- Home

- »

- Clinical Diagnostics

- »

-

U.S. Employer And Workplace Drug Testing Market Report, 2033GVR Report cover

![U.S. Employer And Workplace Drug Testing Market Size, Share & Trends Report]()

U.S. Employer And Workplace Drug Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Pre-employment Drug Screens, Post-employment), By Product, By Mode, By Drug, By End-use (IT/Finance, Manufacturing), And Segment Forecasts

- Report ID: GVR-4-68040-450-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

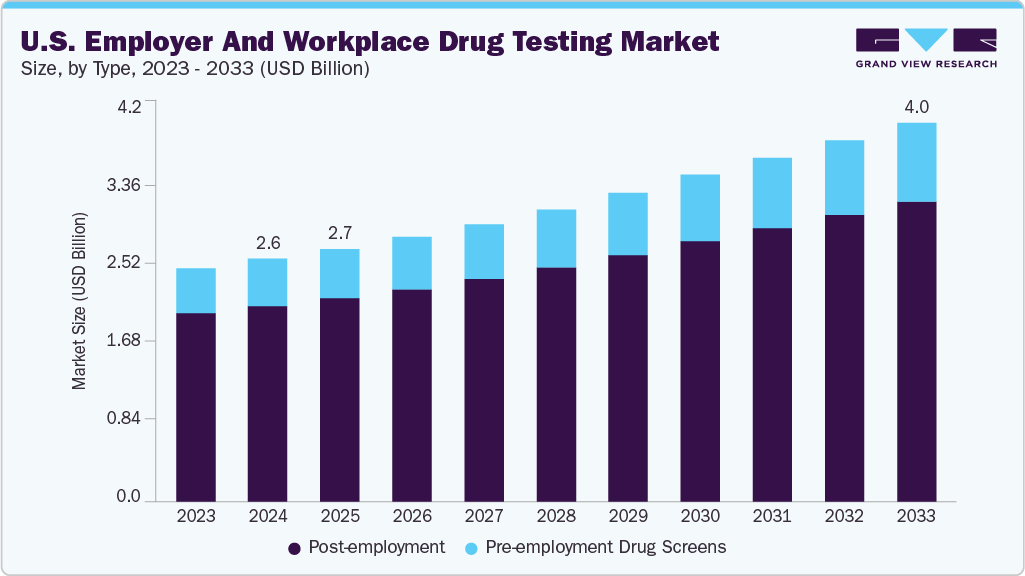

The U.S. employer and workplace drug testing market size was estimated at USD 2.57 billion in 2024 and is projected to reach USD 4.01 billion by 2033, growing at a CAGR of 5.2% from 2025 to 2033. The market is primarily driven by stringent workplace safety regulations, growing awareness of substance abuse risks, and the increasing adoption of preventive screening measures across various industries. Drug testing programs are widely implemented to detect the presence of illicit substances and misuse of prescription medications, while comprehensive screening protocols support compliance with federal and state requirements, promote productivity, and reduce workplace incidents.

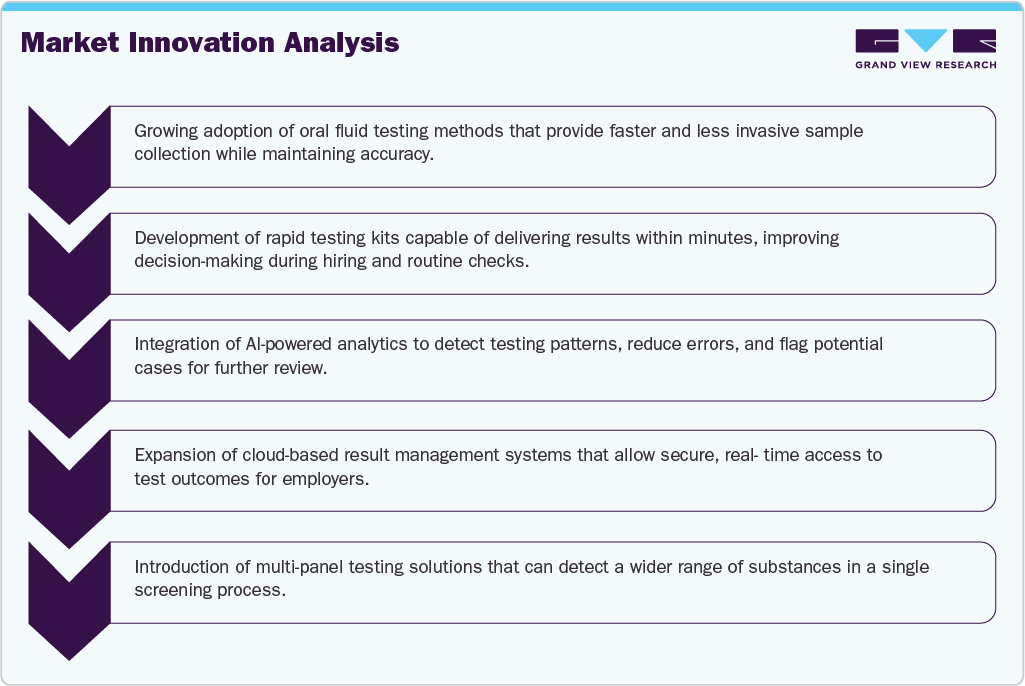

The demand for pre-employment and random workplace testing is growing, supported by improvements in rapid testing kits, lab-based tests, and oral fluid testing methods. Digital result systems and automated reporting have made the process faster and more accurate, helping employers make quick hiring decisions and monitor staff more effectively. Changing cannabis laws in several states are also leading companies to adjust their testing policies to meet both compliance needs and evolving legal standards.

A national survey by American Addiction Centers in 2024 found that 15.3% of U.S. workers had worked under the influence of alcohol, while 2.9% admitted to being under the influence of illegal drugs. This shows the ongoing challenges faced by employers and highlights the need for strong drug testing policies to protect workplace safety and productivity.

The rising number of employees with substance use disorders (SUD) further increases the importance of workplace testing. Substance abuse can lead to lower productivity, more absenteeism, and higher rates of illness. It also harms employee morale and raises the risk of workplace accidents and injuries, which together cost U.S. businesses billions of dollars each year. These factors are expected to keep driving the demand for employer and workplace drug testing services across the country.

Overall, the U.S. employer and workplace drug testing market is experiencing steady innovation aimed at improving speed, accuracy, and ease of use. Advancements in testing methods, digital result management, and analytical tools are helping employers streamline screening processes while ensuring compliance with evolving regulations. The adoption of multi-panel and oral fluid testing, supported by cloud-based platforms and AI-driven analytics, is making it easier to detect a broader range of substances and identify potential issues early. These innovations are expected to strengthen workplace safety programs and support more effective workforce management in the years ahead.

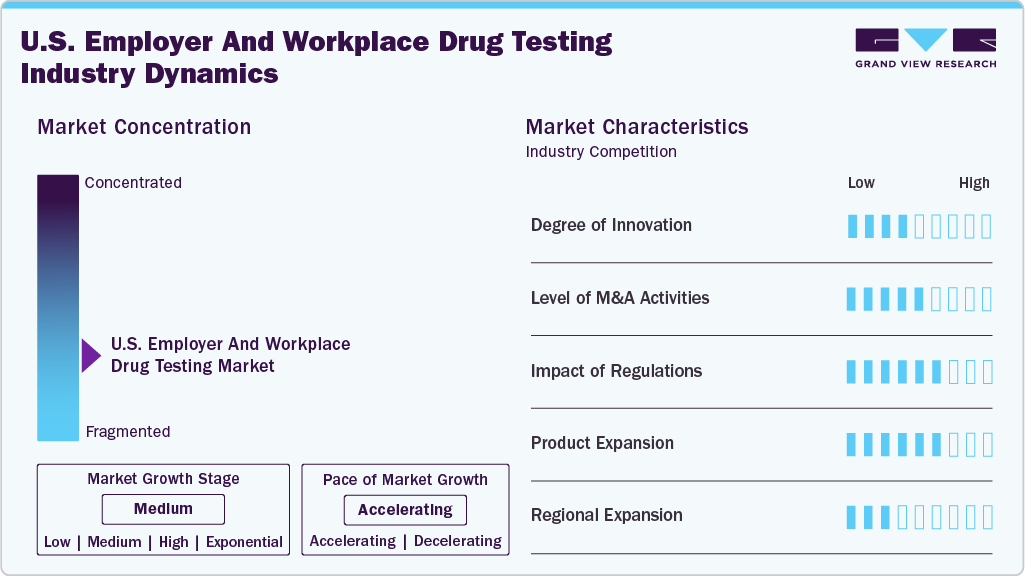

Market Concentration & Characteristics

The U.S. employer and workplace drug testing market is experiencing a high degree of innovation, driven by advancements in rapid testing technologies, non-invasive testing methods like saliva and hair analysis, and the integration of artificial intelligence for more accurate and efficient results. Additionally, the development of remote testing solutions is addressing the challenges posed by the increasing trend of remote and hybrid work environments.

The market for employer and workplace drug testing in the U.S. has experienced a notable level of mergers and acquisitions, with companies focusing on expanding their service portfolios and improving technological capabilities. These strategic moves are aimed at delivering faster, more reliable, and efficient testing solutions, enabling providers to better meet the evolving needs of employers while maintaining compliance with regulatory standards.

Regulations significantly impact the U.S. employer and workplace drug testing market by mandating testing in safety-sensitive industries, such as transportation and healthcare. Compliance with federal and state laws drives demand for drug testing services, ensuring workplaces remain drug-free. Evolving legal landscapes, including changing marijuana laws, also compel employers to regularly update their testing policies, further shaping market dynamics.

Product expansion in the market is driven by the need to address emerging drug trends. In October 2023, Psychemedics Corporation introduced its Advanced 5-Panel Drug Screen, an FDA-cleared test replacing marijuana with fentanyl detection. This new panel responds to the rising fentanyl crisis and also tests for cocaine, opioids, PCP, and amphetamines. It offers significantly improved accuracy, with enhanced detection capabilities-25 times more effective for opioids, 23 times for cocaine, and 13 times for amphetamines compared to traditional tests.

Regional expansion is driven by the growing demand for testing services across various states, particularly those with strict regulatory requirements. Companies are broadening their geographic reach to tap into markets with high industrial activity, such as the Midwest and South, where safety-sensitive industries like manufacturing and transportation are prevalent. Additionally, regional expansion efforts often focus on establishing local laboratories and service centers, enhancing accessibility and reducing turnaround times for employers across different regions.

Type Insights

The post-employment segment dominated the market in terms of revenue share in 2024 and is expected to grow at a CAGR of 5.0% over the forecast period. Reducing the risk of accidents, workplace injuries, and associated liabilities is a crucial driver for post-employment drug testing in the U.S. Employers in high-risk industries such as construction, transportation, and manufacturing are acutely aware of the dangers posed by impaired employees to workplace safety. In 2023, alcohol-impaired driving fatalities in the U.S. dropped by approximately 8%, from 13,458 in 2022 to 12,429 in 2023, yet still accounted for 30% of all traffic fatalities. This statistic highlights the ongoing need for rigorous surveillance and prevention systems across all safety areas, including the workplace. Post-employment testing remains a vital tool to deter substance use and help maintain safer working environments, especially in industries with heightened safety risks.

The segment also benefits from the growing use of random and reasonable suspicion testing to maintain consistent safety standards. Technological improvements have made testing quicker and more discreet, supporting regular monitoring without disrupting operations. These factors are expected to sustain strong demand for post-employment drug testing across U.S. industries.

The pre-employment drug screens segment in the market is anticipated to grow at the fastest CAGR. Legal and regulatory compliance is a key driver of pre-employment drug screening in the U.S. Federal mandates, such as those issued by the Department of Transportation (DOT), require drug testing in safety-sensitive industries to ensure workplace safety and minimize liability risks. Additionally, state-specific laws further emphasize the necessity of drug testing, with many states mandating it for specific positions. Adhering to these regulations not only protects companies from potential legal issues but also enhances operational efficiency by reducing risks associated with impaired employees. Compliance with these standards is essential for maintaining corporate integrity and gaining investor confidence.

To alleviate the financial burden on employers, several insurance companies are now covering drug testing expenses, making pre-employment screening more accessible and attractive, particularly for smaller businesses. For example, in February 2023, the Trustees of the MEBA Medical and Benefits Plan introduced a Technical Amendment to clarify the Plan's Rules and Regulations concerning Pre-Employment Drug Testing. The new Article VI-A, titled "Pre-Employment Drug Test Benefit," allows eligible employees to receive coverage for a pre-employment drug test once every six months. To qualify, employees must have worked in covered employment for at least 60 days within the preceding six months and be employed by an employer subject to the DOT's drug testing regulations under 49 C.F.R. Part 40.

Product Insights

The consumable segment dominated the market in terms of revenue share of 33.32% in 2024. The consumables segment in the U.S. employer and workplace drug testing market encompasses a variety of essential products, including urine collection cups, saliva swabs, hair collection kits, test strips, reagent kits, and chain-of-custody forms. This segment is vital for ensuring the accuracy and reliability of drug tests, which directly impacts the effectiveness of screening programs. The market is highly competitive, with major players like Quest Diagnostics, Labcorp, and Abbott leading due to their extensive product ranges and well-established distribution networks.

To gain a competitive advantage, companies are increasingly investing in the development of more efficient and user-friendly consumables, such as rapid test kits and integrated collection devices. The regulatory landscape significantly influences the consumables segment, with federal guidelines from the Department of Transportation (DOT) and the Substance Abuse and Mental Health Services Administration (SAMHSA) setting specific standards for drug testing procedures and associated products. Adhering to these regulations is essential for companies to maintain credibility and avoid legal consequences. Additionally, emerging state-level legislation, such as Washington State's SB 5123, is prompting shifts in the types of consumables required, particularly in the context of marijuana testing.

The services segment is anticipated to grow at the highest CAGR from 2025 to 2033. The market is highly competitive, featuring a wide array of players, from established diagnostic laboratories to specialized testing service providers. These companies hold a dominant position in the market due to their extensive laboratory networks and diverse testing services, which include urine, hair, saliva, and blood tests. They offer comprehensive testing solutions with rapid turnaround times and nationwide coverage, leveraging strong brand presence and advanced technological capabilities to maintain a competitive edge. Companies like First Advantage, Psychemedics, and Omega Laboratories focus on niche areas, such as hair drug testing or specialized employer screening services. Psychemedics, for example, is renowned for its patented hair testing technology, which provides a longer detection window than other methods. This specialization allows these companies to carve out distinct positions in the competitive landscape.

Mode Insights

The urine segment held the largest market share of 41.38% in 2024. Urine tests are the most common type of pre-employment drug tests used by employers, driven by their established reliability and ease of use. This method remains a staple in both regulated and non-regulated industries, ensuring consistent application across various sectors. For employers conducting drug screens under federal mandates, urinalysis is the only approved method. This compliance requirement solidifies the use of urine testing as the standard, especially in industries where federal regulations are stringent.

The oral fluid segment is expected to grow at the fastest CAGR over the forecast period. Oral fluid offers a rapid and noninvasive specimen collection method. However, challenges such as insufficient fluid due to physiological conditions or recent drug use, as well as potential interference from food or techniques to stimulate saliva production, can impact drug concentration measurements. Currently, oral fluid testing is primarily used for drug abuse detection in safety-sensitive workplaces, roadside testing for drivers, and other scenarios where drug impairment is a concern. This testing method covers substances such as alcohol (ethanol), amphetamines, cocaine, opioids (such as morphine, methadone, & heroin), and cannabis. The evolving use of oral fluid testing significantly influences the U.S. drug testing market by offering a less invasive alternative to traditional methods and driving the market growth.

Drug Insights

The cannabis/marijuana segment held the largest market share of 57.32% in 2024 and is expected to grow at the fastest CAGR of 6.0% over the forecast period. The legalization and decriminalization of marijuana in many states have reduced the stigma surrounding its use, resulting in increased consumption, including among employees.

According to the 2023 National Survey on Drug Use and Health (NSDUH) released by SAMHSA, marijuana was the most commonly used illicit drug, with 21.8% of people aged 12 or older, or 61.8 million individuals, reporting its use in the past year. This widespread use among the workforce has prompted employers to enhance drug testing protocols to address potential safety and compliance challenges related to cannabis consumption.

Employers are responding to this shift by updating drug testing policies and adopting more sensitive detection methods to accurately identify marijuana use while balancing legal considerations. The rise in cannabis use has also driven demand for testing technologies capable of distinguishing between recent use and impairment, helping employers maintain workplace safety and compliance. These trends are expected to support continued growth in the cannabis/marijuana segment within the U.S. employer and workplace drug testing market.

The amphetamine & methamphetamine segment is expected to grow significantly in forecast period. Their misuse is linked to problems such as higher absenteeism, reduced productivity, and greater safety risks. Consequently, the growing prevalence of amphetamine and methamphetamine use is expected to drive higher demand for employer and workplace drug testing.

End-use Insights

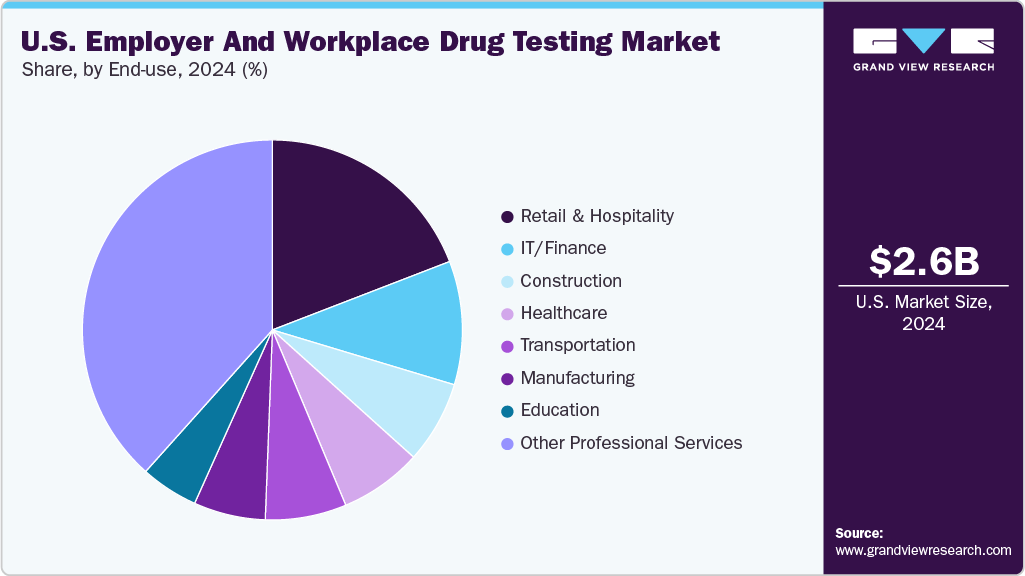

Other professional services dominated the market with the largest revenue share of 38.60% in 2024. Other professional services include Professional, Scientific and Technical, Wholesale Trade, and Public Administration. The demand for employer and workplace drug testing in the U.S. is driven across various professional services sectors, including Professional, Scientific and Technical, Wholesale Trade, and Public Administration industries, due to the critical nature of their work and the need for maintaining high standards of safety, compliance, and productivity.

In the Professional, Scientific, and Technical sectors, employees often handle sensitive information, conduct complex analyses, and engage in high-stakes decision-making where impairment could lead to costly errors and compromised data integrity. Drug testing ensures that workers are operating at their highest capacity, protecting both project outcomes and client trust.

Transportation is projected to experience significant growth over the forecast period, due to the critical importance of safety in this sector. Transportation workers, including truck drivers, pilots, and railway operators, are responsible for the safe movement of goods and people across vast distances. Any impairment due to substance use can lead to catastrophic accidents, endangering lives and causing significant financial and legal consequences. Federal regulations, particularly those enforced by the Department of Transportation (DOT), mandate strict drug and alcohol testing protocols for safety-sensitive positions in the transportation industry. These regulations are designed to ensure that all personnel operating vehicles or handling hazardous materials are free from the influence of drugs or alcohol, thereby reducing the risk of accidents and ensuring public safety

Key U.S. Employer And Workplace Drug Testing Company Insights

Key participants in the U.S. employer and workplace drug testing market are concentrating on developing innovative testing solutions and obtaining essential certifications to expand their product portfolios. Additionally, companies are engaging in partnerships, collaborations, mergers, and acquisitions to reinforce their market presence. These efforts aim to enhance technological capabilities, broaden regional reach, and improve access to rapid, accurate, and non-invasive drug testing methods across various workplace settings.

Key U.S. Employer And Workplace Drug Testing Companies:

- First Advantage

- Laboratory Corporation of America Holdings (Labcorp)

- Drägerwerk AG & Co. KGaA

- Bio-Rad Laboratories, Inc.

- Abbott

- Clinical Reference Laboratory Inc.

- Quest Diagnostics

- Cordant Health Solutions

- DISA Global Solutions

- HireRight, LLC

- OraSure Technologies, Inc.

- Omega Laboratories

- Psychemedics Corporation

Recent Developments

-

In January 2025, the Department of Health and Human Services (HHS) released updated Mandatory Guidelines for Federal Workplace Drug Testing Programs. These revisions, effective July 7, 2025, include changes to the authorized drug testing panels for both urine and oral fluid tests, as well as updated nomenclature for laboratory and Medical Review Officer reports. The updates aim to enhance the accuracy and consistency of drug testing procedures across federal agencies.

-

In June 2024, HireRight completed its acquisition by General Atlantic and Stone Point Capital in a USD 1.7 billion all-cash deal. Following the merger, HireRight’s common stock was delisted from the New York Stock Exchange. HireRight, known for its comprehensive background screening and risk management services, will continue its operations under new ownership.

-

In May 2024, Omega Laboratories announced a partnership with Cannabix Technologies Inc. to integrate Cannabix’s advanced THC breathalyzer into Omega’s drug testing services. This collaboration made Omega the exclusive provider of laboratory services for Cannabix, enhancing its drug testing accuracy & efficiency.

U.S. Employer And Workplace Drug Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.68 billion

Revenue forecast in 2033

USD 4.01 billion

Growth rate

CAGR of 5.2% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, mode, drug, end-use

Key companies profiled

First Advantage; Laboratory Corporation of America Holdings (Labcorp); Drägerwerk AG & Co. KGaA; Bio-Rad Laboratories, Inc.; Abbott; Clinical Reference Laboratory Inc.; Quest Diagnostics; Cordant Health Solutions; DISA Global Solutions; HireRight, LLC; OraSure Technologies, Inc.; Omega Laboratories; Psychemedics Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

U.S. Employer And Workplace Drug Testing Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For the purpose of this report, Grand View Research has segmented the U.S. employer and workplace drug testing market on type, product, mode, drug and end-use:

-

Type Outlook (Revenue in USD Million, 2021 - 2033)

-

Pre-employment Drug Screens

-

Post-employment

-

-

Product Outlook (Revenue in USD Million, 2021 - 2033)

-

Consumables

-

Instruments

-

Rapid Testing Devices

-

Services

-

-

Mode Outlook (Revenue in USD Million, 2021 - 2033)

-

Consumables

-

Instruments

-

Rapid Testing Devices

-

Services

-

-

Drug Outlook (Revenue in USD Million, 2021 - 2033)

-

Alcohol

-

Cannabis/Marijuana

-

Cocaine

-

Opioids

-

Amphetamine & Methamphetamine

-

LSD

-

Others

-

-

End-use Outlook (Revenue in USD Million, 2021 - 2033)

-

IT/Finance

-

Manufacturing

-

Transportation

-

Construction

-

Retail and Hospitality

-

Healthcare

-

Education

-

Other Professional Services

-

Frequently Asked Questions About This Report

b. The U.S. employer and workplace drug testing market size was estimated at USD 2.57 billion in 2024 and is expected to reach USD 2.68 billion in 2025.

b. The U.S. employer and workplace drug testing market is expected to grow at a compound annual growth rate of 5.2% from 2025 to 2033 to reach USD 4.01 billion by 2033.

b. Post-employment dominated the U.S. employer and workplace drug testing market, with a share of 80.70% in 2024. This is attributable to the rising number of drug tests being done during the tenure of the employees in the workplace.

b. Some key players operating in the U.S. employer and workplace drug testing market include First Advantage; Labcorp; Drägerwerk AG & Co. KGaA; Bio-Rad Laboratories; Abbott; Clinical Reference Laboratory Inc.; Quest Diagnostics; Cordant Health Solutions; DISA Global Solutions; HireRight, LLC.; OraSure Technologies Inc.; Omega Laboratories ; Psychemedics

b. Key factors that are driving the market growth include the rising prevalence of substance abuse in the workplace along with stringent laws mandating drug testing in workplaces

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.