U.S. Formulation Development Outsourcing Market Size, Share & Trends Analysis Report, By Service, By Formulation, By Therapeutic Area, By End-use, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-281-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

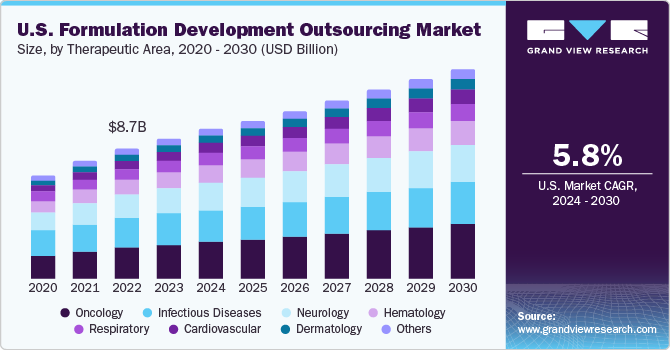

The U.S. formulation development outsourcing market size was estimated at USD 9.28 billion in 2023 and is expected to register a CAGR of 5.8% from 2024 to 2030. This growth is driven by increasing demand for innovative pharmaceutical and biotech products, rising R&D costs, and a need for specialized expertise. Outsourcing formulation development is an attractive option for companies looking to streamline their R&D processes, reduce costs, and access a wider range of resources.

The surge in R&D by pharmaceutical and biotechnology firms is a major driver propelling the demand for outsourced formulation development services. Over the past two decades, R&D spending and new drug launches have increased, leading to cost reduction and accelerated processes through outsourcing. This rising demand has prompted contract service providers to expand their capacities, fostering the growth of formulation development outsourcing market. Consequently, these factors substantially contribute to market expansion.

Drug formulation relies heavily on trial-and-error methods to predict optimal formulations, which can be costly, time-consuming, and labor-intensive. To address the need for reducing expenses on new Active Pharmaceutical Ingredients (APIs) and overall healthcare costs in the pharmaceuticals market, it is crucial to estimate preferred formulations. This helps the industry identify efficient drug development approaches. Consequently, the pharmaceutical and biotechnology sector extensively outsources these services to contract manufacturers to streamline costs and processes.

Advancements in technology drive innovations encourage companies to invest in discovering new compounds and developing blockbuster drugs. This leads to an increase in generic manufacturers and a growing pharmaceuticals market, driven by unmet needs for various disorders and rising R&D activities for orphan therapies. As of 2019, the National Institutes of Health Office of Rare Diseases Research identified around 7,000 orphan diseases, with 1,043 projects on developing orphan diseases, including 822 in the clinical phase.

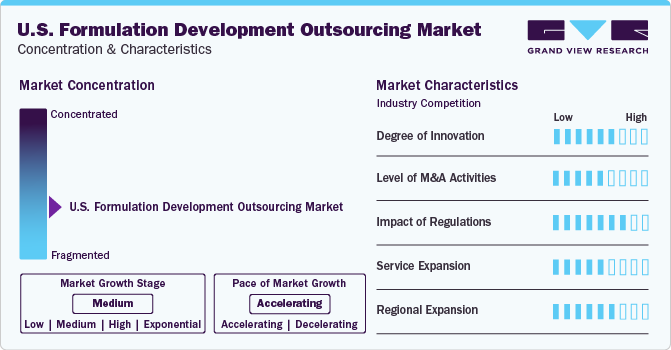

Market Concentration & Characteristics

U.S. accounts for a major share of clinical trial recruitment across the globe, with over 20,000 trial studies being recruited within the country as of March 2023. Thus, the industry is characterized by a high degree of R&D and innovation in varied areas of application.

Post-pandemic long-term capital-intensive mergers & acquisitions and expansions, coupled with government collaborations with pharmaceutical companies to vaccine manufacturers, are helping fuel the market growth. For example, Catalent, Inc. acquired Metrics Contract Services in August 2022 from Mayne Pharma Group Limited. The acquisition was intended to enhance the company's abilities in areas such as oral solid formulation development.

Regulatory framework in this industry is impacted by pharmaceutical industry as well as set regulations for clinical trials. For instance, notices such as a November 2023 amendment in clinical trial requirement regulated by the NIH, CDC, and FDA impact the industry indirectly.

According to a Cardinal Health report, there were approximately 33 FDA-approved biosimilars in the U.S. in January 2022, with 21 of them commercially available. This growing number of approved biosimilars is anticipated to boost the demand for formulation development processes and outsourcing activities in the U.S., significantly impacting the industry’s growth.

The industry is expected to witness an increased emphasis on establishing new facilities, particularly for vaccines, focusing on regional manufacturing and distribution of supplies and biopharmaceuticals. This may involve expanding equipment capacity in the U.S. industry to cater to domestic demand. For instance, in December 2022, Catalent, Inc. inaugurated a new biologics analytical center of excellence in Durham, U.S., expanding its facilities in the country.

Service Insights

Formulation development services dominated this market with over 75.0% share in 2023 and is anticipated to register the fastest CAGR over the forecast period. Major factors boosting the demand for formulation development services include bioavailability enhancement for poorly water-soluble compounds, increasing innovation of novel drugs due to patent expirations, and overcoming the risks associated with development.

It is estimated that the pre-formulation services will witness high demand due to the dynamics of pharmaceutical industry. Pharma industry is anticipated to witness a high level of competition from generic drugs as more blockbuster drugs undergo patent expiry phase and the development of biosimilars is expected to significantly increase, thus boosting demand for pre-formulation services. For instance, the custom pharmaceutical services division of Dr. Reddy’s is serving the generic, pharmaceutical, and biotech space with two R&D centers for formulation development and pre-formulation studies of generic drug products and novel drug candidates.

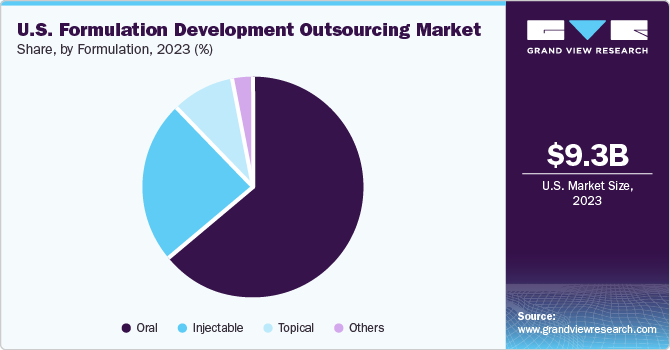

Formulation Insights

Oral formulation led the market in 2023 with 63.0% share as these formulations are commonly used for treating diseases such as diabetes, fever, migraines, and infectious diseases. Based on formulation type, the segment is classified into oral, injectable, topical, and other formulation types. The convenience offered by oral formulations is driving the segment growth further, as they are self-administering and do not require a trained physician for drug administration.

The injectable segment is anticipated to witness the highest CAGR from 2024 to 2030. Rising demand for insulin, vaccines, and other drugs administered through the parenteral route, along with the technological advancements in injectables manufacturing, including the formulation complexities of long-lasting, advanced injectable devices, high-viscosity, and high-volume drug delivery systems, are anticipated to fuel market expansion significantly.

Therapeutic Area Insights

Oncological formulation held the largest market share in 2023, accounting for 25.0% share, and is anticipated to register the fastest growth over the forecast period. This can be attributed to the high prevalence of cancer, prompting the need for safe and effective treatment options. According to the 2023 American Association for Cancer Research Progress Report, despite the declining cancer mortality in the U.S. since the 1990s, rising number of cancer cases and the growing economic burden of cancer on both individuals and the U.S. healthcare system in the coming decades emphasize the urgent need for accelerated research progress to combat cancer more effectively.

Respiratory formulation development outsourcing is also anticipated to grow lucratively from 2024 to 2030. The expected increase in respiratory conditions such as asthma, COPD, and cystic fibrosis is likely to drive the growth of this segment. Similarly, the infectious disease sector, which includes conditions such as Stoneman syndrome, chronic focal encephalitis, and rare diseases like Q fever, Acanthamoeba keratitis, and Marburg virus, held a substantial market share in 2023.

Key U.S. Formulation Development Outsourcing Company Insights

The U.S. formulation development outsourcing market is highly competitive. Some notable companies operating in the market include SGS S.A.; Intertek Group plc; Recipharm; Lonza; and Charles River Laboratories International, Inc. To gain market share, prominent organizations within this sector often pursue various acquisition strategies such as acquisitions, collaborations, and partnerships.

In April 2022, Recipharm AB announced the acquisition of Vibalogics, a virotherapy CDMO, and Arranta Bio, an advanced therapy CDMO, exemplifying strategic movements in the market, aiming to enhance Recipharm’s presence and capabilities in the rapidly growing biologics market, thereby boosting the company’s overall position within the competitive landscape.

Key U.S. Formulation Development Outsourcing Companies:

- SGS S.A.

- Intertek Group plc

- Recipharm

- Lonza

- Charles River Laboratories International, Inc.

- Eurofins Scientific SE

- Element

- Labcorp

- Thermo Fisher Scientific, Inc. (Patheon)

- Catalent Inc.

Recent Developments

-

In January 2024, Charles River Laboratories International, Inc. launched its off-the-shelf Rep/Cap plasmid to streamline specific gene therapy programs, solidifying its position in the niche space.

-

In March 2023, Arranta Bio, a Recipharm company, expanded its RNA process development capacity by 50% at its Watertown, Massachusetts facility to meet increased customer demand.

-

In December 2021, Amgen announced the U.S. FDA approval of AstraZeneca and Amgen’s Tezspire for the treatment of pediatric and adult patients aged 12 and above suffering from severe asthma.

U.S. Formulation Development Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 9.88 billion |

|

Revenue forecast in 2030 |

USD 13.80 billion |

|

Growth rate |

CAGR of 5.72% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Service, formulation, therapeutic area |

|

Country scope |

U.S. |

|

Key companies profiled |

SGS S.A.; Intertek Group plc; Recipharm; Lonza; Charles River Laboratories International, Inc.; Eurofins Scientific SE; Element; Labcorp; Thermo Fisher Scientific, Inc. (Patheon); Catalent Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Formulation Development Outsourcing Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. formulation development outsourcing market report based on service, formulation, and therapeutic area.

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Preformulation

-

Formulation Development

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Oral

-

Injectable

-

Topical

-

Others

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Infectious Diseases

-

Neurology

-

Hematology

-

Respiratory

-

Cardiovascular

-

Dermatology

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. formulation development outsourcing market size was estimated at USD 9.28 billion in 2023 and is expected to reach USD 9.88 billion in 2024.

b. The U.S. formulation development outsourcing market is expected to grow at a compound annual growth rate (CAGR) of 5.72% from 2024 to 2030 to reach USD 13.80 billion by 2030.

b. The formulation development dominated the U.S. formulation development outsourcing market in 2023 with a market share of 75.0%. Major factors boosting the demand for formulation development services include bioavailability enhancement for poorly water-soluble compounds, increasing innovation of novel drugs due to patent expirations, and overcoming the risks associated with development

b. SGS S.A.; Intertek Group plc; Recipharm; Lonza; Charles River Laboratories International, Inc.; Eurofins Scientific SE; Element; Labcorp; Thermo Fisher Scientific, Inc. (Patheon); Catalent Inc. among others.

b. The increasing demand for innovative pharmaceutical and biotech products, rising R&D costs, and a need for specialized expertise are key growth drivers for this market. Moreover, discovery of new compounds and developing blockbuster drugs further supports the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."