- Home

- »

- Food Additives & Nutricosmetics

- »

-

U.S. Flavors And Fragrances Market, Industry Report, 2030GVR Report cover

![U.S. Flavors And Fragrances Market Size, Share & Trends Report]()

U.S. Flavors And Fragrances Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Aroma Chemicals, Natural), By Application (Flavors, Fragrances), And Segment Forecasts

- Report ID: GVR-4-68040-220-8

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

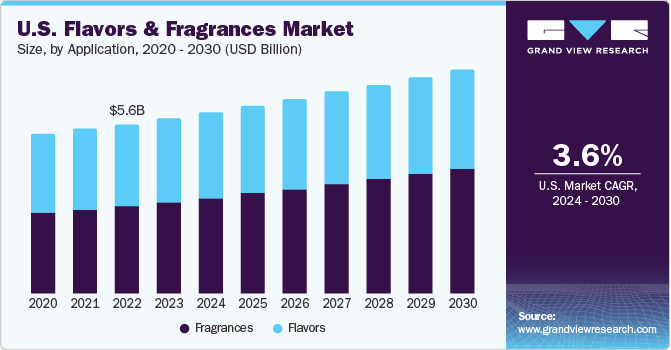

The U.S. flavors and fragrances market size was estimated at USD 5.80 billion in 2023 and is expected to expand at a CAGR of 3.6% from 2024 to 2030. The growth can be attributed to the rising inclusion of different flavors & fragrances in the formulation of fine scents and perfumes. Additionally, surging demand for flavors & fragrances for use in beverages, personal care products & skincare is expected to contribute to the market growth.

The flavor and fragrance industry in the United States has a strong foothold in the global market as the consumers in the country are open to trying new food products, which shows consumers' affinity for ethnic flavors and dishes. The Asian and Hispanic populations are rising in the country, which has led to the emergence of ethnic new tastes and flavor profiles. Such factors provide a great opportunity for the flavor manufacturers to launch natural ethnic flavors, such as fish sauce, doenjang, garlic chives, ginger, and lapsang souchong, to boost their growth.

Majority of dips and sauces available in the market are dairy-based owing to their rich texture and creamy flavor profiles. However, consumers are increasingly shifting toward plant-based alternatives due to the emerging trend of veganism and the prevalence of lactose intolerance among adults. The market is responding with technological innovations aimed at replicating the richness of whole milk and cream, with dairy alternatives. In December 2021, T. Hasegawa developed EmulsiTRACTTM giving full-bodied flavor to plant-based milk, coffee creamer, ice cream, and yogurt.

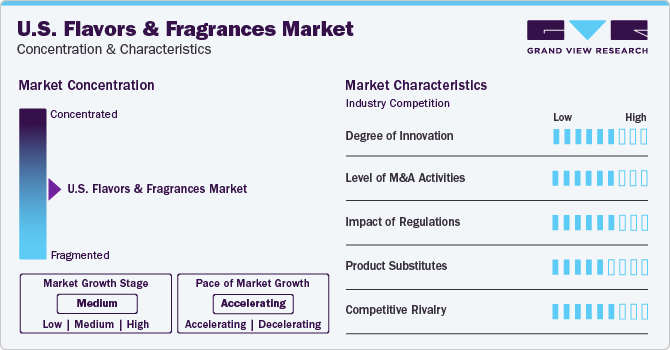

Market Concentration & Characteristics

The market growth is medium and is accelerating at a significant pace owing to a moderately fragmented market. U.S. flavors and fragrances manufacturers are actively implementing challenging strategic initiatives such as mergers & acquisitions, innovation, and production expansion, among others.

The degree of innovation is high. Consumers are diving into the diversity of different cultures and the complex science of flavour development is rapidly evolving. The food and beverage industry is continuously changing and technical innovations are reshaping consumer experience. For instance, T. Hasegawa USA is integrating international flavors and ingredients with the help of its BOOSTRACT, EmulsiTRACTTM, HASEAROMATM, and ChefAroma technologies.

The threat of substitutes is expected to be low. Market players are focused on increasing the manufacturing capacities of key flavors and fragrance products and are installing new facilities for various niche specialty flavors and fragrances for new product development. Limited availability of raw materials and stringent regulatory environment for the production of flavors and fragrances are likely to minimize the threat of substitutes.

Most of these companies are vertically integrated and produce products that cater to various applications. Manufacturers have to abide by manufacturing & labelling laws, regulations, and guidelines published by regulatory authorities such as the U.S. Food & Drug Agency (FDA), U.S. Department of Agriculture (USDA), and the World Health Organization.

Application Insights

Fragrances accounted for the largest revenue share of 52.6% in 2023 and is projected to register the fastest CAGR during the forecast period. The segment growth is driven by the high disposable income in the U.S. and the subsequent demand for luxury fragrances in cosmetics, toiletries, and perfumes. Furthermore, manufacturers engaged in developing natural fragrances often charge a “green premium” on their products. Furthermore, busy lifestyle in the U.S. is projected to surge the number of retail outlets catering to ready-to-eat meals. In addition, feed and feed additive manufacturers such as Kemin Industries, Inc. and Bentoli, LLC among others are focused on providing palatability solutions to increase the feed intake. This is projected to drive the demand for flavors in animal feed applications.

The flavors segment is expected to grow at a significant CAGR from 2024 to 2030 owing to the increasing use of flavors in dietary supplements. The health & wellness trend prevailing in the market is anticipated to enhance the preference given to natural flavor ingredients. The food & beverage industry offers huge potential due to rising demand for ready-to-eat meals, processed food, snacks, juices, and other beverages. The growing demand for food & beverages is expected to drive flavor demand over the forecast period.

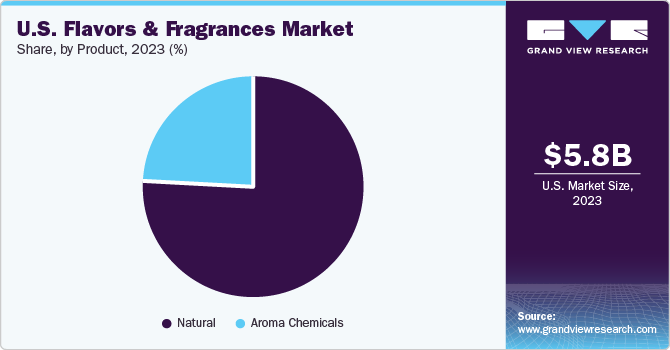

Product Insights

The natural segment held the largest revenue share of 76.3% in 2023 and is expected to expand at the fastest CAGR during the forecast period. Increasing demand for natural essential oils in the cosmetics and skincare sectors is expected to foster the market over the forecast period. Increasing consumer preference for natural and organic products is further projected to fuel the demand for essential oils from end-use industries.

Aroma chemicals is projected to expand at a prominent CAGR from 2024 to 2030. Aroma chemicals play a pivotal role in manufacturing food flavors and fragrances. These chemicals are classified as esters, alcohols, aldehydes, phenols, and other chemicals. The market is projected to grow at a high CAGR over the coming years owing to their increased usage in pharmaceuticals, wine, and perfumeries.

Key U.S. Flavors And Fragrances Company Insights

Increasing development activities in the country are attracting the attention of several international players for establishing and expanding their operations and distribution facilities while, key players in the country are focusing on establishing a strong foothold by adopting strategies such as agreements, joint ventures, and acquisitions. In January 2023 Symrise AG made a strategic investment in Ignite Venture Studio, a B2C startup venture in the personal care sector. The investment will aid Symrise in strengthening its position in the U.S. market.

Key U.S. Flavors And Fragrances Companies:

- International Flavors & Fragrances Inc.

- Young Living Essential Oils

- dōTERRA International

- Ungerer & Company

- Vigon International, Inc.

- Elevance Renewable Sciences, Inc.

- Alpha Aromatics

- BASF SE

- Archer-Daniels-Midland Company

Recent Developments

-

In September 2023, Coca‑Cola launched the AI-driven flavored Coca‑Cola Y3000 Zero Sugar to explore what a Coke from the year 3000 might taste like. The zero-sugar is a limited-edition drink available in select markets including the U.S., Canada, Europe, China, and Africa.

-

In July 2023, Symrise AG announced an investment agreement with Bonumose to develop enzymatic technology for flavor innovation of tagatose and allulose. This will strengthen Symrise AG’s position in the North America region, particularly in the U.S.

U.S. Flavors And Fragrances Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 6.01 billion

Revenue forecast in 2030

USD 7.43 billion

Growth Rate

CAGR of 3.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application

Country scope

U.S.

Key companies profiled

International Flavors & Fragrances Inc.; Young Living Essential Oils; dōTERRA International; Ungerer & Company; Vigon International, Inc.; Elevance Renewable Sciences, Inc.; Alpha Aromatics; BASF SE; Archer-Daniels-Midland Company

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Flavors And Fragrances Market Report Segmentation

This report forecasts revenue and volume growth at the country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. flavors and fragrances market report based on product and application:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Natural

-

Essential Oils

-

Orange Essential Oils

-

Limonene

-

Myrcene

-

Others

-

-

Corn mint Essential Oils

-

Menthol

-

Menthone

-

Others

-

-

Eucalyptus Essential Oils

-

Eucalyptol

-

Limonene

-

Others

-

-

Pepper Mint Essential Oils

-

Menthol

-

Menthone

-

Others

-

-

Lemon Essential Oils

-

Pinene

-

Limonene

-

Camphene

-

-

Citronella Essential Oils

-

Citronellal

-

Others

-

-

Patchouli Essential Oils

-

Patchouli Alcohol

-

Others

-

-

Clove Essential Oils

-

Eugenol

-

Others

-

-

Ylang Ylang/Canaga Essential Oils

-

Lavender Essential Oils

-

Linalyl Acetate

-

Others

-

-

-

Oleoresins

-

Paprika Oleoresins

-

Piperine

-

Others

-

-

Black Pepper Oleoresins

-

Piperine

-

Others

-

-

Turmeric Oleoresins

-

Curcumin

-

Others

-

-

Ginger Oleoresins

-

Gingerol

-

Others

-

-

-

Others

-

-

Aroma Chemicals

-

Esters

-

Ethyl acetate

-

Benzyl Acetate

-

Ethyl benzoate

-

Methyl Decanoate

-

Others

-

-

Alcohol

-

Lauryl Alcohol

-

Menthol

-

Others

-

-

Aldehydes

-

Benzaldehyde

-

Vanillin

-

Others

-

-

Phenol

-

Ethylvanillin

-

Others

-

-

Terpenes

-

Limonene

-

Camphor

-

Eucalyptol

-

Others

-

-

Others

-

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Flavors

-

Confectionery

-

Convenience Food

-

Bakery Food

-

Dairy Food

-

Beverages

-

Animal Feed

-

Others

-

-

Fragrances

-

Fine Fragrances

-

Cosmetics & Toiletries

-

Soaps & detergents

-

Aromatherapy

-

Others

-

-

Frequently Asked Questions About This Report

b. The U.S. flavors and fragrances market size was estimated at USD 5.80 billion in 2023

b. The U.S. flavors and fragrances market is expected to expand at a compound annual growth rate (CAGR) of 3.6% from 2024 to 2030 to reach USD 7.43 billion by 2030.

b. The natural segment held the largest revenue share of 76.3% in 2023 and is expected to expand at the fastest CAGR during the forecast period. Increasing demand for natural essential oils in the cosmetics and skincare sectors is expected to foster the market over the forecast period.

b. Some of the key players operating in the U.S. flavors and fragrances market: o International Flavors & Fragrances Inc. o Young Living Essential Oils o dōTERRA International o Ungerer & Company o Vigon International, Inc. o Elevance Renewable Sciences, Inc.

b. The growth can be attributed to the rising inclusion of different flavors & fragrances in the formulation of fine scents and perfumes. Additionally, surging demand for flavors & fragrances for use in beverages, personal care products & skincare is expected to contribute to the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.