U.S. & Europe Extractable And Leachable Testing Services Market Size, Share & Trends Analysis Report By Product (Container Closure Systems, Single-use Systems), By Application, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-108-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

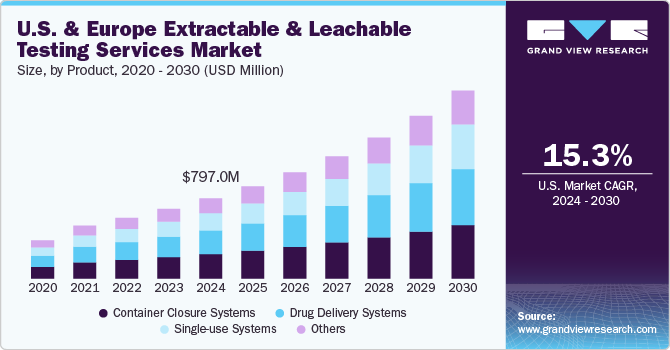

The U.S. & Europe extractable and leachable testing services market size was estimated at USD 797.0 million in 2024 and is projected to grow at a CAGR of 15.3% from 2025 to 2030. Increasing regulatory scrutiny on the quality of healthcare products and rising emphasis on product safety are key drivers fueling the market growth. Moreover, flourishing pharmaceutical and biotechnology sectors across the U.S. & Europe and supportive government legislation are further projected to support market expansion.

The COVID-19 pandemic has positively impacted the U.S. & Europe extractable and leachable testing services market owing to rising demand for novel therapeutics and healthcare products. The pandemic created a higher demand for pharmaceuticals, comprising treatments, vaccines, and medical devices. As companies scaled up manufacturing these products, the demand for extractable and leachable testing services increased to ensure product safety and compliance with regulatory requirements. In addition, with the introduction of new drugs and medical devices during the pandemic, regulatory bodies increased their emphasis on product safety and quality. As a result, companies had to perform exhaustive leachable testing as a part of their new product development process.

Extractable and leachable testing is the analysis of harmful foreign materials that could enter a patient’s body with devices or medicines. Various pharmaceutical and biotechnology companies use different extractable testing services to safeguard their products from regulatory scrutiny. The regulatory framework for extractable and leachable testing has become more stringent as it is directly concerned with patient safety. In March 2022, the UK government with its Medicines and Healthcare Products Regulatory Agency announced a change in the UK clinical trial regulations. Thereby increasing the demand for extractable and leachable testing services over the forecast period.

In addition, rising government support and increasing investment opportunities in the biopharmaceutical domain are anticipated to boost industry growth & positively affect the U.S. and Europe extractable and leachable testing services market. For instance, in April 2021, venture capital firms invested over USD 36.6 billion in biopharmaceutical companies in the U.S., the UK, and countries in the European Union, accounting for an increase of around 281% from 2017. Thereby, the demand for extractable and leachable testing services is increasing in the region and driving the market’s growth over the forecast period.

Furthermore, growing demand for innovations in bioprocess engineering has led to considerable developments in single-use systems. Advancements in this domain are also fueled by the high usage rate of biopharmaceuticals in recent times. Furthermore, the increasing number of studies conducted to evaluate the efficiency of single-use bioprocesses is also aiding the rise in awareness about these technologies. Single-use technologies also offer a wide range of benefits, such as a lower risk of cross-contamination, shorter turnaround times, cost-effectiveness, and higher flexibility for altering production volumes. Thus, the rising adoption of single-use technology raised several issues regarding leachable and extractable, as single-use systems can easily come in contact with products and affect their safety and quality. Thus, growing the demand for extractable and leachable testing services.

Product Insights

The container closure systems segment held the largest revenue share of 30.4% of the market. The rising use of container closure systems in formulations because of their ability to provide long-term stability is boosting the revenue share of this segment. The container closure systems also consist of several package/delivery systems and can leach over time, making E & L testing extremely essential for CCS. Adequate container closure systems are important to maintain the drugs' safety, sterility, and quality. Various cases have been observed involving the loss of safety or formation of harmful contaminants due to the transfer of impurities from container closure systems to pharmaceutical products. For instance, Apotex Corp. recalled the Brimonidine Tartrate Ophthalmic Solution, 0.15%, in March 2023. Thus, increasing the demand for container closure systems in the market is anticipated to grow in the near future.

The single-use systems segments are expected to grow at a significant growth rate of 17.5% during 2023-2030. Single-use components and systems have increased significantly in commercial & clinical biopharmaceutical manufacturing. These components are generally made up of polymers or plastics. The single-use systems & components provide several advantages such as speed, flexibility, and operation efficiency over reusable components. However, the major concern with these SUS is that compounds can leach from the polymeric component, impacting the pharmaceutical product quality or process performance. Thus, extractable & leachable testing has become crucial for single-use systems.

Application Insights

Orally inhaled and nasal drug products segment held the largest share in 2024, with a revenue share of 41.2%. Orally inhaled and nasal drug products include nasal sprays, metered dose inhalers, dry powder inhalers, nebulizers, and inhalers. These products are widely used for systemic delivery of various therapeutics. These products represent the highest-risk drug products concerning the possible introduction of contaminants via container closure contact. Moreover, these products are used indiseases like asthma and Chronic Obstructive Pulmonary Disease (COPD). Therefore, extractable and leachable testing is vital for orally inhaled and nasal drug products. Thus, increasing the demand for extractable and leachable testing services for this segment over the forecast period.

The parenteral drug products segment is projected to witness the fastest growth rate of 17.5% over the forecast period. The segment growth is driven by the rising adoption of parenteral preparations across end users and the increasing burden of chronic conditions requiring parenteral products. Moreover, parenteral products usually have high concentrations of additives like solubilizing agents, plasticizers, etc., which may leach over time, thus, growing the demand for extractable and leachable testing services market.

Country Insights

U.S. Extractable And Leachable Testing Services Market Trends

The U.S. held the largest market share of 57.5% in 2024. The market growth can be attributed to the presence of advanced healthcare infrastructure, the flourishing pharmaceutical & biotechnology sector, and the presence of a large number of market participants. Some key market players offering E&L testing services are Eurofins Scientific; Sartorius AG; Pacific Biolabs; and Element Material Technology. Stringent government regulations for the safety and quality of healthcare products are encouraging these companies to develop precise analytical solutions for healthcare products. For instance, Eurofins Scientific developed its Good Manufacturing Products (GMP)-compliant protocols for direct E&L testing.

Europe Extractable and Leachable Testing Services Market Trends

Europe is expected to witness significant growth during 2025-2030. The growth can be attributed to developed economies like the UK, Germany, Spain, France, and Italy. These countries have an established infrastructure, which is anticipated to significantly boost the demand for healthcare products in the region. Moreover, the market growth can be attributed to a growing biotechnology & pharmaceutical industry and rising investments by the key players. Furthermore, supportive government regulations and the presence of numerous testing service providers are supporting growth.Thereby, rising the demand for extractable and leachable testing services over the estimated period in this region.

UK Extractable And Leachable Testing Services Market Trends

The UK extractable and leachable testing services market is driven by the presence of a robust pharmaceutical and biotechnology industry, combined with stringent regulatory requirements. The increased emphasis on patient safety and product quality has led to a greater need for comprehensive E&L testing. The adoption of advanced single-use technologies in pharmaceutical manufacturing also contributes to market growth.

France Extractable And Leachable Testing Services Market Trends

Extractable and leachable testing services market in France is influenced by a growing biopharmaceutical industry, coupled with regulatory agencies' focus on ensuring the safety and efficacy of pharmaceutical products. Increased adoption of advanced drug delivery systems and supportive government policies encourage the use of extractable and leachable testing services, driving market growth. Moreover, collaborations and partnerships between CROs and pharmaceutical companies also contribute to market expansion.

Germany Extractable And Leachable Testing Services Market Trends

Germany extractable and leachable testing services marketis propelled by the country’s strong pharmaceutical sector, which focuses on innovative drug delivery systems. Regulatory agencies' strict guidelines and emphasis on product safety have further increased the demand for E&L testing. Additionally, the presence of major market players investing in research and development and expanding their testing capabilities is a significant growth factor.

Key U.S. & Europe Extractable And Leachable Testing Services Company Insights

Several strategies, such as mergers & acquisitions, undertaken by these organizations to expand their market presence are anticipated to create significant growth opportunities over the forecast period. This strategy enables companies to increase their capabilities, expand their product portfolios, and improve their competencies.

Key U.S. & Europe Extractable And Leachable Testing Services Companies:

- Eurofins Scientific

- Intertek Group plc

- SGS Société Générale de Surveillance SA

- WuXi AppTec

- Merck KGaA

- West Pharmaceutical Services, Inc

- Wickham Micro Limited (Medical Engineering Technologies Ltd.)

- Pacific Biolabs

- Boston Analytical

- Sotera Health (Nelson Laboratories, LLC)

Recent Development

-

In March 2023, Nelson Labs Europe collaborated with Nemera, a drug delivery device solutions provider, to offer integrated services to customers. This partnership was anticipated to benefit biotech & pharmaceutical customers by supplying drug compatibility lab testing, analytical chemistry, and expert advice.

-

In October 2022, Gerresheimer AG and Nelson Labs NV have announced a strategic partnership to enhance their capabilities in providing Extractables and Leachables (E&L) laboratory testing services for the pharmaceutical and biotechnology sectors.

U.S. & Europe Extractable And Leachable Testing Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 916.4 million |

|

Revenue forecast in 2030 |

USD 1,867.7 million |

|

Growth rate |

CAGR of 15.3% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, country |

|

Regional scope |

U.S., Europe |

|

Country scope |

U.S.; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark |

|

Key companies profiled |

Eurofins Scientific; Intertek Group plc; SGS Société Générale de Surveillance SA; WuXi AppTec; Merck KGaA; West Pharmaceutical Services, Inc; Wickham Micro Limited (Medical Engineering Technologies Ltd.); Pacific Biolabs; Boston Analytical; Sotera Health (Nelson Laboratories, LLC). |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope |

U.S. & Europe Extractable And Leachable Testing Services Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. & Europe extractable and leachable testing services market based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Container Closure Systems

-

Single-use Systems

-

Drug Delivery Systems

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral Drug Products

-

Orally Inhaled and Nasal Drug Products (OINDP)

-

Ophthalmic

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The U.S. & Europe extractable and leachable testing services market size was estimated at USD 797.0 million in 2024 and is expected to reach USD 916.4 million in 2025.

b. The U.S. & Europe extractable and leachable testing services market is expected to grow at a compound annual growth rate of 15.3% from 2025 to 2030 to reach USD 1,867.7 million by 2030.

b. On the basis of product, the container closure systems segment held the largest revenue share of 30.40% of the market. The rising use of container closure systems in formulations because of their ability to provide long-term stability is boosting the revenue share of this segment.

b. Some of the key players operating in the U.S. & Europe extractable and leachable testing services include Eurofins Scientific, Intertek Group plc, SGS Société Générale de Surveillance SA, WuXi AppTec, Merck KGaA, West Pharmaceutical Services, Inc, Wickham Micro Limited (Medical Engineering Technologies Ltd.), Pacific Biolabs, Boston Analytical, and Sotera Health (Nelson Laboratories, LLC).

b. Increasing regulatory scrutiny on the quality of healthcare products and rising emphasis on product safety are key drivers fueling market growth. Moreover, flourishing pharmaceutical and biotechnology sectors across the U.S. & Europe and supportive government legislation are further projected to support market expansion.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."