- Home

- »

- Advanced Interior Materials

- »

-

U.S. Frac Tanks Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Frac Tanks Market Size, Share & Trends Report]()

U.S. Frac Tanks Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Open Top, Closed Top), By Application (Oil & Gas, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-334-4

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Frac Tanks Market Size & Trends

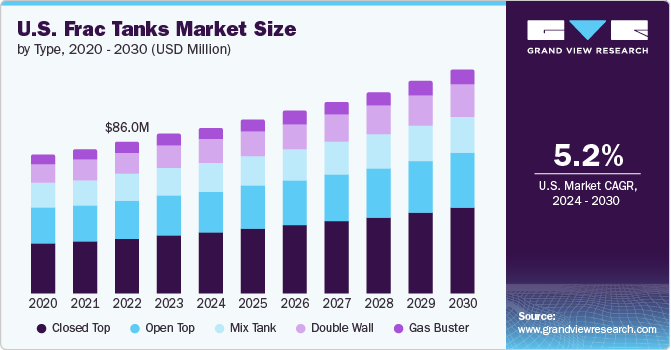

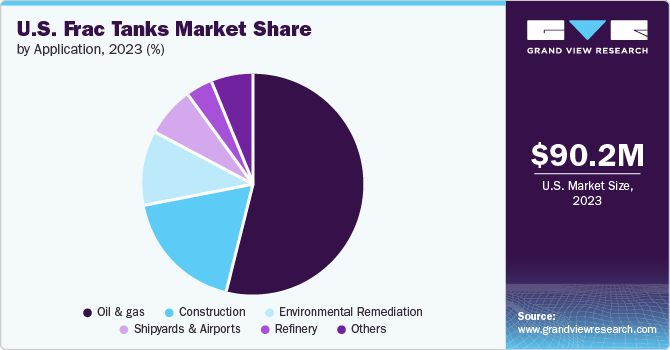

The U.S. frac tanks market was estimated at USD 90.2 million in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The growth of the market can be attributed to the requirement for these tanks due to increased hydraulic fracturing activities, particularly in shale gas and oil exploration in the U.S., that necessitate the storage and transportation of large volumes of fracturing fluids.

The market in the U.S. is significantly influenced by the Spill Prevention, Control, and Countermeasure (SPCC) regulations enforced by the EPA, which mandate secondary containment measures such as frac tanks for oil and hazardous material storage to prevent environmental spills during fracking & drilling operations. This factor, coupled with rising fracking activities to meet the country's energy needs, is driving the demand for SPCC-compliant frac tanks. The demand not only boosts market growth but also encourages innovation and quality enhancements in frac tank manufacturing as companies strive to meet stringent regulatory standards.

Environmental regulations and concerns about water management are also significant drivers for market growth. The need for efficient and safe storage of water, both fresh and produced, during fracking operations is crucial to comply with environmental standards and mitigate the impact on local ecosystems. This has led to the adoption of advanced frac tanks that offer enhanced safety features, leak prevention, and efficient handling of wastewater, thus propelling the market growth.

Drivers, Opportunities & Restraints

The total crude oil production in the U.S. increased from 12.31 million barrels per day in 2018 to 13.71 million barrels per day in 2024. The Permian Basin is at the forefront of this growth, contributing nearly half of the country's crude oil output. The Eagle Ford Shale region and the Federal Gulf of Mexico also contribute significantly to the increasing production. These aforementioned factors are expected to drive the demand for U.S. frac tanks in the coming years.

Technological advancements and innovations in frac tank design and materials are further driving the market growth. Companies are investing in the development of more durable, efficient, and cost-effective frac tanks to meet the evolving needs of the industry. Innovations such as modular and mobile frac tanks, which offer flexibility and ease of transportation, have gained popularity, enabling quicker and more efficient operations in remote or challenging locations.

The decline in total frac spreads in the U.S. from 2017 to 2023 can be attributed to factors such as the global oil price crash that promoted the companies to reduce exploration and production activities, thereby reducing demand for fracking services. Subsequent to this downturn, technological advancements in horizontal drilling and fracking techniques significantly boosted efficiency, allowing operators to achieve higher output with fewer wells and thus decreasing the need for frac spreads.

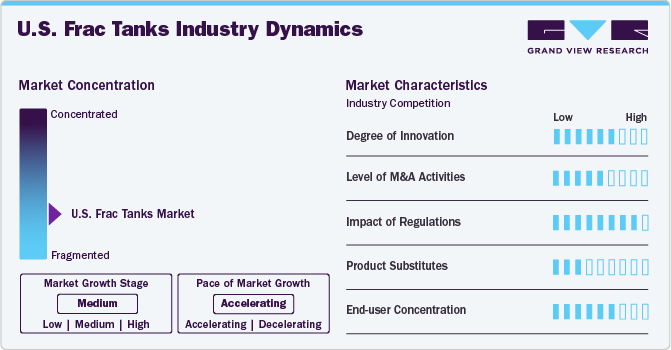

Industry Dynamics

The industry growth stage is medium, with an accelerating pace. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations have a profound impact on the U.S. market for frac tank, primarily shaping the industry's standards and operational practices. Environmental regulations, in particular, play a critical role in determining the design, usage, and maintenance of frac tanks. Federal and state agencies such as the Environmental Protection Agency (EPA) and local environmental authorities enforce strict guidelines to ensure the safe storage and handling of fluids used in hydraulic fracturing. These regulations mandate robust measures for leak prevention, spill containment, and the management of hazardous materials, compelling manufacturers to innovate and produce frac tanks that comply with these stringent standards.

The end-user concentration in the U.S. market is notably high, with a significant portion of demand stemming from the oil and gas industry. Large oil and gas companies, including major players like ExxonMobil, Chevron, and ConocoPhillips, are among the primary end-users of frac tanks. These companies require substantial storage solutions for the vast amounts of water, chemicals, and proppants used in hydraulic fracturing operations. Due to the scale of their operations, these companies typically have long-term contracts with frac tank manufacturers and rental companies, ensuring a steady and substantial demand.

The threat of substitutes in the U.S. market is relatively low, primarily due to the specialized nature and critical role of frac tanks in hydraulic fracturing operations. Frac tanks are specifically designed to handle the storage and transportation of large volumes of water, chemicals, and proppants essential for the fracking process. The unique requirements of hydraulic fracturing, such as the need for durable, portable, and leak-proof storage solutions, limit the feasibility of direct substitutes.

Type Insights

“The demand for closed top type segment is expected to grow at a significant CAGR of 5.8% from 2024 to 2030 in terms of revenue.”

The closed top type segment held the largest share in 2023. A closed-top frac tank is a specialized storage container designed to transport and store fluids, also known as a flat-top frac tank. These tanks provide a secure, leak-proof storage solution for fracking fluids, chemicals, and wastewater. The tanks are also equipped with a robust valve system that allows for easy filling and emptying, making them a convenient and efficient solution for fracking operations.

The demand for the double wall type segment is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. The double-wall frac tank offers an extra layer of protection against leaks and spills, these tanks are essential in operations where environmental protection and fluid containment are paramount. Double-wall frac tanks are engineered with an inner and outer steel wall for added safety against contamination of soil or water resources in the event of a spill.

Application Insights

“The demand for environmental remediation application segment is expected to grow at a significant CAGR of 13.0% from 2024 to 2030 in terms of revenue.”

The oil & gas application segment held the largest share in 2023. The market is driven by several factors, prominently the increasing demand for unconventional oil & gas exploration and production activities globally. The growing adoption of hydraulic fracturing techniques, especially in shale gas and tight oil formations, requires the deployment of frac tanks to efficiently handle the substantial volumes of fluids necessary for the process of hydraulic fracturing.

The demand for the environmental remediation application segment is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. Frac tanks play a crucial role in containing and managing contaminated liquids, such as groundwater, surface water, or industrial wastewater. These tanks are particularly valuable for temporary storage during cleanup and remediation activities at sites contaminated by pollutants like chemicals, oils, or hazardous materials.

Regional Insights

“In the U.S., Southwest dominated the market in 2023, and it accounted for 47.7% market share in 2023.”

The market in the southwestern region of the U.S., which includes states such as Texas, Oklahoma, New Mexico, and Arizona, is a significant segment within the broader oil and gas industry. This region is a hub of hydraulic fracturing activities due to extensive shale formations in the Permian Basin, Eagle Ford Shale, and the Haynesville Shale. The demand for frac tanks, essential for storing water, chemicals, and proppants used in the fracking process, is robust due to the high volume of drilling and production in the region.

The west region of the U.S. registered second second-largest CAGR from 2024 to 2030. In the West, the oil & gas industry, particularly in California and Alaska, significantly influences the demand for frac tanks. California's major oil fields in the San Joaquin Valley and Alaska's North Slope oil operations require substantial water storage and fluid handling solutions, which is positively influencing the market growth. In California, the need for frac tanks is driven by stringent environmental regulations that mandate proper containment and handling of wastewater and drilling fluids. This ensures a steady demand for high-quality, compliant frac tanks in the region.

Key U.S. Frac Tanks Company Insights

Some of the key players operating in the market include Dragon Products, Texoma MFG LLC, Wichita Tank, and CST Industries.

-

Dragon Products manufactures and distributes energy and oilfield industry equipment for storage, hauling, and other applications. It offers frac tanks & trailers, liquid tank trailers & haulers, dump trailers, drilling rigs, workover rigs, and water transfer pumps. In addition, it provides used equipment on a direct sale or consignment basis. Moreover, the company has 24 strategic delivery locations across the U.S.

-

Texoma MFG LLC manufactures and offers portable chemical containment solutions. These solutions include leak-proof acid storage tanks, standard frac tanks, storm shelters, refuse container systems, and gooseneck trailer hitches. These products are used in applications such as oilfields, petrochemicals, and municipalities.

Pinnacle Manufacturing, Sabre Manufacturing, Geneva Equipment, and KOKS Group bv are some of the emerging market participants in the U.S. frac tank market.

-

Pinnacle Manufacturing is a manufacturer and provider of tanks. The company offers multiple tanks, such as portable storage tanks, vertical storage tanks, environmental containers, poly storage tanks, pool tanks, trash containers, and trench shoring. In addition, it offers various services, including tank refurbishing, contract manufacturing, logistic management, industrial coatings, custom fabrication & engineering, and OEM parts & accessories.

-

Sabre Manufacturing manufactures and sells custom liquid storage and containment solutions for oil & gas, wastewater, construction, and environmental industries. It offers frac tanks, round bottom tanks, mixer tanks, double wall tanks, 240bbl mini frac tanks, weir tanks, and trailers.

Key U.S. Frac Tanks Companies:

- Dragon Products

- Texoma MFG LLC

- Wichita Tank

- CST Industries

- Pinnacle Manufacturing

- Sabre Manufacturing

- Geneva Equipment

- KOKS Group BV

- H & H Welding LLC

- JWF Industries, Inc

Recent Developments

-

In February 2024, CST Industries, a storage tanks and covers manufacturing company, expanded its global presence through the acquisition of Ostsee Tank Solutions GmbH (OTS). The company intended to utilize OTS' state-of-the-art facilities and solutions to expand its production and global market presence, aligning with its approach to strengthen its position as a leading provider of storage tanks, dome, and cover solutions.

-

In September 2023, Dragon Products, a manufacturer of mission-critical products serving the energy and industrial sectors, acquired a new 19-acre production tank manufacturing plant in San Angelo, Texas. The newly acquired facility will continue to build API-certified production tanks and fiberglass tanks. The acquisition was driven by increased customer demand for Dragon Products' surface production equipment in the Permian Basin.

U.S. Frac Tanks Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 94.1 million

Revenue forecast in 2030

USD 127.3 million

Growth rate

CAGR of 5.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Region scope

Southwest, West, Midwest, Southeast, Northeast

Key companies profiled

Dragon Products, Texoma MFG LLC, Wichita Tank, CST Industries, Pinnacle Manufacturing, Sabre Manufacturing, Geneva Equipment, KOKS Group bv, H & H Welding LLC, JWF Industries, Inc

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Frac Tanks Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. frac tanks market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Open Top

-

Closed Top

-

Mix Tank

-

Double Wall

-

Gas Buster

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & gas

-

Construction

-

Environmental remediation

-

Shipyards and Airports

-

Refinery

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

Southwest

-

West

-

Midwest

-

Southeast

-

Northeast

-

Frequently Asked Questions About This Report

b. The U.S. frac tank market size was estimated at USD 90.2 million in 2023 and is expected to reach USD 94.1 million in 2024.

b. The U.S. frac tank market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030 to reach USD 127.3 million by 2030.

b. Southwest dominated the U.S. frac tank market and accounted for a 47.7% share, in terms of revenue, in 2023. The demand for frac tanks, essential for storing water, chemicals, and proppants used in the fracking process, is robust due to the high volume of drilling and production in the region.

b. Some of the key players operating in the U.S. frac tank market include Dragon Products, Texoma MFG LLC, Wichita Tank, CST Industries, Pinnacle Manufacturing, Sabre Manufacturing, Geneva Equipment, KOKS Group bv, H & H Welding LLC, JWF Industries, Inc among others.

b. The growth of the market can be attributed to the requirement for these tanks due to increased hydraulic fracturing activities, particularly in shale gas and oil exploration in the U.S. that necessitate the storage and transportation of large volumes of fracturing fluids.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.