- Home

- »

- Food Safety & Processing

- »

-

U.S. Food Preservatives Market Size, Industry Report, 2030GVR Report cover

![U.S. Food Preservatives Market Size, Share & Trends Report]()

U.S. Food Preservatives Market (2024 - 2030) Size, Share & Trends Analysis Report By Label (Clean Label, Conventional), By Type (Natural, Synthetic), By Function (Anti-microbial, Anti-oxidant), By Application, And Segment Forecasts

- Report ID: GVR-4-68040-217-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Food Preservatives Market Trends

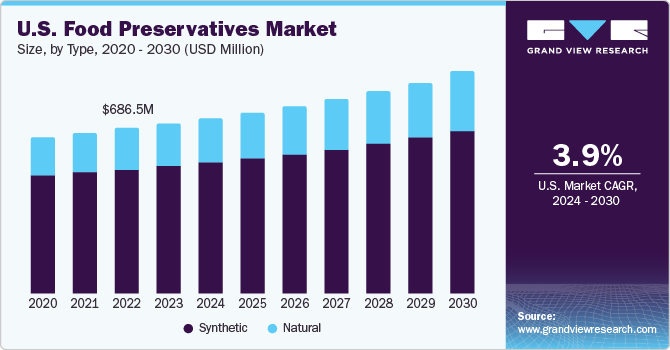

The U.S. food preservatives market size was estimated at USD 706.7 million in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030. The countries' export units, joint ventures, overseas collaborations, and industrial license approvals, among other forms of government backing, have been crucial in propelling the food preservative market's expansion in the country.

The U.S. market accounted for a revenue share of 23.7% of the global food preservatives market in 2023. The demands of consumers for convenience food and organic products with reduced artificial preservatives and improved taste are transforming the dynamics of the American food business. Another trend that is gaining traction in the market is accurate ingredient labeling, as customers become more aware of the potential negative effects of food chemicals.

Because of their affordability, ease of formulation, and access to current technology, synthetic food preservatives dominate the U.S. market for food preservatives. Nonetheless, it is anticipated that the market for natural products would be driven by the quickly increasing demand for food that contains natural or preservative-free preservatives. But it takes a lot of money and effort to develop technology that can extract natural preservatives with the same level of effectiveness as artificial preservatives. Consequently, over the foreseeable years, synthetic preservatives will continue to have a higher share of the market.

A number of preservatives, including sugar, vinegar, salt, honey, and edible oil, are commonly employed to preserve food goods. However, throughout time, synthetic preservatives were chosen over natural preservatives in food processing due to a number of factors including availability and cost competitiveness. Customers' growing concerns about taking healthy supplements is steadily making natural preservatives more and more in demand. Rosemary extracts have the potential to become a very popular natural preservative substitute because of its antioxidant qualities and enhanced ability to prolong food goods' shelf lives. The use of rosemary extracts in the food processing business in the U.S. has been permitted by the Food and Drug Administration.

The market is driven by the increasing demand for clean label solutions, the expanding acceptance of packaged and processed foods, and the intricate supply chain dynamics within the food industry. Growing organized retail, particularly in emerging nations, is expected to propel the food preservatives industry. The primary barriers to the market are the increased expense of naturally occurring preservatives, which are in greater demand, and customer knowledge of the negative consequences of artificial preservatives. For instance, Corbion NV worked on growth projects in Europe and other locations concurrently, increasing its production of lactic acid and goods derived from lactic acid in March 2021.

Market Concentration & Characteristics

The food preservatives industry in the U.S. is expanding at a moderate rate and is rather fragmented. The industry is growing because of ongoing innovation, which includes developments in preservation technologies like the creation of natural and clean-label preservatives.

The industry is seeing partnerships and acquisitions driven by the rising demand for natural preservatives. In 2021, Kerry purchased Niacet, a company that provides solutions for food preservation. The use of natural and clean-label ingredients in food items is becoming more and more important.

Strong laws governing acceptable food additives and food safety are what fuel the market for preservatives that adhere to strict guidelines. To guarantee consumer trust and product acceptance, market participants must adhere to these regulations. Natural preservatives are becoming more widely available, which is affecting the industry.

There could be a move away from artificial preservatives due to growing consumer desire for natural and organic alternatives. In order to obtain a competitive advantage, industry participants are adjusting to these shifting demands by developing novel, natural preservatives or investigating fresh preservation techniques.

Type Insights

The synthetic food preservatives market accounted for a revenue share of nearly 75% in 2023. The synthetic variety is commonly utilized due to its affordability and ease of preparation. Depending on the needs of the application, they can be created. Because they are used so extensively in meat, poultry, and dairy products, of all the chemical categories, sorbates held the biggest proportion in terms of value in 2023. Benzoates, propionates, and nitrites are other common synthetic kinds. To increase effectiveness, sorbates, benzoates, and propionates are frequently combined. Propionates are becoming more widely accepted because of their higher acceptable limit and range of uses, which include baked goods, snacks, and other confections, as well as preservation at higher pH levels.

The U.S. natural food preservatives market is projected to grow at a CAGR of 4.7% from 2024 to 2030. Due to the approval of natural preservatives by pertinent regulatory bodies and growing consumer health consciousness, the market for natural food preservatives is anticipated to expand at a faster rate than that of synthetic food preservatives. In order to address the demand for clean labeled products, many firms are implementing novel formulation techniques for the creation of organic products.

In the U.S., the most common natural preservative is edible oil. It is commonly used for pickling vegetables, seafood, poultry, and meals. Because it is used so extensively for pickling and food preparation, edible oil holds a substantial market share among natural preservative types.

Label Insights

The conventional food preservatives market accounted for a revenue share of 58.2% in 2023. Conventional food preservatives can be combined with other preservation methods or used on their own. Antioxidants that function as oxygen absorbers and antimicrobial preservatives that stop the growth of bacteria or fungus are the two main types of conventional preservatives.

Product recalls are increasing, mostly in the U.S. but also in other nations as a result of many outbreaks, such as salmonella illnesses and E. coli. Coronavirus (SARS-CoV-2) contamination of ice cream in January 2021 in China has likewise prompted consumers to source food goods more carefully and, consequently, to pay more attention to product labeling.The clean label food preservatives market is projected to grow at a CAGR of 5.1% from 2024 to 2030. The market for clean-label food preservatives has grown as a result of consumers' increased attention to reliable and easily understood ingredients. As the food industry tries to fulfill the demands of a consumer base that is label-conscious, it is quickly implementing clean-label preservatives that assist meet the needs of food formulators.

In response to end-user demand, manufacturers have launched a clean label line that works with food compositions. For example, Corbion has created an enzyme technology that safeguards bakery goods during handling, distribution, and processing to ensure that they maintain the consistent freshness that customers want. The rise in demand for clean-label food items in recent years can be attributed to the development of novel clean-label preservatives.

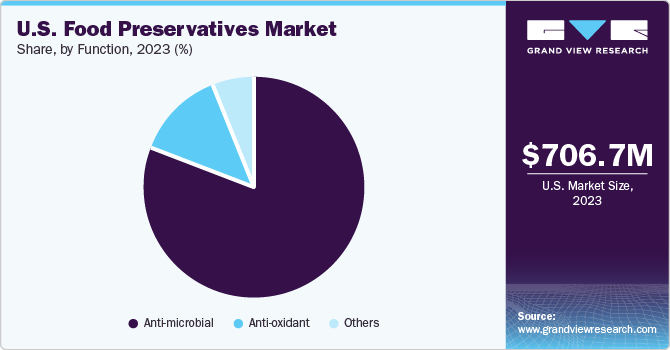

Function Insights

Anti-microbial food preservatives dominated the market in 2023, having accounted for a revenue share of nearly 81%. In the U.S., substances classified as generally recognized as safe (GRAS) include sorbates, benzoates, and other compounds that function as antimicrobial preservatives.

Mold inhibitors such as calcium and sodium propionate are used in cheese, cake, bread, and other baked and confectionary goods. Edible oils and extracts from rosemary are a couple of examples of natural microbial agents derived from plants or animals. These include compounds that prevent bacteria including Salmonella, Escherichia coli, Aeromonas hydrophila, and Staphylococcus aureus from growing.

Sulfites are employed in the brewing business as anti-microbial agents with propionate, benzoates, and sorbates. The antifungal and antibacterial qualities that natamycin and reuterin give are among their additional roles. Since customers are now aware of the health advantages of additives, they choose products high in antioxidant content, making antioxidants one of the most important ingredients to be listed on food labels. Ascorbic acid, acerola, rosemary extract, and green tea extracts are antioxidants that are mostly used to stop food from oxidizing.

Application Insights

The use of food preservatives in the meat & poultry products accounted for a revenue share of 33.2% in 2023. The demand is anticipated to be driven by processed meat, poultry, and seafood industries. Food preservatives find extensive usage in a range of food products, such as dairy, frozen goods, meat and poultry, seafood, baked goods, beverages, and confections.

Products from bakeries are known for having a short shelf life because of microbial deterioration, which lowers the food product's quality and causes financial loss. In bakery applications, essential oils of thyme, cinnamon, and lemongrass have become a desirable natural substitute. The demand for food preservatives in bakery products is projected to grow at a CAGR of 3.9% from 2024 to 2030.

One of the main things that is thought to shorten the shelf life of cheese is the development of mold on its surface. In dairy products, natamycin, sorbate, and benzoate are the most often used food preservatives. The substances are used to prevent various germs from growing. With the increased consumption of milk and milk-based products, the dairy industry is likely to utilize more food preservatives.

Key U.S. Food Preservatives Company Insights

The market is distinguished by the abundance of companies that produce synthetic preservatives. However, new players have entered the market as a result of the growing demand for organic preservatives. The rising willingness of consumers to pay for high-quality items and growing health consciousness among consumers are driving up demand for natural food products. This has led to a significant influx of natural food producers into the market, hence escalating competition.

Kemin Industries, Inc. and Galactic S.A. are two recent competitors that have entered the market with new products that are manufactured with innovative technology and developed from natural sources such as vinegar and rosemary extracts.Key U.S. Food Preservatives Companies:

- Cargill, Inc.

- Kemin Industries, Inc.

- Archer Daniels Midland Company

- Tate & Lyle

- Koninklijke DSM N.V.

- BASF SE

- Celanese Corporation

- Corbion N.V.

- Galactic S.A.

- Kerry Group plc

Recent Developments

-

In November 2022, ICL Food Specialties and Protera Biosciences to create and market sustainable protein-based products used Precision fermentation. The collaboration seeks to meet consumer requests, enhance sensory qualities, and substitute chemical additives in plant-based food applications. Protera predicts and matches the structure and functionality of vegetable proteins using the deep learning platform Madi. The platform also makes it possible to find underutilized, highly effective plant-based proteins to replace stabilizers, preservatives, and texturizers.

-

In November 2022, to meet the rising demand for natural preservatives, Prinova Europe announced the launch of PlantGuard AM, a new plant-based antibacterial that inhibits bacteria, molds, and yeasts. This exclusive combination of organic plant extracts works well to prolong freshness and shelf life, postpone rancidity, prevent microbiological growth, and preserve flavor and color. It also possesses antioxidant qualities. In a variety of meals and drinks, heat-stable and flavor-neutral preservatives work better than synthetic substitutes. PlantGuard AM can replace artificial preservatives in a range of product categories, such as dairy, fish, meat, fruit, vegetables, cereals, and juices.

U.S. Food Preservatives Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 728.6 million

Revenue forecast in 2030

USD 917.3 million

Growth rate

CAGR of 3.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Label, type, function, application

Country scope

U.S.

Key companies profiled

Cargill, Inc.; Kemin Industries, Inc.; ADM; Tate & Lyle; Koninklijke DSM N.V.; BASF SE; Celanese Corporation; Corbion N.V.; Galactic S.A.; Kerry

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Food Preservatives Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. food preservatives market report on the basis of label, type, function, application:

-

Label Outlook (Revenue, USD Million, 2018 - 2030)

-

Clean Label

-

Conventional

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Edible Oil

-

Rosemary Extracts

-

Natamycin

-

Vinegar

-

Chitosan

-

Others

-

-

Synthetic

-

Propionates

-

Sorbates

-

Benzoates

-

Others

-

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Anti-microbial

-

Anti-oxidant

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Meat & Poultry Products

-

Bakery Products

-

Dairy Products

-

Beverages

-

Snacks

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. food preservatives market size was estimated at USD 706.7 million in 2023 and is expected to reach USD 728.6 million in 2024.

b. The U.S. food preservatives market is expected to grow at a compound annual growth rate of 3.9% from 2024 to 2030 to reach USD 917.3 million by 2030.

b. Synthetic food preservatives dominated the U.S. food preservatives market with a share of 75% in 2023. This is attributable to the relatively higher range of uses of the synthetic preservatives, allowing for wide usage across baked goods, snacks, and meat & poultry products.

b. Some key players operating in the U.S. food preservatives market include Cargill, Inc., Kemin Industries, Inc., ADM, Tate & Lyle, Koninklijke DSM N.V., BASF SE, Celanese Corporation, Corbion N.V., Galactic S.A., and Kerry.

b. Key factors that are driving the market growth include the rapid growth of the food processing industry and the increasing demand for high-quality packaged foods in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.