- Home

- »

- Consumer F&B

- »

-

U.S Food Truck Services Market Size & Share Report, 2030GVR Report cover

![U.S. Food Trucks Services Market Size, Share & Trends Report]()

U.S. Food Trucks Services Market Size, Share & Trends Analysis Report By Offering (Food, Beverages), By Cuisine Type (Chinese, Japanese, Mexican), By Platform (Mobile Vending, Online Delivery), And Segment Forecasts, 2022 - 2030

- Report ID: GVR-4-68039-965-1

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

Report Overview

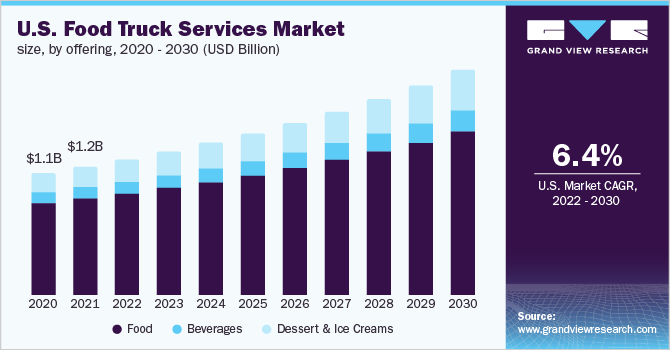

The U.S. food truck services market size was valued at USD 1.16 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2022 to 2030. A rapid surge in gastronomy and the rising demand among youth for novel dining experiences over traditional dining in brick-and-mortar restaurants are the factors driving the growth. Furthermore, the growing demand for food on the go along with the rising popularity of the mobile lifestyle are other major factors driving the growth.

The COVID-19 pandemic negatively impacted the growth of many sectors of the U.S. economy. Strict lockdown measures and stay-at-home orders resulted in closure & restrictions of on-premises dining at restaurants and cafes. The ban on street food vendors directly impacted the food truck services and their business models.

The reduction in purchasing power along with the avoidance of eating outside forced consumers to change their consumption patterns during the COVID-19 pandemic. Furthermore, the cancellation of events such as parades, food festivals, concerts, and other social gatherings resulted in a decline in food truck revenues.

Food truck services are one of the fastest-growing concepts and one of the most in-demand restaurants in the country owing to their affordability, versatility, and accessibility. The upscale food truck services phenomenon majorly happened due to recession thumping trends. Meals on wheels are popular in American culture.

There are over 35,000 food trucks spread across the cities with more than 14,000 people employed in the industry. The shift in consumer preference, especially the millennial and Gen Z group, toward gourmet foods and unique & adventurous food concepts is propelling the demand for these food truck services in the U.S.

The rise of social media has contributed to the growth of food trucks in the U.S. Food trucks are leveraging social media engagement such as Facebook and Twitter to gain a competitive edge over others in the country.

To maintain and grow their consumer base, which is highly dependent on the young population, food truck service providers are adopting Instagram, Tik Tok, and Snapchat to advertise their menu, locations, and operating times as well as keep in touch with their customers.

The initial investment and operational cost of food trucks are significantly low than setting up a brick-and-mortar restaurant. As per the U.S. Chamber of Commerce, it costs USD 50,000 to USD 60,000 on average to start a food truck business in the U.S. These costs include paying for licenses and permits, investing in a point-of-sale (POS) system, and other legal compliances.

Furthermore, as per the Restaurant report, setting up a new food truck, ranges from USD 75,000 to USD 150,000, while starting up restaurants cost anywhere from USD 275,000 to USD 2 million on average.

Several food chain restaurants, such as Hard Rock Café, Outback, and Dunkin’Donuts, are using food trucks as a catalyst to widen their customer base. Many new restaurants are supplying food trucks with new menu items to track sales performance.

Food trucks are also being utilized to determine consumer preferences for food categories and the likelihood of regional success. Established restaurants are employing food trucks to monitor their performance in certain locations rather than doing surveys to determine what kind of food would be popular in that particular location.

Offering Insights

The food segment held the largest revenue share of more than 75.8% in 2021. Fast food consumption has increased significantly in the U.S. owing to low cost, convenience, and a variety of menus & flavors offered. According to Technomic’s new College and University Trend Report, 42% of Gen Z preferred street food on the menu.

Barbecue, hamburgers, sandwiches, tacos, and hot dogs are some of the popular items consumed. Food trucks are coming up with meatless protein, and vegan meat blend options for attracting consumers owing to increasing consumer demand for plant-based food products.

Furthermore, meat-plant blends are also becoming popular among omnivores who want healthier options. For instance, in July 2021, a new vegan food truck, Plantology, was launched in Gainesville, Florida. The plant-based food truck offers homemade cheesy burgers, mac bowls, and loaded fries.

Several vegetarian-friendly and vegan food trucks have emerged across the nation. Cities such as San Francisco, Los Angeles, and Portland are witnessing a large number of vegan food trucks serving anything from plant-based BBQ, and tacos to kettle corn and veggie burgers.

The beverages segment is anticipated to register a CAGR of 7.0% over the forecast period. Both alcoholic and non-alcoholic beverages are being increasingly sold by food trucks. Non-alcoholic beverages including coffee, tea, lemonade, smoothies, fruit punch, nitro brew, and others are the most demanded beverages. Non-alcoholic beverages such as craft and cocktails in particular have become popular over the last few years.

There has been a growing demand for mobile cocktail bar trucks at concerts, carnivals, weddings, and private functions. Most of the beverages food truck services offer a unique fusion of drinks to widen the young consumer base. This has led to a rise in demand for customized food trucks specializing in beverages.

Cuisine Type Insights

The Mexican cuisine segment accounted for the largest market share of 34.6% in 2021. Mexican cuisines offer more nutritious options for health-conscious consumers than other types of cuisines. Mexican dishes often include protein sources like beans and meat along with vegetables like avocados, tomatoes, peppers, and limes.

Moreover, Mexican recipes usually include fresh vegetables and other ingredients, thus, are preferred by a lot of Americans. Furthermore, Mexican food has many spices and natural flavorings and is topped with a variety of different sauces, which make it far from bland and boring.

The Italian cuisine segment is anticipated to register the highest CAGR of 8.4% over the forecast period. Italian food is one of the fastest-growing cuisines. Globalization has been one of the primary reasons for the surge in Italian cuisine’s popularity. As per the American Community 2019 Survey, out of a total 328.2 million U.S. population, 16.1 million people are reported to be of Italian ancestry.

Italian cuisine is a blend of herbs and spices and uses exotic flavors to create unique dishes. As per the YouGovAmerica 2019 report, 88% of U.S. residents preferred Italian cuisine, particularly pizza and pasta. Food trucks, therefore, are serving Italian dishes to attract European customers in the U.S. market.

Platform Insights

The mobile vending segment held a larger market share of 91.6% in 2021. The food truck operators are increasingly adopting vans and buses owing to their easy mobility and lower operational costs, which is significantly contributing to the segment growth. A rise in demand for a unique consumer experience is the major factor driving the growth of this segment.

The online delivery segment is anticipated to register a higher CAGR of 10.4% over the forecast period. Online ordering gives eaters the ability to place orders for pickup, skip the crowd, and have hassle-free dining experiences. Easy payment methods that fit into the regulatory standards of the country have made transactions a lot easier. Thus, consumers are switching to online delivery platforms.

The food truck industry has witnessed major technological advancements in the past few years, which makes it easier for food truck operators to develop their online ordering platform. For instance, in March 2021, Menufy, an online ordering system for small independent restaurant owners, expanded its online ordering to include food trucks, to improve the revenue stream for mobile restaurateurs.

Online ordering consumers can request food delivery or pick up orders on site. Diners can take advantage of features including group ordering and placing advanced orders. The platform is customizable and user-friendly. It streamlines food truckers' workflows ranging from order placement to fulfillment.

Key Companies & Market Share Insights

The market is characterized by the presence of a few well-established players and several small and medium players.Companies are focusing on signing new food truck contracts as one of the key strategic initiatives in the industry. For instance:

-

In August 2021, Shake Shack launched its first ever food truck in Los Angeles. The food truck will offer burger fixes, hot honey fries, hot honey chicken sandwich

-

In August 2020, Whataburger, a burger chain, announced to launch a food truck for a multistate tour in 2021 and features a four-foot grill, for cooking burgers

Some prominent participants in the U.S. food trucks market include:

-

Stoked Wood Fired Pizza

-

Tenoch Mexican

-

Roxy’s Gourmet Grilled Cheese

-

Vibe Food Truck

-

Slide by Food Truck

-

Rocket Fine Street Food

-

Noble Knots Food Truck and Catering

-

Dee’s Deli Food Truck & Catering

-

Twisted T’s Food Truck

-

Gastros

U.S. Food Truck Services Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 1.23 billion

Revenue forecast in 2030

USD 2.04 billion

Growth Rate

CAGR of 6.4% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Country scope

U.S.

Segments covered

Offering, cuisine type, platform

Key companies profiled

Stoked Wood Fired Pizza; Tenoch Mexican, Roxy’s Gourmet Grilled Cheese; Vibe Food Truck; Slide by Food Truck; Rocket Fine Street Food; Noble Knots Food Truck and Catering; Dee’s Deli Food Truck & Catering; Twisted T’s Food Truck; Gastros

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Food Trucks Services Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. food truck services market report based on offering, cuisine type, and platform:

-

Offering Outlook (Revenue, USD Million, 2017 - 2030)

-

Food

-

Non-Vegetarian

-

Vegetarian

-

Vegan

-

-

Beverages

-

Alcoholic Beverages

-

Non-Alcoholic Beverages

-

-

Dessert and Ice Creams

-

-

Cuisine Type Outlook (Revenue, USD Million, 2017 - 2030)

-

American

-

Chinese

-

Japanese

-

Mexican

-

Italian

-

Others

-

-

Platform Outlook (Revenue, USD Million, 2017 - 2030)

-

Mobile Vending

-

Online Delivery

-

Frequently Asked Questions About This Report

b. The U.S. food truck services market size was estimated at USD 1.16 billion in 2021 and is expected to reach USD 1.23 billion in 2022.

b. The U.S. food truck services market is expected to grow at a compound annual growth rate of 6.4% from 2022 to 2030 to reach USD 2.04 billion by 2030.

b. The food segment dominated the U.S. food truck services market with a share of more than 75% in 2021. The market is driven by the increasing availability of different kind of cuisines including Mexican, Italian, Chinese, American, and Japanese at affordable prices.

b. Some of the key players in the U.S. food truck services market are Stoked Wood Fired Pizza, Tenoch Mexican, Vibe Food Truck, Slide by Food Truck, Rocket Fine Street Food Truck, Noble Knots Food Truck and Catering, Dee's Deli Food Truck & Catering, Twisted T’s Food Truck, Gastros

b. Key factors that are driving the U.S. food truck services market growth include increasing penetration of food trucks coupled with broadened offerings in healthy food categories such as vegan.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."