- Home

- »

- Medical Devices

- »

-

U.S. Female External Catheter Market, Industry Report, 2033GVR Report cover

![U.S. Female External Catheter Market Size, Share & Trends Report]()

U.S. Female External Catheter Market (2025 - 2033) Size, Share & Trends Analysis Report By Application (Diabetes, Strokes, Ovarian Cancer, Bladder Cancer), By Area Of Incontinence, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-366-9

- Number of Report Pages: 300

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Female External Catheter Market Summary

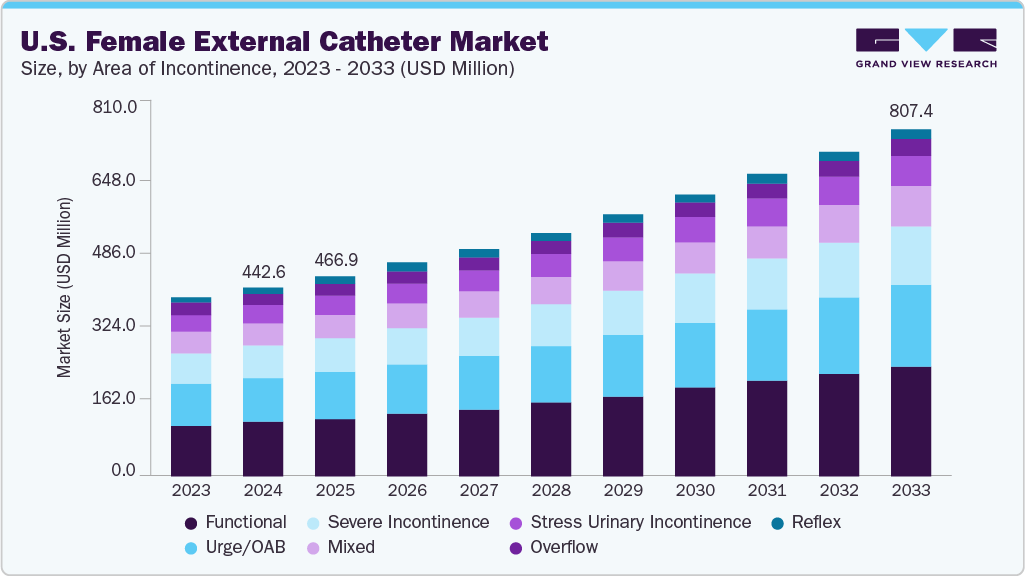

The U.S. female external catheter market size was estimated at USD 442.65 million in 2024 and is projected to reach USD 807.43 million by 2033, growing at a CAGR of 7.09% from 2025 to 2033. The market growth is driven by the rising prevalence of urinary incontinence among women, especially in the aging population, increasing awareness and adoption of non-invasive urinary management solutions, and the growing demand for improved hygiene and comfort in long-term care and hospital settings.

Key Market Trends & Insights

- Based on application, the strokes segment led the market with the largest revenue share of 23.09% in 2024.

- Based on area of incontinence, the functional segment led the market with the largest revenue share of 30.14% in 2024.

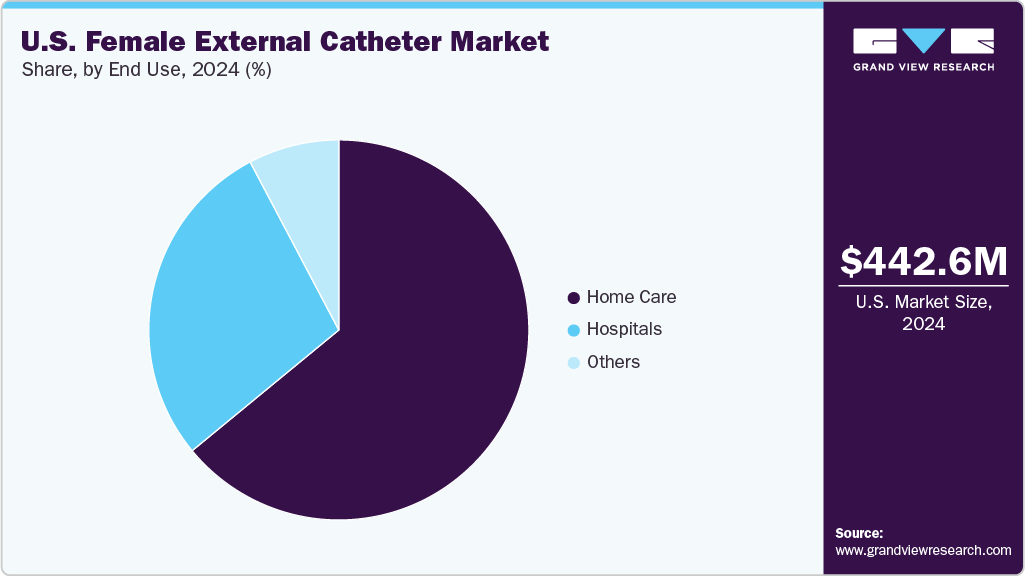

- By end use, the home care segment led the market with the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 442.65 Million

- 2033 Projected Market Size: USD 807.43 Million

- CAGR (2025-2033): 7.09%

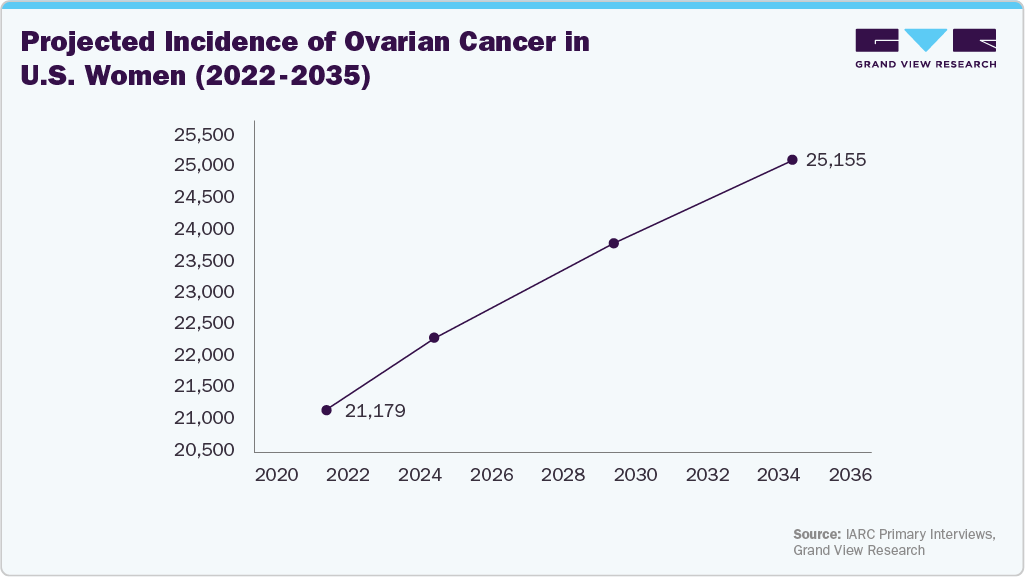

In addition, the shift toward home healthcare services and advancements in female external catheter design further fuel market growth. According to the Vintage 2024 Population Estimates released by the U.S. Census Bureau, in 2024, women accounted for 50.5% of the total U.S. population, overtaking the number of men by approximately 3.4 million.The increasing prevalence of chronic health conditions, particularly diabetes and ovarian cancer, is anticipated to significantly contribute to the growing demand for female external catheters in the U.S. These conditions are associated with urinary complications, such as bladder dysfunction or incontinence, which require non-invasive and patient-friendly management solutions to maintain comfort, hygiene, and quality of life, especially in elderly and chronically ill patients. According to data published in August 2024 by Diabetes, Obesity, and Metabolism, approximately 96 million U.S. adults are living with prediabetes, while an additional 37 million individuals have been diagnosed with diabetes. The prevalence of diabetes among females stood at 11.56% in 2022, highlighting a substantial burden on the female population.

Furthermore, ovarian cancer remains a critical health issue among U.S. women, with rising case numbers projected over the coming decades. This form of cancer can also lead to urinary dysfunctions, particularly after surgery or treatment, further increasing the need for supportive urinary care products such as female external catheters.

Female external catheters are essential for managing urinary complications associated with diabetes and ovarian cancer. As the prevalence of these conditions continues to rise, the demand for comfortable and hygienic urinary management solutions, like female external catheters, is expected to grow, especially in hospitals and home care settings.

The increasing awareness of urinary incontinence and available treatment options is expected to play a pivotal role in driving market growth over the forecast years. Organizations and industry stakeholders are actively working to educate the public and reduce the stigma surrounding UI.

For instance, in May 2025, the National Association for Continence (NAFC) launched a nationwide awareness initiative titled “We Count,” focused specifically on Stress Urinary Incontinence (SUI). Running throughout May and June, the campaign aims to:

-

Educate the public about what SUI is and its underlying causes.

-

Encourage women to consult healthcare providers regarding their symptoms.

-

Elevate awareness around the mental health impacts of SUI, such as isolation and reduced self-esteem.

-

Engage women through digital resources, including symptom checkers, treatment options, and wellness strategies.

“We want women to know: You’re not alone, and your condition is treatable, by launching the We Count campaign, we are breaking the silence around incontinence, particularly SUI, and empowering women to reclaim their quality of life.” said Sarah Jenkins, Executive Director of NAFC.

Moreover, the rising prevalence of neurodegenerative diseases such as Alzheimer's and Parkinson's is a significant driver of the U.S. female external catheter industry’s growth. Both conditions are associated with a progressive loss of muscle control and cognitive function, which often leads to urinary incontinence or difficulties in bladder management. As these diseases disproportionately affect the elderly-particularly women, who tend to live longer and make up a larger share of the aging population-the demand for non-invasive, hygienic, and comfortable urinary management solutions continues to grow. Female external catheters offer an effective alternative to indwelling catheters by reducing the risk of urinary tract infections and improving patient comfort, especially in long-term care, hospice, and home healthcare settings. As Alzheimer's and Parkinson's cases increase with the aging population, the need for such patient-friendly continence care devices is expected to rise significantly.

-

According to the Alzheimer's Association, almost two-thirds of Americans living with Alzheimer's are women. Of the 7.2 million people age 65 and older with Alzheimer's in the U.S., 4.4 million are women.

-

According to the Parkinson's Foundation, an estimated 1.1 million people in the U.S. are currently living with Parkinson's disease, a number projected to rise to 1.2 million by 2030.

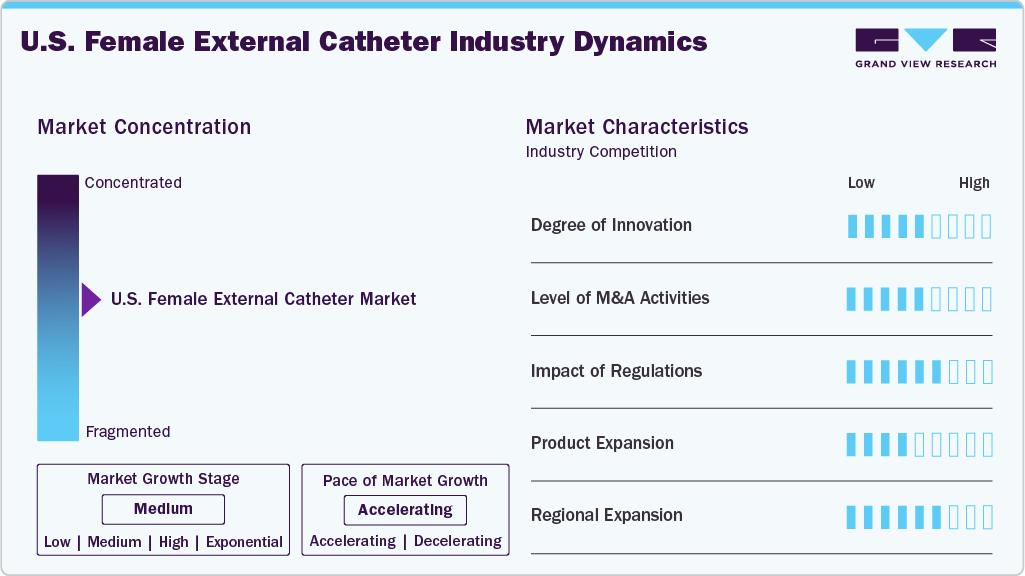

Market Characteristics & Concentration

The market growth stage is high, and the pace of growth is accelerating. The U.S. market for female external catheters is characterized by increasing cases of chronic diseases, growing prevalence of urinary incontinence among women coupled with growing demand for discreet and convenient urinary management solutions for women.

The U.S. market has witnessed a moderate to high degree of innovation in recent years. The market has seen the introduction of new products with advanced features, improved designs, and enhanced materials, which have significantly impacted the industry. One of the key drivers of innovation is the increasing demand for discreet and comfortable products that cater to the specific needs of women with urinary incontinence. As a result, manufacturers have developed products with ergonomic designs, soft and breathable materials, and advanced drainage systems.

The level of mergers and acquisitions (M&A) in the U.S. female external catheter industry is moderate to high, driven by the need for portfolio expansion, technological innovation, and increased market penetration. Large medical device companies are acquiring niche players and specialized product lines to strengthen their presence in the urinary continence care segment.

Regulations significantly impact the U.S. female external catheter market, shaping product development, approval, and adoption. As Class II medical devices, these products require FDA 510(k) clearance, adherence to quality manufacturing standards, and clear labeling to ensure safety and effectiveness. Regulatory focus on reducing hospital-acquired infections, particularly catheter-associated urinary tract infections, has increased the use of non-invasive female external catheters in hospitals and long-term care facilities. Reimbursement policies under Medicare and Medicaid support their adoption, especially in home healthcare settings.

Product expansion in the U.S. female external catheter industry is gaining momentum as manufacturers focus on meeting the diverse needs of patients across hospital, long-term care, and home settings. Companies are introducing advanced designs tailored to female anatomy, offering improved fit, comfort, and leakage control. Innovations in skin-friendly adhesives and breathable fabrics enhance user experience and reduce skin irritation risk during prolonged use. Additionally, the market is witnessing the development of disposable and reusable options, allowing greater flexibility based on care settings.

Regional expansion is playing a crucial role in accelerating the growth of the U.S. female external catheter market. With urinary incontinence and chronic conditions like Alzheimer’s and Parkinson’s more prevalent among aging populations, manufacturers are strategically expanding their reach into underserved regions, particularly in the South and Midwest, where median ages are rising and healthcare infrastructure is evolving.

Application Insights

The strokes segment dominated the market in 2024 with a share of 23.09%, due to the high prevalence of neurogenic bladder dysfunction among stroke survivors, particularly in elderly female patients. Stroke impairs the central nervous system’s control over bladder function, leading to urinary incontinence, urgency, or retention. As a result, there is an increased need for effective, non-invasive urinary management solutions in acute and post-stroke rehabilitation settings. Female external catheters offer a hygienic, comfortable alternative to indwelling catheters, helping to prevent catheter-associated urinary tract infections and improve patient outcomes. The growing number of stroke cases, driven by aging demographics and lifestyle-related risk factors, has significantly contributed to the demand for external urinary continence devices, reinforcing stroke as the leading indication in the market. According to data published by the CDC in May 2024, stroke is a leading cause of death among women in the U.S., with approximately 1 in 5 women aged between 55 and 75 expected to experience a stroke in their lifetime.

The diabetes segment is expected to register the fastest CAGR during the forecast period, driven by the growing prevalence of diabetes-related complications that affect bladder function, such as diabetic neuropathy. Many individuals with long-standing diabetes experience neurogenic bladder characterized by poor bladder control, urinary retention, or incontinence. These issues are prevalent among older diabetic women, who represent a significant portion of the target population for female external catheters. As awareness of non-invasive continence care solutions increases, the demand for female external catheters in diabetic patients is expected to rise rapidly. Additionally, advancements in home healthcare and reimbursement support for diabetic care further contribute to the segment's accelerated growth. According to data published by The National Center for Health Statistics in November 2024, between August 2021 and August 2023, the prevalence of total diabetes among U.S. adults was 15.8%, with 11.3% representing diagnosed cases and 4.5% remaining undiagnosed. Specifically, 18.0% of men had total diabetes, and 12.9% were diagnosed, while among women, the corresponding figures were 13.7% and 9.7%, respectively.

Area Of Incontinence Insights

Functional incontinence dominated the U.S. female external catheter industry in 2024, primarily due to its high prevalence among elderly women with mobility impairments, cognitive decline, or neurological disorders such as dementia and Parkinson’s disease. Functional incontinence occurs when a person cannot reach the toilet in time due to physical or cognitive limitations despite having normal bladder function. This condition is prevalent in long-term care and hospital settings, where patients often face challenges in self-care and mobility. Female external catheters offer a practical, non-invasive solution for managing urine output in such cases, reducing caregiver burden and minimizing the risk of skin complications and urinary tract infections. As the aging population grows and the focus on patient dignity and comfort intensifies, the demand for external catheter solutions for functional incontinence is expected to remain strong.

The urge incontinence/Overactive Bladder (OAB) segment is expected to grow at a significant CAGR during the forecast period, driven by the rising incidence of OAB among aging women and individuals with chronic health conditions such as diabetes, obesity, and neurological disorders. Urge incontinence is characterized by a sudden, intense urge to urinate followed by involuntary leakage, disrupting daily activities and reducing quality of life. With increasing awareness and diagnosis of OAB, there is a growing demand for discreet, comfortable, and non-invasive urinary management solutions. Female external catheters offer an effective alternative for managing urine leakage without the discomfort and infection risks associated with indwelling devices. As healthcare providers and patients prioritize solutions that enhance comfort, hygiene, and independence, adopting external catheters for OAB management is expected to expand rapidly, contributing to the segment’s strong growth. According to the Urology Care Foundation, OAB affects millions of women and men in the U.S. Many older men (30%) and women (40%) struggle with OAB symptoms.

End Use Insights

The home care end use segment dominated the U.S. female external catheter market in 2024 with a share of 64.04%, driven by the rising preference for at-home treatment among elderly patients and individuals with chronic conditions such as stroke, Alzheimer’s disease, Parkinson’s disease, and diabetes. Female external catheters are particularly well-suited for home care settings due to their ease of use, non-invasive design, and ability to improve hygiene and comfort without requiring professional catheterization. The growing availability of portable and user-friendly catheter systems and increased caregiver training and telehealth support have further supported this trend. Additionally, favorable reimbursement policies for urinary incontinence management products under Medicare and Medicaid have encouraged greater home care adoption.

The hospital segment is expected to register a significant CAGR during the forecast period due to its critical role in the acute management of urinary incontinence, especially among post-operative, immobile, and elderly female patients. Hospitals increasingly prefer female external catheters as a safer alternative to indwelling catheters to reduce the risk of catheter-associated urinary tract infections, improve patient comfort, and support infection control initiatives. The rising incidence of stroke, Parkinson’s, and other neurologic conditions requiring hospitalization has further fueled demand for non-invasive urinary management solutions. Additionally, advancements in hospital-grade external catheter systems-such as suction-enabled designs-have enhanced usability and hygiene, contributing to their growing adoption. As hospitals prioritize patient safety and adhere to strict infection prevention protocols, the use of external catheters is expected to expand, driving strong growth in this segment.

U.S. number of hospital data for the years 2023 And 2022

The growing demand for female external catheters in the U.S. is expected to be fueled by the increasing number of hospitals, driven by various factors such as improved healthcare access initiatives, modernization efforts, and a shifting focus toward patient-centric care. As healthcare systems in the country continue to evolve and expand to meet the diverse needs of a growing patient population, this trend is likely to persist, presenting opportunities for market growth and development.

U.S. hospital statistics for the years 2023 and 2022:

2023

2022

Total Number of All U.S. Hospitals

6,129

6,093

Number of U.S. Community Hospitals

5,157

5,139

Number of Nongovernment Not-for-Profit Community Hospitals

2,978

2,960

Number of Investor-Owned (For-Profit) Community Hospitals

1,235

1,228

Number of State and Local Government Community Hospitals

944

951

Number of Federal Government Hospitals

206

207

Number of Nonfederal Psychiatric Hospitals

659

635

Other Hospitals

107

112

Total Admissions in All U.S. Hospitals

34,011,386

33,356,853

Total Expenses for All U.S. Hospitals

NA

USD 1,213,881,001,000

Source: Health Forum LLC, an affiliate of the American Hospital Association, 2023

Key U.S. Female External Catheter Company Insights

Stryker, BD, Medline Industries, LP., and Boehringer Laboratories, LLC., among others, are some of the prominent players operating in the U.S. female external catheter market. These companies are expanding their product portfolios by introducing advanced female external catheter solutions designed for enhanced comfort, hygiene, and usability. In response to the growing demand, many manufacturers are also scaling up their production capacities and strengthening distribution networks to ensure reliable supply across hospital, long-term care, and home care settings.

Key U.S. Female External Catheter Companies:

- Stryker

- BD (Becton, Dickinson & Corporation)

- Medline Industries, LP.

- Boehringer Laboratories, LLC.

- Consure Medical

- Ur24Technology, Inc.

- TillaCare Ltd.

Recent Developments

-

In February 2025, BD announced that its Board has approved plans to spin off its Biosciences and Diagnostic Solutions division into a separate, standalone entity, with the split expected to be finalized by fiscal 2026.

-

In February 2023, Tillacare obtained a U. S. patent for the UriCap Female. The UriCap Female received U.S. Patent No. 11,666,474. This strengthens TillaCare’s position in the U.S. market.

-

In January 2023, Ur24Technology Inc. introduced the TrueClr catheter product line, a latex-free external device engineered to actively drain bladders in both adults and children.

U.S. Female External Catheter Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 466.86 million

Revenue forecast in 2033

USD 807.43 million

Growth rate

CAGR of 7.09% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Application, area of incontinence, end use

Country scope

U.S.

Key companies profiled

Stryker; BD; Medline Industries, LP.; Boehringer Laboratories, LLC.; Consure Medical; Ur24Technology, Inc.; TillaCare Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Female External Catheter Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the U.S. female external catheter market report based on application, area of incontinence, and end use:

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Strokes

-

Alzheimer's Disease

-

Spinal Cord Injury

-

Parkinson's Disease

-

Multiple Sclerosis

-

Bladder Cancer

-

Ovarian Cancer

-

Diabetes

-

Others

-

-

Area of Incontinence Outlook (Revenue, USD Million, 2021 - 2033)

-

Functional

-

Urge/OAB

-

Severe Incontinence

-

Mixed

-

Stress Urinary Incontinence

-

Overflow

-

Reflex

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Home Care

-

Hospitals

-

Other

-

Frequently Asked Questions About This Report

b. The U.S. female external catheter market size was estimated at USD 442.65 million in 2024.

b. The U.S. female external catheter market is expected to grow at a compound annual growth rate of 7.09% from 2025 to 2033 to reach USD 807.43 million by 2033.

b. Based on application, the strokes segment led the market with the largest revenue share, 23.09%, in 2024.

b. Some of the players operating in the U.S. female external catheter market are BD, Stryker, Boehringer Laboratories, LLC., Consure Medical, Hollister Incorporated.

b. The female external catheter market in the U.S. is driven by the increasing demand for innovative and effective solutions for managing urinary incontinence and catheterization in women. Female external catheters are designed to provide a safe, comfortable, and hygienic alternative to traditional indwelling urethral catheters, which can be associated with complications such as urinary tract infections and bladder damage.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.