- Home

- »

- Biotechnology

- »

-

U.S. Glycomics Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Glycomics Market Size, Share & Trends Report]()

U.S. Glycomics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Enzymes, Kits, Reagents, Instruments), By Application (Drug Discovery & Development, Diagnostics), By End Use, And Segment Forecasts

- Report ID: GVR-4-68040-289-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Glycomics Market Size & Trends

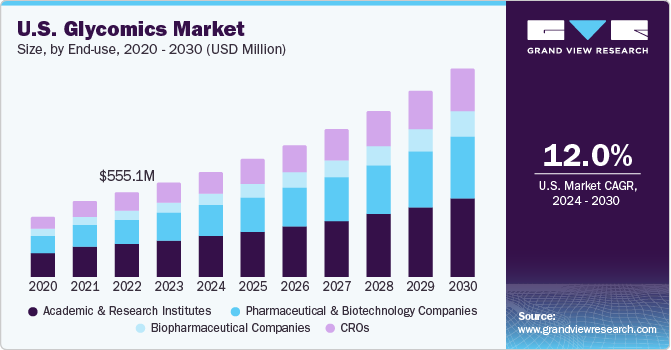

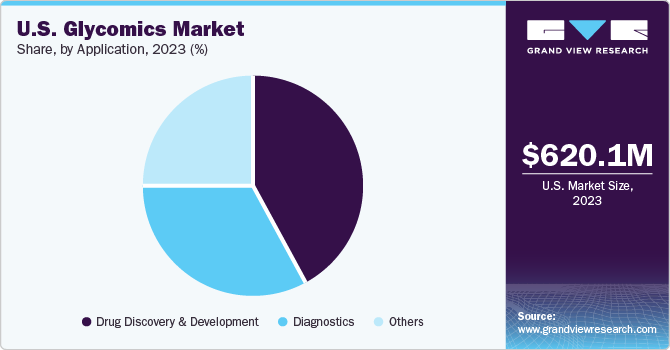

The U.S. glycomics market size was estimated at USD 620.08 million in 2023 and is projected to grow at a CAGR of 12.0% from 2024 to 2030. The gGrowing focus on glycomics and proteomics, rising investments in research by various government bodies, and development of novel drugs by pharmaceutical and biotechnology companies are the major driving factors in this market. Additionally, technological advancements in glycan profiling, spatial organization, isoform analysis, and site-specific glycan analysis are likely to contribute to the growth trajectory over the forecast period.

The U.S. glycomics market accounted for a 38% share of the global glycomics market in 2023. This market is experiencing significant growth, driven by various factors such as the growing interest in glycobiology, increasing frequency of chronic illnesses, technological advancements in glycomics tools, rising importance of glycans in drug development, and their biomedical applications. The high prevalence of cancer and other chronic diseases has driven the demand for R&D in glycomics products. These products are increasingly utilized in early cancer detection, showcasing significant attention in this industry. Furthermore, the rise in industry-academic collaborations fosters increased research in the field of glycomics, indicating a growing focus on advancing knowledge and applications in this area.

Technological advancements in glycomics have significantly increased the demand for glycomics instruments, with procedures like protein characterizations evolving into advanced techniques such as High-Performance Liquid Chromatography (HPLC), Mass Spectrometry (MS), and Capillary Electrophoresis (CE) in chemical and biochemical research. These cutting-edge technologies offer rapid and high-sensitivity results, contributing to the standardization and streamlining of glycomics technologies available today. Instruments found in protein analytical laboratory centers play a crucial role in determining most characteristics of protein glycosylation, showcasing the pivotal role of advanced instrumentation in glycomics research.

Rising R&D activities by leading biopharmaceutical, pharmaceutical, and biotechnology manufacturers is driven by the goal of developing innovative antibodies, particularly monoclonal antibodies. This focus on R&D and new product development is crucial for advancing treatments and therapies in various fields, including oncology and other diseases.

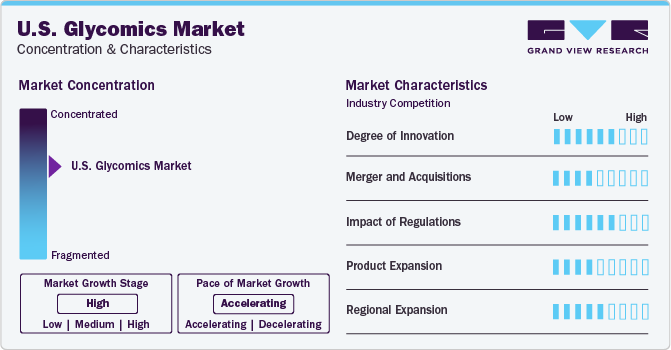

Market Concentration & Characteristics

The U.S. glycomics industry is characterized by a high level of competitiveness and a concentrated market landscape, showcasing intense competition among key companies. These companies engage in various strategic initiatives such as innovative product launches, mergers and acquisitions, and expansions into new products and regions to maintain and strengthen their market positions amidst the competitive environment.

Innovation allows companies to attract customers, boost revenue, and enhance patient outcomes significantly in this industry. Glycomics in developing cutting-edge therapies, enzyme products, and kits offer unique opportunities for companies to differentiate themselves in the industry, cater to evolving patient needs, and contribute to the advancement of personalized medicine. For instance, in July 2022, Vector Laboratories introduced its latest product, the Glysite™ Scout Glycan Screening Kits. These immunofluorescence (IF) kits are comprehensive tools designed for detecting glycan expression in tissue sections, facilitating the analysis and characterization of intricate glycans within biological systems.

The moderate to high levels of M&A activities in the U.S. genomics industry support companies in strengthening their capabilities, expanding product portfolios, and improving their competencies strategically. For instance, Thermo Fisher Scientific announced the acquisition of The Binding Site Group, a prominent company in specialty diagnostics, valued at $2.8 billion at current exchange rates. his acquisition complements Thermo Fisher's existing Specialty Diagnostics offerings with established technologies that deliver significant clinical value to patients in a rapidly growing diagnostics segment.

Glycomic industry supported by the regulatory bodies like U.S. FDA, an agency of the U.S. Department of Health and Human Services, ensuring the efficacy and safety of human and veterinary drugs, food, medical devices, cosmetics, tobacco products, radiation emitting products, vaccines, and biologics. Additionally, the FDA Modernization Act of 1997 oversees the regulation of food, drugs, devices, and biological products approved by FDA..

The increasing focus on regional and product expansion by major companies aims to serve diverse customer bases and capitalize on growth prospects in distinct geographic locations. For instance, in February 2024, Thermo Fisher Scientific announced expansion of its St. Louis manufacturing facility to facilitate the production of biologic therapies for rare diseases, strengthening its biologics manufacturing capabilities.

Product Insights

Enzymes segment dominated the market with a share of 31% in 2023 and is expected to experience a growth at largest CAGR in the forecast period. Glycomics comprises various research aspects requiring the involvement of various enzymes to determine biological processes. This includes glycosidases, glycosyltransferases, neuraminidases, sialyltransferases, and others. These enzymes are pivotal in therapeutic which help in direct antiviral activity, antibacterial, and anticancer activity, and aid in the treatment of various diseases. Such therapeutic trends of enzymes propel the segment’s growth. Moreover, research institutes and companies undertake collaboration initiatives to develop innovative enzyme products which boosts the market growth. For instance, in December 2022, researchers of Wyss Institute announced partnership with Kraft Heinz to develop a micro-encapsulated enzyme product that can convert sugar to gut-healthy fiber in the human gut. This innovative product, inspired by enzymes found in plants, is designed to activate only in human gut.

Glycomic kits segment is projected to grow at a significant CAGR from 2024 to 2030 owing to the increasing focus of biotechnological and pharmaceutical companies to develop kits for various research approaches. These include glycan purification kits, glycan labeling kits, glycan release kits, and other kits used in glycomics. Moreover, The compact design, user-friendly nature, and convenience of these kits for both therapeutic and research applications are key factors driving segment growth.

Application Insights

Drug discovery and development segment held the largest share of 42% in 2023, driven by the surge in R&D investments from pharmaceutical companies. The structural diversity and functional importance of glycans, proteoglycans, carbohydrate chains of glycoproteins, and glycolipids are pivotal in drug development. Furthermore, the increasing utilization of glycobiology in R&D activities is projected to further stimulate market growth in the upcoming period.

The diagnostics segment is anticipated to witness growth at the fastest CAGR from 2024 to 2030. The gylacans are used as diagnostic markers for various diseases highlighting their significance in disease diagnosis. Moreover, the continuous advancements in glycomics technology are expanding opportunities for personalized therapy development. These trends are anticipated to drive market growth in the forecast period.

End-use Insights

Academic and research institute segment dominated the market with a share of 39% in 2023 owing to the widespread utilization of glycan structure data analysis by research institutions. The rising preference for glycomics for educational and training purposes is driving significant market revenue. Moreover, glycomics products find diverse applications in biomedical research, drug discovery and development, immunology, and increasing government funding for academic institutions, which are anticipated to further boost market expansion in the coming years.

The biopharmaceutical Companies segment is projected to experience at the fastest CAGR from 2024 to 2030. Rising focus of biopharmaceutical companies on the development of glycobiology-based therapies for chronic diseases like diabetes, cancer, and other conditions contributes to this growth. Moreover, strategic initiatives undertaken by these companies are expected to drive segment growth in the forecast period. For instance, in October 2022, The Centre for Cellular and Molecular Platform (C-CAMP) collaborated with Agilent Technologies for research and technology development within the biosimilars and biopharmaceuticals sector. This partnership aims to leverage the expertise and resources of both organizations to advance scientific advancements in the field of biopharmaceuticals.

Key U.S. Glycomics Company Insights

The dominant companies in the U.S. glycomics market include Agilent Technologies, Thermo Fisher Scientific, Inc., and Danaher Corporation among others.

These companies are adopting strategic initiatives to enhance their competitive edge which include increasing product differentiation and expanding their product portfolios. Additionally, the development of high-quality and sustainable products is anticipated to sustain intense market competition at a high level.

Key U.S. Glycomics Companies:

- Thermo Fisher Scientific, Inc.

- Danaher

- New England Biolabs

- Bruker

- Agilent Technologies

- Waters Corporation

- Creative Proteomics

- BioAge Labs

- Frontier Medicines

- Monte Rose Therapeutics

Recent Developments

-

In February 2024, GNC announced the launch of a new weight loss supplement called Total Lean GlucaTrim. This product is designed to assist in weight loss, protect lean muscle mass, and maintain healthy blood sugar and insulin levels.

-

In June 2023, Ambrosia Bio partnered with Ginkgo Bioworks to leverage Ginkgo Enzyme Services in developing a more scalable enzymatic process for allulose, a next-generation sugar replacement. This partnership aims to enhance the production of allulose by utilizing Ambrosia Bio's proprietary enzymes and Ginkgo's expertise in synthetic biology and precision fermentation.

-

In February 2023, Creative Enzymes started commercialization of diagnostic enzymes for kidney and pancreas function, offering reliable enzyme products to accelerate research projects in this field.

U.S. Glycomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 620.1 million

Revenue Forecast in 2030

USD 1.37 billion

Growth rate

CAGR of 12.0% from 2024 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Country scope

U.S.

Key companies profiled

Thermo Fisher Scientific, Inc.; Danaher; New England; Biolabs ; Bruker; Agilent Technologies; Waters Corporation; Creative Proteomics; BioAge Labs; Frontier Medicines; Monte Rose Therapeutics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Glycomics Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. Glycomics market report based on product, application, and end-use:

-

Product Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Enzymes

-

Glycosidases

-

Neuraminidases

-

Glycosyltransferases

-

Sialyltransferases

-

Others

-

-

Kits

-

Glycan Labeling Kits

-

Glycan Purification Kits

-

Glycan Release Kits

-

Others

-

-

Reagents

-

Glycoproteins

-

Monosaccharides

-

Oligosaccharides

-

Others

-

-

Instruments

-

Mass Spectrometers

-

HPLC

-

MALDI-TOF

-

Array Systems

-

Others

-

-

-

Application Scope Outlook (Revenue, USD Million, 2018 - 2030)

-

Drug Discovery & Development

-

Diagnostics

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic & Research Institutes

-

Pharmaceutical & Biotechnology Companies

-

Biopharmaceutical Companies

-

CROs

-

Frequently Asked Questions About This Report

b. The U.S. glycomics market size was estimated at USD 620.08 million in 2023 and is expected to reach USD 693.16 million in 2024.

b. The U.S. glycomics market is expected to grow at a compound annual growth rate of 12.1% from 2024 to 2030 to reach USD 1.37 billion by 2030.

b. Enzymes dominated the U.S. glycomics market with a share of 30.68% in 2023. This is attributable to frequent usage in drug discovery and diagnostic testing applications.

b. Some key players operating in the U.S. glycomics market include Thermo Fisher Scientific, Inc.; Danaher; New England; Biolabs ; Bruker; Agilent Technologies; Waters Corporation; Creative Proteomics; BioAge Labs; Frontier Medicines; Monte Rose Therapeutics.

b. Key factors that are driving the U.S. glycomics market growth include technological advancements, rising investments in research by various government bodies, and the development of novel drugs by pharmaceutical and biotechnology companies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.