- Home

- »

- Biotechnology

- »

-

U.S. Epigenetics Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. Epigenetics Market Size, Share & Trends Report]()

U.S. Epigenetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Reagents, Kits), By Technology (DNA Methylation, Histone Methylation), By Application (Oncology, Non-oncology), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-301-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Epigenetics Market Size & Trends

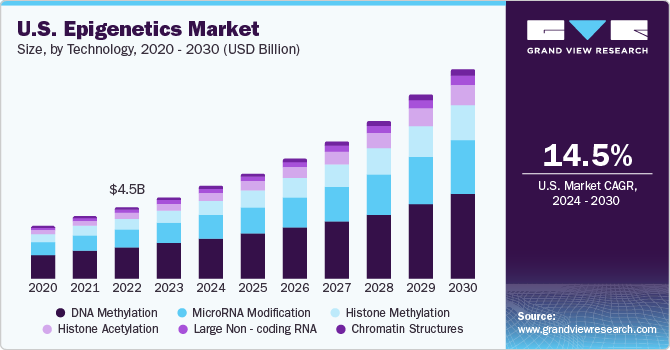

The U.S. epigenetics market size was estimated at USD 5.13 billion in 2023 and is projected to witness a CAGR of 14.5% from 2024 to 2030. This growth can be attributed to the pivotal role of epigenetics in understanding gene regulation beyond DNA sequencing, aiding disease research, and advancing personalized medicine. The established companies and startups operating in the industry are investing significantly to develop the epigenetics domain.

The epigenetics market has been significantly influenced by the COVID-19 pandemic. The growing understanding of the intricate relationship between the SARS-CoV-2 virus and epigenetic mechanisms has highlighted the potential for using epigenetic treatments to fight the virus. With the current lack of antiviral drugs that are clinically approved, there's a window for industry participants to investigate new methods. This includes the combination of antiviral medications with DNMT/HDAC inhibitors and other epigenetic therapies. Should these innovative strategies prove effective in clinical trials, they could reduce drug resistance and improve treatment outcomes, offering a promising future for the growth of the market.

Furthermore, the increasing incidence of disease is propelling the demand for diagnosis of cancers at early stages. According to The American Cancer Society also estimates that almost 8 million individuals die due to cancer each year. Across several countries, cancer cases are twice that of non-communicable diseases, encouraging government & private players to increase the number of awareness and screening programs in U.S. Thus, rising prevalence of cancer is anticipated to significantly boost the demand for cancer diagnostic products during the forecast period.

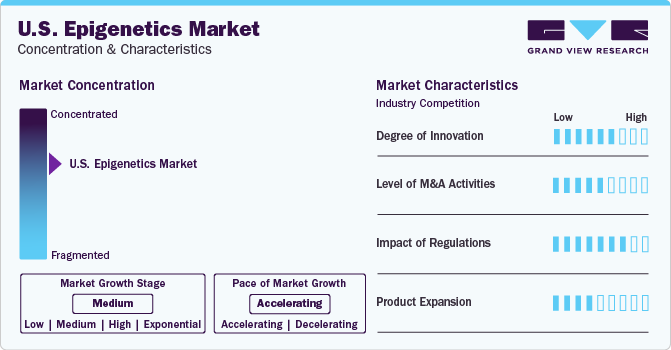

Market Concentration & Characteristics

The epigenetics industry in the U.S. has a moderate degree of innovation owing to the development of new technologies. Advances in high-throughput sequencing technologies and bioinformatics have revolutionized the ability to analyze epigenetic modifications at a genome-wide scale, leading to deeper insights into gene regulation mechanisms.

In recent years, there has been a significant increase in the level of M&A (mergers and acquisitions) activities in the market. For instance, in June 2022, Dovetail Genomics and sibling company Arc Bio joined forces to establish Cantata Bio through a merger. This strategic move aims to streamline operations and consolidate business segments, focusing on epigenetics and genome structure, microbial profiling, and genetic analysis solutions.

Regulations play a crucial role in shaping the epigenetics industry. Emerging developments in regulations about advanced analysis methods for gene expression and protein modulation are expected to further strengthen the regulatory stipulations in the industry and can have a significant impact on the market in the near future.

The growing demand for epigenetics products is driven by the increasing recognition of their potential in understanding and treating a wide range of diseases, including cancer, neurological disorders, and autoimmune diseases. Additionally, the pharmaceutical and biotechnology industries are investing heavily in epigenetic research, further fueling demand for specialized products that can facilitate developments in medical science and improve patient outcomes.

Product Insights

The reagents segment dominated the market with the largest share of 32.5% in 2023. Epigenetic reagents play a crucial role in the study and manipulation of epigenetic mechanisms, which involve changes in gene expression that do not alter the underlying DNA sequence. These reagents are essential for understanding epigenetic regulation and are used in research & potential therapeutic applications. Additionally, numerous companies in the field provide reagents tailored for epigenetics research. For instance, Promega Corporation offers a range of kits and reagents for DNA methylation, histone modification, and RNA transcription analysis, aiding in epigenetic research. Consequently, the provision of numerous reagents by leading companies is anticipated to significantly drive the growth of this segment.

The services segment is anticipated to grow at the fastest CAGR from 2024 to 2030. Epigenetic services encompass a range of offerings, including sequencing, analysis, and consultation services. Epigenetic analysis involves sophisticated techniques, such as ChIP-seq, bisulfite sequencing, and DNA methylation profiling. Many researchers and institutions rely on specialized services to perform these complex analyses accurately and efficiently. Thus, anticipated to propel the growth of the segment over the forecast period.

Technology Insights

The DNA methylation segment accounted for the largest revenue share of 44.8% in 2023. DNA methylation is increasingly used to aid sequencing techniques. The methylated DNA immunoprecipitation sequencing and the methylated DNA binding domain sequencing preferentially highlight the methylated regions for sequencing. The increasing number of research activities in biological and pharmaceutical research is boosting the demand for DNA methylation as it profoundly influences gene expression by modifying the interactions with DNA of the chromatin proteins & specific transcription factors. These factors are anticipated to impel the boost the growth of the segment.

The histone acetylation segment is anticipated to witness the fastest CAGR during the forecast period owing to its improved efficacy due to the development of innovative methods. Numerous studies have suggested that histone acetylation may have therapeutic benefits in conditions, such as solid tumors, inflammation, leukemia, and viral infection. The driving factors for histone acetylation encompass a wide range of biological processes and influences, including gene activation, the activity of histone acetyltransferases and deacetylases, chromatin remodeling, epigenetic memory, cellular development, environmental stimuli, crosstalk with other modifications, disease associations, cellular memory, and drug development.

Application Insights

The oncology segment accounted for the largest revenue share in 2023. Currently, cancer is the major area for epigenetics research. With the increasing incidence of cancer, the market for cancer-related epigenetic diagnosis is likely to grow. As per the American Cancer Society, the estimated number of new cancer cases in the U.S. in 2022 was 1.9 million, with around 609,360 related deaths. Epigenetics research in oncology is driven by several factors, reflecting the critical role of epigenetic alterations in the development and progression of cancer. Collaborative initiatives, such as The Cancer Genome Atlas (TCGA), bring together researchers, clinicians, and bioinformaticians to analyze large-scale cancer genomics & epigenomics datasets, accelerating discoveries in cancer epigenetics.

The non-oncology segment is anticipated to witness the fastest CAGR during the forecast period. The market in non-oncology fields is driven by a diverse range of factors related to various medical disciplines. The knowledge of epigenetic mechanisms in a variety of fields, including neurological and cardiovascular diseases, metabolic and autoimmune disorders, aging, mental health, drug development, and precision medicine, significantly drives the expansion of the market in non-cancer applications.

End-use Insights

In 2023, academic research held the largest market share of 37.2% in the end-use segment. The growing field of epigenetics has become a major focus area fueling a rapid expansion in academic research. This demand is due to the wide implications epigenetics holds for understanding gene expression regulation beyond DNA sequence alterations. Moreover, as technologies advance, enabling more precise mapping and manipulation of epigenetic marks, the demand for skilled researchers and innovative methodologies is expected to grow. These factors contribute to the growing demand for epigenetics in the U.S.

The clinical research is expected to grow at the fastest CAGR of 15.57% from 2024 to 2030. The lucrative demand for epigenetics within clinical research reflects a transformative shift in drug discovery and development concepts. Epigenetics, with its complex exploration of gene expression beyond DNA sequencing, presents a wide opportunity for understanding disease mechanisms at a ground level.

Key U.S. Epigenetics Company Insights

The market players operating in the market are undertaking product approvals to expand their product presence and enhance accessibility across various geographical regions. Expansion serves as a strategy to bolster production and research purposes. Moreover, numerous market entities are engaging in acquisitions of smaller firms to improve their market position. This approach enables companies to enhance capabilities, broaden product offerings, and develop new competencies.

Key U.S. Epigenetics Companies:

- Roche Diagnostics

- Thermo Fisher Scientific, Inc

- Danaher

- Eisai Co. Ltd.

- Novartis AG

- Element Biosciences, Inc.

- Dovetail Genomics LLC.

- Illumina, Inc.

- Promega Corporation.

- Abcam plc.

Recent Development

-

In December 2023, BioLabs and Promega expanded their joint effort to accelerate life sciences innovation globally by supporting early-stage startups.

-

In November 2023, Element Biosciences, Inc. and QIAGEN partnered strategically to provide broad NGS workflows for the innovative Element AVITI System.

-

In April 2023, Eisai collaborated with the National Cancer Center to advance investigator-initiated clinical research for the anticancer agent Tazemetostat. This collaboration is based on the “patient-proposed healthcare services” system.

U.S. Epigenetics Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 13.10 billion

Growth rate

CAGR of 14.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, application, end-use

Country scope

U.S.

Key companies profiled

Roche Diagnostics; Thermo Fisher Scientific, Inc; Eisai Co. Ltd.; Novartis AG; Element Biosciences, Inc.; Dovetail Genomics LLC.; Illumina, Inc.; Promega Corporation.; Abcam plc.; Danaher

Customization scope

Free report customization (equivalent up to 8 analyst's working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Epigenetics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. epigenetics market report based on product, technology, application, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Reagents

-

Kits

-

ChIP Sequencing Kit

-

Whole Genomic Amplification Kit

-

Bisulfite Conversion Kit

-

RNA Sequencing Kit

-

Others

-

-

Instruments

-

Enzymes

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

DNA Methylation

-

Histone Methylation

-

Histone Acetylation

-

Large Non - coding RNA

-

MicroRNA Modification

-

Chromatin Structures

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Solid Tumors

-

Liquid Tumors

-

-

Non - oncology

-

Inflammatory Diseases

-

Metabolic Diseases

-

Infectious Diseases

-

Cardiovascular Diseases

-

Others

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academic Research

-

Clinical Research

-

Hospitals & Clinics

-

Pharmaceutical & Biotechnology Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. epigenetics market size was estimated at USD 5.13 billion in 2023 and is expected to reach USD 5.82 billion in 2024.

b. The U.S. epigenetics market is expected to grow at a compound annual growth rate of 14.5% from 2024 to 2030 to reach USD 13.10 billion by 2030.

b. The reagents segment dominated the U.S. epigenetics market with a share of 32.53% in 2023. This is attributable to the increasing demand for cost-effective and advanced reagents for epigenetics research and development applications.

b. Some key players operating in the U.S. epigenetics market include Roche Diagnostics; Thermo Fisher Scientific, Inc; Eisai Co. Ltd.; Novartis AG; Element Biosciences, Inc.; Dovetail Genomics LLC.; Illumina, Inc.; Promega Corporation.; Abcam plc.; Danaher

b. Key factors that are driving the market growth include the growing importance of epigenetics in understanding gene regulation beyond DNA sequencing, aiding disease research, and advancing personalized medicine.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.