- Home

- »

- Medical Devices

- »

-

U.S. Glucagon Delivery Devices Market Size, Report, 2030GVR Report cover

![U.S. Glucagon Delivery Devices Market Size, Share & Trends Report]()

U.S. Glucagon Delivery Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Device Type (Injectable, Intranasal), By Distribution Channel (Retail Pharmacies, Online Pharmacies), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-421-0

- Number of Report Pages: 180

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

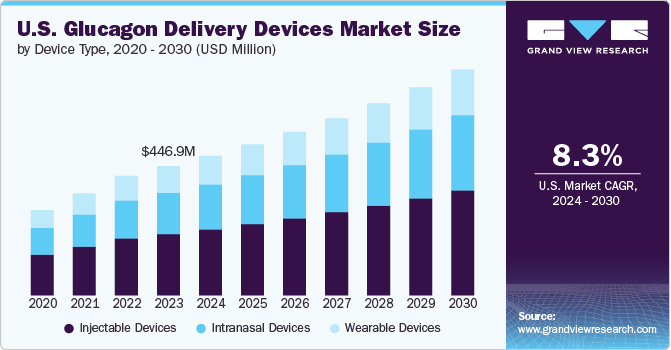

The U.S. glucagon delivery devices market size was estimated at USD 446.98 million in 2023 and is projected to grow at a CAGR of 8.33% from 2024 to 2030. There are several factors contributing to the market growth in the U.S., which include the growing prevalence of diabetes in the country, the development of advanced and user-friendly delivery devices, aging population, and increasing awareness about advantages of glucagon among patients and healthcare professionals.

According to the American Diabetes Association, around 38.4 million people in the U.S., accounting for around 11.6% of the population, had diabetes in 2021. Moreover, around 1.2 million people in the country are diagnosed with diabetes every year.

As the number of individuals diagnosed with diabetes continues to increase, the incidence of hypoglycemia, a condition in which blood glucose levels drop, is also anticipated to rise. This condition is especially common among those on insulin therapy or certain oral medications, which are prescribed to manage blood sugar. Hypoglycemia can lead to serious complications, including unconsciousness or seizures, necessitating the need for glucagon, a hormone that quickly raises blood sugar levels. The increasing diabetic population has, therefore, led to a higher demand for glucagon delivery devices, which are essential tools for managing these emergencies, especially in non-clinical settings. Moreover, as diabetes becomes more prevalent across diverse demographic groups, such as the geriatric population, there is a greater need for easy-to-use and reliable glucagon delivery methods.

In addition, manufacturers have focused on simplifying the process with the development of auto-injectors and pre-mixed, ready-to-use glucagon devices. These innovations allow users to deliver the medication quickly and with minimal preparation, making them particularly valuable for individuals without medical training. This ease of use is crucial for caregivers, parents of diabetic children, and patients themselves, who might need to administer glucagon during a severe hypoglycemic event. The increasing demand for self-administration in using these devices directly contributes to their increasing adoption.

Moreover, the convenience and reduced complexity of these technologically advanced devices are also encouraging healthcare providers to recommend them more frequently. The emphasis on improving patient outcomes and reducing barriers to effective treatment has led to the development of technologically advanced devices. For instance, in March 2021, the FDA approved dasiglucagon (Zegalogue) for treating severe hypoglycemia in individuals with diabetes aged six and older. Available as an autoinjector and prefilled syringe, dasiglucagon has a 36-month shelf-life when refrigerated and remains stable for 12 months at room temperature. This approval facilitates rapid response to severe hypoglycemic events, which can escalate quickly. The drug is also being investigated for other uses, including congenital hyperinsulinemia and as part of a bihormonal artificial pancreas system.

Market Concentration & Characteristics

The market growth stage is moderate and at an accelerating pace. The industry for U.S. glucagon delivery devices has seen significant innovation, marked by the advent of advanced injectable devices, intranasal devices, and wearable devices. These innovations aim to enhance the medication process, offering ease of administration and better outcomes.

The degree of innovation in the industry is significantly high as companies operating in the industry are focused on developing innovative and advanced solutions to address the increasing demand for glucagon. For instance, in June 2024, Teva Pharmaceuticals launched liraglutide injection (Victoza) 1.8 mg in the U.S. This generic is approved for adults and children aged 10 and older with type 2 diabetes (T2D) to enhance glycemic control and reduce cardiovascular event risks in adults with existing cardiovascular disease. Teva aims to meet the growing demand for GLP-1 therapies, providing patients with more treatment options.

“By launching an authorized generic for Victoza (liraglutide injection 1.8 mg), we are providing patients with type 2 diabetes another option for this important treatment. In addition to strengthening Teva’s diverse complex generics portfolio, we are providing the first generic GLP-1 product to the U.S. marketplace, demonstrating once again our ability to sustain a generics powerhouse.”

- Ernie Richardsen, (senior vice president and head of U.S. commercial generics at Teva)

The merger and acquisition (M&A) activity in the U.S. glucagon delivery devices industry is low to medium. Companies operating in the industry use a wide range of strategies, such as product launches, partnerships, product approvals, expansion, and M&A. However, the industry has witnessed significant M&A activity aimed at enhancing technological capabilities or expanding product portfolios.

Regulations significantly impact the U.S. glucagon delivery devices industry by shaping product development, industry entry, and overall industry dynamics. The U.S. Food and Drug Administration (FDA) plays a crucial role in ensuring the safety, efficacy, and quality of glucagon delivery devices. Stringent regulatory requirements mandate that manufacturers conduct clinical trials and submit detailed data for approval before their products can enter the industry. This rigorous approval process ensures only the safety and effectiveness of devices.

The level of partnership and collaboration in the glucagon delivery devices industry is increasing due to the growing complexity of product development, regulatory challenges, and the need for rapid innovation. Companies are forming strategic alliances to enhance manufacturing capabilities, streamline distribution, and accelerate FDA approvals. For instance, in May 2024, Xeris and Beta Bionics announced a global partnership to develop a glucagon product designed for use with proprietary pump technology. This collaboration and licensing agreement focuses on the development and commercialization of a glucagon product that leverages Xeris' XeriSol technology. Both companies plan to integrate this product with Beta Bionics' proprietary bi-hormonal pump and pump systems.

Product approvals in the glucagon delivery devices industry are growing due to several factors, including strategic alliances, research and development investments, and technological advancements in drug delivery methods. Major players like Eli Lilly, Xeris Pharmaceuticals, and Novo Nordisk are driving innovations to improve patient compliance and ease of use.

The regional expansion of the U.S. glucagon delivery devices industry is characterized as medium. The industry is expanding in various regions of the country, driven by increased diabetes prevalence and advancements in delivery devices. Efforts by industry players to improve access to these devices are significantly contributing to the regional expansion. Similarly, regulatory and reimbursement landscapes also impact the speed of expansion, with increasing efforts to harmonize regulatory scenarios in various regions of the country.

Device Type Insights

The injectable devices segment held 47.6% of the U.S. market share in 2023, accounting for the largest proportion in the market. The accuracy and proven efficacy of injectable glucagon among healthcare providers and patients have solidified its position as a trusted delivery device. Auto-injectors, in particular, have gained traction by addressing the usability challenges associated with traditional kits, offering a more convenient and less error-prone solution. This established trust and ongoing innovations within the injectable segment contribute significantly to its dominant market share. For instance, in August 2020, Xeris Pharmaceuticals launched Gvoke HypoPen, the first FDA-approved auto-injector for treating severe hypoglycemia in children and adults with diabetes. Pre-mixed and ready-to-use, Gvoke HypoPen allows patients to quickly inject glucagon themselves, unlike the prefilled syringe version, which requires assistance. Xeris also ensures broad insurance coverage and offers copay assistance to make HypoPen affordable for patients.

The intranasal devices segment is expected to grow at the fastest CAGR over the forecast period due to its innovative, non-invasive administration method, which addresses several limitations of traditional injectable glucagon. Intranasal glucagon offers a needle-free alternative, making it particularly appealing to patients who have a fear of needles or difficulties with injections, such as young children and the elderly. The simplicity of using a nasal spray in an emergency situation requiring no preparation or complex steps enhances its appeal, especially in high-stress scenarios where rapid intervention is critical. Moreover, the increasing efforts by market players to increase their presence are further increasing the availability of these devices, thereby contributing to the segment growth. For instance, in April 2023, Amphastar Pharmaceuticals acquired Baqsimi, an emergency intranasal glucagon treatment Eli Lilly. Amphastar aims to enhance its diabetes portfolio with this acquisition, complementing its existing products.

Distribution Channel Insights

The retail pharmacies segment held 51.7% of the market share in 2023, accounting for the largest proportion of the market due to their widespread accessibility and consumer convenience. Retail pharmacies are often the first point of contact for patients seeking medical supplies and prescription medications, including glucagon delivery devices. The vast network of retail pharmacies across the U.S., from national chains to independent stores, ensures that these critical devices are readily available to patients in both urban and rural areas. Similarly, retail pharmacies offer immediate product availability, which is crucial for emergency treatments such as glucagon, where time-sensitive access can be crucial.

The online pharmacies segment is expected to grow at the fastest CAGR over the forecast period owing to the increasing consumer preference for the convenience and accessibility offered by digital platforms. Online pharmacies provide patients with the ability to order glucagon devices from the comfort of their homes, which is particularly appealing for individuals managing chronic conditions such as diabetes. In addition, the ability to compare prices, access detailed product information, and read reviews also empowers consumers to make informed decisions. As online pharmacies continue to expand their offerings and enhance user experience, this segment is expected to witness significant growth.

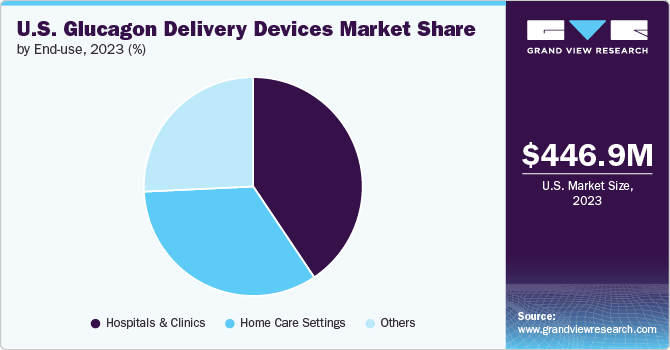

End-use Insights

The hospitals & clinics segment accounted for the largest market share of 40.6% in 2023. In hospitals and clinics, glucagon is frequently administered to patients experiencing hypoglycemic episodes, especially in emergency departments and inpatient units where immediate medical intervention is necessary. These settings require a steady supply of glucagon delivery devices to ensure readiness for any emergency, leading to bulk purchases and consistent demand. In addition, the wider presence of hospitals and clinics in the country makes them the first point of care for newly diagnosed diabetes patients. Moreover, these healthcare settings are increasingly adopting newer, user-friendly glucagon delivery systems, such as auto-injectors and nasal sprays, to streamline emergency care. This adoption enhances patient outcomes and reinforces the demand for these devices within hospitals and clinics.

The home care settings segment is expected to witness the fastest CAGR over the forecast period due to the increasing emphasis on managing chronic conditions such as diabetes at home. The availability of easy-to-use glucagon delivery devices, such as auto-injectors and wearable devices, has empowered patients and caregivers to handle these emergencies independently. These devices are specifically designed for non-professional use, with simple instructions and minimal steps required for administration. The shift towards home-based care, driven by a desire for convenience and the need to reduce healthcare costs, is driving the growth of this segment.

Key U.S. Glucagon Delivery Devices Company Insights

Key players in the glucagon delivery devices market in the U.S. include Eli Lilly and Company, Novo Nordisk A/SXeris Pharmaceuticals, Inc., Boehringer Ingelheim Pharmaceuticals, Inc., and others. These players are focusing on enhancing their product offerings through product upgrades, strategic collaborations, and merger and acquisition activities to hold a prominent share of the market.

Key U.S. Glucagon Delivery Devices Companies:

- Eli Lilly and Company

- Novo Nordisk A/S

- Xeris Pharmaceuticals, Inc.

- Boehringer Ingelheim Pharmaceuticals, Inc.

- Tandem Diabetes Care, Inc.

- Fresenius Kabi USA, LLC.

- Zealand Pharma A/S

- Amphastar Pharmaceuticals, Inc.

Recent Developments

-

In May 2022, Eli Lilly's Mounjaro (tirzepatide) received FDA approval as the first and only dual GIP and GLP-1 receptor agonist for adults with type 2 diabetes. While not approved for weight loss, Mounjaro resulted in significant weight reductions. It will be available in six doses and is expected to launch in the U.S. soon, marking a significant advancement in diabetes treatment options.

-

In February 2020, Fresenius Kabi launched a Glucagon Emergency Kit in the U.S. to treat severe hypoglycemia in diabetes patients. The kit includes 1 mg of Glucagon for Injection and a prefilled syringe with sterile water, providing a cost-effective and convenient option for emergency situations. Designed for easy portability, the kit features a bright orange case for quick identification during crises.

U.S. Glucagon Delivery Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 483.19 million

Revenue forecast in 2030

USD 781.07 million

Growth rate

CAGR of 8.33% from 2024 to 2030

Actual period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Device type, distribution channel, end-use

Key companies profiled

Eli Lilly and Company; Novo Nordisk A/S; Xeris Pharmaceuticals, Inc.; Boehringer Ingelheim Pharmaceuticals, Inc.; Tandem Diabetes Care, Inc.;

Fresenius Kabi USA, LLC.; Zealand Pharma A/S;

Amphastar Pharmaceuticals, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Glucagon Delivery Devices Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. glucagon delivery devices market report based on device type, distribution channel, and end-use:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable Devices

-

Intranasal Devices

-

Wearable Devices

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail Pharmacies

-

Online Pharmacies

-

Hospital Pharmacies

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Clinics

-

Home Care Settings

-

Other End-users

-

Frequently Asked Questions About This Report

b. The U.S. glucagon delivery devices market size was estimated at USD 446.98 million in 2023 and is expected to reach USD 483.19 million in 2024.

b. The U.S. glucagon delivery devices market is expected to grow at a compound annual growth rate of 8.33% from 2024 to 2030 to reach USD 781.07 million by 2030.

b. Injectable devices dominated the U.S. glucagon delivery devices market with a share of 47.6% in 2023 as it is efficient in quickly elevating blood sugar levels which makes them a preferred choice for many patients and healthcare providers.

b. Some key players operating in the U.S. glucagon delivery devices market include Eli Lilly and Company Novo Nordisk A/S, Xeris Pharmaceuticals, Inc., Boehringer Ingelheim Pharmaceuticals, Inc., Tandem Diabetes Care, Inc., Fresenius Kabi USA, LLC., Zealand Pharma A/S, Amphastar Pharmaceuticals, Inc.

b. Key factors that are driving the market growth include the increasing prevalence of diabetes in the U.S., technological advancements, and favorable reimbursement policies

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.