U.S. End Stage Renal Disease Market Size, Share & Trends Analysis Report By Treatment (Transplant, Dialysis, Peritoneal Dialysis, Hemodialysis, Wearable Artificial Kidney), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-239-7

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

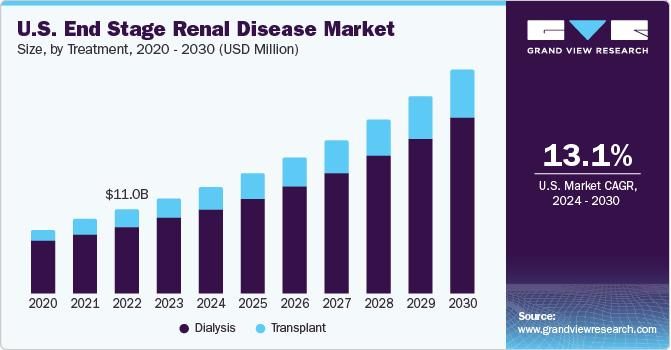

The U.S. end stage renal disease market size was valued at USD 15.95 billion in 2023 and is anticipated to grow at a CAGR of 13.1% over the forecast period of 2024 to 2030. The market is witnessing growth owing to factors such as rising incidence of kidney failures and chronic kidney diseases (CKD), and enormous demand for dialysis procedures. Increasing healthcare spending, government initiatives, and high disposable income are a few other factors contributing toward market growth.

U.S. end stage renal disease market accounted for 14.0% of the global end stage renal disease market in 2023. Increase in the number of initiatives associated with treatment of chronic kidney disease is expected to boost market growth. For instance, in 2019, U.S. Department of Health & Human Services launched President Trump’s Advancing Kidney health initiative. In addition, favorable reimbursement policies for patients suffering from end stage renal disease in this region may positively impact the market.

As per the National Kidney Foundation, CKD has affected around 37 million people in the U.S. Approximately 80 million people, which is around 1 in 3 American adults, are at risk of chronic kidney disease, and it is the ninth leading cause of death in this region. CKD is more common in women as compared to that in men. The number of patients continues to increase at a rate of 5% to 7% per year, and patients require kidney transplant or dialysis to survive. Increasing prevalence of CKD and healthcare spending by the Medicare, which is a U.S, federal agency, are expected to drive the market growth.

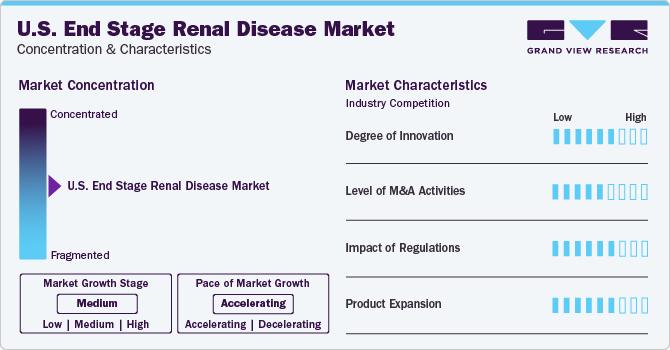

Market Concentration & Characteristics

Rising number of initiatives and increasing awareness among kidney failure patients about choosing peritoneal dialysis or hemodialysis are expected to boost the demand for end stage renal disease (ESRD) treatment, thereby fueling the industry growth during the forecast period.

Launching technologically advanced products may lead to higher effectiveness, which is expected to support the increase in product demand. Recently, key companies are launching products with almost similar features to compete with each other. For instance, in January 2020, Fresenius Medical introduced its latest 4008A dialysis machine with the aim to improve dialysis treatment for patients who are surviving from end stage renal disease. Such advanced product launches are reducing the sale of some of the existing products.

Increased merger & acquisition (M&A) activities, collaboration and partnerships between companies to provide advanced services and solutions are expected to boost the industry growth over the forecast period. For instance, in February 2019, Fresenius Medical Care announced the acquisition of NxStage Medical, Inc. to strengthen its position in home-based hemodialysis machines market.

The U.S. FDA expanded and finalized 510(k) registration route for safety and performance of medical devices. The enhanced industry approval pathway is focused on analyzing and assessing performance issues & device safety by demonstrating substantial equivalence. However, increasing government initiatives, supportive regulations and laws, and increasing awareness in the community are expected to drive the market growth.

Treatment Insights

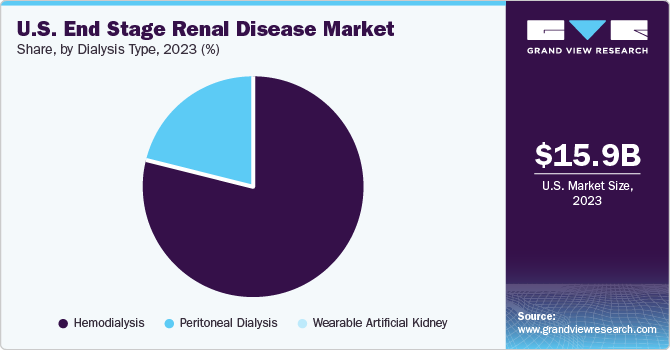

The dialysis segment accounted for the largest share of 78.13% in 2023. According to the U.S. National Kidney Foundation, end-stage kidney failure occurs due to only 10% to 15% of kidneys functioning normally. Dialysis filters purify fluids and blood using machines such as dialyzers and water treatment systems. There are majorly two types of dialysis including peritoneal dialysis and hemodialysis. The increasing prevalence of Chronic Kidney Disease (CKD) and End Stage Renal Disease (ESRD) is further boosting the demand for dialysis.

The transplant segment is expected to register a considerable CAGR over the forecast period as it can help recover end-stage renal disease. Factors such as obesity, lifestyle changes, and diabetes lead to severe kidney failures that require transplant. According to the United Network for Organ Sharing (UNOS), over 25,000 kidney transplants were performed in the 2022. Owing to lesser availability of kidneys in comparison to the list of people waiting, the segment is expected to witness higher demands in the forthcoming years.

Key U.S. End Stage Renal Disease Company Insights

Companies operating in the market are Nipro Corporation, Fresenius Medical Care AG & Co. KGaA, Medtronic, B. Braun Melsungen AG, BD, Baxter, Asahi Kasei Medical co., Ltd, Cantel Medical, Nikkiso Co. Ltd, JMS Co. Ltd. Key companies are adopting various strategies such as new product launch, mergers and acquisitions to gain more market share.

Key companies are strategizing to geographically expand their businesses and build more warehouses at various places so that they can run their business through various local channels in the country with a high patient count. Moreover, key companies are constantly incorporating technologies that can meet specific requirements of patients.

Key U.S. End Stage Renal Disease Companies:

- Nipro Corp.

- Fresenius Medical Care AG & Co. KGaA

- Baxter International, Inc.

- Medtronic Plc

- B. Braun Melsungen AG

- BD

- Asahi Kasei Medical Co., Ltd.

- Cantel Medical

- Nikkiso Co., Ltd.

- JMS Co. Ltd.

Recent Developments

-

In October 2023, Ardelyx announced the FDA approval of Tenapanor for reducing serum phosphorus in adults with chronic kidney disease on dialysis

-

In September 2023, the US FDA approved Jardiance(empagliflozin) 10 mg tablets for reducing the risk of sustained decline in estimated glomerular filtration rate (eGFR), end-stage kidney disease, cardiovascular death, and hospitalization in adults with chronic kidney disease (CKD) at risk of progression

U.S. End Stage Renal Disease Market Report Scope

|

Reports Attribute |

Details |

|

Market size value in 2024 |

USD 17.94 billion |

|

Revenue forecast in 2030 |

USD 37.79 billion |

|

Growth rate |

CAGR of 13.1% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company share, competitive landscape, growth factors & trends |

|

Segments covered |

Treatment |

|

Country scope |

U.S. |

|

Key companies profiled |

Nipro Corp.; Fresenius Medical Care AG & Co. KGaA; Medtronic; B. Braun Melsungen AG; BD; Baxter; Asahi Kasei Medical Co., Ltd.; Cantel Medical; Nikkiso Co. Ltd.; JMS Co. Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope |

U.S. End Stage Renal Disease Market Report Segmentation

This report forecasts revenue growth at a country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. end stage renal disease market report based on treatment:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

Transplant

-

Dialysis

-

Peritoneal Dialysis

-

Hemodialysis

-

Wearable Artificial Kidney

-

-

Frequently Asked Questions About This Report

b. The U.S. end stage renal disease market size was estimated at USD 15.95 billion in 2023 and is expected to reach USD 17.94 billion in 2024.

b. The U.S. end stage renal disease market is expected to grow at a compound annual growth rate of 13.1% from 2024 to 2030 to reach USD 37.79 billion by 2030.

b. The dialysis segment dominated the market in 2023 and accounted for the maximum share of more than 78%of the total revenue. The segment is also expected to grow at the highest CAGR during the forecast period. Dialysis is more convenient and easier to obtain for a patient with ESRD and the whole process can be done at a dialysis center or home.

b. Some prominent players operating in the global end stage renal disease treatment market include Nipro Corp.; Fresenius Medical Care AG & Co. KGaA; Medtronic; B. Braun Melsungen AG; BD; Baxter; Asahi Kasei Medical Co., Ltd.; Cantel Medical; Nikkiso Co. Ltd.; JMS Co. Ltd.

b. An increasing number of patients suffering from kidney failure and the introduction of technologically advanced products, such as low-maintenance dialysis equipment and artificial kidney, are the major factors expected to drive the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."