U.S. Fencing Market Size, Share & Trends Analysis Report By Material (Metal, Wood, Concrete, Plastic & Composites), By Application, By Region, And Segment Forecasts, 2022 - 2030

- Report ID: GVR-1-68038-245-7

- Number of Report Pages: 65

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Advanced Materials

Report Overview

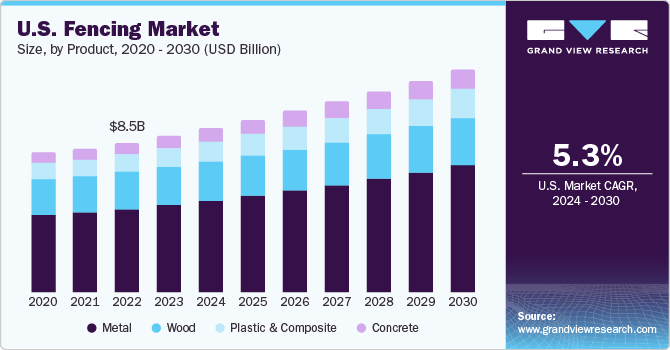

The U.S. fencing market size was estimated at USD 8.20 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 5.0% from 2022 to 2030. The considerable growth can be accredited to the availability of high-quality materials, consumer affordability, and varied designs on offer. The growth is primarily driven by factors such as increasing housing construction and growing demand from end-user industries such as the residential, industrial, and agricultural sectors. In the residential sector, the vinyl fence is mostly preferred due to its low maintenance, durability, and eco-friendly characteristics. Wooden fences are predominant in areas close to forests whereas wire fences are highly popular in the industrial sector as they provide enhanced security.

Metal fencing accounted for the largest market share of 55.4% in 2021, owing to the growing interest in chain link, ornamental, and barbed wire fencing to mark boundaries and in security-oriented projects. Wood fencing is anticipated to advance at a CAGR of 3.2%, owing to its cheaper prices and low maintenance costs. In addition, plastic & composite fences are estimated to expand at the highest CAGR of 6.9%, owing to their recyclable properties.

Due to the increasing environmental awareness, eco-friendly fence materials are expected to gain popularity. However, they require high maintenance due to which there is a shift toward low maintenance fences such as vinyl. Other eco-friendly options such as wood, composite, and natural recycled materials are also highly preferred. Wood fencing is a popular choice for residential applications owing to its natural appearance.

Several technologies are used in fencing procedures such as detection systems, wherein they have built-in sensors to detect any disruption produced by any efforts to climb or hack the fence. There are numerous systems for detecting threats, including infrared sensors, hidden cable detection, and alarm monitoring & control systems.

The solar fence is a sophisticated and unusual technology that not only ensures the protection of one's property but also operates on sustainable solar energy. A solar fence functions similar to an electric fence, delivering a brief but powerful shock when humans or animals come in contact with the barrier. The shock has a deterring impact while guaranteeing that no lives are lost.

Material Insights

The metal fencing product segment led the market and had a major share of the revenue with USD 4.55 billion in 2021. Metal fence materials include steel, aluminum, and other materials such as wrought iron and cast iron. The factors propelling the demand include affordable materials, cost-effectiveness, security, and aesthetic value.

Wood, as a material for fencing, accounted for the second largest revenue share in 2021 and is expected to drive the market at a CAGR of 3.2% during the forecast period. Wood fencing includes various types such as lattice, picket, rail, and chain link wooden-framed fences. The segment is expected to witness growth owing to its popularity and increased adoption in residential applications due to its distinctive aesthetic appeal and reasonable price.

The plastic & composite fencing segment includes vinyl, HDPE, polypropylene, and other plastics & composites. The segment contributes significantly to the market growth due to its cost-effectiveness, coupled with advantages such as high durability, lightweight, low or no maintenance, and easy replacement over conventional wood and metal fences. Plastic-wood fence is a versatile and functional solution that is completely environment-friendly. It is constructed from natural plastic fibers such as recycled plastic or trash.

The concrete fencing segment is poised to advance at the highest CAGR of 6.9% during the forecast period of 2022-2030. Concrete fences include concrete blocks, precast concrete, and poured-in-place concrete. It is long-lasting, sound-absorbing, and requires less maintenance, which is driving its application in the residential area. They are more resistant to weather than any other form of fence.

Application Insights

Residential application contributes the largest share to the U.S. fencing market and accounted for 33.6% of revenue in 2021. The segment is expected to expand at a CAGR of around 5.3% during the forecast period, owing to the significant residential construction activities globally. The high emphasis that households lay on security and privacy, as well as rising disposable income, are driving investments in residential fencing systems.

The residential fence market is gaining a majority of its revenue from metal and PVC fences. Privacy fences are gaining more popularity in this segment as many new communities place their homes closer together, making this fence style more relevant for lifestyle comfort and convenience.

Other application segments include agricultural, industrial, and commercial sectors. The agricultural segment includes fences for the safety and security of crops, land, and animals. In the agricultural sector, fencing includes a much wider range of materials, from conventional old wood materials to new high-tech materials such as electro-plastic twine and high tensile polymer rail.

There is a high demand for fencing for schools, colleges, and commercial and industrial premises. In the industrial application segment, barbed wire and electric wire fencing are mostly used. The increasing construction of offices and commercial spaces is promoting the demand for the installation of fencing.

Regional Insights

The south U.S. regional segment accounted for the highest revenue share of USD 3.2 billion and is poised to advance at a CAGR of around 5.8% during the forecast period. Agricultural applications are increasingly adopting fencing materials to safeguard their cattle and property in a variety of locations in the southern U.S., which will be a significant driver for the regional fencing industry.

The Northeast region includes Maine, New Hampshire, Vermont, Massachusetts, Rhode Island, Connecticut, New York, New Jersey, and Pennsylvania. Due to the increasing construction projects in the region, there has been a significant rise in demand for the fencing market. Furthermore, the increasing interest of consumers for home décor items has been widely adopted in northeastern states, which is driving the demand in the region.

The Midwest U.S. region accounted for a significant revenue share of the fencing market in 2021. The growing number of industries has resulted in an increase in demand in the Midwest area of the United States. Chicago, the largest metropolis in the mid-western area and a business, manufacturing, and transportation hub, is boosting the need for fencing to be utilized in a variety of applications around the region.

West U.S. region accounted for 20.3% of the global revenue share in 2021 on account of the region's increased infrastructure development and construction activity. The numerous transportation projects in California will increase the demand for fencing products. Additionally, increased agricultural activity is driving demand in the western area.

Key Companies & Market Share Insights

The industry has a large number of players, resulting in a threat of product substitution, coupled with the risk of new players entering the market. The key players operating in the market include Allied Tube & Conduit, Ameristar Fence Products Incorporated, Associated Materials LLC, Bekaert, and CERTAINTEED.

Raw material price fluctuations are one of the key issues encountered by market players, resulting in a high degree of backward and forward integration among major firms. This is expected to enhance market rivalry and competitiveness, making it difficult for new businesses to remain competitive.

Some prominent players in the U.S. fencing market include:

-

Allied Tube & Conduit

-

Ameristar Fence Products Incorporated

-

Associated Materials LLC

-

Bekaert

-

CERTAINTEED

-

Gregory Industries

-

Jerith Manufacturing

-

Long Fence Company Inc.

-

Ply Gem Residential Solutions

-

Poly Vinyl Creations

U.S. Fencing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2022 |

USD 8.51 billion |

|

Revenue forecast in 2030 |

USD 12.70 billion |

|

Growth Rate |

CAGR of 5.0% from 2022 to 2030 |

|

Base year for estimation |

2021 |

|

Actual estimates/Historical data |

2017 - 2020 |

|

Forecast period |

2022 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2021 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, application, region |

|

Regional scope |

U.S. (Northeast, Midwest, South, West) |

|

Key companies profiled |

Allied Tube & Conduit; Ameristar Fence Products Incorporated; Associated Materials LLC; Bekaert; CERTAINTEED; Gregory Industries; Jerith Manufacturing; Long Fence Company Inc.; Ply Gem Residential Solutions; Poly Vinyl Creations |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Fencing Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2030. For this study, Grand View Research has segmented the U.S. fencing market report based on material, application, and region:

-

Material Outlook (Revenue, USD Million, 2021 - 2030)

-

Metal

-

Wood

-

Plastic & Composites

-

Concrete

-

-

Application Outlook (Revenue, USD Million, 2021 - 2030)

-

Residential

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2030)

-

Northeast U.S.

-

Midwest U.S.

-

South U.S.

-

West U.S.

-

Frequently Asked Questions About This Report

b. U.S. fencing market size was estimated at USD 8.20 billion in 2021 and is expected to reach USD 8.51 billion in 2022.

b. The U.S. fencing market is expected to grow at a compound annual growth rate of 5.0% from 2021 to 2030 to reach USD 12.70 billion by 2030.

b. Metal fencing dominated the U.S. fencing market with a share of 55.4% in 2021. The factors propelling the demand for the fencing market include affordable materials, cost-effectiveness, security, and aesthetic value.

b. Some of the key players operating in the U.S. fencing market include Allied Tube & Conduit, Ameristar Fence Products Incorporated, Associated Materials LLC, Bekaert, CERTAINTEED, Gregory Industries, Jerith Manufacturing, Long Fence Company Inc., and, Ply Gem Residential Solutions.

b. The key factors that are driving the U.S. fencing market due to increasing housing construction, growing demand from end-user industries such as the residential, industrial, and agricultural sectors, and increasing safety concerns.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."