- Home

- »

- Nutraceuticals & Functional Foods

- »

-

U.S. Gummy Market Size And Share, Industry Report, 2030GVR Report cover

![U.S. Gummy Market Size, Share & Trends Report]()

U.S. Gummy Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Vitamins, Dietary Fibres, Melatonin), By Ingredient (Gelatine, Plant-based Gelatine Substitute), By End-use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-212-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Gummy Market Size & Trends

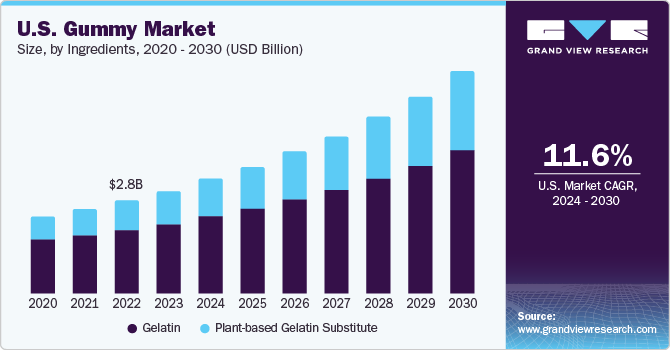

The U.S. gummy market size was estimated at USD 3.12 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 11.6% from 2024 to 2030. Expected growth in demand for this market can be attributed to widespread popularity of gummy supplements in the U.S., increased awareness about ingredients used in the foods, conscious consumer behaviour regarding food and beverages that they consume, changing trends resulting into inclination towards nutraceuticals instead of pharmaceuticals, and unceasing prevalence of health problems such as cardiovascular diseases, diabetes, hypertension among others.

The U.S. gummy market accounted for 32.10% of the global gummy market in 2023. Aspects that primarily drive the gummy market in the U.S. are rising consumer preferences toward a healthier lifestyle, adoption of easy-to-consume forms of dietary supplements, increasing availability of different gummy variants such as vegan and plant-based alternatives, growing awareness about ethical as well as environmental responsibilities as consumers, and innovation coupled with vast product portfolio developed through it.

The changing lifestyle of young population, exhausting long work hours, increased urbanisations has led to scenario where consumers have to prioritise their health over anything else. This has resulted into consumption of healthy foods, deliberate inclusion of probiotics & prebiotics, vitamins, minerals, and melatonin in diet, considerations about animal welfare leading to adoption of vegan trend, and strategic moves by manufacturers to highlight their inclination towards development of cruelty free and sustainable products.

Market Concentration & Characterisation

The U.S. gummy market is growing at accelerating pace and the growth stage is identified as high. The market is characterised by presence of multiple well - established brands as well as many other manufacturers and suppliers who operate at comparatively smaller or medium range scale in the business. This develops extremely competitive market, which is fragmented in nature.

Degree of innovation is moderate in the industry. The demand for innovation is in line with generation of new products, delivery of flavors and inclusion of novel ingredients that can enhance the value of the product. Manufacturers have been inventing customised blends and specialised formulations to cater to consumer requirements. This is resulting in overwhelming response and increasing number of consumers preferring the gummies to substitute products.

The impact of regulation in this market is at high level as compliance, adherence to regulatory measure, adoption of quality control techniques has paramount significance in U.S. gummy industry. As safety and efficacy of the product is heavily reliant on these regulations, the manufacturer tend to invest large amounts in this. Threat of substitutes is fairly low in the market, as most of the consumers are increasingly preferring the use of gummies over other alternatives.

Product Insights

Vitamin-based gummy U.S. market accounted for 26.01% in the year 2023. The main reason attributing to the growing demand of vitamin gummies market is increasing prevalence of vitamin deficiencies identified. The changing lifestyles, lack of balance in diet and chaotic routines of many, leads to deficiency of vitamin D and vitamin B12. Vitamin gummies are perceived as one of the most convenient ways for consumers to maintain their vitamin intake. The popularity of vitamin-based gummies is also generated by manufacturers through inclusion of gummy vitamins in diverse colours, sizes, shapes, and inventive flavors.

The U.S. CBD/CBN-based gummy market is expected to grow at CAGR of 17.3% from 2024 to 2030. CBD/CBN, (Cannabidiol/Cannabinol) two of hundred other types of chemical components naturally found in the cannabis plant. The expected growth for this market is also driven by increasing use of CBD gummies in the geriatric population by those who are suffering from chronic diseases such as dementia. CBD/CBN-based gummies are also considered as one of the key alternatives for traditional methods of CBD consumption.

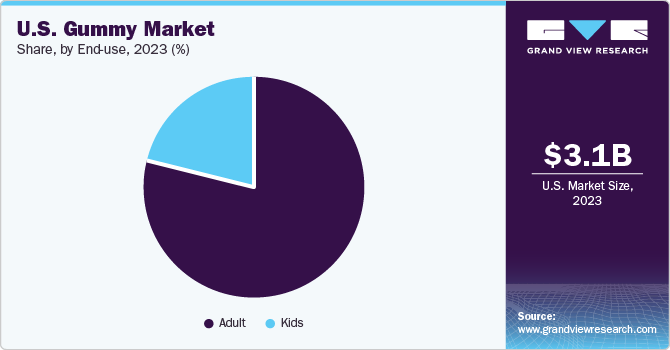

End-use Insights

The U.S. Gummy market for adults accounted for 78.93% in 2023. However, the market for kids is growing rapidly and is most likely to hold increasing revenue share every year from 2024 to 2030. For adults, taste and texture of the product are the most influencing drivers. In addition, these gummies are preferred by those who need to maintain routine intake of traditional supplements in the form of pills and capsules. Some of the common health needs such as multivitamins for adults or prenatal vitamins for expectant mothers are taken into consideration by manufacturers while developing new gummy products. Such strategies also help them generate greater sales.

For kids, the gummy market in U.S. is expected to grow at CAGR of 13.51% from 2024 to 2030. This market has constantly been gaining greater market share every year than the prior year and is projected to reach unprecedented growth patterns in approaching years.

Ingredients Insights

The gelatin-based gummy market in the U.S. accounted for 67.56% in the year 2023. These are the most common supplements provided by manufacturing companies. The ideal textures, compatibility with other ingredients and cost-effectiveness are some of the factors, which help companies in generation of greater demands. Consumers extensively like the harder and chewy texture delivered by gelatin-based gummies. This adds to aspects, which lead to consumers choosing gelatine-based gummies over other variants.

On other hand, the plant-based gelatin-substitute market in the country is expected to grow at CAGR of 13.1% from 2024-2030. This segment of the market is projected to experience the growth owing to increasing awareness about consequences of excessive consumption of gelatine-based gummies.

Distribution Channel Insights

The sales generated through offline distribution channel in U.S. gummy market accounted for 80.00% of the market size in 2023. This is mainly due to unparalleled distribution and availability of gummies through offline channels such as practitioners, hypermarkets, speciality store, supermarkets and most importantly local pharmacies. This approach offers increased brand visibility as well as enhanced market penetration for companies. This is easiest for makers to reach their consumers directly.

However, the U.S. gummy market, through online distribution channel is expected to grow at CAGR of 14.5% from 2024 to 2030. This can be attributed to slowly yet steadily growing popularity of online shopping experience. The online way of buying gummies is also considered as absolutely private and limited to knowledge of the buyer only.

Key U.S. Gummy Company Insights

The following are the leading companies in the U.S. gummy market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these gummy companies are analyzed to map the supply network.

-

SCN Best Co manufactures inventive pharmaceutical dosage forms including gummies, and soft chews. The company has established partnerships and collaborations with country’s leading retails businesses as well as consumer brands to accomplish effective distribution of their products.

-

Better Nutritionals, LLC, founded in 2015, is well-known contract gummy manufacturer, which delivers gummy projects to its clients through excellence in quality, safety and compliance it has achieved in the process. Customer oriented approach and innovation are two of their core competencies, which enable to become key market participant in U.S. gummy market.

Key U.S. Gummy Companies:

- SCN BestCo

- BOSCOGEN

- Catalent, Inc

- Better Nutritionals, LLC

- SMPNutra

- Superior Supplement Manufacturing

- Well Aliments

- Vitakem Nutraceutical Inc.

- Nature's Bounty

- CBD American Shaman

Recent Developments

-

HARIBO, a German confectionary company opened its first manufacturing facility in United States in July 2023. The company produces 25 different types of gummies for the country and more than 1000 types for the global market.

-

In October 2022, Better Nutritionals and Doux Matok announced partnership developed for manufacturing gummies that would have less sugar contents but similar tastes.

U.S. Gummy Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3.46 billion

Revenue Forecast in 2030

USD 6.71 billion

Growth rate

CAGR of 11.6% from 2024 to 2030

Actuals

2018 - 2023

Forecasts

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments covered

Product, end-use, ingredient, distribution channel

Key companies profiled

SCN BestCo; BOSCOGEN; Catalent, Inc; Better Nutritionals, LLC; SMPNutra; Superior Supplement Manufacturing; Well Aliments; Vitakem Nutraceutical Inc.; Nature's Bounty; CBD American Shaman

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gummy Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. gummy market report based on product, end-use, ingredient, and distribution channel:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Vitamins

-

Minerals

-

Carbohydrates

-

Omega Fatty Acids

-

Proteins & Amino Acids

-

Probiotics & Prebiotics

-

Dietary Fibers

-

CBD/CBN

-

Psylocybin/Psychedelic Mushroom

-

Melotonin

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Adult

-

Men

-

Women

-

Pregnant Women

-

Geriatric

-

-

Kids

-

-

Ingredients Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gelatin

-

Plant-based Gelatin Substitute

-

-

Distribution Channel Outlook (Reveune, USD Billion, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others

-

-

Online

-

Frequently Asked Questions About This Report

b. Expected growth in demand for this market can be attributed to the widespread popularity of gummy supplements in the U.S., increased awareness about ingredients used in the foods, conscious consumer behavior regarding food and beverages that they consume, changing trends resulting in inclination towards nutraceuticals instead of pharmaceuticals, and unceasing prevalence of health problems such as cardiovascular diseases, diabetes, hypertension among others.

b. The U.S. gummy market was estimated at USD 3.12 billion in 2023 and is expected to reach USD 3.46 billion in 2024.

b. The U.S. gummy market is expected to grow at a compound annual growth rate of 11.6% from 2024 to 2030 to reach USD 6.71 billion by 2030.

b. Vitamin gummies dominated the U.S. gummy market with a share of around 26% in 2023. The main reason attributing to the growing demand for vitamin gummies market is the increasing prevalence of vitamin deficiencies identified. The changing lifestyles, lack of balance in diet, and chaotic routines of many leads to a deficiency of vitamin D and vitamin B12.

b. Some of the key players operating in the U.S. gummy market include SCN BestCo; BOSCOGEN; Catalent, Inc.; Better Nutritionals, LLC; SMPNutra; Superior Supplement Manufacturing; Well Aliments; Vitakem Nutraceutical Inc.; Nature's Bounty; CBD American Shaman

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.