- Home

- »

- Biotechnology

- »

-

U.S. Genomics Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Genomics Market Size, Share & Trends Report]()

U.S. Genomics Market (2024 - 2030) Size, Share & Trends Analysis Report By Application & Technology, By Deliverable, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-288-1

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Genomics Market Size & Trends

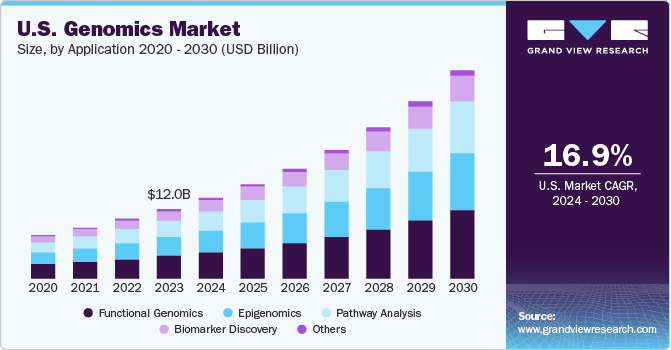

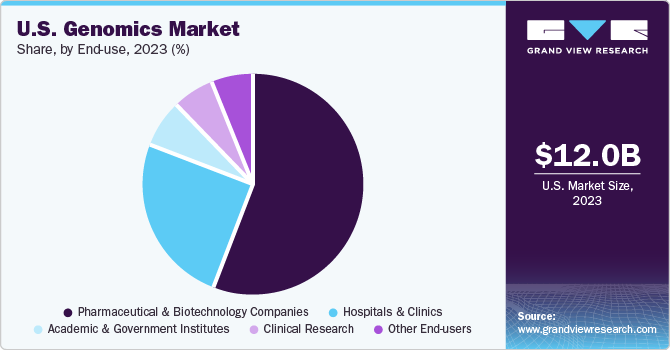

The U.S. genomics market size was estimated at USD 12.0 billion in 2023 and is projected to grow at a CAGR of 16.9% from 2024 to 2030. The increasing demand for gene therapy and personalized medicine has significantly boosted investment in genomics research and development. Additionally, advancements in drug discovery are leveraging genomics technologies to identify potential drug targets more efficiently. The rising incidence of cancer has heightened interest in cancer genomics as researchers strive to understand the genetic foundations of various cancers.

The popularity of consumer genomics services is also on the rise, with companies offering direct-to-consumer options. The reduction in sequencing costs, technological advancements, and the increasing demand for personalized medicine are accelerating the transformation and expansion of the market. The entry of new players, substantial government funding for genomics projects, and the broadening application areas of genomics further contribute to this growth.

The U.S. market accounted for 36.8% of the revenue share of the global genomics market in 2023. The Coordinated Framework for the Regulation of Biotechnology, established in 1986, delineates the collaborative roles of three federal agencies: the FDA, which ensures GMO foods meet safety standards; the EPA, which oversees the safety of substances used in GMO plants and monitors pesticide use; and the USDA's APHIS, which ensures GMO plants do not harm other plants.

Privacy regulations, although not specific to the genomics market, play a critical role, with various state laws governing genomic privacy and data usage. The USDA revised its regulations for GMO and gene-edited plants in June 2020, allowing developers to self-determine product regulation, though concerns remain about environmental impacts, food safety, trade disruptions, and consumer acceptance. Additionally, the regulation of gene-edited crops, including those modified with CRISPR technology, continues to be an area of active evaluation by the USDA and other agencies.

Application & Technology Insights

The functional genomics segment held the largest market share, accounting for 32.2% of total revenue in 2023. Functional genomics focuses on understanding gene function, interactions, and regulation. Researchers use techniques such as RNA sequencing, CRISPR-Cas9, and gene expression profiling to explore how genes contribute to biological processes and diseases. This segment is crucial for drug discovery, personalized medicine, and disease diagnostics. The increasing adoption of precision medicine, advancements in high-throughput sequencing technologies, and growing research in areas like cancer biology and rare diseases drive the demand for functional genomics solutions. Data analysis complexity, ethical considerations, and the need for robust bioinformatics tools remain challenges in this segment.

The pathway analysis is projected to experience the fastest revenue growth with a predicted CAGR of 17.8% from 2024 to 2030. Pathway analysis involves studying complex biological pathways and networks to understand how genes interact and influence cellular processes. Researchers use pathway analysis to identify key signaling pathways involved in diseases, drug response, and toxicity. It aids in drug target identification, biomarker discovery, and personalized treatment strategies. Advances in omics data integration, network biology, and machine learning algorithms enhance pathway analysis capabilities. Compliance with data privacy regulations and ethical guidelines is essential, especially when analyzing patient-specific genomic data.

Deliverable Insights

In 2023, the products segment accounted for the largest share of the U.S. genomics market, representing an impressive 70.0% of total revenue. These products encompass a wide range of offerings, including sequencing instruments, reagents, consumables, and software tools. Next-generation sequencing (NGS) platforms, microarray kits, and gene expression arrays are examples of genomic products. The robust demand for NGS platforms, driven by research institutions, clinical laboratories, and biopharmaceutical companies, contributed significantly to this segment's dominance. Additionally, the projected growth of products remains robust due to ongoing technological advancements, increased adoption of genomic tools, and the emergence of novel applications.

While products led the market, services is expected to be the second-fastest-growing segment, with a predicted CAGR of 15.0% from 2024 to 2030. Genomic services include sequencing services, bioinformatics analysis, and consulting. Researchers and organizations often rely on specialized service providers for NGS library preparation, data analysis, and interpretation. As genomics becomes more integrated into research, clinical diagnostics, and personalized medicine, the demand for high-quality services continues to rise. Service providers play a crucial role in supporting genomic research, ensuring data accuracy, and translating findings into actionable insights.

End-use Insights

In 2023, pharmaceutical and biotechnology companies held the largest market, accounting for approximately 23.0% of total revenue. These companies play a pivotal role in advancing genomics research and translating discoveries into therapeutic applications. Their investment in genomic technologies spans drug development, personalized medicine, and disease diagnostics. By leveraging genomic insights, these companies aim to identify novel drug targets, develop precision therapies, and enhance patient outcomes. As the field continues to evolve, collaborations between industry players, academic institutions, and research organizations will drive further growth in this segment.

The clinical research sector is poised for rapid growth, with a predicted CAGR of 18.0% from 2024 to 2030. Clinical studies increasingly recognize the impact of genomic variations on disease susceptibility, progression, and treatment response. Researchers conduct genomic analyses to identify biomarkers, stratify patient populations, and guide therapeutic decisions. Techniques such as next-generation sequencing (NGS), gene expression profiling, and single-cell genomics contribute to our understanding of diseases ranging from cancer to rare genetic disorders. As precision medicine gains prominence, clinical research will continue to fuel innovation in genomics, ultimately benefiting patients worldwide.

Key U.S. Genomics Company Insights

The U.S. genomics market indicates a dynamic and competitive structure. Some key players operating in this market include Illumina and Thermo Fisher Scientific:

-

Illumina, Inc.: Illumina, headquartered in the United States, is a global leader in genomics and sequencing technologies. Their innovative platforms, like next-generation sequencing (NGS), have transformed genomic research, diagnostics, and personalized medicine. Illumina’s high-throughput sequencers enable rapid and cost-effective analysis of DNA, RNA, and epigenetic modifications.

-

Thermo Fisher Scientific, Inc.: Thermo Fisher Scientific, another major player, offers a comprehensive portfolio of genomics solutions. Their products span DNA and RNA extraction, library preparation, sequencing, and bioinformatics.

Key U.S. Genomics Companies:

- Illumina Inc.

- Thermo Fisher Scientific Inc.

- Agilent Technologies

- Luminex Corporation

- Myriad Genetics Inc.

- BGI Genomics Co. Ltd.

- Bio Rad Laboratories Inc.

- Caris Life Sciences

- Danaher Corp.

- Eurofins Scientific SE

Recent Developments

-

In January 2024, Illumina Ventures launched Illumina Ventures Labs and replaced its Accelerator program with a new genomics-focused initiative offering funding, mentorship, and continued access to technical guidance and DNA analysis hardware.

-

In January 2024, Thermo Fisher Scientific introduced the Axiom PangenomiX Array, a human genomics research tool aligned with the recent pangenome development for enhanced investigation of human genetic diversity.

-

In September 2023, LabGenomics expanded its North American footprint through its subsidiary LabGenomics USA's acquisition of diagnostic and molecular service provider QDx Pathology, aiming to offer a broader range of diagnostic services.

U.S. Genomics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.0 billion

Revenue forecast in 2030

USD 35.8 billion

Growth rate

CAGR of 16.9% from 2024 to 2030

Base year for estimation

2023

Forecast period

2024 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Application & technology, deliverable, end-use

Key companies profiled

Illumina Inc.; Thermo Fisher Scientific Inc.; Agilent Technologies; Luminex Corporation; Myriad Genetics Inc.; BGI Genomics Co. Ltd.; Bio Rad Laboratories Inc.; Caris Life Sciences; Danaher Corp.; Eurofins Scientific SE

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Genomics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. genomics market report based on application & technology, deliverable, and end-use:

-

Application & Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Functional Genomics

-

Transfection

-

Real-Time PCR

-

RNA Interference

-

Mutational Analysis

-

SNP Analysis

-

Microarray Analysis

-

-

Epigenomics

-

Bisulfite Sequencing

-

Chromatin Immunoprecipitation (ChIP & ChIP-Seq)

-

Methylated DNA Immunoprecipitation (MeDIP)

-

High-Resolution Melt (HRM)

-

Chromatin Accessibility Assays

-

Microarray Analysis

-

-

Pathway Analysis

-

Bead-Based Analysis

-

Microarray Analysis

-

Real-time PCR

-

Proteomics Tools (2-D PAGE; yeast 2-hybrid studies)

-

-

Biomarker Discovery

-

Mass Spectrometry

-

Real-time PCR

-

Microarray Analysis

-

Statistical Analysis

-

Bioinformatics

-

DNA Sequencing

-

-

Others

-

-

Deliverables Outlook (Revenue, USD Billion, 2018 - 2030)

-

Products

-

Instruments/Systems/Software

-

Consumables & Reagents

-

-

Services

-

NGS-based Services

-

Core Genomics Services

-

Biomarker Translation Services

-

Computational Services

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Research

-

Academic & Government Institutes

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Other End-users

-

Frequently Asked Questions About This Report

b. The U.S. genomics market was valued at USD 12.0 billion in 2023.

b. The U.S. genomics market is projected to expand at a CAGR of 16.9% from 2024 to 2030 to reach USD 35.8 billion by 2030.

b. The functional genomics segment held the largest market share, accounting for 32.2% of total revenue in 2023. Functional genomics focuses on understanding gene function, interactions, and regulation. Researchers use techniques such as RNA sequencing, CRISPR-Cas9, and gene expression profiling to explore how genes contribute to biological processes and diseases.

b. The U.S. genomics market indicates a dynamic and competitive structure. Some key players operating in this market include Illumina, and Thermo Fisher Scientific.

b. The increasing demand for gene therapy and personalized medicine has significantly boosted investment in genomics research and development. Additionally, advancements in drug discovery are leveraging genomics technologies to identify potential drug targets more efficiently. The rising incidence of cancer has heightened interest in cancer genomics as researchers strive to understand the genetic foundations of various cancers.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.