- Home

- »

- Plastics, Polymers & Resins

- »

-

U.S. Flexible Packaging Market Size, Industry Report, 2030GVR Report cover

![U.S. Flexible Packaging Market Size, Share & Trends Report]()

U.S. Flexible Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastics, Paper, Metal, Bioplastics), By Product (Pouches, Bags), By Application (Food & Beverage, Pharmaceutical), And Segment Forecasts

- Report ID: GVR-4-68040-239-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Flexible Packaging Market Trends

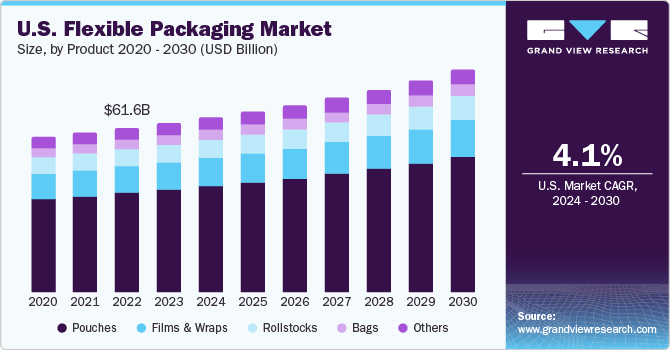

The U.S. flexible packaging market was valued at USD 63.46 billion in 2023 and is projected to grow at a CAGR of 4.1% from 2024 to 2030. This growth can be attributed to increasing demand for sustainable packaging solutions and rising consumer preference for lightweight, durable, and attractive packaging. Advancements in packaging technologies and the growing e-commerce sector are further driving this market growth. However, packaging industry is subject to strict regulations regarding use of certain materials and the disposal of packaging waste, which can increase production costs and limit material choices.

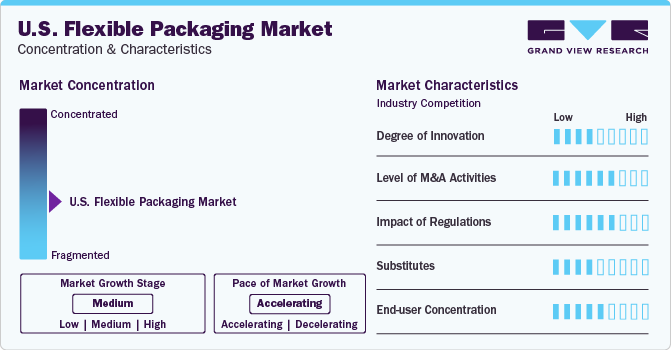

Regulatory agencies such as the U.S. Environmental Protection Agency, the U.S. Occupational Safety and Health Administration, the Federal Trade Commission, and the Food and Drug Administration have regulations that the flexible packaging industry players are required to follow. Compliance with these regulations is crucial for companies operating in this market and can impact market players operations.

Market Concentration & Characteristics

Innovation is a significant driver in the U.S. flexible packaging market. Technological advancements and sustainability concerns are among the reasons for the remarkable growth of flexible packaging in the U.S. For instance, the advent of digital watermark technology has improved the sortation of films and flexible packaging. Moreover, the rising focus on sustainability has led to the development of more sustainable flexible packaging solutions.

Merger and acquisition (M&A) activities have been robust in the global flexible packaging market. The market has witnessed a significant rise in M&A activity year-over-year. This demonstrates companies’ desire to expand their market presence, diversify their product offerings, and achieve economies of scale. For instance, in February 2023, Sealed Air completed acquisition of Liquibox for USD 1.15 billion. This acquisition will enable Sealed Air to accelerate its CRYOVAC brand Fluids & Liquids business related to flexible packaging segment.

In response to the increasing emphasis on sustainability, conventional rigid packaging solutions are being replaced by innovative, more sustainable flexible packaging. The rising demand for user-friendly packaging and enhanced product protection is anticipated to drive the adoption of flexible packaging as a practical and cost-effective alternative. This positions the overall threat of rigid packaging low.

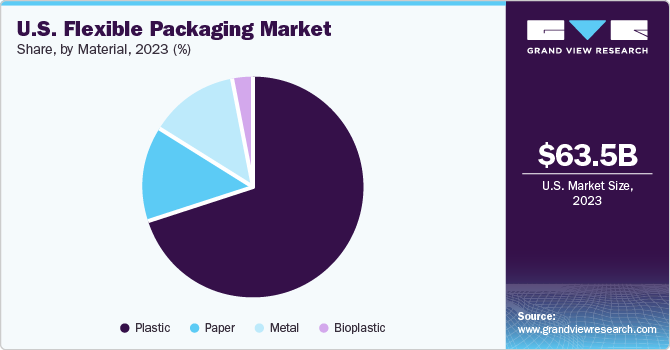

Material Insights

The plastics segment dominated the U.S. market in 2023 with more than 69.0% revenue share. This dominance can be attributed to the cost-effectiveness of plastics compared to glass metals and other materials as well as inherent properties such as excellent moisture and gas barrier resistance, light weight, good puncture resistance, and transparency, making them an attractive choice for manufacturers. Plastic pouches and bags are convenient for consumers due to their ease of use and re-sealable features. Plastics find application in food, beverages, pharmaceuticals, household products, and others.

The paper segment of the U.S. flexible packaging market is a significant part of the industry. Paper-based flexible packaging solutions are favored for their biodegradability and recyclability, making them an environmentally friendly option. They are commonly used in the food and beverage industry, particularly for packaging dry food items.

Bioplastics represent the fastest-growing segment in the U.S. flexible packaging market, with a projected CAGR of 5.4% from 2024 to 2030. This growth is driven by the increasing demand for sustainable and environmentally friendly packaging solutions. Bioplastics, made from renewable resources like plant starches or cellulose, offer a more eco-friendly option.

Product Insights

The pouches dominated the U.S. market in 2023 with more than 60.0% revenue share. This dominance can be attributed to their versatility, offering convenience with features like zippers or spouts for various products. They are widely used for packaging food products, beverages, pet food, personal care items, and even pharmaceuticals.

The bags segment is projected to have steady growth, driven by the steady growth of the healthcare, food & beverage, and personal care industries. Bags come in various styles, including flat, gusset, and re-sealable bags. Additionally, lifestyle changes and demographic factors are expected to further extend the demand for bag products.

The films and wraps segment is the fastest-growing product segment in the U.S. flexible packaging market with a CAGR of 4.9% from 2024 to 2030. These products offer several advantages, including container versatility, reduced raw material requirements, ease of disposal, and lightweight properties, all contributing to their growing popularity.

Application Insights

The food & beverage segment dominated the U.S. market in 2023 with more than 24.0% revenue share. This dominance is due to the wide range of applications of flexible packaging in the food industry, including frozen food, dairy products, fruits & vegetables, meat, poultry, seafood, baked goods, snack foods, and candy & confections. The choice of flexible packaging in the food business is influenced by factors beyond convenience, such as sustainability, transparency, food safety, and a reduction in food waste. Companies are increasingly focusing on flexible packaging solutions that incorporate recyclable and recycled content, driven by sustainability considerations.

The pharmaceutical segment is projected to experience the fastest growth in the U.S. flexible packaging market, with a projected CAGR of 4.9% from 2024 to 2030. The increased use of flexible packaging in medical and pharmaceutical contexts is contributing to this market growth. These products offer various advantages, such as the benefits of container flexibility, reduced material usage, easy disposal, and lightweight design play a crucial role, in boosting product demand over the forecast period.

The cosmetics segment also plays a significant role in the U.S. flexible packaging market. Lifestyle and demographic factors contribute to the demand for cosmetic products. The adoption of flexible metal packaging across various applications has led rigid metal packaging manufacturers to shift toward more flexible options. Lower energy consumption and reduced waste production further support this transition. Additionally, U.S. government initiatives aimed at reducing carbon emissions and energy use provide a positive outlook for the market.

Key U.S. Flexible Packaging Company Insights

The U.S. flexible packaging market is highly competitive, with many players of varying sizes holding a small share of the market. Mergers and acquisitions are also common in this market, driven by companies' desire to expand their market presence, diversify their product offerings, and achieve economies of scale. Some key players operating in this market include Amcor PLC, Berry Global Inc., and Sonoco:

-

Amcor PLC operates globally and offers a wide range of packaging products, such as pouches, bags, films, and wraps. Amcor focuses on sustainable packaging options. They aim to reduce resource usage, energy consumption, and environmental impact.

-

Berry Global Inc. offers rollstock, pouches, and lid film. Their rotogravure and flexographic printing capabilities allow for high-quality graphics and branding on flexible packaging.

Key U.S. Flexible Packaging Companies:

- Amcor plc

- Berry Global Inc.

- Mondi

- Sonoco Products Company

- Constantia Flexibles

- Sealed Air

- TC Transcontinental

- WINPAK LTD

- Bemis Company, Inc.

- Coveris Holdings S.A.

Recent Developments

-

In January 2024, NBI FlexPack, launched flexible packaging for legal cannabis market. The packaging products will be manufactured at its Wisconsin based facility.

-

In February 2024, Amcor plc collaborated with Cheer Pack North America, a spouted pouch manufacturer and Stonyfield Organic, a U.S. based yogurt manufacturer to introduce a polyethylene based spouted pouch for North American market.

U.S. Flexible Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 65.5 billion

Revenue forecast in 2030

USD 83.5 billion

Growth rate

CAGR of 4.1% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, trends

Segments covered

Material, product, application

Key companies profiled

Amcor plc; Berry Global Inc.; Mondi; Sonoco Products Company; Constantia Flexibles; Sealed Air; TC Transcontinental; WINPAK LTD; Bemis Company, Inc.; Coveris Holdings S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flexible Packaging Market Report Segmentation

This report forecasts revenue and volume growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. flexible packaging market report based on material, product, and application:

-

U.S. Flexible Packaging Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Paper

-

Metal

-

Bioplastic

-

-

U.S. Flexible Packaging Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pouches

-

Retort Pouches

-

Refill Pouches

-

Bags

-

Films & Wraps

-

Stretch & Shrink Labels

-

Rollstocks

-

Others

-

-

U.S. Flexible Packaging Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Food & Beverage

-

Pharmaceutical

-

Cosmetics

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. flexible packaging market size was estimated at USD 63.46 billion in 2023 and is expected to be USD 65.5 billion in 2024.

b. The U.S. flexible packaging market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 83.5 billion by 2030.

b. The plastics segment dominated the U.S. flexible packaging market with a revenue share of 69% in 2023, on account of several factors including the cost-effectiveness of plastics which makes plastics an attractive choice for manufacturers.

b. Some of the key players operating in the U.S. flexible packaging market include Amcor PLC; Berry Global Inc.; Mondi; Sonoco; Constantia Flexibles; Sealed Air Corporation; TC Transcontinental; Winpak Limited; Bemis Company, Inc.; Coveris Holdings S.A.

b. Key factors that are driving the U.S. flexible packaging market growth includethe increasing demand for sustainable packaging solutions and the rising consumer preference for lightweight, durable, and attractive packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.