- Home

- »

- Next Generation Technologies

- »

-

U.S. Embedded Finance Market Size, Industry Report, 2030GVR Report cover

![U.S. Embedded Finance Market Size, Share & Trends Report]()

U.S. Embedded Finance Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Embedded Payment, Embedded Insurance), By Business Model (B2B, B2C), By Enterprise Size, By End-use, And Segment Forecasts

- Report ID: GVR-4-68040-250-1

- Number of Report Pages: 103

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Embedded Finance Market Trends

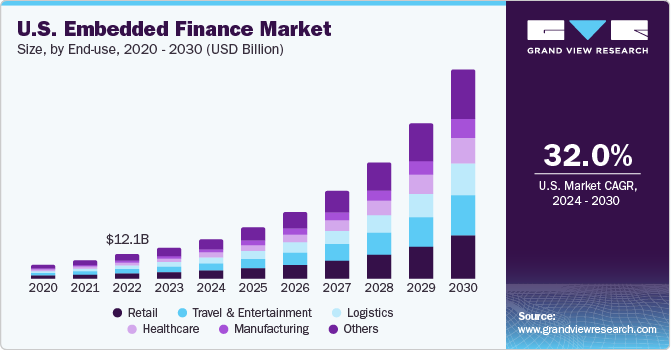

The U.S. embedded finance market size was valued at USD 15.36 billion in 2023 and is anticipated to grow at a CAGR of 32.0% from 2024 to 2030. The increasing smartphone penetration globally, coupled with the rapid proliferation of internet services across sectors such as retail, logistics, and media & entertainment, is a major factor driving market expansion in the United States. Established companies such as Uber, Amazon, Tesla, and Apple have embedded financial services in their mobile applications to improve user experience, with other companies following their example and offering similar services. Additionally, the growing trend of e-commerce retailers providing banking services on their websites directly via third-party BaaS (banking-as-a-service) companies is also enabling industry growth. For customers, this avoids the hassle of getting re-directed to bank websites, vastly improving their experience.

The U.S. accounted for a revenue share of 18.43% in the global embedded finance market in 2023. The country is a major market for e-commerce, owing to the extensive smartphone penetration and high popularity of social media platforms. According to data from the U.S. Department of Commerce, the e-commerce segment accounted for 22.0% of the overall retail sales in the country in 2023, signifying the extent of usage of these services. As a result, e-commerce companies are leveraging embedded financing to increase their revenue while improving their service levels at no additional cost for users. Notable services include lending, insurance, and payments, with names such as Amazon.com and PayPal offering their customers “Buy now, pay later” services. Additionally, companies such as Home Depot and Shopify have started offering working capital and virtual cards to merchants doing business online, helping them to continue their operations. Such factors are expected to drive market expansion.

With the continued growth of banks and technology firms in the U.S., the presence of embedded finance is expected to become critical for businesses aiming to diversify their revenue stream and provide a seamless customer experience. The rapidly growing trend of using digital wallets for making payments provides several growth avenues for companies. For instance, according to a report by Capital One Shopping, 53% of U.S. citizens stated that they used their digital wallets more frequently than conventional payment options in 2023, while 64% claimed to use digital wallets as often as conventional methods. The integration of various financial services, including loans, investments, and insurance into digital wallets offers providers the capability to provide end-to-end financial solutions. On the other hand, banks are able to expand their reach while generating new revenue streams.

The use of artificial intelligence (AI) in the embedded finance sector is expected to present further expansion opportunities to organizations involved in the market. For instance, AI can boost risk management capabilities through intelligent algorithms that can detect inconsistencies and identify challenges in areas such as lending and insurance underwriting. Non-financial platforms providing financial services can utilize AI to understand user requirements even if they are not apparent; for instance, the technology can offer a financial product such as a short-term loan or installment options to a buyer looking for a premium electronic product online. Growth in the embedded finance space is expected to be substantially accelerated by the integration of AI, which would ensure better value proposition for customers and a streamlined experience to increase their satisfaction and loyalty.

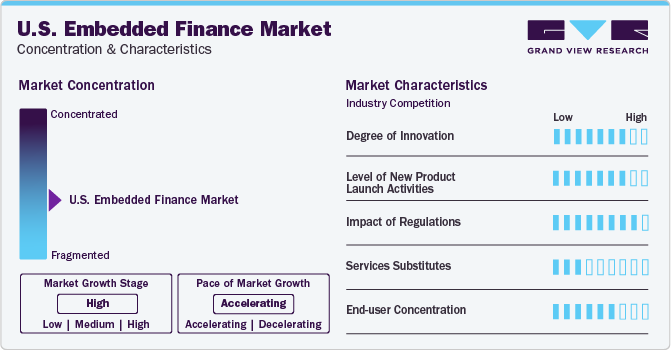

Market Concentration & Characteristics

The market growth stage is high, and pace of market growth is accelerating. As a number of start-ups are emerging in this industry to compete with established organizations, there is a substantial degree of innovation. The integration of generative AI in the near future can lead to creation of advanced chatbots that can more effectively understand a situational context and accordingly offer tailored financial support. Open banking, in combination with social media platforms and embedded finance, can lead to a greater level of customer acquisition, thus improving the company’s reach and ensuring a better customer experience. Investments are expected to remain strong in areas such as embedded finance and AI, which is expected to bring innovative solutions in the market.

There have been several developments in the form of launch of new solutions and services, mergers & acquisitions, and partnerships, which have established the industry’s expansion. For instance, in January 2023, the travel search engine KAYAK announced its partnership with Affirm, exclusively making the payment network its U.S. pay-over-time provider. Through this agreement, KAYAK travelers can select Affirm at KAYAK.com’s checkout page and split the overall accommodation, flight, and rental & car sharing costs over USD 150 into monthly payments. Such partnerships have become a major enabler of industry expansion.

In the U.S., as financial services are regulated heavily, the integration of financial products into a non-financial platform can lead to regulatory issues, making it necessary for providers to comply with regulations concerning consumer protection, data privacy, and anti-money laundering. These companies are adopting approaches such as collaborating with existing financial institutions that adhere to required regulations, or obtaining regulatory approvals and licenses to function as a financial institution. Different licensing types have been introduced to minimize third-party risks, with regulators rapidly adapting to address aspects such as KYC requirements.

The risk of substitutes is low for embedded finance technology, as it offers noticeable benefits such as faster and smoother transactions, better transparency for users, and extensive functionalities. Furthermore, the use of banking-as-a-service is expected to complement market expansion. The end-user base for embedded finance is growing rapidly in the U.S., as non-financial companies are increasingly considering this an effective solution for expanding their revenue stream. Concepts such as digital lending and digital payments have become well-established among both businesses and customers, leading to higher awareness about the use of these services.

Business Model Insights

The B2B segment held the largest revenue share of 31.12% in the U.S. embedded finance market in 2023, mainly aided by the increasing rate of launch of embedded finance platforms in this segment. Furthermore, increasing complexities in business requirements along with growing business trade digitization have created a necessity for embedded financing solutions. The ‘2023 Embedded Payments Survey’ conducted by BlueSnap in collaboration with Gartner highlighted the importance of embedded payments in B2B organizations. As per survey results, 48% respondents stated that embedded payments gave them a competitive advantage, while 34% reported a growth in new client acquisitions. This indicates strong demand for the technology in this area in the coming years. Several companies in the U.S. aim to bring innovative solutions in this space. For instance, Cybrid, a New Jersey-based provider of embedded finance API solutions, offers solutions that remove operational challenges in B2B payments by streamlining fund flow, incorporating stringent security measures, and simplifying the transaction process.

The B2C segment is expected to account for a substantial revenue share in the U.S. market over the forecast period. A consistent growth in the use of ride-sharing and food delivery services by Americans, particularly working professionals, has led companies such as Lyft, Uber, and GrubHub to enhance their apps by offering an end-to-end customer experience. As a result, consumers are able to seamlessly pay through in-app services, resulting in better customer satisfaction and increased revenue generation for the company. Uber offers a Branch-powered Uber Pro debit Mastercard and bank account, which enables couriers and drivers to receive a guaranteed cash back on refuelling their vehicles. Moreover, the feature also provides free automatic cash-outs after each trip, along with a backup balance of up to USD 150. Such initiatives are expected to aid market expansion.

Enterprise Size Insights

With regard to enterprise size, the large enterprises segment held the highest revenue share in the market in 2023. The United States has conventionally been home to a significant number of large-scale technological businesses such as Uber and Amazon, which has increased competition for better service offerings and integration of latest financial innovations. Large enterprises have a better grasp of government regulations and policies, while they also have the capacity to significantly invest in the development of embedded financing platforms. Additionally, frequent instances of strategic initiatives such as new product launches, mergers & expansions, and partnerships help drive segment growth.

The small and medium enterprises (SMEs) segment is expected to advance at the fastest CAGR through 2030. SMEs have become increasingly more open to integrating financial offerings as they have become more aware of their benefits in terms of customer satisfaction and revenue generation. According to an SME survey by Accenture, 41% of such enterprises claimed to be interested in leveraging banking services from a digital provider, while 47% stated that they were willing to pay same or more for the embedded finance technology, in comparison to conventional banks. Providers such as Affirm, Afterpay, Klarna, and Sezzle have gained significant traction in the SME sector, which has aided in boosting market demand in this area.

End-use Insights

In terms of end-use, the retail segment held a substantial market revenue share in 2023. With a view to provide more comprehensive and convenient services to their customers, retailers are turning to embedded finance solutions, boosting industry demand. The high popularity of digital wallets and their extensive usage by the younger and middle-aged demographics is a key aspect of embedded finance in retail. According to a study by Marqeta released in June 2023, 86% of mobile wallet users in the U.S. made a purchase through the embedded mobile application of retailers. The attractive payment rewards system associated with this trend is driving this behaviour. Digital wallets offer support for account-to-account transfers, leading to a potential reduction of transaction expenses for online as well as in-store purchases. The strengthening performance of the retail and e-commerce industries is expected to enable further market growth in the coming years.

The travel & entertainment segment is expected to expand at the fastest growth rate through 2030. Rapid developments in the digital media industry in recent years have led to increased consumption of video and music content on smartphones or tablets. Companies such as Netflix have eased the payment process for their subscriptions through in-app management of debit and credit cards that store user information securely. In the music industry, embedded finance helps to increase transparency for artists in their payment from promoters and improve their profits. Companies such as Kobalt and DICE are making major movements in this area, leading to their rising adoption among musicians.

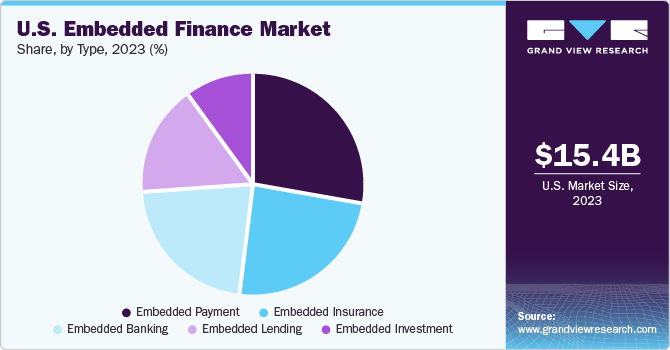

Type Insights

The embedded payment segment accounted for the largest revenue share in the U.S. market for embedded finance in 2023. The exponential growth of the e-commerce sector, particularly during the COVID-19 pandemic, has resulted in companies focusing on offering a seamless customer experience to retain business customers and individuals. Embedded payments streamline the payment process for users by enabling transaction processing at the point of service directly, thus avoiding page or application rerouting. This leads to several benefits for businesses, including higher conversion rates in direct-to-consumer sectors and better customer satisfaction due to a smoother purchase journey. According to BlueSnap, businesses that embed payments into a software platform can expect to see a five-fold rise in value per customer while also generating higher revenue. Thus, the segment is expected to maintain a strong growth pace in the coming years.

On the other hand, the embedded lending segment is expected to advance at the highest growth rate through 2030. The presence of embedded lending has increased the accessibility to favourable loan options for users at the point of sale and leads to increased sales for companies. The emergence of “Buy now, pay later” (BNPL) has made it very convenient for online shoppers to divide the payment over a period of time at no interest, making it easier to make premium purchases. This leads to increased sales for companies and improved customer engagement, leading to better chances of customer retention. As per the LendingTree BNPL Tracker report for February 2024, around 31% Americans stated that they were considering availing a BNPL loan for that month, highlighting the continued importance of this service for consumers.

Key U.S. Embedded Finance Company Insights

The presence of several established and emerging companies in the U.S. market for embedded finance has meant that there are notable developments in this space, particularly in recent years. Companies are aiming to generate better and more profitable revenue streams by leveraging this technology, leading to collaborations, partnerships, and merger & acquisition activities. Additionally, there is a growing focus on expanding geographical reach by understanding and complying with regulatory requirements in different states.

For instance, in June 2023, Stripe announced its partnership with Google Workspace to allow customers to directly pay for booking appointments with Google Calendar. In another development, the company launched its charge card program for Stripe Issuing, the company’s commercial card issuing offering. This program enables platforms and fintechs to provide expense cards to their customers with flexible credit options, offering platforms with additional revenue streams. Similar initiatives by other companies have solidified market growth in the United States.

Key U.S. Embedded Finance Companies:

- Stripe, Inc.

- PAYRIX

- Cybrid Technology Inc.

- ChargeAfter

- Lendflow

- Finastra

- FundThrough

- Fortis Payment Systems, LLC

- Transcard Payments

- Balance

Recent Developments

-

In February 2024, ChargeAfter announced that Citi Retail Services, a leading North American provider of credit solutions and retail payments, had selected ChargeAfter as a technology provider for its Citi Pay solutions, which include Citi Pay Installment Loan and Citi Pay Credit. The collaboration would allow online merchants to integrate Citi Pay products seamlessly into their PoS (point of sale) experience

-

In January 2024, Stripe announced that it had collaborated with Best Buy to enable the latter to expand into the prescription health and wellness technology product segments. As per the agreement, Stripe has offered its payment infrastructure service for ‘Wellness.BestBuyHealth.com’, which is Best Buy’s online platform for selling continuous glucose monitoring devices to customers

-

In January 2024, Cybrid announced that it was expanding its Fintech API platform to include B2B (business-to-business) payments. As part of this strategy, the integration of B2B payment capabilities with a KYB (Know Your Business) process is expected to facilitate seamless and smooth onboarding of business customers to allow both fiat as well as cryptocurrency transactions

-

In August 2023, Fortis announced its integration with the Sage 50 desktop accounting software that offers cloud connectivity, providing customers a comprehensive view of their inventory and business finances provided by Sage. This development aims to leverage the expertise of Fortis in payments technology and the advanced accounting functionalities of Sage, bringing an integrated and efficient solution for users

U.S. Embedded Finance Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 103.86 billion

Growth rate

CAGR of 32.0% from 2024 to 2030

Historical data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Type, business model, enterprise size, end-use

Key companies profiled

Stripe, Inc.; PAYRIX; Cybrid Technology Inc.; ChargeAfter; Lendflow; Finastra; FundThrough; Fortis Payment Systems, LLC; Transcard Payments; Balance

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Embedded Finance Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the U.S. embedded finance market report based on type, business model, enterprise size, and end-use:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Embedded Payment

-

Embedded Insurance

-

Embedded Investment

-

Embedded Lending

-

Embedded Banking

-

-

Business Model Outlook (Revenue, USD Billion, 2017 - 2030)

-

B2B

-

B2C

-

B2B2B

-

B2B2C

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2017 - 2030)

-

Large Enterprises

-

Small & Medium Enterprises (SMEs)

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Retail

-

Healthcare

-

Logistics

-

Manufacturing

-

Travel & Entertainment

-

Others

-

Frequently Asked Questions About This Report

b. The increasing smartphone penetration globally, coupled with the rapid proliferation of internet services across sectors such as retail, logistics, and media & entertainment, is a major factor driving market expansion in the United States.

b. The U.S. embedded finance market size was estimated at USD 15.36 billion in 2023 and is expected to reach USD 19.65 million in 2024.

b. The U.S. embedded finance market is expected to grow at a compound annual growth rate of 32.0% from 2024 to 2030 to reach USD 103.86 million by 2030.

b. In terms of business model, the B2B segment dominated the market in 2023. Increasing complexities in business requirements along with growing business trade digitization have created a necessity for embedded financing solutions, which is driving the B2B segment’s growth in U.S. embedded finance market.

b. Some key players operating in the U.S. embedded finance market Stripe, Inc., PAYRIX, Cybrid Technology Inc., ChargeAfter, Lendflow, Finastra, FundThrough, Fortis Payment Systems, LLC, Transcard Payments, and Balance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.