U.S. Floriculture Market Size, Share & Trends Analysis Report By Product (Bedding & Garden Plants, Pott Plants), By Distribution Channel (Offline, Online), By End Use (Commercial, Industrial), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-395-2

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

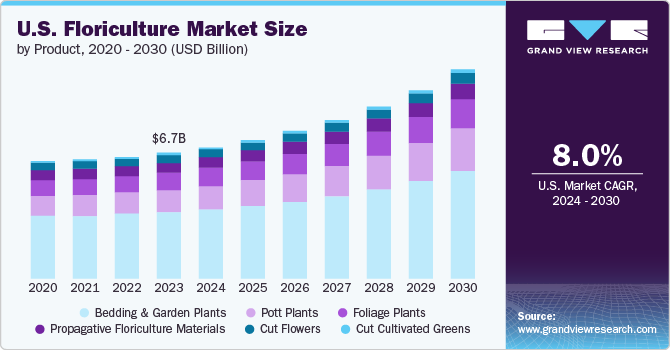

The U.S. floriculture market size was estimated at USD 6.70 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.0% from 2024 to 2030. The growing trend of urban gardening and the increased interest in indoor plants have significantly boosted demand. Millennials and Gen Z consumers, in particular, are adopting floriculture plants to improve indoor air quality and living spaces.

Innovations in greenhouse technologies, including climate control systems, hydroponics, and vertical farming, have improved the efficiency and yield of flower and plant cultivation. These technologies enable producers to grow a wider variety of plants year-round, regardless of external weather conditions, thus stabilizing supply and reducing seasonal fluctuations. Additionally, logistics and cold chain management advancements have enhanced the ability to transport flowers and plants over long distances while maintaining their freshness and quality, expanding market reach and availability.

The influence of major retailers and e-commerce platforms is driving the floriculture market in the U.S. Large retailers, including grocery chains and big-box stores, play a significant role in distributing and selling flowers and plants. Their ability to offer a wide range of products at competitive prices makes floricultural products more accessible to a broader consumer base. According to the National Agricultural Statistics Service, Americans purchased approximately 10 million cut flowers daily from retail outlets in 2022. The Society of American Florists also reported 12,154 retail florist shops and around 500 wholesale cut flower distributors in 2022.

The rise of e-commerce platforms and online flower delivery services has transformed how consumers purchase flowers and plants. Online sales channels provide convenience and a wider selection, catering to the growing demand for home delivery and personalized floral arrangements. Integrating digital technologies in sales and marketing has expanded the reach of floriculture businesses and enhanced customer engagement.

Industry Dynamics

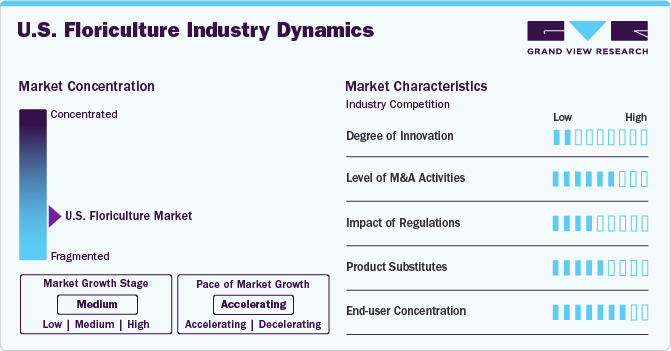

The U.S. floriculture industry is fragmented, and the industry growth stage is medium. The pace is accelerating owing to increasing marketing and branding strategies that play a crucial role in driving the U.S. floriculture market. Companies increasingly focus on creating strong brands and leveraging marketing campaigns to attract consumers. Using storytelling and emotional branding helps connect consumers with floricultural products on a personal level. Seasonal and occasion-based marketing, such as Valentine's Day, Mother's Day, and Christmas, drives spikes in demand as consumers purchase flowers and plants as gifts. Collaborations with influencers and celebrities and strategic partnerships with lifestyle brands further enhance the visibility and appeal of floricultural products. According to the U.S. Bureau of Economic Analysis (BEA), Valentine's Day in 2022 accounted for 30% of floral purchases, while Christmas made up 26% of the U.S. floral purchases.

Artificial flowers represent a significant substitute for live floricultural products. These flowers are made from materials such as silk, plastic, and polyester, and they offer several advantages over their natural counterparts. They are durable, low-maintenance, and can be kept indefinitely without water or sunlight. Additionally, artificial flowers can be more cost-effective over the long term, as they do not require the ongoing care and replacement that original flowers require.

Commercial establishments, including hotels, restaurants, and retail stores, represent a concentrated and influential end-user group within the floriculture market. These businesses often use flowers and plants to enhance their ambiance and appeal to customers. Retail stores, particularly those in the fashion and luxury sectors, use flowers and plants as visual merchandising strategies to attract and engage customers. The concentration of demand from commercial establishments is typically higher in urban areas and regions with a strong hospitality and retail presence, reflecting the importance of floriculture products in creating a desirable customer experience.

Product Insights

The bedding and garden plants segment led the market with largest revenue share of 52.8% in 2023 and is expected to continue to dominate the industry over the forecast period. Urban planning and community initiatives are also contributing to the growth of the bedding and garden plants segment. Many cities and towns are incorporating green spaces, community gardens, and urban agriculture projects into their development plans. These initiatives aim to enhance urban livability, promote environmental sustainability, and foster social cohesion. These projects increase the demand for garden plants and raise awareness about the importance of green spaces in urban environments.

The pott plants segment is anticipated to witness the fastest CAGR during the forecast period. Health and wellness benefits associated with potted plants are driving consumer interest and market growth. Scientific studies have shown that indoor plants can improve air quality by filtering pollutants and increasing humidity. Moreover, the presence of plants has been linked to reduced stress levels, enhanced mood, and improved concentration and productivity. These health benefits resonate strongly with consumers, particularly in the context of increasing awareness of mental health and well-being.

Distribution Channel Insights

The offline segment led the market with the largest revenue share in 2023. Personalization and customization are driving the offline segment, particularly in florist shops and specialty stores. These retail channels offer customized floral arrangements and personalized services tailored to individual preferences and occasions. Customers can work directly with florists to create bespoke bouquets, centerpieces, and floral designs that reflect their unique style, taste, and sentiments. The ability to add a personal touch to floral gifts, such as selecting specific flower types, colors, and arrangements, drives the segment growth.

The online segment is expected to witness the fastest CAGR during the forecast period. Online floriculture platforms offer consumers the convenience of browsing and purchasing flowers and plants from the comfort of their homes or on-the-go through mobile devices. This accessibility eliminates the need for physical travel to brick-and-mortar stores, saving time and effort for busy consumers. Additionally, online platforms provide 24/7 availability, allowing customers to shop at their convenience without being constrained by store hours or location limitations.

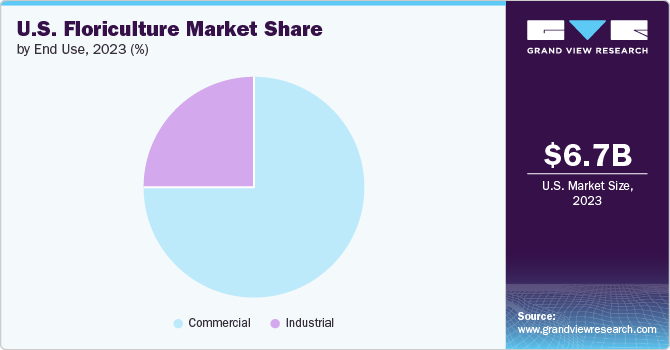

End Use Insights

The commercial segment led the market with the largest revenue share in 2023. The events and entertainment industry plays a vital role in driving demand within the commercial segment. Event planners, wedding coordinators, and entertainment venues regularly source flowers and plants for weddings, parties, galas, concerts, and other special occasions. Floral decorations serve as focal points of attention, enhancing the ambiance and thematic elements of the event. Additionally, the trend toward experiential marketing and immersive brand experiences has led many companies to incorporate floral installations and interactive displays into their promotional events and product launches. The creativity and innovation of event professionals drive demand for unique floriculture products.

The industrial segment is expected to witness the significant CAGR during the forecast period. Growing demand for natural ingredients in pharmaceuticals, cosmetics, and food products is driving the segment's growth. Consumers are adopting natural, plant-based ingredients in their products due to concerns about synthetic chemicals, environmental sustainability, and health benefits. Flowers and plants are rich sources of bioactive compounds, antioxidants, and essential oils that have therapeutic, cosmetic, and flavor-enhancing properties. Pharmaceutical companies, cosmetics manufacturers, and food processors are sourcing botanical extracts, floral essences, and herbal ingredients from floriculture suppliers to meet consumer demand for natural and sustainable products.

Key U.S. Floriculture Company Insights

Some of the key players operating in the market include Kurt Weiss Greenhouses, Inc.; Sun Valley Floral Farms; and Costa Farms.

-

Kurt Weiss Greenhouses, Inc. is a U.S.-based floriculture company that grows plants and flowers. Its product offerings include Hydrangeas, Azaleas, and succulents. The company also grows annuals, perennials, hanging baskets, and seasonal plants such as poinsettias and mums. It utilizes advanced growing techniques and technologies to ensure the highest quality products for its customers.

-

Sun Valley Floral Farms offers an extensive range of products to meet its customers' diverse needs. It grows various flowers, including roses, lilies, tulips, and sunflowers. These flowers are available in different colors and sizes, catering to multiple occasions such as weddings, events, and everyday floral arrangements. Sun Valley Floral Farms also provides custom floral designs and arrangements for special events and celebrations.

-

Costa Farms is a U.S. company that cultivates more than 1,500 varieties of plants on 5,200 acres. Its product offerings include annuals, perennials, vegetative liners, tropical foliage plants, and poinsettias suitable for tropical landscapes and container gardens. Costa Farms offers its products in Florida, Miami, and North Carolina.

Key U.S. floriculture Companies:

- Kurt Weiss Greenhouses, Inc.

- Costa Farms

- The Queen’s Flowers

- Green Circle Growers

- Greenheart Farms

- MONROVIA NURSERY COMPANY

- Larksilk

- Sun Valley Floral Farms

- TERRA NOVA Nurseries, Inc.

- Benary

Recent Developments

-

In April 2024, Costa Farms launched its latest Greenteriors collection, featuring a curated selection of eight plants. The Baltic Blue Pothos, Global Green Pothos, Mini Monstera, Monstera Little Swiss, Pink Princess Philodendron, Polka Dot Begonia, Raven ZZ Plant, and Silver Dragon Alocasia are among them. Through this release launch, Costa Farms aims to assist both consumers and designers in enhancing their environments and overall well-being.

-

In January 2024, Costa Farms acquired Battlefield Farms, a grower of over 700 bedding annuals and perennials. This strategic acquisition expands Costa Farms' geographical reach and strengthens its position within the industry. By integrating Battlefield Farms into its operations, Costa Farms strengthened its commitment to the All Thumbs are Green Mission, ensuring that it continues to provide top-quality plants and exceptional gardening experiences to its expanding customer base.

-

In February 2022, Royal Van Zanten partnered with The Queen's Flowers to develop a fresh flower variety, Astronova. Astronova flowers have a distinct appearance and longer-than-average vase life. This partnership is vital for consistently affirming and enhancing Astronova's demand in the market.

U.S. Floriculture Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.01 billion |

|

Revenue forecast in 2030 |

USD 11.12 billion |

|

Growth rate |

CAGR of 8.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, end use |

|

Key companies profiled |

Kurt Weiss Greenhouses, Inc.; Costa Farms; The Queen’s Flowers; Green Circle Growers; Greenheart Farms; MONROVIA NURSERY COMPANY; Larksilk; Sun Valley Floral Farms; TERRA NOVA Nurseries, Inc.; Benary |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Floriculture Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. floriculturemarket research report based on the product, distribution channel, end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bedding and Garden Plants

-

Pott Plants

-

Foliage Plants

-

Propagative Floriculture Materials

-

Cut Flowers

-

Tulip

-

Lilies

-

Gerbera

-

Gladioli

-

Sunflower

-

Rose

-

Others

-

-

Cut Cultivated Greens

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Frequently Asked Questions About This Report

b. The U.S. floriculture market size was estimated at USD 6.70 billion in 2023 and is expected to reach USD 7.01 billion in 2024

b. The U.S. floriculture market is expected to grow at a compound annual growth rate of 8.0% from 2023 to 2030 to reach USD 11.12 billion by 2030

b. The bedding and garden plants segment led the market with the largest revenue share of 52.8% in 2023 and is expected to continue to dominate the industry over the forecast period. Urban planning and community initiatives are also contributing to the growth of the bedding and garden plants segment.

b. Some key players operating in the U.S. floriculture market include Cargill, Incorporated, Louis Dreyfus Company, Nitin Spinners, Trikuta Exim International, Jaydeep Cotton Fibres Pvt. Ltd., Om Organic Cotton Pvt. Ltd. , GP Group India, SUNIL COTTON COMPANY, Changzhou Keteng Textile Co., Ltd, Allmonde International, Satya Cotton Mills, KAUSHIK COTTON CORPORATION, Bhura Group

b. Factors such as growing trend of urban gardening and the increased interest in indoor plants is driving the market growth

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."