- Home

- »

- Green Building Materials

- »

-

U.S. Environment Health & Safety Market, Industry Report, 2030GVR Report cover

![U.S. Environment Health & Safety Market Size, Share & Trends Report]()

U.S. Environment Health & Safety Market Size, Share & Trends Analysis Report By Product (Services, Software), By Deployment Mode (Cloud, On-premise), By End-use (Construction, Healthcare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-214-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

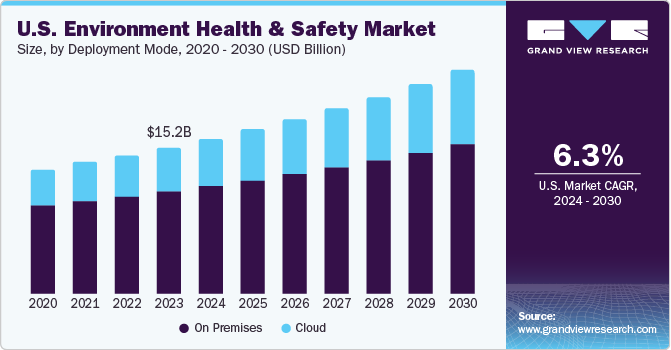

The U.S. environment health & safety market size was estimated at USD 16.08 billion in 2023 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% from 2024 to 2030. The U.S. accounted for 32.6% of the global environment health & safety market . This growth trajectory can be attributed to the stringent EHS standards imposed on companies which necessitates substantial investment in EHS practices to avoid substantial fines and penalties associated with non-compliance.

For instance, Trane Technologies strives for a safety-focused culture and works to achieve zero accidents and injuries across the whole organization. Government agencies, including the U.S. Environmental Protection Agency (EPA), Occupational Safety and Health Administration (OSHA), and the U.S. Department of Labor, lay down the EHS norms and regulations. In the U.S., among major market participants are Jacobs; AECOM; Enablon; Tetra Tech, Inc.; and VelocityEHS. These companies provide a wide range of EHS software and services, including ergonomics, engineering and construction, risk assessment, EHS software, and management consulting and compliance.

Regulations play a significant role in shaping the U.S. environmental health & safety market. Government authorities such as the Occupational Health and Safety Administration (OSHA), the Environmental Protection Agency (EPA), and the Department of Justice (DOJ) require organizations to follow certain workforce safety and environmental regulations and standards.

Companies in the U.S. need to follow strict environment health & safety norms and regulations, such as the Toxics Release Inventory (TRI). These stringent norms are anticipated to propel industry growth. Moreover, rising public awareness regarding environmental issues has resulted in the development of environmental protection laws, which are expected to drive market growth. The high scrutiny and stringent regulations exert economic pressure on organizations to optimize their business processes and make them environment-friendly. As a result, management teams are forced to deploy EHS software solutions in the workplace to reduce the occurrence of incidents.

The escalating concern about the environmental footprint of business operations has spurred demand for EHS services. Moreover, the advent and adoption of sophisticated EHS software solutions have streamlined the monitoring and management of EHS practices. 84% of companies who use EHS software have reported they can identify and fix potential safety issues before they occur. Furthermore, societal expectations for sustainable business operations have fueled the EHS market's expansion. The growing consumer consciousness about companies' environmental practices often translates into greater support for those prioritizing EHS.

Market Concentration & Characteristics

The U.S. EHS market is marked by a high degree of innovation. Technological advancements have fostered the development of advanced EHS software solutions, enabling companies to more efficiently monitor and manage their EHS practices. For instance, Intenseye Inc., an emerging player in the market, secured the largest-ever funding round in the EHS category, and raised USD 64.1 million in February 2024. This highlights the shift toward AI and other new technologies. These innovations have enhanced the efficacy of EHS practices and facilitated regulatory compliance.

The U.S. EHS market witnesses a relatively high level of M&A activities. Larger corporations often acquire specialized smaller firms to augment their EHS capabilities and extend their market reach. These activities contribute to market consolidation and can significantly influence market dynamics and competition. For instance, In January 2020, Cority acquired Enviance, a pioneer in environmental, chemical, sustainability, & ergonomics software, which uses a SaaS strategy to provide its EHS platform across the globe, at any time. Around 400 firms across 30 industries use Enviance's software.

In the EHS context, substitutes would refer to alternative methods or practices that companies could adopt instead of investing in EHS. However, given the stringent regulatory obligations and the growing societal expectation for sustainable business operations, there are limited effective substitutes to comprehensive EHS practices. This lack of substitutes further bolsters the demand for EHS in the market.

End-use Insights

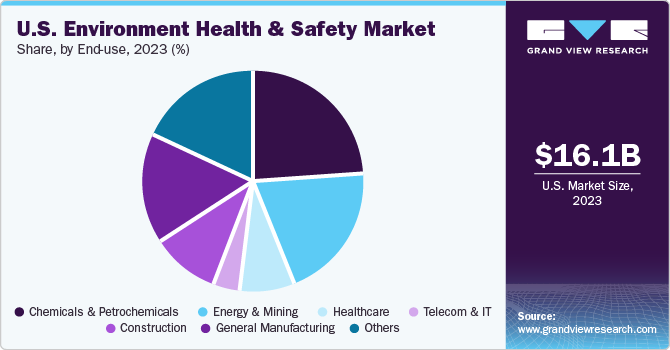

Chemicals & petrochemicals segment dominated the U.S. market share in 2023. It is also expected to be the fastest growing from 2024 to 2030. The growth can be attributed to stringent regulations regarding the handling and disposal of chemicals, as well as the high risk associated with chemical manufacturing processes. The sector’s growth is also driven by the increasing global demand for chemicals in various industries, including agriculture, pharmaceuticals, and consumer goods. The need for safe and environmentally friendly chemical production processes is expected to drive the growth of the EHS market further in this sector.

The EHS practices in this sector are crucial due to the high risk of accidents and the potential environmental impact of mining operations. The sector is expected to continue to invest in EHS due to the increasing focus on sustainable practices and the need to comply with stringent environmental regulations. The growth of renewable energy sources and the shift away from fossil fuels are likely to impact the EHS practices in this sector. The need for safe working conditions, especially in offshore and remote locations, is another factor contributing to the EHS market in the energy and mining sector.

The healthcare sector is expected to be the second fastest-growing . The growth can be attributed to the increasing focus on patient safety and well-being, as well as the management of medical waste. The healthcare sector is subject to numerous EHS regulations, including those related to the disposal of biohazardous waste, the management of patient health information, and the prevention of workplace injuries. The need for proper waste management, especially hazardous medical waste, is expected to drive the growth of the EHS market in the healthcare sector.

Product Insights

The service segment dominated the U.S. market in 2023 with around 96% revenue share. This dominance can be attributed to the critical role that EHS services play in ensuring regulatory compliance, reducing risk, and improving overall operational efficiency. These services encompass a broad range of activities, including but not limited to, environmental consulting, project implementation, analytics, and auditing. The high demand for these services is driven by the increasing complexity of EHS regulations and the severe penalties associated with non-compliance. Moreover, the ongoing industrial development and the growing awareness about the importance of a safe and healthy work environment have further fueled the demand for EHS services.

On the other hand, the software product segment, while currently smaller in size, is projected to be the fastest-growing segment in the U.S. EHS market. It is expected to register a significant CAGR from 2024 to 2030. This growth can be attributed to the digital transformation trends across industries such as general manufacturing,construction, and healthcare as well as the increasing need for efficient data management systems. EHS software solutions offer numerous benefits such as streamlined data collection, improved data accuracy, real-time reporting, and enhanced visibility into EHS performance. These advantages make EHS software an attractive investment for businesses looking to optimize their EHS processes and drive performance improvements. Furthermore, the ongoing advancements in technology, such as the integration of artificial intelligence and machine learning capabilities, are expected to provide a significant boost to the growth of the EHS software segment in the coming years.

Deployment Mode Insights

The on-premises deployment type dominated the U.S. market in 2023. This dominance can be attributed to the control, security, and customization that on-premises solutions offer. Many organizations, particularly those in highly regulated industries, prefer on-premises EHS solutions because they allow for greater control over data and systems, as well as the ability to customize the software to suit their specific needs. Moreover, on-premises solutions are perceived to offer superior security, as all data is stored in-house, reducing the risk of data breaches.

However, the cloud deployment segment is expected to be the fastest-growing segment in the U.S. EHS market from 2024 to 2030.. This growth can be attributed to the numerous advantages that cloud-based solutions offer, including scalability, cost-effectiveness, and accessibility. Cloud-based EHS solutions allow organizations to scale their EHS operations as needed without the need for significant upfront investment. They also offer the advantage of being accessible from anywhere, which is particularly beneficial for organizations with multiple locations or remote workers. Furthermore, as cloud technology continues to evolve and improve, concerns about data security are being addressed, making cloud-based EHS solutions an increasingly attractive option for organizations.

Key U.S. Environment Health & Safety Company Insights

The U.S. environment, health, and safety market exhibit a moderate degree of concentration, with a handful of key players commanding significant market shares. These encompass multinational corporations offering comprehensive EHS solutions and niche firms specializing in specific EHS aspects. This landscape creates competitive dynamics and potential barriers to entry for emerging players.

To increase market penetration and meet shifts in technological demands from various applications, including chemicals & petrochemicals, telecom & IT, energy & mining, healthcare, construction, and manufacturing, manufacturers use a variety of strategies, including acquisitions, mergers, joint ventures, new product developments, and geographic expansions. For instance, in February 2023, AECOM and its Office of Air and Radiation (OAR) collaborated in 2023.

Key U.S. Environment Health & Safety Companies:

- Enablon

- VelocityEHS

- Intelex Technologies

- Cority

- Gensuite

- Sphera

- SAI Global

- Quentic

- Alcumus

- SHE Software

Recent Developments

-

In January 2024, Wolters Kluwer released a new service pack for the Enablon Vision Platform, enhancing its ease of use, analytics, and data visualization capabilities. This highlights the market commitment to actively seeking and responding to customer insights and user feedback.

-

In January 2024, Sphera acquired SupplyShift, a supply chain sustainability software company. This acquisition improves Sphera’s supply chain offering with extended supplier mapping, scoring, and traceability capabilities.

-

In June 2023, Alcumus acquired Cognibox, a Canada-based risk management firm as part of their international growth strategy.

U.S. Environment Health & Safety Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 17.02 billion

Revenue forecast in 2030

USD 24.58 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Base year for estimation

2023

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, deployment mode, end-use

Key companies profiled

Enablon, VelocityEHS, Intelex Technologies, Cority, Gensuite, Sphera, SAI Global, Quentic, Alcumus, SHE Software

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Environment Health & Safety Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. environment health & safety market report based on product, deployment mode, end-use:

-

U.S. Environment Health & Safety Market Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Services

-

Analytics

-

Project Deployment & Implementation

-

Business Consulting & Advisory

-

Audit, Assessment, & Regulatory Compliance

-

Certification

-

Others

-

-

-

U.S. Environment Health & Safety Market Deployment Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-Premises

-

-

U.S. Environment Health & Safety Market End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Chemicals & petrochemicals

-

Energy & Mining

-

Healthcare

-

Telecom & IT

-

Construction

-

General Manufacturing

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. environment health & safety market was valued at USD 16.08 billion in the year 2023 and is expected to reach USD 17.02 billion in 2024.

b. The U.S. environment health & safety market is expected to grow at a compound annual growth rate of 6.3% from 2024 to 2030 to reach USD 24.58 billion by 2030.

b. The services segment emerged as a dominating segment in the market with over a share of 96% in 2023 due to the critical role that EHS services play in ensuring regulatory compliance, reducing risk, and improving overall operational efficiency.

b. The key market player in the U.S. environment health & safety market includes Enablon, VelocityEHS, Intelex Technologies, Cority, Gensuite, Sphera, SAI Global, Quentic, Alcumus, SHE Software.

b. The key factors that are driving the U.S environment health & safety market include regulatory compliance, technological advancements, and societal expectations for sustainable business operations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."