U.S. Generative AI Market Size, Share & Trends Analysis Report By Component (Software, Services), By Technology, By End-use, By Application, By Model, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-197-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Generative AI Market Size & Trends

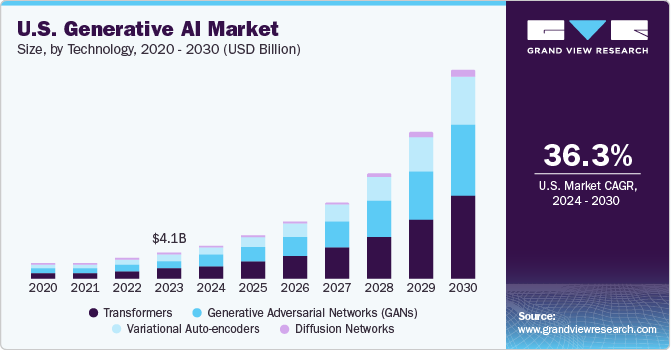

The U.S. generative AI market size was estimated at USD 4.06 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 36.3% from 2024 to 2030. Generative artificial intelligence defines algorithms that can be used to create new content, including images, audio, code, text, videos, and simulations. Automating time-consuming and repetitive tasks is driving the growth of generative AI technology in the country. Generative AI empowers employees to free up time and concentrate on tasks requiring greater creativity and complexity. Through its capacity to analyze unstructured data, facilitate decision-making, and streamline workflows, this technology enhances productivity and reduces the likelihood of errors.

The availability of vast amounts of data is crucial for improving and training generative AI models. The presence of advanced technological infrastructure in the country provides a rich data source for training models, particularly in areas such as computer vision and language processing, thus presenting an opportunity for a generative AI market. Furthermore, cloud storage solutions provide numerous advantages for Generative AI initiatives. They facilitate streamlined data accessibility and collaboration, enabling teams nationwide to store and exchange diverse datasets seamlessly.

The U.S. generative AI market trends include using AI, statistics, and probability to create computer-based representations of targeted variables based on previous input, observations, or datasets. Moreover, generative AI tools have experienced significant growth due to advancements in deep learning. The progress in deep learning techniques has enhanced the intelligence and capabilities of models, allowing them to undertake intricate tasks like image recognition, language translation, and content generation with remarkable precision and efficiency. Also, the increasing demand for content and experiences that are personalized, relevant, and engaging has fueled the growth of the generative AI sector.

The U.S. labor market is going through a rapid evolution in the way people work and the work they do. The job market in the U.S. is going through a strong and fast recovery after a sudden decline. This revival is aligned with a shift in work patterns. More workers now opt for remote or hybrid models while employers expedite their automation technology integration. The rapid advancement of generative AI, characterized by its refined natural language capabilities, has expanded the scope of U.S. Generative AI automation to encompass a broader range of occupations.

The U.S. generative AI gaming market is witnessing growth due to an increasing player base and diversification, which has created a demand for immersive and personalized gaming experiences. Generative AI saves resources and time, thus enhancing gameplay, increasing game performance, providing personalization to gamers, and increasing game developers' creativity. In addition, the increase in the availability of hardware and advancements in machine learning algorithms have enabled the integration of AI features, contributing to the overall evolution of gaming experiences in the region. Many gaming companies are partnering with cloud companies to develop their cloud infrastructure and enhance their gaming experiences for players. For instance, in December 2023, NCSOFT, a game developer and publisher, partnered with Google Cloud to power its in-house large language model (LLM) set, VARCO LLM. NCSOFT's VARCO LLM represents a specialized model for developing high-quality content for game development. Utilizing this technology, the company created a collection of AI-powered tools encompassing text generation, digital character management, facilitating interactions between players and virtual characters, and dynamically generating storylines based on player actions. The game now offers a more immersive experience with an engaging storyline and dynamic gameplay.

Generative artificial intelligence (AI) is rapidly gaining popularity in the U.S. owing to the increasing demand for creative and personalized content across various industries. Generative AI technology enables the automatic generation of content tailored to individual preferences and needs, ranging from personalized product recommendations to custom-designed artwork. In the entertainment, advertising, and e-commerce sectors, generative AI is leveraged to create immersive and engaging consumer experiences, driving customer engagement and brand commitment.

Generative AI has the potential to generate a new stream of software revenue. It is being utilized to create specialized assistants, new infrastructure products, and copilots that speed up coding. Cloud computing companies are positioned to reap the most significant rewards from this trend. As businesses increasingly migrate their workloads to public cloud platforms, there will be a growing demand for generative AI solutions to streamline operations and enhance productivity. Major players in the cloud computing industry, such as Microsoft, Amazon Web Services, Nvidia, and Google, are already strategically positioned to meet this demand and capitalize on the opportunity.

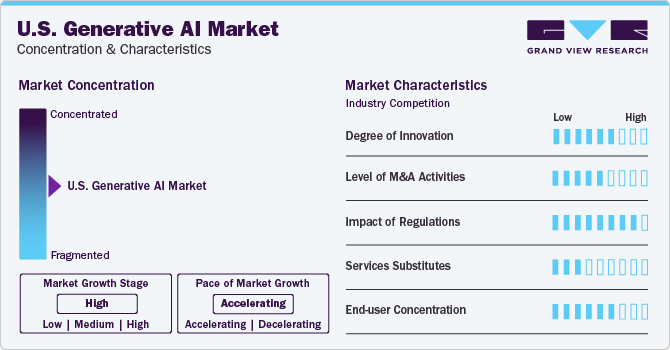

Market Concentration & Characteristics

The U.S. generative AI market growth stage is high, and the pace is accelerating. The generative AI market in the region is characterized by an active and rapidly evolving landscape driven by technological advancements, diverse applications, and a supportive ecosystem. One prominent feature is the increasing adoption of generative AI across various industries, including finance, entertainment, healthcare, and more. The demand for innovative solutions in healthcare, such as medical image synthesis and drug discovery, boosted significant growth in the region.

Government initiatives and policies supporting AI development influence the growth of the generative artificial intelligence market in the region. U.S. has implemented strategies to promote research, innovation, and the responsible use of AI technologies. These initiatives often include funding, collaborations, and regulatory frameworks between government bodies, industry, and academia. As governments actively engage in shaping the AI landscape, it contributes to a favorable environment for the growth of the generative AI market in the region, fostering innovation and cross-industry collaborations. Many IT companies in the Northeast region of the U.S. are collaborating with cloud companies to leverage cloud computing resources and advance their offerings in the generative AI market. For instance, in February 2024, Kyndryl, an IT infrastructure service provider, partnered with Google Cloud to develop responsible generative AI solutions and accelerate customer adoption.

The U.S. generative AI market is developing and has a slightly concentrated nature, featuring several regional and global players. The market players are investing in research & development to create advanced solutions and gain a competitive edge. Moreover, they are entering into mergers & acquisitions and partnerships as the market is characterized by rapid change, innovation, and disruption. Moreover, according to a survey by KPMG, 65% of the executives in the U.S. believe generative AI would have a high impact on organizations in the next three to five years, thus driving the growth of generative AI in the U.S.

Component Insights

Based on components, the market is further segmented into services and software. The software segment accounted for the largest revenue share of 64.8% in 2023 and is expected to continue to dominate the industry over the forecast period. The expansion of the software sector can be attributed to various elements, including the adoption of advanced technologies, increased investment in artificial intelligence, escalating demand for automation, and favorable regulatory conditions. In addition, the emergence of generative AI software is anticipated to have considerable influence across diverse sectors and industries, such as manufacturing, gaming, and design.

The service segment is anticipated to witness the fastest CAGR during the forecast period. The segment growth can be attributed to the increasing concerns over fraud detection, risk factor modeling, data protection, and trading prediction. Cloud-based generative AI services are expected to gain popularity as they provide scalability, flexibility, and cost-effectiveness, fueling the segment's growth. For instance, in February 2024, S&P Global launched a generative AI search on the S&P Global Marketplace. The Global Solution for Marketplace Generative AI Search aims to streamline and improve the exploration of S&P Global's offerings worldwide. Interpreting users' natural language inquiries provides comprehensive responses, streamlining and enhancing the search experience. Moreover, it takes proactive measures by suggesting additional relevant data sets and services and expanding users' insights and options.

Technology Insights

The market is segmented based on technology into transformers, Generative Adversarial Networks (GANs), diffusion networks, and variational auto-encoders. The transformers segment held the largest revenue share in 2023. It can be attributed to the increasing adoption of transformer applications, including text-to-image AI, that convert text to an image. Many companies are introducing text-to-image AI tools on their platforms to revolutionize how visuals are created for projects, campaigns, and brands. For instance, in January 2023, Shutterstock, Inc. launched its AI image generation platform for its customers in every language the website offers. It converts prompts into visuals that are ready for licensing.

Furthermore, the diffusion networks segment is expected to grow fastest during the forecast period. Image synthesis has become crucial for multiple industries such as healthcare, automotive & transportation, defense, media & entertainment, BFSI, and many others. This technology has enabled these industries to fulfill the growing demands of image generation and provide high-value services to businesses, the government, and the public.

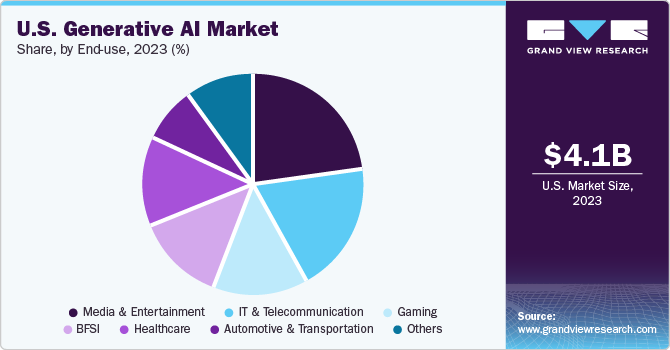

End-use Insights

Based on end-use, the market is segmented into media & entertainment, BFSI, IT & telecommunications, healthcare, automotive & transportation, and others. The other sub-segment further comprises security, aerospace & defense. The media & entertainment segment accounted for the largest market share in 2023 and is projected to grow at a significant CAGR during the forecast period. The increasing adoption of generative AI for better advertisement and campaign journalism will likely drive demand for this technology in the media & entertainment industry. For instance, in October 2023, Amazon Ads launched a generative AI solution for image generation to help advertisers create more engaging content and improve their ad campaigns.

The BFSI segment is expected to witness the fastest growth rate during the forecast period. The market growth in this segment is attributed to simplifying complex data analysis, enhancing customer experiences, and risk management. Moreover, the banking sector has found generative AI beneficial in creating marketing visuals and text and improving the efficiency and accuracy of machine learning applications by generating data.

Application Insights

The Natural Language Processing (NLP) segment dominated the market in 2023 and is projected to grow at a significant CAGR during the forecast period. Generative AI is crucial in enhancing NLP processing by offering complex prompts equivalent to creating human feedback. Moreover, generative AI in NLP offers enhanced models and ethical considerations that would pave the way for applications in content summarization, sentiment analysis, and personalized user experiences.

The computer vision segment is anticipated to grow at the fastest CAGR during the forecast period, owing to the increasing adoption of computer vision systems in the automotive and transportation sectors. Moreover, generative AI techniques empower computers to understand and manipulate visual data in unexplored ways, such as image inpainting, style transfer, and image-to-image translation, opening up new avenues for applications in fields like digital content creation, medical imaging, autonomous vehicles, and surveillance systems.

Model Insights

The large language model segment dominated the market in 2023 and is projected to grow at a significant CAGR over the forecast period. Breakthroughs in neural network architectures, particularly transformer-based models like GPT, have enabled the development of large language models with millions, and even billions, of parameters. This development has vastly enhanced their ability to understand and generate human-like text across diverse contexts and domains. These technological advancements increased interest and investment in generative AI, driving its rapid growth and adoption across various applications.

The multimodal generative model is expected to grow fastest during the forecast period. The ability of the multimodal generative model to enhance accuracy and robustness by integrating data from various modalities is fueling segment’s growth. This model type can achieve increased performance by combining information from multiple sources, driving its expansion within the field. The segment of image and video models is expected to experience significant growth due to its ability to produce high-quality and realistic images and videos quickly. These outputs, often difficult or impossible to achieve through traditional methods, drive this model type's widespread adoption and development.

Key U.S. Generative AI Company Insights

Some key players operating in the market include Amazon Web Services, Inc.; IBM; and Microsoft.

-

Amazon Web Services (AWS) offers a variety of solutions and services for generative artificial intelligence (AI). These offerings are tailored to assist organizations in innovating and scaling generative AI applications with enterprise-grade security, privacy, and access to industry-leading foundation models. AWS provides tools such as Amazon Bedrock, Amazon SageMaker, NVIDIA GPU-powered Amazon EC2 instances, AWS Trainium, and AWS Inferentia to facilitate the development and scaling of generative AI applications.

-

Google LLC, a subsidiary of Alphabet, is a multinational technology company focusing on search engines, computer software, online advertising, Artificial Intelligence (AI), and cloud computing. Google LLC offers generative AI solutions and services through its Google Cloud platform. The platform provides tools like Google DeepMind’s multimodal model from Google DeepMind and Gemini. Additionally, Google Cloud's Generative AI Studio enables developers to interact with, tune, and deploy large AI models, thus accelerating generative AI production.

Cohere, Hugging Face, and Tome.App are some of the other market participants in the U.S. generative AI market.

-

Cohere, an AI startup, specializes in constructing multilingual Large Language Models (LLMs) tailored for enterprise businesses aimed at optimizing various tasks. Through Cohere's platform, users gain the capability to develop chatbots, knowledge assistants, and search solutions, enhancing operational efficiency and effectiveness within their organizations.

-

Hugging Face is a collaborative AI community dedicated to crafting developer tools. With an extensive storage of more than 7,000 datasets and 61,000 pre-trained models, this platform empowers innovators to expedite the development of generative AI and machine learning models. Developers can accelerate projects through these open-source resources and rapidly advance AI technology.

Key U.S. Generative AI Companies:

The following are the leading companies in the U.S. generative AI market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. generative AI companies are analyzed to map the supply network.

- Google LLC

- Amazon Web Services, Inc.

- IBM

- Microsoft

- Hugging Face

- Cohere

- Tome.App

- AssemblyAI

- Midjourney

- Klaviyo

Recent Developments

-

In January 2024, Oracle introduced the Oracle Cloud Infrastructure Generative AI service, featuring innovations designed to simplify enterprises' utilization of cutting-edge generative AI technologies. This offering aims to facilitate easier access for businesses to leverage the latest advancements in generative AI, enhance their capabilities, and drive innovation within their operations.

-

In November 2023, U.S. News launched a generative AI search across USNews.com. Generative AI search feature is developed to empower consumers to make quick and more informed decisions.

-

In November 2023, Accenture started a network of generative AI studios across North America, offering companies opportunities to innovate and refine their business strategies through the responsible integration of generative AI applications. The studios aim to facilitate connections between clients and Accenture's leading data and AI professionals. These experts will assist in harnessing Accenture's extensive network of ventures, ecosystem partnerships, and strategic investments within the Center for Advanced AI.

U.S. Generative AI Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 5.26 billion |

|

Revenue forecast in 2030 |

USD 33.78 billion |

|

Growth rate |

CAGR of 36.3% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2017 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

February 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Component, technology, end-use, application, model |

|

Key companies profiled |

Google LLC; Amazon Web Services, Inc.; IBM; Microsoft; Hugging Face; Cohere; Tome.App; AssemblyAI; Midjourney; Klaviyo |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Generative AI Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. generative AI marketreport based on component, technology, end-use, application, and model:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Generative Adversarial Networks (GANs)

-

Transformers

-

Variational auto-encoders

-

Diffusion Networks

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Media & Entertainment

-

BFSI

-

IT & Telecommunication

-

Healthcare

-

Automotive & Transportation

-

Gaming

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Computer Vision

-

NLP

-

Robotics and Automation

-

Content Generation

-

Chatbots and Intelligent Virtual Assistants

-

Predictive Analytics

-

Others

-

-

Model Outlook (Revenue, USD Million, 2017 - 2030)

-

Large Language models

-

Image & Video generative models

-

Multi-modal generative models

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. generative AI market size was estimated at USD 4.06 billion in 2023 and is expected to reach USD 5.26 billion in 2024

b. The U.S. generative AI market is expected to grow at a compound annual growth rate of 36.3% from 2024 to 2030 to reach USD 33.78 billion by 2030

b. The transformers segment held the largest revenue share in 2023. It can be attributed to the increasing adoption of transformer applications, including text-to-image AI, that convert text to an image.

b. Some key players operating in the U.S. generative AI market include Google LLC, Amazon Web Services, Inc., IBM, Microsoft, Hugging Face, Cohere, Tome.App, AssemblyAI, Midjourney, Klaviyo

b. Automating time-consuming and repetitive tasks is driving the growth of generative AI technology in the country.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."