- Home

- »

- Medical Devices

- »

-

U.S. Gamma Knife Market Size, Share, Industry Report 2030GVR Report cover

![U.S. Gamma Knife Market Size, Share & Trends Report]()

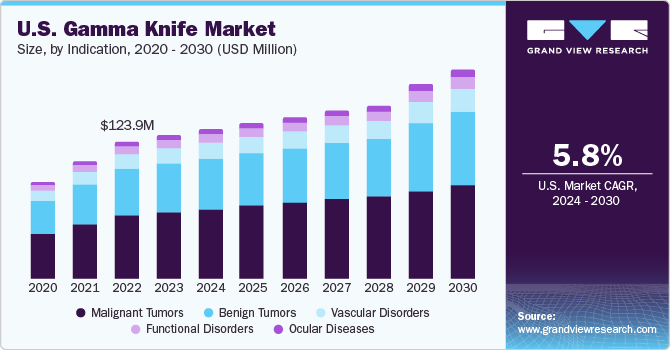

U.S. Gamma Knife Market Size, Share & Trends Analysis Report By Indication (Malignant Tumors, Benign Tumors, Vascular Disorders, Functional Disorders, Ocular Diseases), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-243-3

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Gamma Knife Market Size & Trends

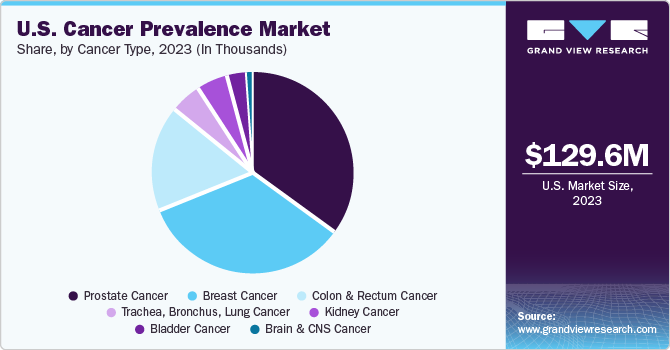

The U.S. gamma knife market size was estimated at USD 129.6 million in 2023 and is expected to grow at a CAGR of 5.8% from 2024 to 2030. The market is anticipated to be driven by the rising occurrence of neurological disorders and brain tumors, the swift acceptance of gamma knife surgeries as a potent treatment alternative, ongoing technological progress, and the development of minimally invasive surgical options. On the other hand, factors such as the elevated costs of treatments and machinery installation, variable reimbursement rates, and a shortage of proficient professionals are expected to hinder the market growth.

The U.S. accounted for over 29.1% of the global gamma knife market in 2023. The worldwide impact of neurological conditions is assessed by the total Disability-adjusted Life Years (DALYs), a figure that is on the rise. The occurrence of significant neurological disorders is escalating due to an increasing elderly population. The American Cancer Society states that brain tumors rank as the 8th most prevalent cancer type and the 3rd leading cause of cancer-related deaths for individuals aged 40 and over. As the population continues to age and expand, the need for neurological disease treatments and rehabilitation is projected to substantially grow, thereby influencing market expansion.

The adoption of gamma knife surgery, a painless, computer-guided treatment for brain tumors and neurological diseases, is rapidly increasing. This is expected to boost the gamma knife market. The Leksell Gamma Knife Icon, by Elekta AB, offers precise treatments for these conditions. The use of gamma knife instruments has grown due to the global rise in cancer and neurological diseases. Gamma knife surgeries are crucial in modern healthcare due to the increasing geriatric population and incidence of neurological disorders. They reduce waiting lists for clinics, lessen the healthcare system burden through faster recoveries and shorter treatment times, and decrease the need for hospital readmission and intensive care. The growing adoption of these instruments in both developed and developing economies is expected to boost the market in the forecast period.

Ongoing research and development activities in gamma knife products are expected to drive market growth. Elekta AB first introduced the manually operated Leksell Gamma Knife U in 1987, which has since evolved through several upgrades. The current models, Leksell Gamma Knife Perfexion and Icon, offer flexible and faster therapy options. The Icon model, approved in 2015, limits radiation to healthy tissues and allows ultra-precise treatment of any brain target. Technological advancements are increasing the rate of adoption of these devices. Elekta recently introduced a patient-friendly immobilization system for accurate treatment delivery.

The demand for minimally invasive surgeries is growing due to their benefits like less trauma and faster recovery compared to traditional surgeries. Research indicates a shift from open surgeries to minimally invasive ones, driven by factors like patient satisfaction, shorter hospital stays, fewer post-surgical complications, and lower mortality rates. These surgeries are increasingly used across all therapeutic areas. Their safety and continuity of care without stopping traditional surgeries are leading to their rapid adoption, expected to boost the market in the future.

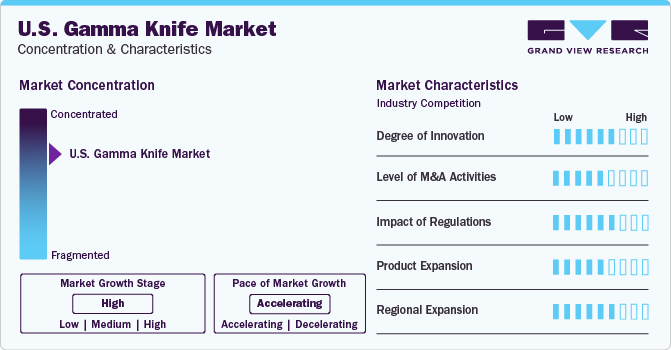

Market Characteristics & Concentration

U.S. gamma knife industry is characterized by intense competition. The key players in this market are continuously engaging in a variety of strategic activities to strengthen their market position. These activities include mergers and acquisitions, which allow companies to expand their product portfolio and market reach. Launching new products is another common strategy, enabling companies to offer innovative solutions and stay ahead of the competition. Collaborations often occur between companies to combine expertise and resources, leading to the development of advanced technologies. Companies are also focusing on product innovation to meet the evolving needs of healthcare providers and patients. In addition, they are expanding their operations regionally to tap into new markets and increase their customer base.

In this industry, emphasis is on innovation, research, and development as companies strive to remain competitive and address the changing needs of healthcare. The innovative advancements in Gamma Knife technology enable more accurate and efficient treatment of brain disorders, which results in better patient outcomes. The focus of research and development is to enhance the effectiveness, safety, and availability of Gamma Knife systems, ensuring they continue to lead in the field of neurosurgery. By investing in these areas, companies can bring new features, enhance treatment methods, and broaden the use of Gamma Knife technology, ultimately providing benefits to patients and healthcare providers in the industry. In September 2019, Akesis Galaxy, a gamma SRS with continuous 360° rotational technology, received 510(k) clearance from the FDA, making this innovative system available to clinicians in the U.S.

Mergers, acquisitions, collaborations, and partnerships play a vital role in the U.S. Gamma Knife industry by enabling companies to achieve scalability, control their product roadmaps, expand into new markets efficiently, and stay competitive in an evolving industry landscape. For instance, in October 2015, the company inaugurated Elekta Training Center Cape Town in collaboration with Tygerberg Hospital and Cape Peninsula University of Technology to provide training to healthcare professionals for the usage of sophisticated radiotherapy solutions.

The medical technology and innovation industry fetches thousands of proposals for medical devices approval every. However, there are concerns about the performance and safety of high-risk devices. Thus, United States Federal regulation is looking up for new shift in the way to monitor and approve medical devices. For instance, from March 2019, revision of ISO 13485 will need the integration of risk management in each aspect of devices. US FDA unconfined medical device regulation documents in 2016 and 2017.

The need for efficient therapies for brain tumors and other neurological disorders is a significant factor propelling the market expansion in the country. The availability of sufficient reimbursement for the treatment procedures of the targeted diseases also promotes the use of sophisticated medical devices such as Gamma Knife systems. An example of product development in the industry is the introduction of new technologies and features in Gamma Knife systems by major market players like Elekta AB and Varian Medical Systems.

Companies often pursue regional or geographic expansion to capitalize on specific market dynamics and opportunities present in different regions. This expansion strategy allows companies to access new customer bases, increase market share, and drive revenue growth by catering to diverse consumer needs and preferences across various regions.

Indication Insights

Malignant tumors dominated and held the largest revenue market share of 46.3% in 2023. Malignant brain tumors, which are cancerous, can metastasize and spread to various body parts, primarily the brain, liver, lungs, and bones. As per the American Society of Clinical Oncology (ASCO) 2020 study, there are currently 700,000 brain tumor patients. In 2021, approximately 24,530 adults and 3,460 children in the U.S. are expected to be diagnosed with these tumors. Sadly, around 18,600 adults are likely to succumb to these cancers. The survival rate varies based on the age and type of tumor. Treatment methods include surgery, various forms of radiation therapy, and chemotherapy.

Functional disorders is anticipated to grow at the fastest CAGR of 7.6% during the forecast period. Functional Neurological Disorder (FND) is a condition with varied neurological symptoms like limb weakness or seizures. It’s more common in adults, with an incidence of 0.4 to 1.2 per 10,000 people. Gamma knife radiosurgery is a treatment option in epilepsy, but its high cost limits its use in most cases. Trigeminal neuralgia, a rare disease affecting 1 in 15,000 to 20,000 people, can also be treated with gamma knife radiosurgery. Recent studies suggest gamma knife therapy could be beneficial for other disorders like essential tremors and Parkinson’s disease. These factors are expected to fuel the segment’s growth during the forecast period.

Key U.S. Gamma Knife Company Insights

Leading U.S. gamma knife companies are concentrating on a range of strategic efforts, including partnerships, expanding their products & services, mergers & acquisitions, and investing in research & development to create cutting-edge applications for gaining a competitive edge. For instance, Elekta introduced Leksell Gamma Knife Lightning in May 2020, which was the sole fully integrated automated treatment planning solution for gamma knives, allowing for plan optimization based on parameters like beam on-time constraints.

Key U.S. Gamma Knife Companies:

- Elekta AB

- Varian Medical Systems

- Huiheng Medical, Inc.

- MASEP Medical Science Technology Development (Shenzhen) Co., Ltd.

- Akesis Inc.

Recent Developments

-

In October 2022, Elekta announced their new Leksell Gamma Knife radiosurgery platform, Elekta Esprit, receiving FDA 510 (k) clearance. The system is engineered to focus on the tiniest and most difficult intracranial tumors and lesions, while having a minimal impact on healthy tissue.

-

In October 2022, Varian, in collaboration with the Cincinnati Children’s/University of Cincinnati Medical Center Proton Therapy Center, shared optimistic outcomes from FAST-01, which is the inaugural human clinical trial of Flash Therapy.

-

In March 2021, Akesis Inc. received FDA clearance for Akesis Galaxy RTi SRS System, which is a high-precision intracranial gamma system to treat brain cancer.

U.S. Gamma Knife Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 129.6 million

Revenue forecast in 2030

USD 189.5 million

Growth rate

CAGR of 5.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Indication

Country scope

U.S.

Key companies profiled

Elekta AB; Varian Medical Systems; Huiheng Medical, Inc.; MASEP Medical Science Technology Development (Shenzhen) Co., Ltd.; Akesis Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Gamma Knife Market Report Segmentation

This report forecasts revenue growth in the U.S. market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. gamma knife market based on indication:

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Malignant tumors

-

Benign tumors

-

Vascular disorders

-

Functional disorders

-

Ocular diseases

-

Frequently Asked Questions About This Report

b. The U.S. gamma knife market size was estimated at USD 129.6 million in 2023 and is expected to reach USD 135.2 million in 2024.

b. The U.S. gamma knife market is expected to grow at a compound annual growth rate of 5.8% from 2024 to 2030 to reach USD 189.5 million by 2030.

b. Based on indication, malignant tumors dominated the U.S. gamma knife market with a share of 46.3% in 2023. This is attributable to rising prevalence of malignant brain tumors.

b. Some key players operating in the U.S. gamma knife market include Elekta AB, Varian Medical Systems, Huiheng Medical, Inc., MASEP Medical Science Technology Development (Shenzhen) Co., Ltd., Akesis Inc.

b. Key factors that are driving the U.S. gamma knife market growth include the rising occurrence of neurological disorders and brain tumors, the swift acceptance of gamma knife surgeries as a potent treatment alternative, ongoing technological progress, and the development of less invasive surgical options

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."