- Home

- »

- Medical Devices

- »

-

U.S. ENT Devices Market Size, Share, Industry Report, 2030GVR Report cover

![U.S. ENT Devices Market Size, Share & Trends Report]()

U.S. ENT Devices Market Size, Share & Trends Analysis Report By Product (Hearing Aids, Hearing Implants, Diagnostic ENT Devices, Surgical ENT Devices, Nasal Splints), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-283-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

U.S. ENT Devices Market Size & Trends

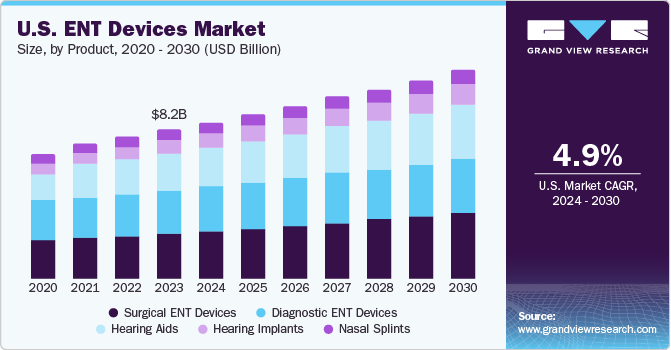

The U.S. ENT devices market size was estimated at USD 8.24 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. This growth is attributable to the increasing prevalence of ear, nose, and throat disorders, rising demand for minimally invasive procedures, and technological advancements.

Another factor driving the market growth is the rise in the geriatric population as they are more prone to ear, nose, and throat disorders, driving the demand for ENT devices. According to the National Library of Medicine, 13,000 laryngeal cancers are diagnosed each year in the U.S.

Minimally invasive surgeries have gained popularity recently due to their numerous benefits, such as reduced scarring, quick recovery, and shorter hospital stays. With the growing demand for minimally invasive procedures, the demand for ENT devices, such as endoscopes, surgical instruments, and navigation systems, is also increasing. The World Health Organization (WHO) estimated that more than 400 million people globally are impacted by hearing impairment. Hearing loss rises with age, with the prevalence nearly doubling every decade of an individual’s life. National Center for Biotechnology Information research suggested that around 63% of adults over 70 years old in the U.S. experience some degree of hearing loss. As the population ages, it is anticipated that the prevalence of hearing loss will increase.

Ear, nose, and throat (ENT) disorders are common health issues affecting people of all ages. The prevalence of these disorders has been increasing in the U.S., leading to a growing demand for ENT devices. Allergies and sinusitis are two of the most common ENT disorders in the U.S. According to the American College of Allergy, Asthma, and Immunology, over 50 million Americans suffer from allergies each year, and sinusitis affects about 37 million Americans. The increasing prevalence of allergies and sinusitis can be attributed to factors such as pollution, climate change, and an increase in the number of people with weakened immune systems.

Hearing loss is another common ENT disorder in the U.S. According to the National Institute on Deafness and Other Communication Disorders, among adults aged 20 to 69 exposed to loud workplace noise for five or more years, around 18% suffer from bilateral speech-frequency hearing loss, while approximately 5.5% without such exposure exhibit the same condition. In the U.S., about 13% of individuals aged 12 or older have bilateral hearing loss, with rates of disabling hearing loss increasing from 5% in the 45-54 age group to 55% in those aged 75 and older.

The rising prevalence of hearing loss among a growing population is driving an increase in demand for these devices, thereby fueling market growth for ENT devices. According to a report released by the World Health Organization in April 2021, projections suggest that by 2050, approximately 2.5 billion individuals will experience some hearing impairment, necessitating hearing rehabilitation for at least 700 million people. Unsafe listening behaviors are putting over 1 billion young adults at risk of irreversible hearing damage.

Market Concentration & Characteristics

The industry growth stage is moderate, and the pace is accelerating in the U.S. This is driven by several factors, including advancements in technology, increasing demand for minimally invasive procedures, and a growing focus on patient outcomes and comfort. ENT devices encompass a wide range of products, including hearing aids, cochlear implants, endoscopes, sinus dilation devices, voice prosthesis devices, and more. Manufacturers in this market continuously invest in research and development to introduce new and improved products that cater to the evolving needs of healthcare providers and patients. For instance, in September 2021, Acclarent, a Johnson & Johnson Medical Devices Companies division, introduced ENT navigation technology powered by artificial intelligence (AI). The advanced software package, featuring TruPath and TruSegfor, is designed to streamline surgical planning and provide real-time feedback during ENT navigation procedures, improving treatment accuracy and effectiveness.

Mergers and acquisitions (M&A) activities in the U.S. market have been relatively high, driven by the increasing demand for ENT device treatments and the consolidation of players in the industry. Companies engage in strategic M&A activities to gain access to new markets, technologies, and capabilities, which can help them expand their business and improve their profitability. For instance, in May 2022, Medtronic, a healthcare technology company, finalized the acquisition of Intersect ENT, further enhancing the company's extensive ear, nose, and throat (ENT) portfolio. This acquisition brings innovative products for sinus procedures to enhance post-operative results and address nasal polyps.

Regulations significantly influence the market growth, with the industry undergoing rigorous regulatory scrutiny from agencies like the Food and Drug Administration (FDA) under the Department of Health and Human Services (HHS). These regulations aim to guarantee medical devices' safety, effectiveness, and quality. In January 2023, EndoTheia Inc., a medical device company, received a Breakthrough Device designation from the FDA for its technology that improves flexible endoscopic minimally invasive surgery. Compliance with regulatory requirements is essential for manufacturers to bring their products to market and maintain their presence in the industry. Regulations impact various aspects of the ENT devices market, including product development, manufacturing processes, marketing practices, and post-market surveillance. Companies in this sector must navigate a complex regulatory landscape to obtain necessary product approvals and certifications.

Product Insights

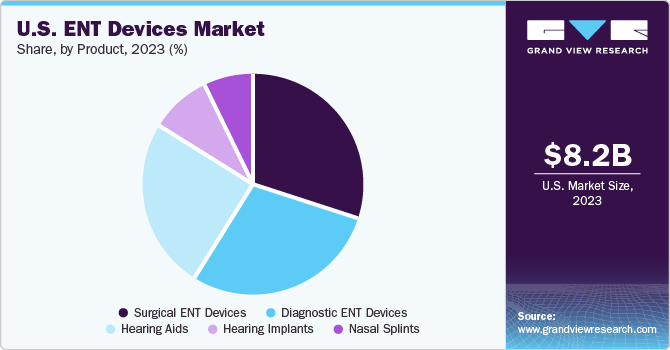

The surgical ENT devices segment led the market with the largest revenue share of 30.3% in 2023. The surgical ENT devices segment is further segmented into radiofrequency handpieces, otological drill burrs, ENT hand instruments, sinus dilation devices, nasal packing devices, and others. This growth of the segment is mainly attributed to the increasing prevalence of hearing disorders, respiratory diseases, and other ENT-related conditions, as well as the rising demand for minimally invasive surgeries. Surgical ENT devices include a wide range of products, such as otoscopes, endoscopes, hearing implants, and surgical instruments, which are used to diagnose and treat ENT disorders such as tonsillectomies, adenoidectomies, and sinus surgeries. Technological advancements in surgical ENT devices have made these procedures safer and less invasive, reducing the risk of complications and improving patient outcomes. For instance, in November 2023, ScopeAround, a prominent supplier of advanced medical imaging solutions, announced an innovative product to transform at-home ear care: the ScopeAround M28 ear otoscope. This state-of-the-art ear camera presents a convenient and efficient method for monitoring ear health in both children and adults.

The hearing implants segment is anticipated to grow at the fastest CAGR of 6.4% over the forecast period. Over the years, hearing aids have become increasingly sophisticated, with advanced features such as noise reduction, Bluetooth connectivity, and directional microphones. These advancements have helped to make hearing aids more effective and user-friendly, making them a popular choice for individuals with hearing loss. Hearing implants are surgically implanted devices that help individuals with severe to profound hearing loss. These devices bypass the damaged part of the inner ear and send electrical signals directly to the auditory nerve. Recent advancements in hearing implant technology have made them more effective and accessible, allowing more individuals to benefit from this treatment. For instance, in September 2023, ELEHEAR Inc., a provider of audio solutions and AI-powered hearing aids, introduced 2 new innovative products: the ELEHEAR Alpha hearing aid devices and ELEHEAR Alpha Pro. These cutting-edge devices incorporate AI noise reduction and extraction, offering an exceptional hearing experience for users in various daily environments.

Key U.S. ENT Devices Company Insights

Some of the key players operating in the U.S. market include Cochlear Ltd., Demant A/S, Stryker, and KARL STORZ SE & Co. KG.

-

Cochlear Ltd. (Cochlear) is a medical device company which offers hearing solutions. It engages in developing and commercializing bone conduction implants, cochlear implants, & acoustic implants to treat hearing-impaired individuals. It has a global presence in more than 180 countries

-

NICO Corporation is a medical technology company that specializes in developing minimally invasive surgical solutions, particularly in the fields of neurosurgery and otolaryngology (ear, nose, and throat or ENT)

Key U.S. ENT Devices Companies:

- Ambu A/S

- Cochlear Ltd.

- Demant A/S

- GN Store Nord A/S

- KARL STORZ SE & Co. KG

- Olympus Corporation

- PENTAX Medical

- Richard Wolf GmbH

- RION Co., Ltd.

- Smith & Nephew, Inc.

- Sonova

- Starkey Laboratories, Inc.

- Stryker

- Nico Corporation

- Nemera

Recent Developments

-

In December 2023, Integra LifeSciences Corporation announced the acquisition of Acclarent, an ENT procedures innovator. The acquisition will be integrated into Integra's Codman Specialty Surgical business unit

-

In July 2023, EndoTheia, Inc., a medical device company, completed its initial clinical trial in humans, showcasing a revolutionary technology that enhances minimally invasive endoscopic surgery. This innovation eliminates the necessity for duodenoscopes and substitutes them with disposable components

-

In April 2023, Unitron introduced Vivante, an innovative platform designed to significantly improve users' hearing experience. This platform combines advanced technology with personalized hearing control to offer a more satisfying and tailored hearing experience

-

In November 2022, Cochlear Ltd., a medical device company, received approval from the U.S. Food and Drug Administration (FDA) for the Nucleus 8 Sound Processor. This device is now recognized as the most compact and lightest cochlear implant sound processor that can be worn behind the ear in the industry

U.S. ENT Devices Market Report Scope

Report Attribute

Details

Market value in 2024

USD 8.63 billion

Revenue forecast in 2030

USD 11.5 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Country scope

U.S.

Key companies profiled

Ambu A/S; Cochlear Ltd.; Demant A/S; GN Store Nord A/S; KARL STORZ SE & Co. KG; Olympus Corporation; PENTAX Medical; Richard Wolf GmbH; RION Co., Ltd.; Smith & Nephew, Inc.; Sonova; Starkey Laboratories, Inc.; Stryker; Nico Corporation; Nemera

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. ENT Devices Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. ENT devices market report based on product and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic ENT Devices

-

Rigid Endoscopes

-

Sinuscopes

-

Otoscopes

-

Laryngoscopes

-

-

Flexible Endoscopes

-

Bronchoscopes

-

Laryngoscopes

-

Nasopharyngoscopes

-

-

Robot Assisted Endoscope

-

Hearing Screening Device

-

-

Surgical ENT Devices

-

Radiofrequency handpieces

-

Otological Drill Burrs

-

ENT Hand Instruments

-

Sinus Dilation Devices

-

Nasal Packing Devices

-

Others

-

-

Hearing Aids

-

Hearing Implants

-

Nasal Splints

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. ENT devices market size was estimated at USD 8.24 billion in 2023 and is expected to reach USD 8.63 billion in 2024.

b. The U.S. ENT devices market size is projected to grow at a compound annual growth rate (CAGR) of 4.9% from 2024 to 2030 to reach USD 11 .5 billion by 2030.

b. The surgical ENT devices segment dominated the market with a revenue share of 30.3% in 2023 owing to the increasing prevalence of hearing disorders, respiratory diseases, and other ENT-related conditions, as well as the rising demand for minimally invasive surgeries.

b. Some of the key players operating in the U.S. ENT devices market include Cochlear Ltd., Demant A/S, Stryker, and KARL STORZ SE & Co. KG.

b. This market growth is attributable to the increasing prevalence of ear, nose, and throat disorders, rising demand for minimally invasive procedures, and the technological advancements. Another factor driving the growth of the ENT devices market is the rise in the geriatric population as they are more prone to ear, nose, and throat disorders, driving the demand for ENT devices.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."