U.S. Flow Cytometry Market Size, Share & Trends Analysis Report By Product (Software, Accessories), By Technology (Cell-based, Bead-based), By Application, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-286-6

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. Flow Cytometry Market Size & Trends

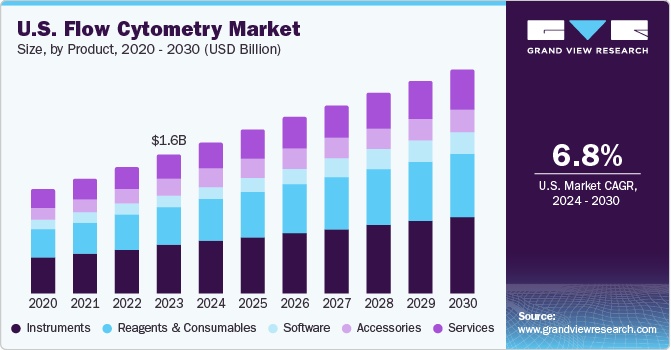

The U.S. flow cytometry market size was estimated at USD 1.61 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The prevalence of chronic diseases such as cancer, HIV, diabetes, and autoimmune disorders has been increasing in the U.S. According to Cancer Facts & Figures 2022, there would be approximately 1.9 million new cancer cases diagnosed and 609,360 cancer deaths in the U.S. flow cytometry is a valuable diagnostic tool in the detection, monitoring, and treatment of these diseases, which contributes to the market's growth.

Key players in the industry are implementing various strategies, including mergers & acquisitions, strategic collaborations, and geographical expansions, to expand their market presence. For instance, in February 2021, Thermo Fisher Scientific acquired Propel Labs, a subsidiary of SIDIS. This acquisition aimed to incorporate Propel's highly skilled employees into Thermo Fisher Scientific's facilities, capitalizing on their enhanced flow cytometry expertise, engineering prowess, and research & development capabilities. The company intends to strengthen its cell therapy research and cell analysis business by doing so. As a result, these strategic moves contribute to the global flow cytometry market growth.

The increasing prevalence of sophisticated flow cytometry technologies, well-established U.S. healthcare systems, and growing pharmaceutical and healthcare developments contribute to the market's expansion. The market is growing due to increasing investments in research and development programs to create flow cytometry devices, growing university research expenditures, and significant pharmaceutical firms contributing to its growth.

Moreover, these major players are launching innovative products, driving market growth. For instance, in August 2023, Bio-Rad launched the first Starbright red dye, expanding the antibody market for conjugated Starbright dyes to improve multiplex flow cytometry and research capabilities. With Bio-Rad's Starbright dyes, researchers can obtain confirmed flow antibodies against important immunology targets linked to exclusive fluorescent nanoparticles. All these factors would drive the market growth. In addition, flow cytometry has various diagnostic applications in clinical research studies. For instance, in June 2022, the medical device manufacturer Sysmex Corporation declared the release of the XF-1600 flow cytometer, which offers enhanced versatility and effectiveness for an extensive array of diagnostic uses. All of the applications mentioned above would propel the market’s growth.

The COVID-19 pandemic has significantly influenced the market. With an increased focus on finding a cure for the virus, researchers require more flow cytometers to obtain accurate experimental results. For instance, in March 2020, Cytek Biosciences Inc. expanded its presence in the European market by offering comprehensive flow cytometry solutions, including instruments and reagents. This initiative aimed to support scientists and researchers globally in examining the impact of the COVID-19 virus on human immune systems.

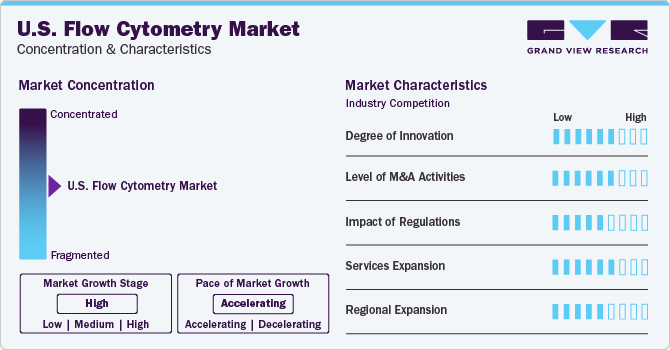

Market Concentration & Characteristics

The industry growth stage is high, and the pace of growth is accelerating. Industry players are involved in developing biotechnological innovations to increase their global market share. For instance, in June 2023, B.D. (Becton, Dickinson, and Company), announced the commercial release of its most recent automated instrument for creating clinical workflow samples using flow cytometry. This instrument allows for the complete "Walkaway" workflow solution to improve standardization and predictability in cellular diagnostics.

The industry is characterized by the leading players’ high merger and acquisition (M&A) activity. This is due to several factors, such as strategic expansion initiatives and the pursuit of partnerships to enhance market competitiveness. For instance, in February 2022, B.D.has acquired the Cytognos, a Vitro subsidiary. With this acquisition, the company sought to meet patient expectations by expanding its portfolio of blood cancer diagnostics, immunological assessment tests, informatics, and clinician and care provider requirements.

The industry is subject to increasing regulatory scrutiny, focusing on ensuring compliance with stringent guidelines and regulations set by agencies such as the FDA and EMA. These regulations aim to guarantee flow cytometry products' safety, efficacy, and quality, particularly those involving nanoparticles and cellular therapies. The FDA's proposed rule for laboratory-developed tests (LDTs) is set to impact how tests exempt from FDA scrutiny are offered, introducing a phased approach to align LDTs with the same enforcement approach as other in vitro diagnostic devices.

The industry faces competition from various service substitutes, including technologies such as mass spectrometry, enzyme-linked immunoassay (ELISA), polymerase chain reaction (PCR), and next-generation sequencing (NGS). These technologies present alternatives to flow cytometry in various applications, contributing to the industry's competitive landscape.

Moreover, in January 2021, Pfizer Inc. invested USD 120 million as a part of the Pfizer Breakthrough Growth Initiative (PBGI) in biotechnology innovation. Such investments and funding have resulted in a robust R&D infrastructure in biotechnology, biopharmaceutical, clinical, and life sciences research. This is expected to strengthen further R&D for cell analysis in new drug discovery and development activities with flow cytometry techniques. Furthermore, technological advancements in the latest flow cytometry instrumentation result in enhanced accuracy, efficiency, and cost-effectiveness of these systems, which is expected to present new growth opportunities for the global flow cytometry market.

Product Insights

Instrument dominated the market and accounted for the highest revenue share of 35.08% in 2023, owing to increased penetration and technological advancements. For instance, in May 2023, B.D. (Becton, Dickinson, and Company) announced the global commercial launch of a novel cell sorting device that combines two ground-breaking technologies to allow researchers to see more detailed information about cells than possible with conventional flow cytometry experiments. Furthermore, significant industry players' launch of new products propels market expansion. The project was expected to open up new growth opportunities for the company. These technological developments improve mobility, accuracy, and cost efficiency while creating new economic prospects.

The software segment is anticipated to register the fastest CAGR during the forecast period.In flow cytometry, the software segment is utilized to administer and gather data generated by cytometers, assess the data, and provide statistical outcomes analysis. In clinical settings, patient samples are studied to diagnose diseases, and the application is utilized for cell collection and data processing. Furthermore, the technological improvements of significant firms are propelling the market's rise. For instance, in February 2023, Agilent Technologies announced the release of NovoExpress software, an integrated compliance solution for NovoCyte flow cytometer equipment. It offers the necessary instruments to guarantee data and electronic record validity and dependability to comply with GxP manufacturing compliance regulations.

Technology Insights

The cell-based segment held the largest market revenue share in 2023. Its dominance results from growing demand for early diagnosis and a growing understanding of the advantages of cell-based assays. Moreover, advancements in cell-based assays, including software, instruments, algorithms, affinity reagents, and labels, are expected to drive adoption in the coming years. The cell-based sector, which encompasses research on gene expression in stem cells, monitoring immune cell responses, and identifying cancer biomarkers, has dramatically profited from using flow cytometry in the U.S.

The bead-based segment is anticipated to register the fastest CAGR during the forecast period. Bead-based technology plays a significant role in the flow cytometry market due to its numerous advantages and applications. Flow cytometry is a technique used to analyze and sort cells based on their physical and chemical properties. Bead-based technology utilizes microscopic beads, typically polystyrene, as carriers for fluorescent markers and antibodies. Beads can be functionalized with multiple fluorescent markers and antibodies, enabling the simultaneous detection of different targets in a single experiment. This significantly increases the throughput and efficiency of the flow cytometry process.

Application Insights

The clinical segment held the largest market revenue share in 2023. This high percentage can be attributed to increased cancer and infectious disease research and development efforts, especially COVID-19. Moreover, increased R&D spending in the pharmaceutical and biotechnology sectors would probably foster a growth-friendly environment for the market. Furthermore, it is also expected that introducing innovative flow cytometry technologies for clinical applications and the industry's leading competitors' unwavering expansion plans would significantly boost sector growth. For instance, in March 2022, Beckman Coulter, a Danaher Corporation subsidiary, was introduced to CellMek SPS. This novel technology is meant to effectively handle data administration and solve obstacles in manual sample preparation for clinical flow cytometry.

The industrial segment is anticipated to register the fastest CAGR during the forecast period. The industrial segment is vital to the market, as it meets the increasing need for research, process optimization, and quality control across various industries. Flow cytometry is a potent analytical instrument that facilitates the examination of high-throughput particle and cellular properties. Flow cytometry is used in multiple industries in the industrial segment, such as biotechnology, pharmaceuticals, food safety, and environmental monitoring.

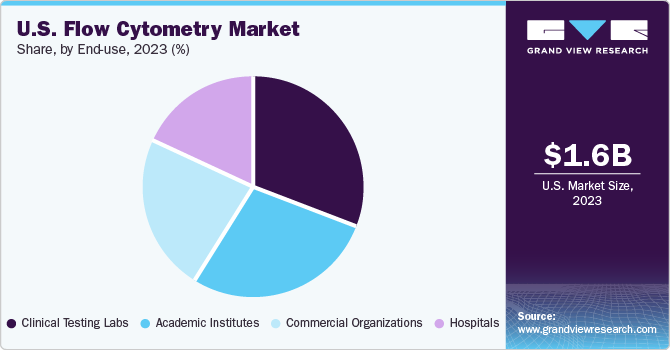

End-use Insights

The academic institutes segment held the largest market revenue share in 2023. Flow cytometry is widely used in academic research to study cellular processes, analyze gene expression, and investigate the mechanisms behind various diseases. Researchers in universities and research institutions across the U.S. utilize flow cytometry to gain insights into fundamental biological processes and develop new therapeutic strategies.

The clinical testing labs segment is anticipated to register the fastest CAGR during the forecast period. Flow cytometry is widely used in clinical testing labs to diagnose and monitor hematological disorders like leukemia, lymphoma, and anemia. By analyzing the characteristics of blood cells, flow cytometry allows for identifying abnormal cell populations and assessing treatment efficacy. For instance, in August 2019, Sysmex America introduced the PS-10 sample preparation system for flow cytometry to the North American market. This highly adaptable system automates sample preparation for clinical laboratory tests and basic flow cytometry applications. It enhances the reliability of test outcomes by offering clinical laboratories improved workflow efficiency and result consistency.

Key Flow Cytometry Company Insights

Some key players operating in the market were Becton, Dickinson, and Company (B.D.), Sysmex Corp, Danaher Corp, and Thermo Fisher Scientific, Inc.

-

B.D. has an extensive product line and emphasizes introducing new goods with cutting-edge technology. B.D. Medical, B.D. Life Sciences, and B.D. Interventional are the three business segments that make up the company's operations. The company has maintained its leading position in the market due to its concentration on creative and user-friendly improvements to technology. The introduction of highly developed instruments and a robust geographic presence are just two elements contributing to B.D.'s dominance in the market.

-

Sysmex Corp produces and sells software, reagents, and tools for in vitro diagnostics. Most of the company's income is derived from testing human body fluids for hospitals and private labs. The company is an industry specialist in hematology devices and reagents. In addition to offering support and maintenance services for its systems, Sysmex also supplies in vitro diagnostics for uses such as hemostasis and urinalysis.

Union Biometrica, Inc., BennuBio Inc., and ORLFO Technologies are some of the other market participants in the U.S. flow cytometry market.

Key Flow Cytometry Companies:

- Sysmex Corp

- Becton, Dickinson, and Company (B.D.)

- Danaher Corp

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Bio-Rad Laboratories, Inc.

- Sony Biotechnology, Inc.

- Beckman Coulter, Inc.

- Cytek Biosciences

- BioLegend, Inc.

- Enzo Biochem Inc.

- Cell Signaling Technology, Inc.

- NeoGenomics Laboratories

- Q2 Solutions (IQVIA)

- Elabscience Biotechnology Inc.

- Stratedigm, Inc.

- BioLegend, Inc.

- Union Biometrica, Inc.

- BennuBio Inc

- ORLFO Technologies

Recent Developments

-

In February 2023, Agilent NovoCyte Penteon, a flow cytometer with five lasers and sensitivity, was released by Agilent Technologies. The new device accommodates multicolor flow cytometry tests and provides enhanced U.V. laser excitation capabilities. Furthermore, the NovoCyte Penteon would continue the heritage of cytometry performance matching simplicity and user-friendliness.

-

In January 2023, NeoGenomics, a prominent oncology testing services company, ConcertAI, a leader in oncology real-world data and A.I. technology, and an oncology real-world evidence data firm formed a strategic partnership to enhance extensive hematological research solutions focusing on outcomes in hematologic malignancies and real-world clinical practice.

U.S. Flow Cytometry Market Report Scope

|

Report Attribute |

Details |

|

Revenue forecast in 2030 |

USD 2.61 billion |

|

Growth rate |

CAGR of 6.8% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, technology, application, end-use, region |

|

Country scope |

U.S. |

|

Key companies profiled |

Sysmex Corp; Becton, Dickinson, and Company (B.D.); Danaher Corp; Thermo Fisher Scientific,,Inc.; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Sony Biotechnology, Inc.; Beckman Coulter, Inc.; Cytek Biosciences; BioLegend, Inc.; Enzo Biochem Inc.; Cell Signaling Technology, Inc.; NeoGenomics Laboratories; Q2 Solutions (IQVIA); Elabscience Biotechnology Inc.; Stratedigm, Inc.; BioLegend, Inc.; Union Biometrica, Inc.; BennuBio Inc.; ORLFO Technologies |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Customized purchase options are available to meet your exact research needs. Explore purchase options |

U.S. Flow Cytometry Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the U.S. flow cytometry market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Instruments

-

Cell Analyzers

-

Cell Sorters

-

Reagents & Consumables

-

Software

-

Accessories

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cell-based

-

Bead-based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Research

-

Pharmaceutical

-

Drug Discovery

-

In Vitro Toxicity

-

Stem Cell

-

-

Apoptosis

-

Cell Sorting

-

Cell Cycle Analysis

-

Immunology

-

Cell Viability

-

Industrial

-

Clinical

-

Cancer

-

Organ Transplantation

-

Immunodeficiency

-

Hematology

-

Autoimmune Disorders

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Clinical Testing Labs

-

Academic Institutes

-

Commercial Organizations

-

Biotechnology Companies

-

Pharmaceutical Companies

-

CROs

-

Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. flow cytometry market size was valued at USD 1.61 billion in 2023.

b. The U.S. flow cytometry market is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030 to reach USD 2.61 billion by 2030.

b. The instrument segment accounted for 35.1% of the market in 2023, owing to increased penetration and technological advancements.

b. Some key players operating in the market were Becton, Dickinson, and Company (B.D.); Sysmex Corp, Danaher Corp, and Thermo Fisher Scientific, Inc., among others.

b. The prevalence of chronic diseases such as cancer, HIV, diabetes, and autoimmune disorders has been increasing in the U.S. According to Cancer Facts & Figures 2022, there would be approximately 1.9 million new cancer cases diagnosed and 609,360 cancer deaths in the U.S. flow cytometry is a valuable diagnostic tool in the detection, monitoring, and treatment of these diseases, which contributes to the market's growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."