of several companies such as. Medtronic plc, Cooper Surgical, Inc., Richard Wolf GmbH., Hologic, Inc., and Boston Scientific Corporation. Approval and commercialization of various products, increasing geographical reach, and expanding application of already existing products are the major strategies being adopted by industry participants to enhance their market share. For instance, in May 2022, GenWorks unveiled the launch of Eva colpo, a non-invasive gynecological device for the examination of cervix in females.

Key U.S. Gynecological Devices Companies:

- Medtronic plc

- Cooper Surgical, Inc.

- Richard Wolf GmbH

- Hologic, Inc.

- Boston Scientific Corporation

- Stryker Corporation

- Karl Storz GmbH & Co. KG

- Ethicon, Inc. (Johnson & Johnson MedTech)

- Cook Medical

- Bayer AG

- Gynemed

- Gynex Corporation

Recent Developments

-

In February 2024, Innovia Medical initiated the offering of single-use DTR Medical Cervical Rotating Biopsy Punch in the U.S market. The device is designed for cervical biopsies in gynecological procedures.

-

In March 2022, Endoluxe, a California-based company, launched Endoluxe eVS, HD wireless endoscopic camera equipped with TowerTech for gynecological, urological, ENT, orthopedics, and general surgery.

-

In October 2021, Hologic, Inc. entered into a definitive agreement for the acquisition of Bolder Surgical, a surgical devices company. The acquisition was focused on the development of laparoscopic dissecting, diving, and vessel sealing devices including Bolder’s CoolSeal, the JustRight 5 mm stapler, and JustRight 3 mm vessel sealer.

U.S. Gynecological Devices Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.25 billion

Revenue forecast in 2030

USD 5.68 billion

Growth Rate

CAGR of 8.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Medtronic plc; Cooper Surgical, Inc.; Richard Wolf GmbH.; Hologic, Inc.; Boston Scientific Corp.; Stryker Corp.; Karl Storz GmbH & Co. KG; Ethicon, Inc., Cook Medical, Bayer AG, Gynemed, Gynex Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gynecological Devices Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. gynecological devices market report based on product and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Surgical devices

-

Gynecological Endoscopy Devices

-

Hysteroscope

-

Colposcope

-

Resectoscope

-

Laparoscope

-

Endoscopic imaging systems

-

-

Endometrial Ablation Devices

-

Hydrothermal ablation devices

-

Radiofrequency ablation devices

-

Balloon ablation devices

-

Others (microwave, laser)

-

-

Fluid Management Systems

-

Female Sterilization/Contraceptive Devices

-

Permanent Birth Control

-

Intra Uterine Devices (IUD)

-

Intravaginal rings

-

Subdermal Contraceptive Implants

-

-

-

Hand Instruments

-

Vaginal Speculum

-

Tenaculum

-

Curettes

-

Trocars Market

-

Biopsy Forceps

-

Others

-

-

Diagnostic Imaging Systems

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital and Clinics

-

Ambulatory Surgery Centers

-

Frequently Asked Questions About This Report

b. The U.S. gynecological devices market size was estimated at USD 3.25 billion in 2023 and is expected to reach USD 3.51 billion in 2024.

b. The U.S. gynecological devices market is expected to grow at a compound annual growth rate of 8.33% from 2024 to 2030 to reach USD 5.68 billion by 2030.

b. Surgical devices segment dominated the U.S. gynecological devices market with a share of 58.35% in 2023. High usage of female contraceptives and endoscopic devices is anticipated to support the dominance of the segment throughout the forecast period.

b. Some key players operating in the U.S. gynecological devices market include Medtronic plc; Cooper Surgical, Inc.; Richard Wolf GmbH.; Hologic, Inc.; Boston Scientific Corporation; Stryker Corporation; Karl Storz GmbH & Co. KG; and Ethicon, Inc.

b. Key factors that are driving the U.S. gynecological devices market growth include the growing prevalence of gynecological diseases and conditions such as cervical cancer, uterine cancer, polycystic ovary syndrome, vaginal melanoma, extended bleeding, and irregular menstrual cycles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.