- Home

- »

- Medical Devices

- »

-

U.S. Empty IV Bags Market Size, Industry Report, 2030GVR Report cover

![U.S. Empty IV Bags Market Size, Share & Trends Report]()

U.S. Empty IV Bags Market (2024 - 2030) Size, Share & Trends Analysis Report by Product (PVC, Non-PVC (Material), Non-PVC (Type)), And Segment Forecasts

- Report ID: GVR-4-68040-235-1

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Empty IV Bags Market Size & Trends

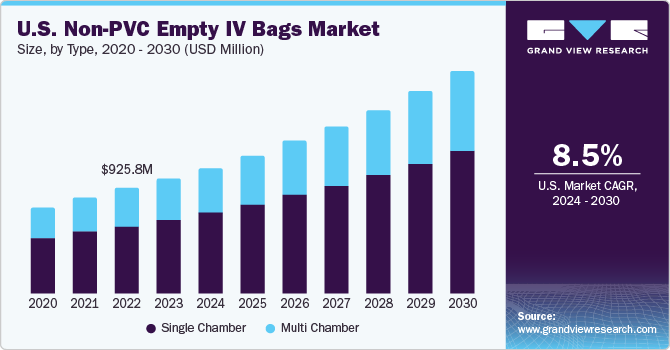

The U.S. empty IV bags market size was valued at USD 1.99 billion in 2023 and is expected to grow at a CAGR of 8.5% from 2024 to 2030. Easy access to healthcare technologies and the presence of strong distribution channels are among the key factors contributing to the increasing adoption of empty IV bags. High disease prevalence, supportive reimbursement policies, and a well-defined regulatory framework are further expected to boost the adoption of empty IV bags in this region.

The growing population of individuals suffering from chronic conditions, including cancer and gastrointestinal diseases, has increased the demand for empty IV bags in healthcare settings. Specifically, the high prevalence of stomach cancer has contributed to this demand surge. For instance, in 2021, the American Cancer Society estimated approximately 26,560 new cases of stomach cancer, accounting for nearly 1.5% of all new cancer diagnoses annually. The inability to ingest food orally and reliance on total parenteral solutions for dietary needs and survival are common effects of such cancers, further driving the demand for empty IV bags and subsequently boosting regional market growth.

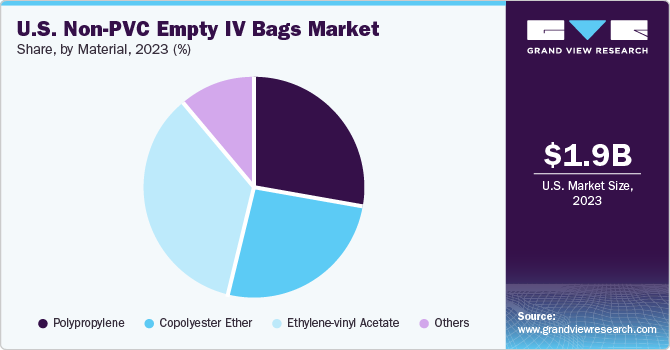

The U.S. empty IV bags market accounted for 41% of the global empty IV bags market in 2023. The country is expected to witness increased adoption of non-PVC bags due to their various benefits, including easy recycling and the availability of cost-effective alternatives with softeners. Many researchers have identified PVC-made empty IV bags as hazardous to both human health and the environment. Consequently, companies such as Baxter, Hospira, and B. Braun Melsungen AG are manufacturing IV bags made of PVC-free materials. These alternatives possess thermal stability, moisture-barrier properties, inertness necessary for IV medications, and are environmentally friendly, thereby further driving market growth.

Market Concentration & Characteristics

Privately funded initiatives are creating opportunities for the growth of the empty IV bags market. Companies are undertaking various strategic initiatives to promote the use of empty IV bags instead of plastic and glass bottles. Industry participants are adopting strategies such as product launches, mergers & acquisitions, collaborations, and partnerships to launch new product lines with advanced technology.

Companies are majorly focusing on using eco-friendly materials for manufacturing empty IV bags to gain a larger share of the market. Moreover, key companies are constantly developing user-friendly bags to meet the specific requirement of patients. In addition, regulatory agencies such as the US FDA have advocated for the use of packaging that is free of di-2-ethylhexyl phthalate (DEHP). DEHP is reported to be incompatible with certain devices. Thereby, companies at present are inventing IV bags made of materials such as Ethyl Vinyl Acetate (EVA), Polypropylene, Copolyester-Ether (COPE), and others.

There are various small- and large-sized market players, which is leading to higher competition. In addition, major companies are also adopting various strategies such as mergers & acquisitions, and partnerships to maintain their position. Key companies are also signing agreements with existing small companies to enhance their product portfolio. For instance, in August 2020, ICU Medical, Inc. signed an agreement with Grifols to distribute its complete range of non-PVC/non-DEHP IV containers for 0.9% Sodium Chloride Injection, USP.

Medical devices are regulated by the U.S. FDA. The intravascular administration set is classified into the class II category of general and special controls. As per FDA regulations, an intravascular administration set is exempted from premarket notification. Intravenous solutions that contain sodium chloride are indicated for parenteral replenishment of fluid as required by the clinical condition of patients.

Product Insights

The non-PVC segment accounted for the largest share of 50.84% in 2023 and is expected to register the highest CAGR during the forecast period. High usage and lack of alternatives are some of the factors expected to drive the segment growth over the forecast period. The non-PVC empty IV bags market has been segmented into single and multi-chambered bags. The demand for multi-chambered bags is expected to increase due to the presence of separate storage for different components. Thus, the segment is expected to grow at the fastest rate during the forecast period.

Furthermore, demand for oncology procedure treatment is rising, particularly chemotherapy and targeted drug delivery. Earlier agents used in therapies interacted with conventional PVC material and formed harmful agents. However, by adopting these non-PVC empty IV bags, these issues are being resolved, resulting in segment growth. As a result, the emergence of non-PVC empty IV bags is expected to replace a significant share of PVC empty IV bags over the forecast period

Key U.S. Empty IV Bags Company Insights

Some of the prominent U.S. empty IV bags companies operating in the market include Sippex IV bag, Technoflex, Wipak Group, PolyCine GmbH, RENOLIT SE, Baxter, B. Braun Melsungen AG, ICU Medical, Inc., Fresenius Kabi AG, and JW Life Science Corp. Companies are adopting various strategies to gain more market share such as new product launch, mergers & acquisitions, and geographic expansion.

Furthermore, major companies are well versed in manufacturing standards set by regulatory bodies, which help them launch new products with various features and modify existing products. This helps them achieve long-term sustainability and increases brand loyalty among customers in the market.

Key U.S. Empty IV Bags Companies:

- Baxter

- B. Braun Medical Inc.

- ICU MEDICAL, INC.

- Wipak

- RENOLIT SE

- TECHNOFLEX

- Sippex IV bags

- JW Life Science Corp

- Fresenius Kabi AG

- POLYCINE GmbH

- BAUSCH Advanced Technology Group

- BD

Recent Developments

-

In December 2023, Baxter International Inc. announced completing the first phase of its intravenous (IV) bag recycling program pilot, launched in conjunction with Northwestern Medicine

-

In January 2022, the U.S. FDA permitted B. Braun Medical Inc. for the company's new pharmaceutical production facility in Daytona Beach, Florida. The facility was expected to produce 500 mL and 1,000 mL Excel Plus IV Bags with 0.9% Sodium Chloride for Injection from B. Braun

U.S. Empty IV Bags Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.16 billion

Revenue forecast in 2030

USD 3.57 billion

Growth Rate

CAGR of 8.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product

Country scope

U.S.

Key companies profiled

Baxter, B. Braun Medical Inc., ICU MEDICAL, INC., Wipak, RENOLIT SE, TECHNOFLEX, Sippex IV bags, JW Life science Corp, Fresenius Kabi AG, POLYCINE GmbH, BAUSCH Advanced Technology Group, BD, Others

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Empty IV Bags Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. empty IV bags market report based on product:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

PVC

-

Non-PVC (Material)

-

Polypropylene

-

Copolyester ether

-

Ethylene-vinyl acetate

-

Others

-

-

Non-PVC (Type)

-

Single Chamber

-

Multi Chamber

-

-

Frequently Asked Questions About This Report

b. The U.S. empty IV bags market size was estimated at USD 1.99 billion in 2023 and is expected to reach USD 2.16 billion in 2024.

b. The U.S. empty IV bags market is expected to grow at a compound annual growth rate of 8.5% from 2024 to 2030 to reach USD 3.57 billion by 2030.

b. The non-PVC segment accounted for the largest share of 50.84% in 2023 and is expected to register the highest CAGR during the forecast period. High usage and lack of alternatives are some of the factors expected to drive the segment growth over the forecast period. The non-PVC empty IV bags market has been segmented into single and multi-chambered bags.

b. Some prominent players in the U.S. empty IV bags market include Baxter, B. Braun Medical Inc., ICU MEDICAL, INC., Wipak, RENOLIT SE, TECHNOFLEX, Sippex IV bags, JW Life science Corp, Fresenius Kabi AG, POLYCINE GmbH, BAUSCH Advanced Technology Group, BD, Others.

b. Easy access to healthcare technologies and the presence of strong distribution channels are among the key factors contributing to the increasing adoption of empty IV bags in the country.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.