U.S. And Europe Outdoor Fabric Market Size, Share & Trends Analysis Report By Material (Polyester, Acrylic, Olefin, Marine Vinyl, Cotton, PTFE, PVC, Other), By Region (U.S., Europe), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-186-9

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

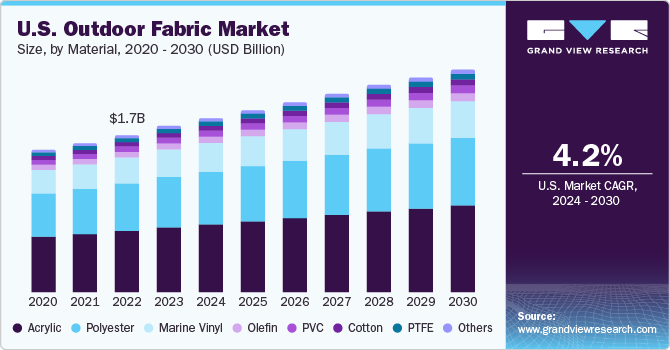

The U.S. and Europe outdoor fabric market size was valued at USD 5.84 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 4.2% from 2024 to 2030. The significant demand for fire-resistant, polymer-coated fabrics, and smart textiles is anticipated to be attributed to the market growth. Smart textiles are expected to grow rapidly over the forecast period due to various potential energy, electronics, medical, security, communication, and transportation applications. There is a rising demand for outdoor materials in industries including healthcare, protective clothing, and construction, owing to their beneficiary features. The demand for outdoor fabric in the U.S. market is driven by its high resistance and durability, making it ideal for applications including chemical protectant, fade resistance, mold resistance, UV resistance, waterproof, stain resistant, and breathable. The material is much more resilient than many indoor fabrics, driving up the price of outdoor fabric in the U.S. and European markets.

The listed properties of the material make it an ideal fabric for various industries, including healthcare, marine, defense, awnings, smart textile, and automotive. Additionally, outdoor fabrics are used primarily in cushions, umbrellas, and canopies, and the marine industry's demand for them is expected to drive the manufacturing of biminis, boats, sail bags & covers, boat covers, weather clothes, windshield covers, and enclosures. Outdoor fabrics are also used in several protective clothing items for bomb disposal crews, naval forces, submarines, and nuclear, chemical, and biological operations.

The fabric is utilized in the automobile sector to make carpeting, upholstery, and convertible tops. The U.S. automotive industry is predicted to develop due to increased investments and technical advancements, which will in turn fuel demand for outdoor fabrics. The economy benefits from an excellent production environment, defined by an attractive investment climate, a significant customer base, excellent infrastructure, and an abundance of highly qualified labor.

In Europe, the demand for fire-resistant materials for protective clothing is expected to increase as strict government laws about worker safety are implemented. The need for fire-resistant textiles is also anticipated to be increased by fire blockers in seats and upholstery and insulating panels. It is expected to contribute to the expansion of the U.S. and Europe outdoor fabric market.

Market Concentration & Characteristics

The listed properties of the material make it an ideal fabric for various industries, including healthcare, marine, defense, awnings, smart textile, and automotive. Additionally, outdoor fabrics are used primarily in cushions, umbrellas, and canopies, and the marine industry's demand for them is expected to drive the manufacturing of biminis, boats, sail bags & covers, boat covers, weather clothes, windshield covers, and enclosures. Outdoor fabrics are also used in several protective clothing items for bomb disposal crews, naval forces, submarines, and nuclear, chemical, and biological operations.

The fabric is utilized in the automobile sector to make carpeting, upholstery, and convertible tops. The U.S. automotive industry is predicted to develop due to increased investments and technical advancements, which will in turn fuel demand for outdoor fabrics. The economy benefits from an excellent production environment, defined by an attractive investment climate, a significant customer base, excellent infrastructure, and an abundance of highly qualified labor.

In Europe, the demand for fire-resistant materials for protective clothing is expected to increase as strict government laws about worker safety are implemented. The need for fire-resistant textiles is also anticipated to be increased by fire blockers in seats and upholstery and insulating panels. It is expected to contribute to the expansion of the market in Europe.

The U.S. and Europe have unique features in the market. It is often very competitive in the U.S. due to numerous suppliers and manufacturers providing a large range of goods. Due to the intense competition, the market is frequently moderately concentrated, with a few players holding sizable market shares.

On the contrary, the European market may show the landscape greater concentration, with a few well-known companies controlling a significant portion of the market owing to their established brand recognition and wide range of products. To satisfy evolving customer demands for long-lasting, weather-resistant, and ecologically friendly materials, both areas prioritize innovation, sustainability, and quality in their outdoor fabric products despite their respective levels of market concentration.

The U.S. and Europe markets is also subject to increasing regulatory scrutiny. This is due to concerns surrounding environmental impact, consumer safety, and fair-trade practices. As a result, governments worldwide are developing regulations to govern the development and use of AI. These regulations could significantly impact the AI market, affecting the development and adoption of AI technologies.

These markets deal with producing, using, and disposing of products like chemical coatings and synthetic fibers that can have major environmental consequences. Environmental regulations are implemented to reduce the adverse effects of production processes, including wastewater discharge, energy consumption, and chemical usage.

Material Insights

Acrylic dominated the market and accounted for a share of 38.7% in 2023. The growth is attributed to their exceptional durability and resistance to outdoor elements such as sunlight, moisture, and mildew. This inherent strength makes them a preferred choice for outdoor applications, ensuring longevity and weather resistance in various climates. The growing demand for outdoor furniture, awnings, umbrellas, and other outdoor accessories has propelled the use of acrylic fabrics, as they offer a compelling balance between performance, aesthetics, and durability in the market.

The polyester segment is expected to grow with the highest CAGR of 4.6% over the forecast period. This high percentage can be attributed to the increasing popularity of acrylic in the fire protection and defense industry. It can offer superior qualities like reducing heat transfer, glare, and harmful UV rays. Additionally, it is ideal for many products in this industry, such as the use of insulation panels, seats, defense equipment, firefighter clothing, and clothing for bomb disposal crews are a few of the products that utilize polyester.

Regional Insights

Europe dominated the market and accounted for a 69.0% share in 2023. Europe held a dominant position in the industry due to several factors including the rich legacy of textile manufacturing and craftsmanship, fostering a tradition of innovation and quality in producing outdoor fabrics. Their cultural heritage gave them an advantage in creating solid and weather-resistant materials for outdoor applications. Moreover, European stringent regulations and standards regarding environmental sustainability and product quality drive manufacturers to create high-performance fabrics that meet these criteria, thereby gaining a competitive edge in the market. Additionally, Europe's emphasis on design and fashion in outdoor textiles has contributed to its stronghold, as consumers often seek functionality and style in their outdoor products.

The U.S. is anticipated to witness significant growth in the outdoor upholstery market. This growth is sowed by the significantly growing inclination towards outdoor leisure activities such as camping, hiking, and outdoor sports, which has significantly bolstered the demand for durable, weather-resistant fabrics for tents, backpacks, outdoor furniture, and apparel. The U.S. market benefits from a robust infrastructure supporting research and development, fostering continuous innovation and product enhancements in outdoor fabric technologies. These combined factors position the U.S. at the forefront, poised for substantial growth in the foreseeable future.

Key Companies & Market Share Insights

Some of the key players operating in the market include Kravet; Sunbrella, The Swavelle Group; and WAVERLY, INC.

-

Kravet distributes home furnishings to enhance the style, luxury, and design of various spaces. It offers a variety of products including fabrics, furniture, wall coverings, trimmings, carpets, and accessories, providing clients with a one-stop shopping resource for all interior design needs.

-

Sunbrella develops and distributes high-performance fabrics for indoor and outdoor use. Sunbrella's fabrics are designed to be durable, comfortable, and color-stable and are used for various applications including marine upholstery, specialty fabrics, and window treatments. The company also offers cleaning products and design inspiration. Sunbrella’s fabrics are offered across the globe.

-

Covington Fabric & Design, LLC, Tropitone Furniture Company, Inc., Charlotte Fabrics, Perennials and Sutherland L.L.C. are some of the emerging market participants in the U.S. and Europe outdoor fabric market.

-

Covington Fabric & Design, LLC, manufactures and provides printed and woven home furnishings fabrics. It offers proprietary designs and foreign sourcing of fabrics and yarns sold to furniture, retail, hospitality, and durable commercial goods markets. It operates in three divisions: Covington Fabrics, Covington Contract Fabrics, and Covington Upholstery Fabrics.

-

Charlotte Fabricsoffers fabric, vinyl, and leather products for different marketplaces including healthcare, marine, auto, outdoors, and contract. It has over 100 stack books containing over 10,000 fabrics. The company is a member of the American Society of Interior Designers and Window Coverings Association of America.

Key U.S. And Europe Outdoor Fabric Companies:

- Kravet

- Sunbrella

- WAVERLY, INC.

- The Swavelle Group

- Charlotte Fabrics

- Covington Fabric & Design, LLC

- Tropitone Furniture Company, Inc.

- Perennials and Sutherland L.L.C.

- Richloom

- Dickson Constant

- OSBORNE & LITTLE

- Schmitz Textiles GmbH + Co. KG (swela)

- Sattler AG

- Klopman International

- Sauleda

- Pierre Frey

- Parà Tempotest

- Texsilk Outdoor Fabrics

- Tuvatextil

Recent Developments

-

In June 2022, Milliken and Company, the U.S.-based global textile manufacturing company, launched Milliken Outdoor Fabrics, marking its entry into the outdoor performance textiles segment. Milliken Outdoor Fabrics are being developed to endure all types of weather safely and meet the mechanical and decorative requirements of customers for an improved and aesthetically appealing environment.

-

In August 2021, Tesco and John Lewis Plc agreed to lease a 1 million-square-foot distribution complex at England's Milton Keynes for a distribution center named Fenny Lock. The company also signed an additional agreement that involves a three-year lease for a 300,000-square-foot distribution center based in Bardon, UK. This initiative is anticipated to help the company meet growing online orders.

-

In April 2021, Netherlands-based outdoor fabric provider TenCate Fabrics announced the launch of WR200, a lightweight polyester fabric. Due to its durable and low-weight features, it is a renovated version of TenCate’s polyester fabric specifically designed for outdoor applications.

U.S. And Europe Outdoor Fabric Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 6.11 billion |

|

Revenue forecast in 2030 |

USD 7.80 billion |

|

Growth rate |

CAGR of 4.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Material, region |

|

Regional scope |

Europe |

|

Country scope |

U.S.; Germany; UK; France; Turkey |

|

Key companies profiled |

Kravet; Sunbrella; Waverly, INC.; The Swavelle Group; Charlotte Fabrics; Covington Fabric & Design, LLC; Tropitone Furniture Company, Inc.; Perennials and Sutherland L.L.C.; Richloom; Dickson Constant; OBSORNE & LITTLE; Sattler AG; Klopman International; Sauleda; Pierre Frey; Para Tempotest; Texsilk Outdoor Fabrics; Tuvatextil; Schmitz Textiles GmbH + Co. KG |

|

Customization scope |

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. And Europe Outdoor Fabric Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. and Europe outdoor fabric market report based on material, and region.

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Polyester

-

Outdoor Upholstery

-

Contract (Custom Manufacturing) Upholstery

-

Marine

-

Shades

-

Flooring

-

Window Treatments

-

Others

-

-

Olefin

-

Outdoor Upholstery

-

Contract (Custom Manufacturing) Upholstery

-

Marine

-

Shades

-

Flooring

-

Window Treatments

-

Others

-

-

Acrylic

-

Outdoor Upholstery

-

Contract (Custom Manufacturing) Upholstery

-

Marine

-

Shades

-

Flooring

-

Window Treatments

-

Others

-

-

Marine Vinyl

-

Outdoor Upholstery

-

Contract (Custom Manufacturing) Upholstery

-

Marine

-

Shades

-

Flooring

-

Window Treatments

-

Others

-

-

Cotton

-

PTFE

-

PVC

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Europe

-

Germany

-

UK

-

France

-

Turkey

-

-

Frequently Asked Questions About This Report

b. The U.S. and Europe outdoor fabric market size was estimated at USD 5.84 billion in 2023 and is expected to reach USD 6.11 billion in 2024.

b. The U.S. and Europe outdoor fabric market is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 7.80 billion by 2030.

b. Polyester dominated the U.S. and Europe outdoor fabric market with a share of 30.1% in 2023. This is attributable to the fashion and design trends in outdoor living spaces along with the versatility allowing for a wide range of color options, patterns, and textures, enabling manufacturers to produce outdoor fabrics that cater to diverse style preferences.

b. Some key players operating in the U.S. and Europe outdoor fabric market include e Kravet, Richloom, Sauleda, Pierre Frey, and Charlotte Fabrics.

b. Key factors that are driving the market growth include the growing trend toward customization and personalization of outdoor spaces coupled with the expansion of online retail and e-commerce platforms.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."