- Home

- »

- Clinical Diagnostics

- »

-

U.S. Exocrine Pancreatic Insufficiency Diagnostics Market, Report, 2030GVR Report cover

![U.S. Exocrine Pancreatic Insufficiency Diagnostics Market Size, Share & Trends Report]()

U.S. Exocrine Pancreatic Insufficiency Diagnostics Market Size, Share & Trends Analysis Report By Diagnostic Method (Laboratory Tests, Imaging Tests), By End-use (Hospitals, Clinics, Diagnostic Laboratories), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-299-1

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

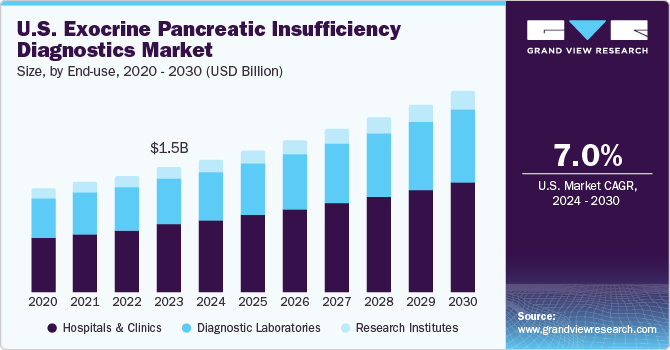

The U.S. exocrine pancreatic insufficiency diagnostics market size was estimated at USD 1.49 billion in 2023 and is projected to grow at a CAGR of 7.04% from 2024 to 2030. The market is driven by the increasing prevalence of diseases such as cystic fibrosis and chronic pancreatitis, which pose a significant threat to public health. It is also shaped by the urgent need for effective tests that address the limitations of current testing options owing to high costs and low availability of tests.

Ongoing research and development efforts are focused on discovering novel tests to overcome these challenges. Market trends and future projections indicate a promising growth trajectory driven by advancements in diagnostic technology and a focus on personalized testing. The market represents a critical area of focus for healthcare providers, researchers, and clinical diagnostic companies in their quest to develop effective & safe tests for Exocrine Pancreatic Insufficiency (EPI).

EPI is prevalent in a significant proportion of patients diagnosed with chronic pancreatitis, a common pancreatic disorder in the U.S., which affects a substantial portion of the population. Early detection and management of EPI in patients with underlying conditions are crucial for improving patient outcomes & quality of life. Thus, the increasing prevalence of diseases such as chronic pancreatitis, diabetes, pancreatic cancer, IBD, and HIV/AIDS results in an increased risk of EPI in the U.S. population.

In patients with type 1 and type 2 diabetes, EPI affects a considerable percentage of the population, ranging from 10% to 56%, highlighting the importance of screening diabetic individuals for pancreatic insufficiency. As the incidence of these conditions continues to rise, there is a corresponding increase in the demand for diagnostic tests to accurately identify and manage EPI, which drives market growth.

Technological advancements in diagnostic tools and assays are pivotal drivers of the market, revolutionizing the landscape of EPI detection and management. These advancements encompass a spectrum of innovative products and methodologies to enhance the accuracy, sensitivity, and accessibility of diagnostic tests for EPI. Thus, growing research in the field of EPI diagnosis is expected to drive market growth.

Several companies, such as ChiRhoClin, Inc.; Immundiagnostik AG; Quest Diagnostics Incorporated, are developing cutting-edge products tailored specifically for EPI diagnostics, each offering unique features and functionalities. For instance, BÜHLMANN fPELA turbo test by Alpha Laboratories is tailored to meet the diagnostic needs of EPI, providing reliable results for healthcare providers. This innovative test streamlines the diagnostic process, ensuring efficient and accurate detection of EPI in clinical settings.

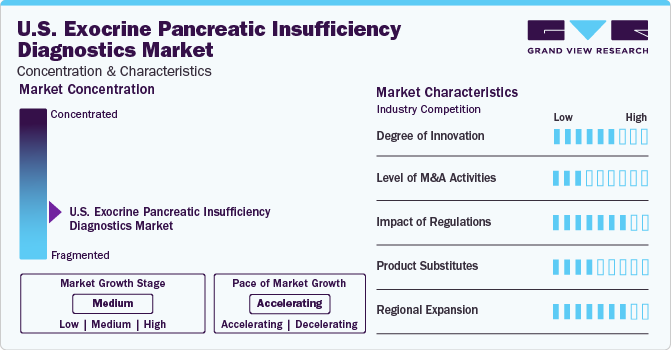

Market Concentration & Characteristics

The U.S. exocrine pancreatic insufficiency diagnostics market is experiencing rapid growth, driven by advancements in treatment approaches and the increasing prevalence of target diseases worldwide. Technological innovations in EPI diagnostic tools contribute to this growth trajectory, enabling more effective disease management.

The market is characterized by a low-to-moderate level of merger and acquisition activity, indicating a landscape characterized by stable competition and a focus on internal development rather than external consolidation. For instance, in April 2022, ALPCO and GeneProof a.s. (GeneProof) merged to strengthen and expand their businesses globally. This merger is anticipated to impact the market growth positively..

A key regulatory trend in the U.S. market for exocrine pancreatic insufficiency diagnostics is the implementation of stricter regulatory requirements for diagnostic tests, such as the adherence to Good Manufacturing Practices (GMP) and ISO standards, which reflects in the growing emphasis on patient safety & product quality assurance in the regulatory landscape.

Product substitutes for these diagnostics are relatively few due to the specialized nature of diagnostic tests and the lack of viable alternatives. Diagnostic tests such as fecal elastase assays and pancreatic function tests are considered the standard methods for diagnosing pancreatic insufficiency, with few alternative tests offering comparable accuracy & reliability. In addition, alternative approaches, such as clinical observation or empirical treatment, are generally not considered effective substitutes for diagnostic testing, further reducing the threat of substitutes in the market.

The market is expanding regionally, with growing access to effective diagnosis in developed and developing regions. Strategies may include partnerships with local healthcare providers, educational initiatives to raise awareness about the importance of early disease diagnosis, and the development of affordable testing options tailored to the needs of different healthcare systems.

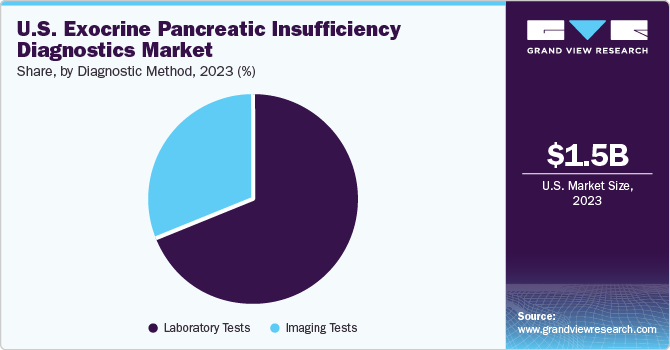

Diagnostic Method Insights

The laboratory tests segment accounted for the largest share in 2023 and is expected to grow at a CAGR of 7.69% over the forecast period. This can be attributed to the extensive advancements, such as automation in laboratories and development of disposable kits for sample collection & storage & assays. Furthermore, growing research and development in EPI diagnostics is projected to propel market growth over the forecast period. In addition, blood tests are an essential component of EPI diagnostics, providing valuable information about pancreatic enzyme levels and inflammation. Tests such as serum amylase, serum lipase, and serum trypsinogen are commonly used to assess pancreatic function and aid in diagnosing EPI. Thus, increasing adoption of laboratory tests in EPI diagnostics contributes to market growth in the U.S.

Furthermore, the imaging tests segment held the second-largest share of the market in 2023. Imaging techniques, including Computed Tomography (CT), Magnetic Resonance Imaging (MRI), and Endoscopic Ultrasound (EUS), play a crucial role in the U.S. market. These imaging modalities offer a detailed view of the pancreas and surrounding structures, aiding in the detection & evaluation of pancreatic disorders. Thus, the increasing adoption of imaging techniques in EPI diagnostics is expected to contribute to market growth in the U.S. Healthcare providers rely on these imaging modalities for their ability to provide detailed anatomical information about the pancreas, complementing other diagnostic modalities such as pancreatic function tests & stool tests

End-use Insights

The hospitals and clinics segment held a dominant share in 2023 and is expected to grow at a CAGR of 7.37% over the forecast period. EPI is a life-long condition affecting adolescents, children, and adults of all ages. Hospitals and clinics play an important role in diagnosing EPI patients. Hospitals are central to identifying high-risk EPI cases, comprising those with pancreatic parenchymal disease, such as cystic fibrosis, pancreatic malignancy, and chronic pancreatitis. According to the Cystic Fibrosis Foundation, in 2022, around 40,000 adults and children suffered from cystic fibrosis in the U.S.

The U.S. exocrine pancreatic insufficiency diagnostics market is experiencing notable growth due to advancements in diagnostic technology and the increasing number of diagnostic facilities for testing EPI. As per LabFlorida data, more than 200,000 clinical laboratories are present in the U.S., and diagnostic tests, such as the Fecal Elastase (FE-1) test, fecal fat test, and secretin pancreatic function test, are commonly performed by these laboratories to check for proper functioning of the pancreas or detecting EPI. In addition, imaging tests such as CT, MRI, and endoscopic ultrasound can help diagnose EPI.

Key U.S. Exocrine Pancreatic Insufficiency Diagnostics Company Insights

Some of the leading players in the market are ChiRhoClin, Certest Biotec, ALPCO Diagnostics, and Quest Diagnostics Incorporated. The players undertake different strategies to strengthen their market positions. Companies are involved in expanding their market presence by signing agreements with other players in emerging economies. Product approval is another strategy adopted by these companies.

Emerging players such as Verisana Laboratories, ScheBo Biotech AG, and Certest Biotec are undertaking different strategic initiatives, such as collaborations & partnerships with key participants and other players in the industry, to enhance their presence. Capturing niche areas of the supply chain, such as distribution and delivery of products & solutions, is another strategy adopted by players to establish themselves.

Key U.S. Exocrine Pancreatic Insufficiency Diagnostics Companies:

- ChiRhoClin

- Certest Biotec

- ScheBo Biotech AG

- Immundiagnostik AG

- Laboratory Corporation of America Holdings

- Boster Biological Technology

- ALPCO Diagnostics

- Quest Diagnostics Incorporated

- DiaSorin S.p.A.

- ARUP Laboratories

- Alpha Laboratories

- Verisana Laboratories

Recent Developments

-

In November 2023, Quest Diagnostics Incorporated launched “Quest Mobile” to boost laboratory testing across the country. Quest Mobile is a moving laboratory testing unit that collects specimens and conducts lab tests in the comfort of a patient's home.

-

In September 2022, ChiRhoClin launched a redesigned website to support various medical professions. This new website helps the company facilitate collaboration across various healthcare communities, including gastrointestinal, radiological, pancreatic, and pediatric care.

-

In November 2019, CERTEST BIOTEC launched a new series of four catalogs that showcase the complete portfolio of Certest IVD products for humans. This catalog includes VIASURE Real Time PCR Detection Kits, Certest Turbilatex (Pancreatic Elastase Turbilatex), and Certest Rapid Test, and Certest bioSCIENCE.

U.S. Exocrine Pancreatic Insufficiency Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.59 billion

Revenue forecast in 2030

USD 2.39 billion

Growth rate

CAGR of 7.04% from 2024 to 2030

Actual years

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Diagnostic method, end-use

Country scope

U.S.

Key companies profiled

ChiRhoClin; Certest Biotec; ScheBo Biotech AG; Immundiagnostik AG; Laboratory Corporation of America Holdings; Boster Biological Technology; ALPCO Diagnostics; Quest Diagnostics Incorporated; DiaSorin S.p.A.; ARUP Laboratories; Alpha Laboratories; Verisana Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Exocrine Pancreatic Insufficiency Diagnostics Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. exocrine pancreatic insufficiency diagnostics market report based on diagnostic method and end-use:

-

Diagnostic Method Outlook (Revenue, USD Million, 2018 - 2030)

-

Laboratory Tests

-

Indirect Pancreatic Function Tests

-

Stool Tests

-

Blood Tests

-

Other Tests

-

Imaging Tests

-

CT scans

-

MRI

-

Endoscopic Ultrasound for Pancreatic Function Tests

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostic Laboratories

-

Research Institutes

-

Frequently Asked Questions About This Report

b. The U.S. exocrine pancreatic insufficiency diagnostics market size was estimated at USD 1.49 billion in 2023 and is expected to reach USD 1.59 billion in 2024.

b. The U.S. exocrine pancreatic insufficiency diagnostics market is expected to grow at a compound annual growth rate of 7.04% from 2024 to 2030 to reach USD 2.39 billion by 2030.

b. Based on diagnostic method, the laboratory dominated the U.S. exocrine pancreatic insufficiency diagnostics market with a share of 68.96% in 2023. This can be attributed to the extensive advancements such as automation in the laboratory, disposable kits, sample collections & storage, and assays.

b. Some of the key players in the U.S. exocrine pancreatic insufficiency diagnostics market are ChiRhoClin, Inc.; ScheBo Biotech AG; Laboratory Corporation of America Holdings; Quest Diagnostics Incorporated; Diasorin S.p.A.; ARUP Laboratories; and ALPCO Diagnostics.

b. Key factors that are driving the immunoassay market growth include a rising prevalence of chronic diseases such as diabetes, pancreatitis, & cystic fibrosis and the rising prescription rate for Exocrine Pancreatic Insufficiency (EPI) tests.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."