U.S. & Europe Ambulatory Surgery Centers Market Size, Share & Trends Analysis Report By Specialty (Orthopedics), By Ownership (Physician Owned), By Type (Single-Specialty), By Services, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-582-3

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

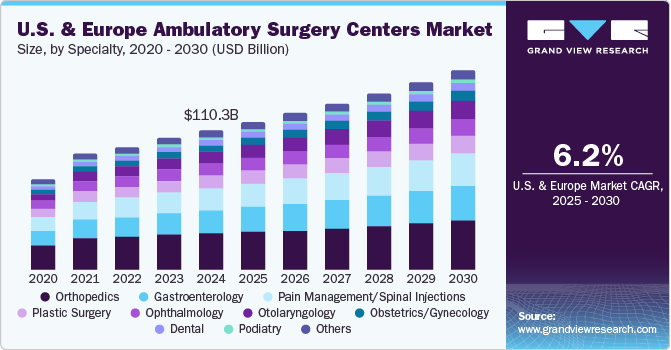

The U.S. & Europe ambulatory surgery centers market size was valued at USD 110.3 billion in 2024 and is anticipated to grow at a CAGR of 6.2% from 2025 to 2030. The market is driven by cost-effectiveness and expanded access to care, enabling wider patient coverage. Improved outcomes and minimally invasive technologies enhance procedural efficiency and patient recovery. In addition, the aging population increases the demand for outpatient surgeries, further boosting market growth.

The market is driven by cost-effectiveness and expanded access to care, allowing broader patient coverage. These factors make services more affordable and accessible, fueling market growth. According to the Center for Medicare Advocacy, as of March 2023, Medicare enrollment reached 65.7 million, marking an increase of nearly 100,000 since September 2022. Of these, 33.9 million were enrolled in Original Medicare, while 31.8 million chose Medicare Advantage or other health plans. In addition, 51.6 million were enrolled in Medicare Part D, which covers prescription drugs through stand-alone or Medicare Advantage plans. Private Part D or MA-PD plans remained the sole option for drug coverage under Medicare.

The growing preference for minimally invasive surgeries, which offer reduced pain, shorter hospital stays, and faster recovery, is contributing to the preference for ambulatory surgical centers. For instance, in October 2023, TeDan Surgical Innovations introduced the Phantom ML3 MIS Lumbar Surgical Access System, designed to streamline transforaminal lumbar procedures such as TLIFs, discectomies, decompressions, and facetectomies. The system features a hand-held, lightweight retractor frame with minimal components, enhancing efficiency and accommodating various patient anatomies.

The aging population in the U.S. and Europe is driving the ambulatory surgical center market as older adults increasingly require surgical procedures for age-related conditions. According to the World Health Organization (WHO), by 2030, 1 in 6 people globally will be 60 or older, with this demographic rising from 1 billion in 2020 to 1.4 billion. By 2050, the number of people aged 60 and older is expected to double to 2.1 billion, while the population aged 80 and above will increase threefold to 426 million, underscoring the significant global aging trend.

Specialty Insights

Orthopedics accounted for the largest share of 26.7% in 2024. Integrating AI-driven platforms and advanced analytics to enhance care coordination and surgical outcomes is a key driving factor for the segment. For instance, in August 2024, Smith+Nephew entered an exclusive collaboration with Healthcare Outcomes Performance Company (HOPCo) to enhance solutions for ambulatory surgical center (ASC) customers, physicians, and patients. This partnership integrated HOPCo's AI-powered myrecovery and Vitals platforms, offering remote care management, real-time communications, and advanced analytics tools to improve care coordination and efficiency.

The patch pump segment is expected to grow at the fastest CAGR of 7.9% over the forecast period, owing to the increasing demand for minimally invasive procedures, advancements in surgical technology, and the growing need for outpatient services due to their cost-effectiveness and quicker recovery times. In addition, the rising prevalence of ear, nose, and throat disorders among the aging population further contributes to market growth.

Ownership Insights

The physician owned segment held the largest market share of 62.1% in 2024. This dominance is attributed to the ability to perform complex outpatient surgeries, such as joint replacements and spine procedures, which enhance access to specialized care and improve operational efficiency. For instance, in November 2023, Regent Surgical expanded its partnership with Oregon Surgical Institute (OSI), gaining majority ownership. This collaboration aims to enhance OSI’s ability to perform complex surgeries in an outpatient setting, including total joint replacements and spine disorders.

The hospital owned segment is expected to grow at the fastest CAGR of 6.3% over the forecast period. This growth is attributed to the enhanced integration with existing hospital services, enabling more coordinated care. Hospitals benefit from expanded outpatient capabilities, allowing them to provide cost-effective treatments while managing increasing patient volumes. In addition, hospital ownership offers access to more resources, advanced technologies, and broader patient networks, enhancing overall efficiency and patient care outcomes.

Type Insights

The single-specialty segment dominated the market with share of 61.2% in 2024. This dominance is attributed to the increasing adoption of advanced robotic systems. These systems enhance surgical precision, improve patient outcomes, and streamline procedures in specialized settings such as spine surgery centers. For instance, in August 2024, DePuy Synthes (Johnson & Johnson Services, Inc.) launched the Velys Spine robot, a surgical system designed to assist spine surgeries with precision and improved outcomes. The robot integrates with the Velys platform, offering enhanced visualization, instrumentation, and real-time data for surgeons.

The multi-specialty segment is expected to grow at the fastest CAGR of 6.3% over the forecast period. The growth is attributed to the rising demand for outpatient procedures, advancements in minimally invasive technologies, cost-effective healthcare solutions, and growing patient preference for convenient, same-day discharge options. In addition, integrating advanced robotics and enhanced surgical techniques improves clinical outcomes, supporting the expansion of multi-specialty centers.

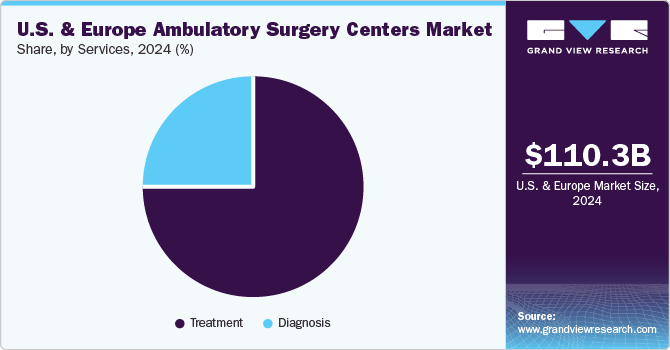

Services Insights

The treatment segment held the largest market share of 75.2% in 2024. This dominance is attributed to the growing demand for high-quality, cost-effective outpatient surgical care facilitated by partnerships that enhance access to specialized services and improve patient outcomes. For instance, in August 2024, Atlas Healthcare Partners and ChristianaCare partnered to create a network of ambulatory surgery centers (ASCs) across Delaware and the Mid-Atlantic region. This collaboration aims to provide high-quality, cost-effective outpatient surgical services while enhancing patient access to specialized care.

The diagnosis segment is expected to grow at the fastest CAGR of 6.3% over the forecast period. This growth is attributed to the advancements in diagnostic technology, increasing patient preference for quicker, less invasive testing, and the rising demand for cost-effective diagnostic solutions in outpatient settings. In addition, the need for efficient diagnosis to support specialized treatments and reduce hospital readmissions contributes to the growth of diagnostic services in ASCs.

Country Insights

U.S. ambulatory surgery centers market held a significant market share in 2024. It is attributable to the growing demand for improved healthcare access through specialized outpatient services, enhanced by advanced surgical technologies and efforts to reduce patient wait times and increase procedural efficiency.For instance, in October 2024, Lake Erie College of Osteopathic Medicine (LECOM) launched a new ambulatory surgery center in Erie, aiming to expand healthcare access in the region. The facility was designed to offer various outpatient surgical services, including advanced surgical technologies and specialized care. This initiative was expected to reduce patient wait times and improve procedure efficiency.

Europe Ambulatory Surgery Centers Market Trends

The Europe ambulatory surgery centers market held the largest market share of 52.5% in 2024 and is expected to grow at the fastest CAGR of 6.3% over the forecast period. This growth is attributed to the increasing adoption of advanced robotic-assisted systems, which enhance precision and control during minimally invasive procedures, improving patient outcomes and procedural efficiency in outpatient settings. For instance, in October 2021, Medtronic's Hugo Robotic-Assisted Surgery System received European CE Mark approval, signifying its safety and performance standards compliance. This system enables enhanced precision and control during minimally invasive procedures, significantly benefiting patients and surgeons.

Germany ambulatory surgery centers market held the largest market share in 2024. Driving factors for the Germany ambulatory surgical center market include the growing demand for cost-effective healthcare services, advancements in minimally invasive procedures, and the increasing adoption of robotic-assisted surgeries. In addition, Germany's well-established healthcare infrastructure, coupled with a shift towards outpatient care for non-complicated surgeries, contributes to the expansion of ambulatory surgical centers. Focusing on improving patient outcomes and reducing recovery times further drives this market.

Key U.S. & Europe Ambulatory Surgery Centers Company Insights

Some of the key companies in the U.S. & Europe ambulatory surgery centers market include Envision Healthcare, TH Medical, Pediatrix Medical Group, TeamHealth and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Envision Healthcare is a U.S. provider of physician-led healthcare and ambulatory surgery services, delivering patient-centered care across hospitals, outpatient centers, and telehealth platforms. Through its physician services, it offers emergency medicine, anesthesiology, radiology, and critical care, while its AmSurg division operates outpatient surgery centers specializing in cost-effective surgical care.

-

Pediatrix Medical Group, part of Mednax, Inc., provides specialized maternal-fetal, neonatal, and pediatric subspecialty care across the U.S., focusing on high-risk pregnancies, critically ill newborns, and pediatric conditions. It offers Neonatal Intensive Care (NICU) services, advanced diagnostics for high-risk pregnancies, and pediatric subspecialties such as cardiology and neurology.

Key U.S. & Europe Ambulatory Surgery Centers Companies:

- Envision Healthcare

- TH Medical

- Pediatrix Medical Group

- TeamHealth

- UnitedHealth Group

- QHCCS, LLC

- Surgery Partners

- SCA Health

- CHSPSC, LLC.

- HCA Management Services, L.P.

- SurgCenter

Recent Developments

-

In August 2024, UnitedHealth Group announced that it was exploring the acquisition of Surgery Partners, a major operator of ambulatory surgery centers. This move was under scrutiny due to potential antitrust concerns, as the merger could impact competition in the healthcare sector.

-

In October 2023, SurgNet Health Partners Inc. announced its initial acquisitions of the Executive Ambulatory Surgery Center in Michigan and the Lippy Surgery Center in Ohio. These acquisitions mark the start of SurgNet's expansion as an ambulatory surgery center (ASC) development and management company.

U.S. & Europe Ambulatory Surgery Centers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 116.8 billion |

|

Revenue forecast in 2030 |

USD 157.8 billion |

|

Growth rate |

CAGR of 6.2% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Specialty, ownership, type, services, country |

|

Regional scope |

Europe |

|

Country scope |

U.S.; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway |

|

Key companies profiled |

Envision Healthcare; TH Medical; Pediatrix Medical Group; TeamHealth; UnitedHealth Group; QHCCS, LLC; Surgery Partners; SCA Health; CHSPSC, LLC.; HCA Management Services, L.P.; SurgCenter |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. & Europe Ambulatory Surgery Centers Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. & Europe ambulatory surgery centers market report based on specialty, ownership, type, services, and region:

-

Specialty Outlook (Revenue, USD Million, 2018 - 2030)

-

Orthopedics

-

Pain Management/Spinal Injections

-

Gastroenterology

-

Ophthalmology

-

Plastic Surgery

-

Otolaryngology

-

Obstetrics/Gynecology

-

Dental

-

Podiatry

-

Others

-

-

Ownership Outlook (Revenue, USD Million, 2018 - 2030)

-

Physician Owned

-

Hospital Owned

-

Corporate Owned

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single-Specialty

-

Multi-Specialty

-

-

Services Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnosis

-

Treatment

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Frequently Asked Questions About This Report

b. The U.S. and Europe ambulatory surgery center market size was estimated at USD 110.26 billion in 2024 and is expected to reach USD 116.8 billion in 2025.

b. The U.S. and Europe ambulatory surgery center market is expected to grow at a compound annual growth rate of 6.20% from 2025 to 2030 to reach USD 157.8 billion by 2030.

b. The physician-owned segment held a major market share of around 62% in 2024. This is attributed to growing physicians’ interest in standalone ambulatory surgery centers for increased profitability.

b. Some key players operating in the U.S. and Europe ambulatory surgery center (ASC) market include Envision Healthcare Corporation; Tenet Healthcare Corporation; MEDNAX Services; Inc., TeamHealth; UnitedHealth Group; Chelsea & Westminster Hospital; Zudecche Day Surgery; The Alan Cumming Day Surgery Unit; and London Day Surgery Centre.

b. Key factors that are driving the market growth include increasing demand for Minimally Invasive Surgeries (MIS), technological developments in surgical devices and equipment, and surgeons’ control over the choice of such equipment.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."