U.S. Gastroenterology Ambulatory Surgery Centers Market Size, Share & Trends Analysis Report By Ownership (Hospital-affiliated, Freestanding, Corporation-owned), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-3-68038-928-9

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

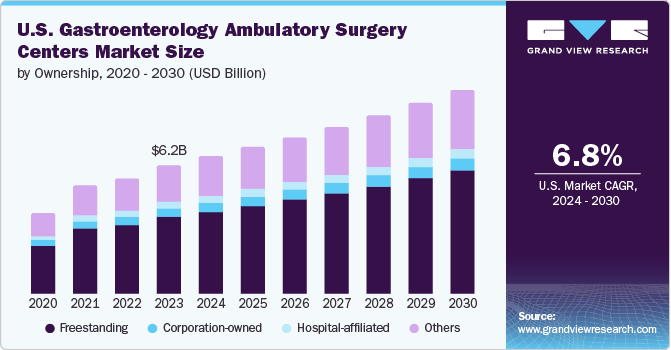

The U.S. gastroenterology ambulatory surgery centers market size was valued at USD 6.17 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. It has been observed a rise in the prevalence of GI (Gastrointestinal) diseases, increasing awareness about public health, and increasing diseases across the country such as gastroesophageal reflux diseases (GERD), irritable stool syndrome (IBS), inflammatory bowel disease (IBD), and gallstones. However, the digestion, absorption, and waste removal processes heavily rely on the GI system, resulting in early diagnosis and improved treatment to minimize more severity.

The rising surgical treatments and hospitalizations due to the growth in GI diseases and increasing R&D investments by pharmaceutical companies are some of the key contributors to the market growth. Digestive problems are rising among patients in the U.S. for many reasons, including dietary patterns, lifestyle variations, environmental changes, and genetic susceptibility.

Hence, ambulatory surgery centers (ASCs) are specialized medical facilities designed to provide procedures in the fields such as gastroenterology (GI), ophthalmology, and others respectively, resulting in more preference by people because of convenience, cost-effective, quality care and better patient outcomes and as an alternative to a full-service hospital. Furthermore, enhancements in laparoscopic processes, the adoption of digital imaging, and telemedicine are attributes of growing many complex procedures, once executed only in hospitals, are now being practiced in ambulatory surgical centers. The future of care within ambulatory service centers continues to expand considerably. In addition, surgeons' and patients' ease and accessibility have also resulted in noteworthy growth in the ambulatory surgical centers offering benefits to providers and patients.

Ownership Insights

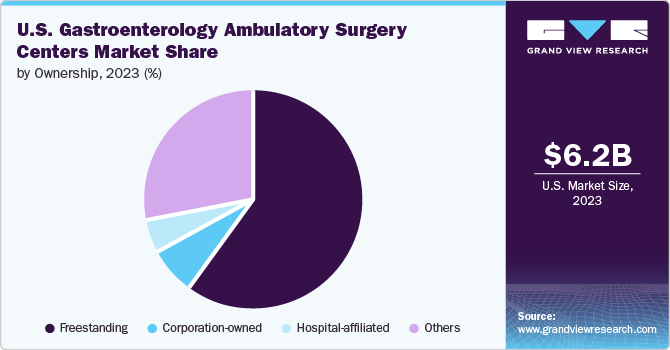

The freestanding ownership dominated the market and accounted for the largest revenue share of 60.0%. The freestanding ownership segment mainly comprises physician-owned ambulatory surgery centers, and due to professional control over the clinical setting and quality of care delivered to patients, it likely boosts the market. It allows the physicians to aim at a small number of processes in one place. In addition, endoscopic ambulatory service centers are freestanding services developed to conduct gastrointestinal procedures at a lower cost than highly expensive hospitals. All these significant aspects of freestanding ownership led to the high demand among the patients, and the companies to implement various market approaches for market growth.

Corporation-owned ownership is expected to grow at a CAGR of 5.4% over the projected years. This is attributed to the increasing focus of companies and physicians on establishing a joint venture. Experienced key companies in the healthcare field provide expertise in financial matters, operations, and recruiting the best and most skilled professionals. In addition, collaborations between corporations and physicians continue to take place, and this ownership model in the ambulatory surgical center market will continue to expand as the key players seek the right blend to fasten efficiency and improve results.

Country Insights

U.S. Gastroenterology Ambulatory Surgery Centers Market Share by Ownership, 2023 (%) Trends

The number of ASCs (Ambulatory Surgical Centers) in the U.S. is rising by huge numbers for reasons such as the high cost involved in healthcare services offered by physicians with unnecessary hospitalization expenses. ASCs are able to perform the surgeries at higher efficiency & a minimal cost. This attracts the patients to prefer ASCs over hospitals, resulting in many hospitals being inclined towards ASCs to move the cases for surgeries.

Many large hospitals and ASCs are expanding their market presence in the U.S.

In addition, the U.S. has a strong presence in ambulatory surgery centers, contributing to the market's growth. Consequently, healthcare companies' innovative offerings to meet the growing demand for gastroenterology ambulatory surgical center services and specialized care for patients requiring gastrointestinal procedures in outpatient settings result in market expansion continually.

Key U.S. Gastroenterology Ambulatory Surgery Centers Company Insights

Some of the key companies in the U.S. gastroenterology ambulatory surgery centers market include TH Medical., GE Healthcare, Universal Health Services, Inc., Covenant Physician Partners, Regent Surgical, Cardinal Health., Boston Scientific Corporation., in the market are focusing on development & to gain a competitive edge in the industry.

-

Cardinal Health produces and supplies performance and data solutions for healthcare facilities and laboratory supplies. Gloves, surgical clothes, and fluid management items are among the medical and surgical supplies offered by the organization. Hospitals, healthcare systems, pharmacies, ambulatory surgery centers, clinical laboratories, doctor offices, and patients in their homes can all benefit from their specialized solutions.

-

Cook Medical is a manufacturer, distributor, and developer of medical equipment intended for minimally invasive treatments. The company’s offerings include catheters, grafts, stents, needles, balloons, wire guides, extractors, and many other items. It offers goods and services in a wide range of specialty areas, including general surgery, gynecologic oncology, urology, neurosurgery, burn surgery, cardiothoracic surgery, colorectal surgery, endovascular surgery, and bariatrics.

Key U.S. Gastroenterology Ambulatory Surgery Centers Companies:

- TH Medical.

- GE Healthcare

- Universal Health Services, Inc.

- Covenant Physician Partners

- Regent Surgical

- Cardinal Health.

- Boston Scientific Corporation

- Olympus Corporation

- Koninklijke Philips N.V.

- Cook Medical

Recent Developments

-

In May 2024, Koninklijke Philips, a significant contributor to the field of health technology, and Radboud University Medical Center established a long-term strategic partnership that will enable the hospital to provide patients with the most up-to-date monitoring applications. Additionally, both parties have signed a service agreement that will enable them to continue providing clinical and technical support for the upkeep of the monitors and basic IT platform. Furthermore, this cooperation would improve clinical outcomes and patient monitoring by reducing alerts and enabling data access and clinical decision-making from any location.

-

In July 2024, GE HealthCare and Amazon Web Services, Inc. (AWS) signed a strategic agreement for the development of foundation models with specific functions and generative artificial intelligence (AI) application designs. This agreement will also help expedite the delivery of innovations that will improve patient outcomes, streamline access issues, improve diagnostic and screening accuracy, and promote equitable care, all of which lessen the workload for healthcare providers.

U.S. Gastroenterology Ambulatory Surgery Centers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.58 billion |

|

Revenue forecast in 2030 |

USD 9.78 billion |

|

Growth Rate |

CAGR of 6.8% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

September 2024 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Ownership |

|

Country scope |

U.S. |

|

Key companies profiled |

TH Medical.; GE Healthcare; Universal Health Services, Inc.; Covenant Physician Partners; Regent Surgical; Cardinal Health.; Boston Scientific Corporation; Olympus Corporation; Koninklijke Philips NV; Cook Medical |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Gastroenterology Ambulatory Surgery Centers Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. gastroenterology ambulatory surgery centers market report based on ownership

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital-affiliated

-

Freestanding

-

Corporation-owned

-

Others

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."