- Home

- »

- Medical Devices

- »

-

U.S. Endoscopy Devices Market Size, Industry Report, 2030GVR Report cover

![U.S. Endoscopy Devices Market Size, Share & Trends Report]()

U.S. Endoscopy Devices Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Endoscopes, Endoscopes Visualization Components), By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-326-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Endoscopy Devices Market Trends

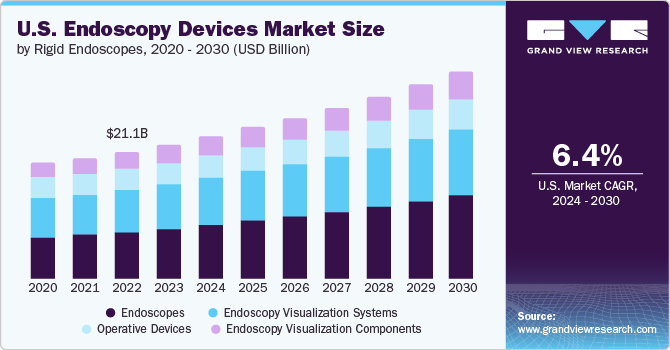

The U.S. endoscopy devices market size was estimated at USD 21.07 billion in 2023 and is projected to grow at a CAGR of 6.4% from 2024 to 2030. The increasing number of healthcare centers, such as hospitals, oncology specialty clinics, and cancer centers, contributed to the growing demand for endoscopy devices in the U.S. The rising prevalence of cancer and cancer-related mortality drives the need for endoscopic procedures with enhanced visualization. For instance, according to the American Cancer Society, in the U.S., 1,958,310 new cancer cases and 609,820 cancer deaths are anticipated to occur in 2023.

Technological advancements in minimally invasive surgeries have driven the demand for endoscopy procedures, with capsule endoscopes and robot-assisted endoscopy significantly increasing the need for minimally invasive endoscopic surgeries. Continuous growth in the U.S. market is fueled by advancements in minimally invasive surgeries and the introduction of new products. For instance, in October 2023, Olympus Corporation, a MedTech company, launched its next-generation EVIS X1 endoscopy system to visualize the GI tract.

Furthermore, the emergence of endoscopic bariatric surgeries, such as endoscopic sleeve gastroplasty, has contributed to market growth. This non-surgical procedure, which uses sutures to restructure the stomach and reduce its size by 70.0%, offers promising weight loss results. The minimally invasive nature and affordable pre- and post-procedure costs of endoscopy devices in the country are major factors anticipated to boost the market growth. For instance, according to an article published by Surgery for Obesity and Related Diseases in February 2024, a total number of 280,000 metabolic and bariatric surgeries were performed in 2022.

Moreover, a growing number of product approvals or clearance and innovations in imaging technology are facilitating the trend of new product launches, enhancing the precision & effectiveness of diagnostic and therapeutic procedures. For instance, in August 2021, Boston Scientific Corporation received 510(k) clearance for its EXALT Model B Bronchoscope from the U.S. FDA. This single-use bronchoscope is designed for bedside procedures in Operating Rooms (OR) and Intensive Care Units (ICU), addressing the need for safer alternatives to reusable devices.

Recent technological advancements in endoscopy have increased their demand in hospitals, diagnostic centers, and clinics, driving the disposable endoscopes’ demand. The applications of disposable endoscopy are widening rapidly. Various types of disposable endoscopes are now available and used in numerous specialties, including ENT, laparoscopy, gynecology, arthroscopy, gastroenterology, urology, and proctoscopy. As the market progresses, endoscopic systems are expected to become more integrated and efficient, providing better diagnostic and therapeutic capabilities. Customized solutions combining standard and private-label products would allow manufacturers to rapidly respond to market needs and develop advanced endoscopic technologies.

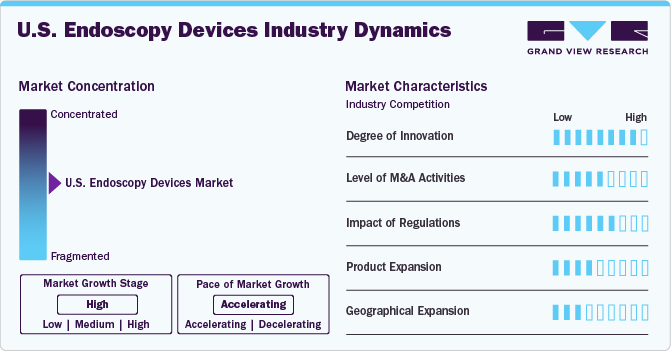

Market Concentration & Characteristics

The market is characterized by a high degree of innovation. High-definition imaging, miniaturization, single-use endoscopy devices, real-time monitoring, and other innovations significantly contribute to industry growth. These advancements aim to improve the overall efficiency and effectiveness of endoscopic procedures while addressing the evolving needs of the healthcare sector. For instance, in November 2023, Virtuoso Surgical, Inc., a medical device company, received a USD 1.8 million Small Business Innovation Research (SBIR) NIH grant to be allocated over two years. The company's robotic surgery system introduces advanced tools and endoscopic surgery techniques that can't be done with current instruments.

The market is characterized by a medium level of merger and acquisition (M&A) activity. These M&As facilitate access to complementary technologies and distribution channels, enabling companies to accelerate product development, improve operational efficiency, and capture a larger market share. For instance, in November 2022, Boston Scientific Corporation acquired Apollo Endosurgery, Inc. for USD 10 per share, valuing the enterprise at USD 615 million. Through this acquisition, the company would fully control the endoluminal surgery product portfolio, further enhancing its resources in the endoscopy business division.

Manufacturers in the industry are subject to various regulatory frameworks, including the Federal Food, Drug, and Cosmetic Act, which focuses on the approval and safety of medical devices. The Centers for Medicare & Medicaid Services (CMS) and the Food and Drug Administration (FDA) are crucial in overseeing reimbursement and safety, respectively. Modernizing the 510(k)-clearance pathway by the FDA is an ongoing effort to enhance the safety and effectiveness of medical devices. This ongoing effort demonstrates the regulatory authorities’ commitment to maintaining high standards and fostering innovation in the endoscopy devices industry.

The industry is witnessing significant growth in product offerings as companies continuously introduce new and innovative products to cater to evolving healthcare needs. This dynamic environment fosters competition and encourages advancements in technology. For instance, in February 2023, Boston Scientific received FDA clearance for the LithoVue Elite Single-Use Digital Flexible Ureteroscope System, designed to monitor intrarenal pressure during kidney stone procedures. This approval highlights the ongoing commitment to innovation within the sector as companies strive to develop cutting-edge devices that enhance patient care and improve medical procedures.

Manufacturers are establishing facilities in various regions across the country to expand their industry presence and better cater to the needs of healthcare providers and patients. For instance, in February 2022, Medtronic collaborated with the American Society for Gastrointestinal Endoscopy (ASGE) to offer AI-powered colonoscopy technology for colorectal cancer screening in underserved communities of the U.S.

Product Insights

The endoscopes segment dominated the market in 2023 with revenue share of 36.8% and is expected to witness the fastest CAGR growth from 2024 to 2030. An advanced healthcare infrastructure, high investments by market players and hospitals promoting the use of novel endoscopy equipment, and favorable reimbursement policies are among the factors expected to drive market growth in the U.S. For instance, in June 2021, EvoEndo raised USD 10.1 million to promote using unsedated transnasal endoscopy for patients and physicians.

The increasing preference for minimally invasive surgeries, which offer faster recovery, enhanced precision and accuracy, and reduced post-surgery infections and complications, and the growing preference by physicians to use technologically advanced endoscopy devices equipped with light sources and HD cameras to help them analyze internal organs of interest fuels the market. Moreover, the rising demand for disposable endoscopes and growing investments by several U.S. companies to develop advanced endoscopes are contributing to market growth.

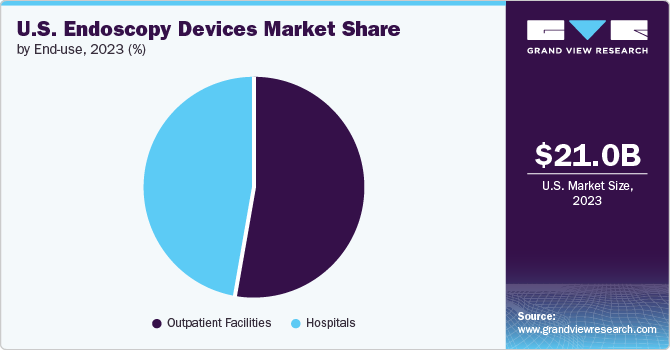

End-use Insights

The outpatient facilities segment held the largest revenue share in 2023 and is anticipated to grow at the fastest CAGR of 7.1% from 2024 to 2030. The growing number of outpatient care centers in the U.S. boosts the market growth. These outpatient centers offer effective diagnostic and therapeutic options. The rising demand for endoscopes in these settings is increasing due to their multiple benefits. A key benefit in these outpatient environments is the cost-efficiency. For instance, according to the County Business Patterns program in the U.S., there are 54,642 outpatient care centers in 2021.

The hospital's segment in the market held a significant revenue share in 2023. Favorable reimbursement policies for patients visiting hospitals compared to those opting for treatment at ambulatory centers and a significant presence of hospitals and primary care centers in developed and developing economies contribute to the high demand for endoscopes. The increasing preference for minimally invasive surgeries has increased the demand for endoscopy devices in hospitals.

Key U.S. Endoscopy Devices Company Insights

Market players in the market focus on devising innovative business growth strategies such as product portfolio expansions, mergers & acquisitions, partnerships & collaborations, and geographical expansions. For instance, in January 2023, UC Davis Health opened an outpatient endoscopy suite to enhance patient care and technologies that result in superior outcomes.

Key U.S. Endoscopy Devices Companies:

- Johnson & Johnson (Ethicon Endo-Surgery, Inc.)

- Stryker Corporation

- Boston Scientific Corporation

- CONMED

- Medtronic PLC

- Fujifilm Holdings Corporation

- Olympus Corporation

- KARL STORZ SE & Co. KG

- Richard Wolf GmbH

- Cook Medical

Recent Developments

-

In March 2024, Scivita Medical Technology Co., Ltd. collaborated with Boston Scientific Corporation and signed a strategic cooperation arrangement. The arrangement includes the development of endoscopic devices and distribution opportunities for Scivita Medical's imaging devices and single-use endoscopes.

-

In March 2024, NTT Corporation (NTT) collaborated with Olympus Corporation (Olympus) to begin a pilot project for a cloud-based endoscopy system that enables image processing through the cloud.

U.S. Endoscopy Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.44 billion

Revenue forecast in 2030

USD 32.55 billion

Growth rate

CAGR of 6.4% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end-use

Country scope

U.S.

Key companies profiled

Johnson & Johnson (Ethicon Endo-Surgery, Inc.); Stryker Corporation; Boston Scientific Corporation; CONMED; Medtronic PLC; Fujifilm Holdings Corporation; Olympus Corporation; KARL STORZ SE & Co. KG; Richard Wolf GmbH; Cook Medical

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Endoscopy Devices Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. endoscopy devices market report based on product, and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Sigmoidoscopes

-

Duodenoscope

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Sigmoidoscopes

-

Duodenoscope

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Sigmoidoscopes

-

Duodenoscope

-

Nasopharyngoscopes

-

Rhinoscopes

-

-

Robot Assisted Endoscope

-

Capsule Endoscopes

-

-

Endoscopy Visualization Systems

-

Standard Definition (SD) Visualization Systems

-

2D Systems

-

3D Systems

-

-

High Definition (HD) Visualization Systems

-

2D Systems

-

3D Systems

-

-

-

Endoscopy Visualization Components

-

Camera Heads

-

Insufflators

-

Light Sources

-

High-Definition Monitors

-

Suction Pumps

-

Video Processors

-

-

Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

Frequently Asked Questions About This Report

b. The U.S. endoscopy devices market size was estimated at USD 21.07 billion in 2023 and is expected to reach USD 22.4 billion in 2024.

b. The U.S. endoscopy devices market is expected to grow at a compound annual growth rate of 6.4% from 2024 to 2030 to reach USD 32.55 billion by 2030.

b. Endoscopes dominated the U.S. endoscopy devices market with a share of 36.8% in 2023. This is attributable to advanced healthcare infrastructure, high investments by market players and hospitals promoting the use of novel endoscopy equipment, and favorable reimbursement policies.

b. Some key players operating in the U.S. endoscopy devices market include Olympus Corporation; Fujifilm Holdings Corporation; Ethicon Endo-Surgery, LLC; Stryker Corporation; Richard Wolf GmbH; Boston Scientific Corporation; and Karl Storz.

b. Key factors that are driving the U.S. endoscopy devices market growth include a significant increase in the prevalence of age-related diseases, a rise in demand for endoscopy devices in diagnostic & therapeutic procedures, and increasing adoption of minimally invasive surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.