U.S. Excavator Market Size, Share & Trends Analysis Report By Vehicle Weight (<10, 11 to 45, 46>), By Engine Capacity (Up to 250 HP), By Type (Wheel, Crawler), By Drive Type (Electric, ICE), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-271-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

U.S. Excavator Market Size & Trends

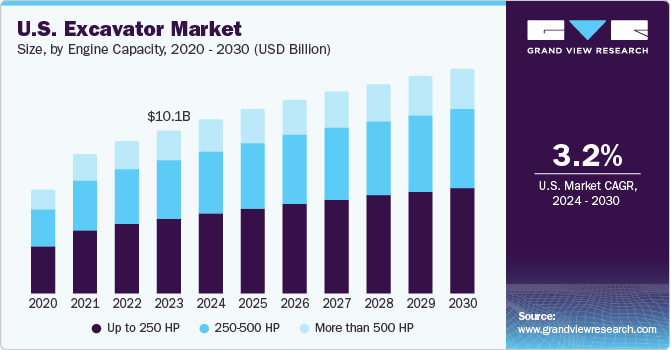

The U.S. excavator market size was estimated at USD 10.10 billion in 2023 and is expected to grow at a CAGR of 3.2% from 2024 to 2030. The demand for excavators is likely to grow due to increased investments in the construction sector. Excavators are vital in digging, material handling, demolition, and heavy lifting applications. Technological advancements in the designs of excavators and an increase in the number of projects, including road and infrastructure construction, further contribute to the market growth of excavators.

Growth in residential and non-residential construction sectors is anticipated in the country, which may give rise to the global excavator market. Excavators perform significant operational tasks, and with manufacturing companies offering a variety of designs for these excavators and innovating feasible products, the use of these instruments is expected to rise in the near future. Caterpillar Inc., Texas, a U.S.-based mining, construction, and engineering equipment manufacturer, offers numerous types of excavators with different features and horsepower in segments such as mini excavators, small excavators, medium excavators, large excavators, demolition excavators, and wheel excavators.

Compact excavators with less horsepower are increasingly popular for their versatility, maneuverability, and ability to work in tight spaces, making them suitable for urban and residential projects. New technological developments in these products make them effective and efficient for construction companies as they deliver higher value during construction. The mini excavators have a cutting-edge hydraulic system and are ideal for a wide range of applications where larger excavators cannot operate. For instance, in September 2023, Hyundai Construction Equipment: America, Inc. launched HX48AZ, HX40A, and HX35AZ within its compact hydraulic excavator of the HX-A series.

Market Concentration & Characteristics

The industry has seen a high degree of innovation as these excavators have undergone significant changes through the years to enhance their efficiency, environmental friendliness, and versatility. Advancements in sensors and various AI-driven algorithms enable users to drive and detect obstacles and reduce the risk of accidents. Sany America’s machines are equipped with advanced safety features that detect overload and alarm the workers about potential danger.

The excavator industry is characterized by a moderately high level of merger & acquisition activity. Industry players desire to gain market share by entering new regions and having access to new technologies, improving product lines, and fulfilling the demand for excavators in the market. For instance, in June 2020, Caterpillar Inc. announced the acquisition of Marble Robot Inc. to gain access to their automation technology expertise and implement them in their products.

An increase in environmental regulations by various authorities across the U.S. has set a high level of impact on the excavator industry. The changing trend towards electric excavators is anticipated to grow as they produce reduced emissions and have an eco-friendly and sustainable use.

A high level of end-user concentration, such as construction companies, mining, agriculture, and other digging and development projects, characterizes the industry. With the rise in the U.S. construction industry, the demand for excavators is anticipated to increase in upcoming years.

Vehicle Weight Insights

The excavators weighing 46> metric tons accounted for the largest market share of 38.3% in 2023. These powerful and large excavators are a long-term investment for digging commercial and residential building foundations. Massive infrastructural developments such as bridges, highways, buildings, and other development initiatives have created a demand for these excavators at a larger scale in the U.S. For instance, in June 2021, AB Volvo launched two 50-ton excavators, the EC550E and EC530E, designed to perform heavy-load digging and operate in large-scale excavation sites.

Excavators weighing <10 metric tons are anticipated to grow at the highest CAGR over the forecast period. The ability to navigate and move through confined spaces has increased the demand for these comparatively smaller excavators. With the integration of advanced technology, these excavators are designed to work precisely on various applications such as installing swimming pools, demolishing smaller buildings, repairing sewer lines, harvesting trees, and other general digging projects.

Engine Capacity Insights

The excavators up to 250 HP engine capacity accounted for the largest market share in 2023. With increased product use in applications such as commercial and residential construction, a rise in this segment is anticipated. These fuel-efficient excavators are used for varied purposes, such as small to medium-scale construction projects, landscaping, and utility works. Up to 250 HP excavators have a calibration between their performance, affordability, functionality, and usability.

The 250-500 HP range of excavators is anticipated to grow at a significant CAGR over the forecast period. The use of powerful excavators in the country is on the rise due to various planned developments, such as expanding transportation networks. Excavators with higher horsepower handle heavy-duty tasks such as demolition, earthmoving, and large-scale excavation to increase the pace and productivity of these projects.

Drive Type Insights

The ICE segment accounted for the highest market share in 2023. The ICE segment in vehicles has seen significant improvements and developments in recent years in terms of fuel efficiency and emissions reduction to meet the Tier 4 standards that require a 90% reduction in particulate matter (PM) and nitrogen oxide (NOx) emissions. The excavators are built to perform in various conditions with high performance and power; hence, with increasing urbanization and infrastructure development projects, the demand for ICE excavators is expected to rise.

The electric segment is anticipated to have the highest CAGR over the forecast period. Rising awareness of using eco-friendly and sustainable machines for construction purposes is driving the electric segment growth. Industries and governments emphasize the reduction of carbon emissions, and with innovation and engineering, electric excavators are seen as a crucial component in the construction industry. For instance, in January 2024, Komatsu Ltd. launched a brand-new electric excavator, PC128E-11. The excavator can operate for a longer duration due to its high-capacity battery.

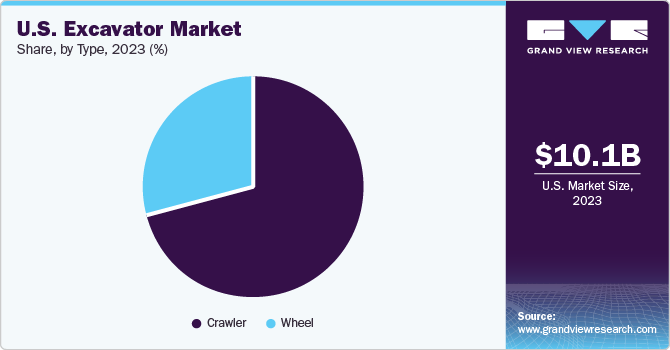

Type Insights

Crawler excavators accounted for the largest market share in 2023. With advanced design, technology, and engineering, these excavators perform high-end tasks with high performance, precision, and durability. The crawler excavator has more effortless mobility from one place to another, and other benefits increase the machine's productivity. For instance, in March 2022, CNH Industrial America LLC launched seven new crawler excavators in its E-Series Crawler Excavator range. These new machines enhance the operator's experience with controllability, comfort, productivity, and efficiency. Manufacturing compact crawler excavators is expected to see high demand for mining projects, the agricultural sector, and others.

The wheel excavators segment is projected to grow at the fastest CAGR over the forecast period. The need for versatile machinery in the construction industry due to the growing trend of urbanization across the country has increased. Wheel excavators have excellent visibility, making working under convenient for machine operators. Wheeled excavators have exceptional maneuverability, allowing various excavators to work in confined areas.

Key U.S. Excavator Company Insights

Some of the key companies operating in the market are Caterpillar Inc. Deere & Company, CNH Industrial America LLC, Doosan Bobcat, AB Volvo, and others.

-

Caterpillar Inc. is a U.S.-based construction equipment manufacturer offering product line of over 300 machines with a variety of excavators in numerous sizes. The company has expanded its capabilities to provide innovative solutions across industries. The company's focus on sustainability and reducing carbon emissions aligns with its mission to help customers build a better world through innovative solutions and services.

-

CNH Industrial America LLC. produces equipment such as forklifts, compact and large excavators, loaders, and others. Excavators come with various attachments, including buckets, hammers, couplers, and others. These machines are engineered to deliver accelerated cycle times, optimal fuel utilization, precise operational control, and an elevated operator interface featuring cutting-edge elements like a 10-inch LCD display and advanced emissions compliance. Renowned for their robust performance, operational efficiency, and versatility, these excavators cater to diverse construction industry requirements with distinction.

Key U.S. Excavator Companies:

- AB Volvo

- Caterpillar Inc.

- CNH Industrial America LLC

- Deere & Company

- Doosan Bobcat

- Hyundai Construction Equipment: America, Inc

- J C Bamford Excavators Ltd.

- Kobelco Construction Machinery U.S.A Inc.

- Komatsu Ltd.

- Mitsubishi Heavy Industries Ltd.

- Sany America

- Terex Corporation

Recent Developments

-

In January 2023, Deere & Company debuted its electric excavator and planter technology ExactShot during CES 2023 tech event. The electric excavator, powered by a Kreisel battery, enhances reliability, performance, and safety in construction while reducing noise pollution and emissions.

-

In August 2023, Kobelco Construction Machinery U.S.A Inc. launched SK380SRLC-7, a large new short-radius excavator. The machine provides the highest digging power, travel performance, and can take up heaviest up-close work with advanced features.

U.S. Excavator Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 10.74 billion |

|

Revenue forecast in 2030 |

USD 13.86 billion |

|

Growth rate |

CAGR of 3.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Vehicle weight, engine capacity, type, drive type |

|

Country scope |

U.S. |

|

Key companies profiled |

AB Volvo, Caterpillar Inc., CNH Industrial America LLC, Deere & Company, Doosan Bobcat, Hyundai Construction Equipment: America, Inc., J C Bamford Excavators Ltd., Kobelco Construction Machinery U.S.A Inc., Komatsu Ltd., Mitsubishi Heavy Industries Ltd., Sany America, Terex Corporation. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Excavator Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. excavatormarket report based on the vehicle weight, engine capacity, type, and drive type:

-

Vehicle Weight (Revenue, USD Million, 2018 - 2030)

-

<10

-

11 to 45

-

46>

-

-

Engine Capacity (Revenue, USD Million, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Type (Revenue, USD Million, 2018 - 2030)

-

Wheel

-

Crawler

-

-

Drive Type (Units, USD Million, 2018 - 2030)

-

Electric

-

ICE

-

Frequently Asked Questions About This Report

b. The U.S. excavator market size was estimated at USD 10.10 billion in 2023 and is expected to reach USD 10.74 billion in 2024

b. The U.S. excavator market is expected to grow at a compound annual growth rate of 3.2% from 2024 to 2030 to reach USD 13.86 billion by 2030

b. The excavators weighing 46> metric tons dominated the market with a share of 38.3% in 2023. Massive infrastructural developments such as bridges, highways, buildings, and other development initiatives have created a demand for these excavators at a larger scale in the U.S.

b. Some key players operating in the U.S. excavator market include AB Volvo, Caterpillar Inc., CNH Industrial America LLC, Deere & Company, Doosan Bobcat, Hyundai Construction Equipment: America, Inc., J C Bamford Excavators Ltd., Kobelco Construction Machinery U.S.A Inc., Komatsu Ltd., Mitsubishi Heavy Industries Ltd., Sany America, Terex Corporation

b. Factors such as technological advancements in excavators' designs and an increase in the number of projects, including road and infrastructure construction, are driving the demand for excavators in the U.S.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."