- Home

- »

- Medical Devices

- »

-

U.S. And Europe On-body Injectors Market, Report, 2030GVR Report cover

![U.S. And Europe On-body Injectors Market Size, Share & Trends Report]()

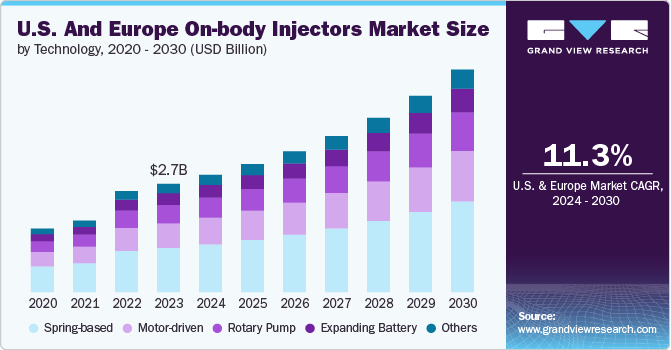

U.S. And Europe On-body Injectors Market Size, Share & Trends Analysis Report By Technology (Spring-based, Motor-driven, Rotary Pump), By Application (Diabetes, Cardiovascular Disease), By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-379-7

- Number of Report Pages: 99

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The U.S. and Europe on-body injectors market size was estimated at USD 2.65 billion in 2023 and is projected to grow at a CAGR of 11.27% from 2024 to 2030, driven by multiple factors. The increasing prevalence of chronic diseases such as diabetes and cancer has heightened the demand for advanced drug delivery systems.

According to CDC data published in July 2022, nearly 60% of adults in the U.S. have been diagnosed with chronic diseases such as cancer, heart disease, or diabetes. These chronic conditions are the primary causes of death and disability in the country, contributing to approximately USD 4.1 trillion in annual healthcare expenses. On-body injectors offer a convenient and less invasive method for administering medications, making them highly attractive for long-term treatment regimens. This convenience is crucial for patients who require regular, self-administered doses, as it improves adherence to prescribed therapies and enhances overall treatment outcomes. The growing aging population, particularly in these regions, further exacerbates the need for efficient drug delivery solutions, propelling market growth.

Moreover, technological advancements in on-body injector design and functionality have significantly contributed to market expansion. Innovations such as Bluetooth connectivity, dose tracking, and improved safety features have made these devices more user-friendly and reliable. These technological improvements not only enhance patient compliance but also allow healthcare providers to monitor and manage treatments more effectively. The integration of smart technology in on-body injectors aligns with the broader trend of digital health, which is transforming healthcare delivery by enabling remote monitoring and personalized medicine. As a result, manufacturers are continuously investing in research and development to create more advanced and sophisticated injectors.

The development of these injectors aligns with the growing trend toward personalized medicine and home healthcare. As the demand for patient-centric solutions increases, the market for on-body wearable injectors is expected to expand. These devices cater to the needs of an aging population and help address the rising incidence of chronic diseases, providing a practical solution that promotes better health outcomes and improved quality of life for patients

In addition, strategic partnerships and collaborations among pharmaceutical companies, medical device manufacturers, and technology firms have accelerated the development and adoption of on-body injectors. These collaborations leverage the strengths of each partner to create more effective and integrated drug delivery solutions. For instance, in March 2023, Stevanato Group collaborated with Thermo Fisher Scientific, Inc. to launch an extensive on-body delivery system platform for subcutaneous drug administration. Such collaborative efforts are crucial in addressing the complex needs of chronic disease management, thereby driving the growth of the on-body injectors market in the U.S. and Europe.

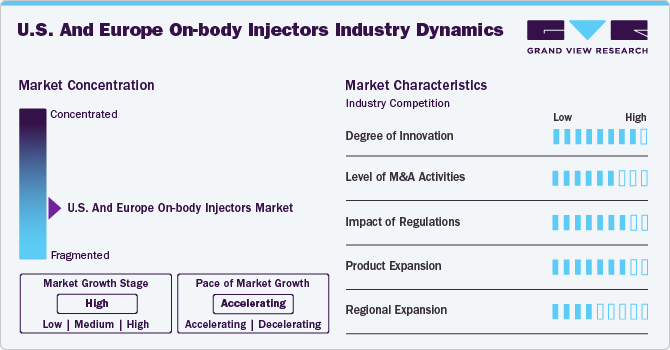

Market Concentration & Characteristics

The U.S. and Europe on-body injectors market is characterized by a high degree of innovation, driven by advancements in smart technology, connectivity features such as Bluetooth, and improved safety mechanisms. Continuous R&D efforts focus on enhancing user-friendliness, dose accuracy, and remote monitoring capabilities, significantly improving patient compliance and treatment outcomes. This innovation fosters market growth and adoption.

The impact of regulations in the U.S. and Europe on the on-body injectors market is high. Clear guidelines and streamlined approval processes from regulatory bodies like the FDA and EMA ensure device safety and efficacy, encouraging innovation and market entry. Harmonized regulatory standards across these regions facilitate easier commercialization, boosting market growth and adoption of advanced drug delivery systems.

The level of M&A activities in the U.S. and Europe on-body injectors market is moderate. For instance, in January 2023, Tandem Diabetes Care, Inc. acquired AMF Medical SA, the maker of the Sigi Patch Pump. Companies are actively pursuing mergers and acquisitions to expand their product portfolios, enhance technological capabilities, and increase market share. These strategic moves drive innovation, foster competitive advantages, and accelerate the development and commercialization of advanced on-body injector solutions, contributing to market growth.

Product expansion in the U.S. and Europe on-body injectors market is high. For instance, in December 2023, Coherus BioSciences, Inc. announced FDA approval for UDENYCA ONBODY, an innovative wearable injector for administering pegfilgrastim, a drug that boosts white blood cell production in cancer patients undergoing chemotherapy. This device provides a convenient at-home administration option, improving treatment adherence and patient comfort.Companies are continuously introducing new and improved injector models with advanced features such as smart connectivity, enhanced safety mechanisms, and user-friendly designs. This ongoing product diversification meets the growing demand for efficient drug delivery solutions, driving market growth and adoption.

Global expansion in the U.S. and Europe on-body injectors market is high. Companies are actively seeking to broaden their market reach by entering new international markets and forming strategic partnerships. For instance, in June 2023, BD opened a new R&D facility in Dublin worth USD 4.4 million and pledged an additional USD 33 million to expand its manufacturing site in Enniscorthy, Wexford, creating more than 85 jobs in Ireland. The 10,600 sq. ft. Blackrock facility will accommodate 35 employees and support the Limerick R&D center in advancing the commercialization of the BD Evolve On-Body Injector. This expansion is driven by the growing demand for advanced drug delivery systems worldwide, enhancing market presence and driving growth in the on-body injectors sector.

Technology Insights

The spring-based segment held the largest share of 40.89% in 2023, spring-based on-body injectors are effective devices offering numerous benefits to both patients and healthcare providers. They administer medication with consistent pressure and speed, ensuring precise dosing essential for treatments requiring accurate amounts, such as insulin for diabetes or biologics for autoimmune disorders. This controlled administration minimizes the potential for human error associated with manual injections. These injectors provide a reliable, comfortable, & efficient method of drug delivery, thus boosting their adoption and market growth. One of the primary factors contributing to the market growth includes the increasing prevalence of chronic diseases such as diabetes and autoimmune disorders, which require regular & precise medication delivery. According to the National Association of Chronic Disease Directors, in 2022, almost 60% of adult Americans were affected by at least one chronic disease. Furthermore, this rise in chronic conditions fuels the demand for reliable and user-friendly injection systems. An example of a spring-based on-body injector is Libertas Wearable Injector (BD).

The rotary pump segment is projected to grow fastest in the coming years. These devices often incorporate advanced features such as customizable settings, wireless connectivity, and capabilities for remote monitoring. This enables healthcare providers to adjust treatment plans remotely and monitor patient adherence effectively. The adoption of these devices is expected to rise due to technological advancements and increasing awareness of the benefits of rotary on-body injectors. Manufacturers are actively developing these sophisticated devices to strengthen their market presence. For instance, Sensile Medical's innovative micro rotary-piston pump is integral to its large-volume infusors. This pump offers versatility in delivery volume and flow rates, ranging from less than 1 µL to 6 mL per minute, capable of transferring up to 50 mL from an external primary container to an internal reservoir.

Application Insights

The diabetes segment held the largest share of 25.45% in 2023. On-body injectors are effective tools in diabetes management because they ensure precise and consistent delivery of medication. This accuracy is essential for maintaining optimal blood glucose levels and preventing the common complications of hyperglycemia and hypoglycemia associated with diabetes. These devices allow patients to self-administer insulin and other diabetes medications at home, reducing the necessity for frequent clinic visits. With the increasing prevalence of diabetes cases, there is a growing demand for efficient and easy-to-use solutions for managing the condition. This expanding patient population underscores the need for devices that facilitate effective and convenient blood sugar control. Moreover, the rising healthcare expenditure on diabetes care further supports the adoption of advanced technologies such as on-body injectors.

The autoimmune disease segment is projected to grow fastest in the coming years. Autoimmune diseases such as rheumatoid arthritis, multiple sclerosis, and lupus often require regular administration of biologics and other injectable medications to regulate the immune system and alleviate inflammation. The increasing incidence of these conditions is projected to stimulate market expansion for on-body injectors. According to statistics from the National Institute of Environmental Health Sciences, approximately 50 million Americans are affected by an autoimmune disease, making it the third most prevalent category of illness in the U.S., after cancer and heart disease. The rise of autoimmune disorders is influenced by genetic predispositions, infections, and environmental factors.

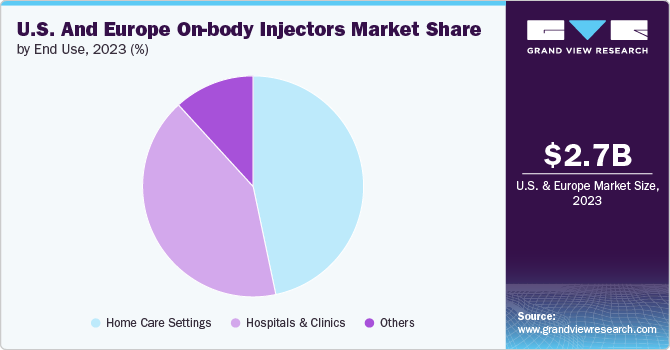

End Use Insights

The hospitals & clinics segment held the largest share of 46.76% in 2023. With the population expanding and aging, there is an increasing demand for healthcare services, especially for chronic ailments such as diabetes, cardiovascular diseases, and autoimmune disorders. Effectively managing these conditions necessitates regular medication, and on-body injectors provide precise and convenient delivery, offering significant advantages. In addition, on-body injectors offer benefits such as accurate dosing, automated delivery, and decreased patient discomfort compared to traditional injection techniques, thereby bolstering their adoption and contributing to market expansion. For instance, in the management of diabetes, on-body injectors streamline the administration of insulin, enhancing treatment effectiveness and improving patient outcomes.

The home care settings segment is expected to grow at a significant rate over the forecast period, owing to the advanced functionalities of on-body injectors, which enhance patient adherence to drug delivery devices. These injectors come in various formats, including prefilled disposable units or reusable devices with replaceable cartridges, and are increasingly favored by patients for enabling them to manage their health while focusing on other activities, thereby potentially reducing healthcare expenditures. According to the World Health Organization, 41 million people die annually from Noncommunicable Diseases (NCDs). Among these, cardiovascular disorders account for 17.9 million deaths, cancer for 9.3 million, respiratory disorders for 4.1 million, and diabetes for 2.0 million. Many of these ailments are lifestyle-related conditions that require ongoing monitoring. This rising prevalence of lifestyle diseases underscores the demand for on-body wearable injectors that patients can self-administer in the comfort of their homes.

Regional Insights

U.S. On-body Injectors Market Trends

U.S. on-body injectors market dominated the overall market and accounted for the 51.15%-revenue share in 2023, driven by several factors, including increased healthcare spending, government initiatives, and higher disposable incomes. In addition, favorable reimbursement scenarios, a rise in chronic diseases requiring long-term care, and high per capita income are expected to further stimulate market expansion. For instance, the American Cancer Society projects that 1,958,310 new cancer cases will be reported in the U.S. by the end of 2023. Furthermore, rapid technological advancements, the presence of key manufacturers in the region, increased investments in research and development, and government funding initiatives are anticipated to bolster market growth in the coming years. Similarly, the well-established healthcare infrastructure and favorable reimbursement and regulatory policies in the U.S. healthcare industry are poised to create significant growth opportunities. According to CMS, healthcare spending in the U.S. is projected to grow annually by 5.5% from 2018 to 2027, reaching an estimated USD 6 trillion by 2027.

Europe On-body Injectors Market Trends

The Europe on-body injectors market held a significant share in 2023. The UK, France, Germany, Italy, and Spain constitute significant markets in this region. Factors expected to drive market growth over the forecast period include the aging population in developed nations like the UK, Germany, Italy, and France, alongside substantial unmet needs in Eastern Europe. The rising incidence of chronic diseases resulting from lifestyle changes, coupled with the convenience and portability of these devices, and increasing demand for home-based monitoring, are key drivers.

According to the International Diabetes Federation, approximately 56.6 million adults in Europe were diagnosed with diabetes in 2022, with this figure projected to rise in the next decade, underscoring the expanding patient base. This trend is anticipated to boost the demand for on-body injectors to enhance medication adherence and overall treatment effectiveness. Furthermore, patients are increasingly seeking treatment options that are user-friendly, painless, and minimally invasive. This growing preference for patient-centric drug delivery methods has contributed significantly to the expansion of the on-body injectors market in Europe. However, challenges such as high technology costs and stringent regulatory frameworks may hinder market growth in developing European countries.

Key U.S. And Europe On-body Injectors Company Insights

The competitive scenario in the U.S. and Europe on-body injectors market is highly competitive, with key players such as West Pharmaceutical Services, Inc.; BD; Stevanato Group; Enable Injections; Nemera; Debiotech SA; AbbVie, Inc. holding significant positions. The major companies are undertaking various strategies such as new product development, collaborations, and regional expansion for serving the unmet needs of their customers.

Key U.S. And Europe On-body Injectors Companies:

- West Pharmaceutical Services, Inc.

- BD

- Stevanato Group

- Enable Injections

- Nemera

- Debiotech SA

- AbbVie, Inc.

- Coherus BioSciences, Inc

- Gerresheimer AG

- E3D Elcam Drug Delivery Devices

Recent Developments

-

In February 2024, Coherus BioSciences, Inc. introduced UDENYCA ONBODY in the U.S., a new wearable injector designed to deliver pegfilgrastim, which helps reduce infection risks in chemotherapy patients. The device aims to increase patient convenience by reducing the need for hospital visits. This launch represents Coherus' expansion into patient-centered solutions for oncology treatment, with the goal of enhancing treatment accessibility and improving outcomes.

-

In May 2024, Enable Injections partnered with Roche, allowing Roche to leverage Enable's expertise and enFuse delivery technology for specific Roche development projects.

-

In January 2024, BD revealed its intention to feature its extensive drug delivery lineup at Pharmapack, emphasizing advancements in on-body injectors. These devices improve patient convenience and adherence through self-administration of medications. BD's latest technologies concentrate on enhancing user satisfaction and effectiveness in drug delivery across diverse therapeutic uses.

-

In June 2023, Stevanato Group launched Vertiva, an innovative on-body delivery system designed for large-volume subcutaneous drug administration. Vertiva includes a disposable pod with a prefilled cartridge and a reusable smart controller, providing accurate and customizable dosing options for different therapies. This enhances patient convenience and improves adherence to treatment regimens.

U.S. and Europe On-body Injectors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.87 billion

Revenue forecast in 2030

USD 5.45 billion

Growth rate

CAGR of 11.27% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, end use, region

Regional scope

Europe

Country scope

U.S.

Key companies profiled

West Pharmaceutical Services, Inc.; BD; Stevanato Group; Enable Injections; Nemera; Debiotech SA; AbbVie, Inc.; Coherus BioSciences, Inc; Gerresheimer AG; E3D Elcam Drug Delivery Devices

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. And Europe On-body Injectors Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. and Europe on-body injectors market report on the basis of technology, application, end use and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Spring-based

-

Motor-driven

-

Rotary Pump

-

Expanding Battery

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oncology

-

Diabetes

-

Cardiovascular Disease

-

Autoimmune Disease

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals & Clinics

-

Home Care Settings

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Europe

-

Frequently Asked Questions About This Report

b. The U.S. and Europe on-body injectors market size was estimated at USD 2.65 billion in 2023 and is expected to reach USD 2.87 billion in 2024.

b. The U.S. and Europe on-body injectors market is expected to grow at a compound annual growth rate of 11.27% from 2024 to 2030 to reach USD 5.45 billion by 2030.

b. U.S. dominated the U.S. and Europe on-body injectors market with a share of 51.1% in 2023. This is attributable to the rising prevalence of chronic & lifestyle-related diseases and the presence of sophisticated healthcare infrastructure.

b. Some key players operating in the U.S. and Europe on-body injectors market include West Pharmaceutical Services, Inc.; BD; Stevanato Group; Enable Injections; Nemera; Debiotech SA; AbbVie, Inc.; Coherus BioSciences, Inc; Gerresheimer AG; E3D Elcam Drug Delivery Devices

b. Key factors that are driving the U.S. and Europe on-body injectors market growth include rising concern over the hazards related to needlestick injuries, and technological developments in On-body injectors.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."