- Home

- »

- Display Technologies

- »

-

U.S. Eyewear Market Size, Share And Growth Report, 2030GVR Report cover

![U.S. Eyewear Market Size, Share & Trends Report]()

U.S. Eyewear Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Contact Lenses, Spectacles, Sunglasses), By Distribution Channel (E-Commerce, Brick & Mortar), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-202-1

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Eyewear Market Size & Trends

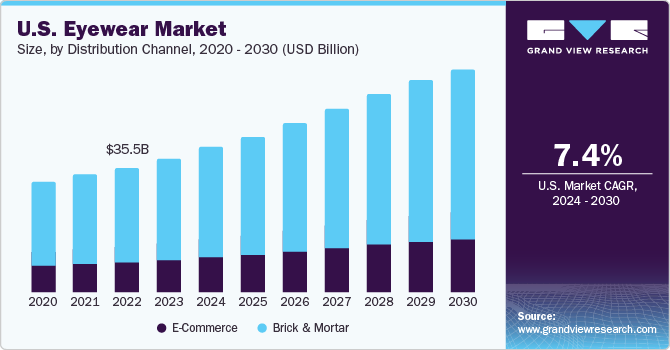

The U.S. eyewear market size was valued at USD 37.98 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 7.4% from 2024 to 2030. Due to the changing lifestyle patterns and increasing adoption of luxurious accessories, especially among millennials, the market is expected to grow. Growing visual inaccuracies, coupled with increased awareness regarding vision correction, are expected to drive market growth. Consistent renewal of spectacle lenses due to the constant change in prescriptions is expected to influence the demand positively over the forecast period.

Eyewear has become an additional add-on accessory as customers have become style-conscious, especially in urban areas. Eyewear has become the new fashion essential, as the providers are offering attractive frames such as vintage-inspired frames, retro, tortoise shell, and geometric frames, creating a lot of choices for the consumers for purchase. Matching eyewear frames with an outfit for various occasions to keep in par with the changing fashion trends is emerging as a new trend among wearers. Growing consumer spending on corrective and luxury eyewear is expected to provide an impetus to the eyewear market growth. The manufacturers have started to target the middle class, young and high-income groups residing in urban areas by introducing innovative and fashionable eyewear.

The increasing brand popularity due to marketing on various social media platforms, and proliferation of eyewear e-commerce platforms have contributed to the market growth. Key companies are advertising on popular social media platforms which offer them an opportunity to analyze audience preferences, thereby offering specially curated products. These online platforms help companies incorporate innovative marketing strategies such as influencer and affiliate marketing to make their business more profitable.

The COVID-19 pandemic has also impacted the market positively. As a result of the implementation of remote working models and online learning due to lockdown restrictions, people spent more time on smartphones, laptops, and desktops, which forced them to spend on anti-fatigue and vision correction glasses, allowing eyewear companies to sell more blue light-canceling and anti-fatigue lenses. Lifestyle changes due to growing urbanization, particularly in developed markets, are a major propeller for the increased usage of corrective eyewear. With the advent of modern healthcare and technology, there has been an increase in the share of the older population on account of the increasing life expectancy rate.

Market Concentration & Characteristics

Due to the increasing prevalence of vision problems and eye conditions, which lead to greater demand for corrective products such as glasses and contact lenses, the pace of the market growth is accelerating. The growing popularity of glasses as a fashion accessory, particularly among younger consumers, is helping to drive demand for designer frames and sunglasses.

The market is characterized by a significant number of mergers and acquisitions. Due to the highly competitive nature of the market, it is difficult for companies to maintain profitability and market share growth on their own. By collaborating with or acquiring other companies, they are trying to gain access to new technologies, markets, or customer bases that can help them stay ahead of their competitors.

The market is also impacted by regulatory frameworks. Regulatory bodies such as the U.S. Food and Drug Administration (US FDA) are responsible for making rules and regulations for the manufacture, distribution, and marketing of products, including glasses, contact lens, and sunglasses. The US FDA requires that all contact lens be approved as safe and effective medical devices before they can be sold to consumers.

End-user concentration is a significant factor in the market. The high cost of luxury eyewear products can make them less accessible to the average consumer. Companies in this segment may need to rely on a smaller number of high-spending consumers to maintain profitability. Many consumers have strong preferences for certain eyewear brands based on factors such as quality, style, or celebrity endorsements and are willing to pay a premium for products that meet their specific preferences.

Distribution Channel Insights

The brick-and-mortar segment dominated the market with the highest revenue share of 76.4% in 2023. This can be attributed to the growing awareness regarding the importance of routine eye exams and the use of eyeglasses, which has prompted the sale of glasses in physical stores. Several companies are focusing on expanding their stores to gain a competitive edge in the market.

The e-commerce segment gained massive traction during the pandemic as people were forced to practice social isolation. In addition, vendors are also adopting modern ways of distribution, such as online retailing. Companies are implementing omnichannel retailing and are selling their products via these platforms as well as physical stores.

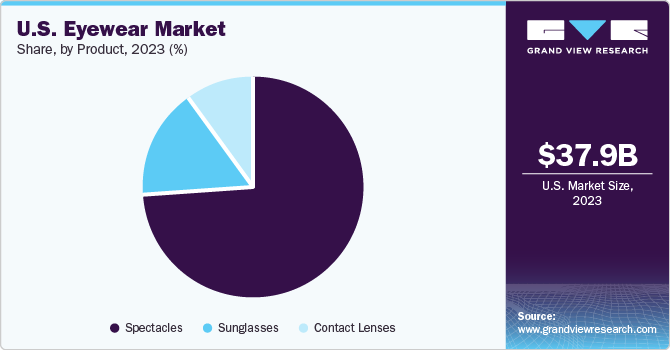

Product Insights

The spectacles segment accounted for the largest market share of 74.0% in 2023. This is attributed to the increased product demand driven by the increasing prevalence of computer vision syndrome (CVS). The adoption of anti-fatigue and anti-glare glasses has been prompted by the rise in cases of CVS among children due to the growing trend of online learning, particularly during the pandemic. Additionally, the demand for spectacles has increased due to the rising popularity of clear and bright translucent glasses.

Contact lenses held a notable revenue share of the market in 2023 due to the emergence of advanced products such as light-adaptive lenses and multifocal toric lenses. These lenses adapt to different lighting conditions quickly and smoothly. It reduces irritation and dryness of eyes often caused by normal contact lenses. The ongoing research and development of contact lenses with improved aesthetics and quality is expected to further support the segment’s growth.

Key U.S. Eyewear Market Company Insights

Some of the key players operating in the market include Johnson & Johnson Vision Care, Inc. and CooperVision.

- Johnson & Johnson Vision Care is engaged in the design, manufacturing, and marketing of disposable contact lenses. The company acquired Frontier contact lenses, after which it was renamed as VISTAKON. The company owns the Acuvue brand of contact lenses and is designed explicitly for vision correction for astigmatism and presbyopia in the U.S.

Carl Zeiss, Bausch & Lomb, Zenni Optical, and Warby Parker are some other participants in the U.S. eyewear market.

-

Warby Parker is a manufacturer and provider of the designer eyewear. The company offers various products in the category of sunglasses, eyeglasses, accessories, etc. The company also offers home-try on and virtual-try on services for customers.

-

Zenni Optical, Inc. is an online retailer of prescription glasses and sunglasses. The company has its in-house manufacturing facility for the development of eyewear products. The company develops its optical frames using a strong, light-weight flexible sheet of hypoallergenic acetate to create fashionable frames for men and women.

Recent Developments

-

In February 2024, ZEISS acquired IP portfolio from Mitsui Chemicals for electronic eyewear. This move is expected to reinforce the company’s commitment to remain at the forefront of technological advancements in the market.

-

In October 2023, Bausch & Lomb launched an ophthalmic diagnostic system SeeNa for refractive cataract patients. SeeNa captures key measurements necessary for evaluating patients’ eyes and determining the cataract intraocular lens (IOL) power calculation in one step. It also offers a user-friendly interface, allowing clinicians and staff to quickly master acquisition and operation and receive results in short duration.

Key U.S. Eyewear Companies:

The following are the leading companies in the U.S. eyewear market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these U.S. eyewear companies are analyzed to map the supply network.

- Johnson & Johnson Vision Care, Inc.

- EssilorLuxottica

- CooperVision

- Carl Zeiss AG

- Bausch & Lomb Inc.

- Safilo Group S.p.A.

- Charmant Group

- CIBA VISION

- De Rigo Vision S.p.A

- Fielmann AG

- HOYA Corporation

- JINS, Inc.

- Marchon Eyewear, Inc.

- QSpex Technologies

- Rodenstock GmbH

- Seiko Optical Products Co., Ltd.

- Shamir Optical Industry Ltd.

- Silhouette International Schmied AG

- Warby Parker

- Zenni Optical, Inc.

U.S. Eyewear Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 62.78 billion

Growth rate

CAGR of 7.4% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in million units; revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, End-Use

Regional scope

U.S.

Key companies profiled

Johnson & Johnson Vision Care, Inc.; ESSILORLUXOTTICA; CooperVision; Carl Zeiss AG; Bausch & Lomb Inc.; Safilo Group S.p.A.; Charmant Group; CIBA VISION; De Rigo Vision S.p.A; Fielmann AG; HOYA Corporation; JINS, Inc.; Marchon Eyewear, Inc.; Marcolin S.p.A; QSpex Technologies; Rodenstock GmbH; Seiko Optical Products Co., Ltd.; Shamir Optical Industry Ltd.; Silhouette International Schmied AG; Warby Parker; Zenni Optical, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Eyewear Market Report Segmentation

This report forecasts volume and revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S eyewear market report based on product and distribution channel:

-

Product Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Contact Lenses

-

Premium Contact Lenses

-

Mass Contact Lenses

-

-

Spectacles

-

Spectacles Frame

-

Spectacles Frame, by Type

-

Premium Spectacle Frames

-

Mass Spectacle Frames

-

-

Spectacles Frame, by Style

-

Round

-

Square

-

Rectangle

-

Oval

-

Others

-

-

-

Spectacles Lenses

-

-

Sunglasses

-

Sunglasses, by Lens Type

-

Polarized Sunglasses

-

Non-Polarized Sunglasses

-

-

Sunglasses, by Lens Material

-

CR-39

-

Polycarbonate

-

Polyurethane

-

Others

-

-

-

-

Distribution Channel Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

E-Commerce

-

Brick & Mortar

-

-

End-use Outlook (Volume, Million Units; Revenue, USD Million, 2018 - 2030)

-

Male

-

Female

-

Unisex

-

Kids

-

Frequently Asked Questions About This Report

b. The U.S. eyewear market size was valued at USD 37.98 billion in 2023 and is expected to reach USD 41.12 billion in 2024.

b. The U.S. eyewear market is expected to grow at a compound annual growth rate (CAGR) of 7.3% from 2024 to 2030 to reach USD 62.78 billion by 2030.

b. The spectacles product type segment dominated the U.S. eyewear market with a share of over 73% in 2023. This is attributed to the increased product demand driven by the increasing prevalence of computer vision syndrome (CVS).

b. Some key players operating in the U.S. eyewear market include Johnson & Johnson Vision Care, Inc.; ESSILORLUXOTTICA; CooperVision; Carl Zeiss AG; Bausch & Lomb Inc.; Safilo Group S.p.A.; Charmant Group; CIBA VISION; De Rigo Vision S.p.A; Fielmann AG; HOYA Corporation; JINS, Inc.; Marchon Eyewear, Inc.; Marcolin S.p.A; QSpex Technologies; Rodenstock GmbH; Seiko Optical Products Co., Ltd.; Shamir Optical Industry Ltd.; Silhouette International Schmied AG; Warby Parker; Zenni Optical, Inc.

b. The factors driving the U.S. eyewear market are changing lifestyle patterns, increasing adoption of luxurious accessories, especially among millennials, growing visual inaccuracies, and increased awareness regarding vision correction.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.