U.S. Gesture Recognition Market Size, Share & Trends Analysis Report By Technology (Touch-based, Touchless), By Industry (Automotive, Consumer Electronics, Healthcare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-250-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Gesture Recognition Market Trends

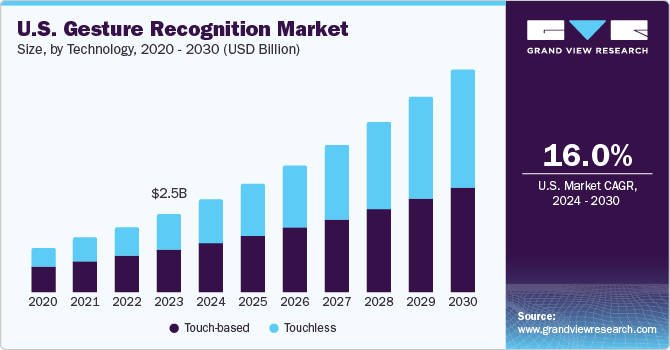

The U.S. gesture recognition market size was valued at USD 2.53 billion in 2023 and is projected to grow at a CAGR of 16.0% between 2024 and 2030. The penetration of unique interfaces that can capture gesture movements, such as deep learning algorithms, computer vision technology and cameras, has augured well for industry growth. In essence, home automation has become pronounced in the U.S., with smart TVs providing touchless control over audio and lighting systems. The trend for immersive and touchless experiences comes against the backdrop of machine learning, 3D depth-sensing cameras, and infrared.

The AI-fueled ability to interact with computers and devices has prompted industry leaders to adopt a contactless business model. Predominantly, the market footprint of consumer electronics and smart homes has boded well for the regional outlook. Gesture recognition has gained ground against the backdrop of surging security standards, hygiene and infrastructural developments. Banks, for instance, use the technology to bolster security and offer a seamless customer experience.

Gesture recognition technology has gained ground from technological advancements and digitization across the region. The U.S. has witnessed an increased adoption of interactive gaming (powered by augmented reality and virtual reality) across industry verticals. For instance, retail stores have sought gaming to provide personalized experiences, as gesture recognition can allow shoppers to try outfits, navigate through products, or receive tailored recommendations.

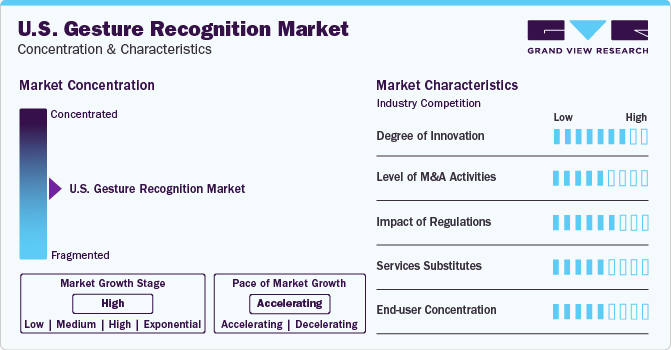

Market Concentration & Characteristics

Innovations have become replete in gesture recognition as end-users seek tools that can reduce resource usage through streamlined algorithms and provide multi-gesture support. The demand for real-time responsiveness, increased user experience and enhanced accuracy will continue to steer innovations. The potential of AI-powered gesture recognition across business verticals will bode well for stakeholders vying to foster their portfolios.

Mergers and acquisitions activities could be noticeable as industry leaders look to solidify their positions in the U.S. landscape. Leading players are likely to bolster and diversify their portfolios and increase market share. For instance, in November 2023, BigBear.ai announced the acquisition of Pangiam to underscore the vision AI ecosystem. The former expects advanced biometrics, facial recognition and computer vision capabilities to augur well.

Regulations on gesture recognition could be pronounced as the U.S. government came up with restrictions on China’s goods. In August 2023, President Biden inked an executive order to create a mechanism for restricting “outbound investment” in AI, quantum information and semiconductor sectors in foreign countries of concern, which includes China. Besides, cyberattacks can lead to unauthorized access to the device and data, which could compel watchdogs and governments to introduce regulations.

The level of substitutes may be moderate following the rising footprint of artificial intelligence, augmented reality and virtual reality across the U.S. market. An uptick in the number of smart infrastructure projects will further propel the footfall of gesture recognition technologies. Furthermore, the penetration of deep learning algorithms and machine learning will further the demand for state-of-the-art technology.

End-users, including automotive, healthcare and consumer electronics, have exhibited an increased adoption of the bespoke solution. For instance, the healthcare sector has injected funds into the technology to boost patient monitoring and diagnostic images. Additionally, it can enhance hygiene and efficiency with reduced risk of contamination during procedures. Gesture recognition tools will play an invaluable role for the future of smart healthcare system.

Technology Insights

The touch-based segment accounted for the largest revenue share in 2023, contributing 53.2% of the U.S. gesture recognition market during the period. Prominently, motion gesture technology and multi-touch systems will gain ground across the region. Stakeholders are likely to witness the use of a host of input devices to recognize gestures with the assistance of videos or images. Robust demand for smartphones and tablets will continue to underscore the penetration of touch-based technologies. Moreover, growing footfall of consumer electronics and automotive applications will bode well for the market outlook.

The touchless technology is poised to depict a notable revenue share against the backdrop of the trend for image sensors, ultrasonic sensors, electric field sensing, infrared and display capacitive sensors across biometric access, medical diagnosis, head-up displays, and smartphone applications. The healthcare and automotive industries are likely to exhibit profound traction for the technology for high accuracy and portability.

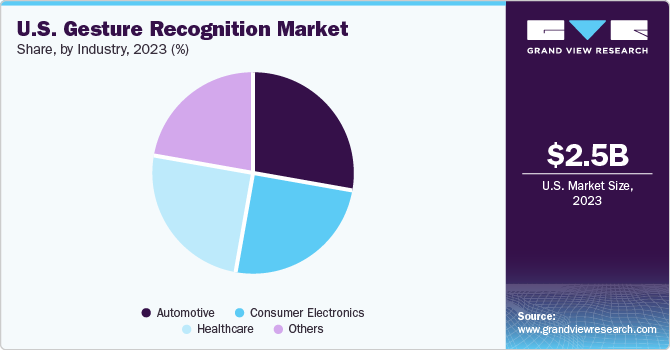

Industry Insights

The automotive sector will account for the largest revenue share in 2023, partly due to increasing safety regulations and the need to minimize driver distraction. Additionally, the prevalence of infotainment in cars has spurred the need for gestures and interaction with in-car controls. Besides, OEMs and automotive manufacturers are focusing on gesture recognition, along with touchless multifactor authentication system.

The consumer electronics segment will showcase robust growth in the wake of low technical complexity and the trend for IoT across the end-use application. The penetration of tablets, TVs, laptops and smartphones will encourage incumbent manufacturers to invest in the portfolio. Millennials and Gen Z American population are expected to seek advanced gesture technologies in consumer electronics products, prompting stakeholders to inject funds into the portfolio.

Key U.S. Gesture Recognition Company Insights

Some of the leading players operating in the market include Apple Inc., Alphabet Inc., Microsoft Corporation and Intel Corporation. They are likely to focus on organic and inorganic strategies to underscore their strategies in the regional landscape.

-

In 2023, Intel reported a 39% reduction in combined hardware and firmware vulnerability vis-à-vis 2022. The company claimed 94% of its vulnerability disclosures are linked to its product security assurance efforts.

-

In September 2022, Microsoft announced that Azure Payment HSM attained a Payment Card Industry Personal Identification Number (PCI PIN).

-

In June 2023, MediaTek joined forces with Nvidia to bring AI and gaming to car infotainment systems.

Some emerging companies are slated to expand their portfolios to bolster their value propositions. Some of the prevailing dynamics are delineated below:

-

In September 2022, Alcatraz AI received USD 25 million series A funding to bolster safety and security amidst surging demand for frictionless authentication solutions.

-

In December 2023, TomTom developed an AI-fueled voice assistant in collaboration with Microsoft.

Key U.S. Gesture Recognition Companies:

- Alphabet Inc.

- Apple Inc.

- Nvidia

- Intel Corporation

- Microchip Technology Incorporated

- Microsoft Corporation

- QUALCOMM Incorporated

- OmniVision Technologies

- eyeSight Technologies Ltd.

- Infineon Technologies AG

Recent Developments

-

In October 2023, Google reportedly made a passkey default authentication system, which will be established through either face scan, fingerprint, or PIN.

-

In January 2024, Qualcomm joined forces with Salesforce to build a biometric-enabled smart vehicle system. It will enable automakers to provide personalized experience.

U.S. Gesture Recognition Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3 billion |

|

Revenue Forecast in 2030 |

USD 7.32 billion |

|

Growth Rate |

CAGR of 16.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2030 |

|

Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments Covered |

Technology, industry |

|

Key Companies Profiled

|

Alphabet Inc.; Apple Inc.; Intel Corporation; Microchip Technology Incorporated; Microsoft Corporation; QUALCOMM Incorporated; OmniVision Technologies, eyeSight Technologies Ltd, Infineon Technologies AG |

|

Customization Scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and Purchase Options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Gesture Recognition Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. gesture recognition market on the basis of technology and industry.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Touch-based

-

Touchless

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Consumer Electronics

-

Healthcare

-

Others

-

Frequently Asked Questions About This Report

b. The global U.S. gesture recognition market size was estimated at USD 2.53 billion in 2023 and is expected to reach USD 3.00 billion in 2024.

b. The global U.S. gesture recognition market is expected to grow at a compound annual growth rate of 16.0% from 2024 to 2030 to reach USD 7.32 billion by 2030.

b. Automotive segment dominated the U.S. gesture recognition market with a share of 28.5% in 2023. This is attributable to increasing safety regulations and the need to minimize driver distraction.

b. Some key players operating in the U.S. gesture recognition market include Alphabet Inc.; Apple Inc.; Intel Corporation; Microchip Technology Incorporated; Microsoft Corporation; QUALCOMM Incorporated; OmniVision Technologies, eyeSight Technologies Ltd, Infineon Technologies AG

b. Key factors that are driving the market growth include the penetration of unique interfaces that can capture gesture movements, surging security standards, hygiene and infrastructural developments, and adoption of contactless business models

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."