- Home

- »

- Healthcare IT

- »

-

U.S. Electronic Clinical Outcome Assessment Solutions Market, Industry Report, 2030GVR Report cover

![U.S. Electronic Clinical Outcome Assessment Solutions Market Size, Share & Trends Report]()

U.S. Electronic Clinical Outcome Assessment Solutions Market (2024 - 2030) Size, Share & Trends Analysis Report By Delivery Mode (Web & Cloud Based, On-premise), By End-user, And Segment Forecasts

- Report ID: GVR-4-68040-278-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

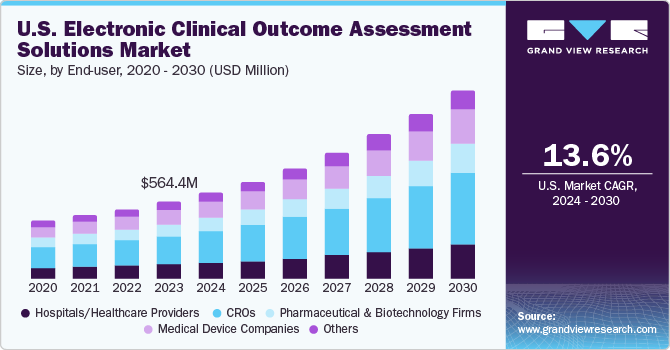

The U.S. electronic clinical outcome assessment solutions market size was valued at USD 625.3 million in 2023 and is estimated to grow at a CAGR of 13.6% from 2024 to 2030. The market growth is expected to be driven by an increasing number of clinical trials, the necessity to enhance compliance, efficient capture and management of clinical information, the need to reduce costs, and increasing R&D activities. Additionally, with the presence of organizations such as Oracle, Parexel International Corporation, and ERT Clinical, the electronic clinical outcome assessment market is becoming more competitive. These are the leading companies in the market with large eCOA product portfolios and major FDA & CE mark approvals, enabling them to introduce newer products with relative ease.

Moreover, clinical research practitioners are increasingly transitioning from paper-based processes to electronic data capture, with increased adoption of Electronic Clinical Outcome Assessment (eCOA) Solutions. Technological advancements in eCOA solutions have significantly improved their availability and ease of use. The decline in the popularity of paper-based approaches in recent years is evidence of the many benefits of using electronic technologies. Therefore, it is projected that ongoing technological advancements will fuel market expansion by providing an efficient workflow.

Clinical outcome assessments (COAs) are thus being used more frequently to evaluate the efficacy of various chronic illness therapies. These have frequently been critical in the regulatory approval of medicines. The addition of numerous services will also aid in its growth. As we move forward, we are witnessing a rapid growth in the healthcare industry, with more companies investing in clinical trials to bring innovative and effective treatments to patients. To cater to this demand, companies such as Signant Health have come up with novel acceleration programs that help reduce study setup timelines by 50.0% or more, without compromising the quality of clinical data. With the launch of such innovative programs, the demand for electronic clinical outcome assessment solutions is expected to increase, thereby boosting the overall market growth.

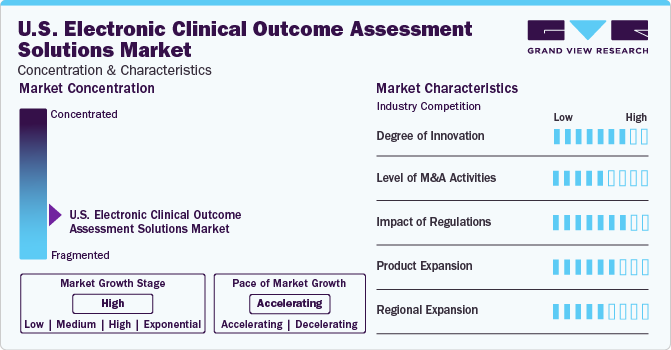

Market Concentration & Characteristics

The market is highly fragmented. The market growth is moderate, and the pace is accelerating. Several key companies are engaged in a high degree of innovation establishing innovative programs thereby boosting the growth of global electronic clinical outcome assessment solutions market. For instance, In September 2022, Clinical Ink introduced its new, configurable eCOA system. This updated eCOA technology guarantees quicker research deployment, higher data quality, and better patient engagement & compliance across all levels of protocol endpoint complexity. It is supported by outcomes science expertise across several treatment areas.

Furthermore, market growth is also expected to be enhanced by the regional expansion initiatives undertaken by key companies. For instance, in October 2022, Medidata announced a partnership with Boehringer Ingelheim for a five-year renewal of their collaboration in the wider area of electronic data capture. This collaboration is primarily focused on enhancing diversity and patient centricity in Decentralized Clinical Trials (DCT), which is expected to boost the growth of the eCOA solution market.

The regulatory authorities, such as the U.S. FDA & CFDA, are striving to strengthen the usefulness of data due to the industry-wide push toward patient-centricity. As a result, eCOAs have gained popularity as a method for streamlining the collection of patient data, and improving the accuracy & integrity of clinical research.

Healthcare companies are enhancing their presence in digital health through partnerships to expand their market shares. These collaborations aim to increase the precision of trials by integrating technological advancements. For instance, in February 2024, Sanofi Vaccines expanded its existing collaboration with Medidata Solutions by incorporating Medidata's electronic clinical outcome assessment (eCOA) technology into its vaccine studies. This initiative aims to accelerate the preparation of upcoming trials, optimize operational efficiency, and uphold stringent data quality standards.

End-user Insights

Contract Research Organizations (CROs) dominated the market with the largest revenue share of about 37% in 2023 and are expected to witness significant growth during forecast years owing to outsourcing of clinical research management by major biopharmaceutical and medical device companies. In March 2021, EvidentIQ introduced its next-generation eCOA and eFeasibility solutions for CROs and study sponsors. Such initiatives by key companies are likely to expand market growth.

Medical device companies are expected to grow at a faster CAGR from 2024 to 2030 due to higher adoption of eCOA by medical device manufacturers. The inclusion of eCOA data helps to produce the greatest outcomes for their regulatory submissions of medical devices. Moreover, eCOA also helps to ensure the integrity of clinical data, facilitating regulatory compliance and improving overall study quality. Such factors further boost the segments growth.

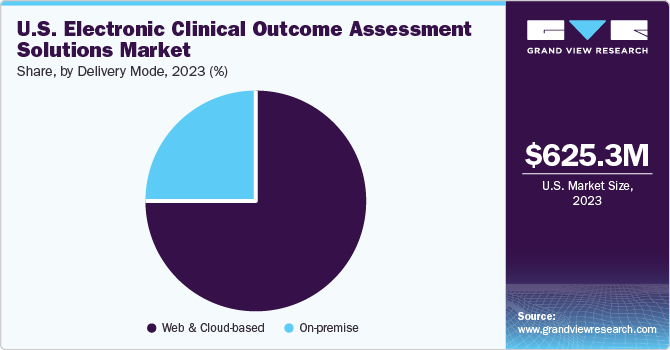

Delivery Mode Insights

Based on delivery mode, the web & cloud-based segment contributed to the largest revenue share of 76.6% in 2023. This growth can be attributed to the remote accessibility and sharing of the patient’s health information. Moreover, centralization of data, scalability, reduced costs, and uptime consistency of electrical clinical outcome assessment solutions drive the market growth. In addition, numerous players are undertaking various strategies to gain a higher market share. For instance, in March 2022, THREAD announced that it has started working with Amazon Web Services, Inc. to introduce updates to the THREAD platform powered by enterprise-scale automation and integrated artificial intelligence-driven technologies. These next-generation decentralized clinical trial technology features help with modern clinical research by facilitating quicker, more effective clinical trials and improving access for research participants with higher-quality data-capturing tools throughout the life cycle of a study.

The on-premise solutions segment is anticipated to grow at the fastest CAGR from 2024 to 2030 owing to the enhancing R&D activities by integrating digital solutions through eCOA, eSource, and clinical trials. Many hospitals and clinics are investing heavily to bring in technology-enabled solutions including on-premise IT solutions in the healthcare sector. Some of the key companies include IQVIA Inc., Medidata Solutions, Inc., Clario, ArisGlobal, Signant Health, and others.

Key U.S. Electronic Clinical Outcome Assessment Solutions Company Insights

The electronic clinical outcome assessment solutions market is consolidated and is dominated by key players such as Signant Health (US), IQVIA Holdings, Inc. (US), Oracle (US), Clario (US), Medable Inc. (US), Medidata (US), and Merative (US). The growth of the electronic clinical outcome assessment market is driven by strategic initiatives, M&A activities, and regional and product expansion undertaken by key companies.

Key U.S. Electronic Clinical Outcome Assessment Solutions Companies:

- IBM Corporation (U.S.)

- IBM Corporation (U.S.)

- Medidata Solutions, Inc. (U.S.)

- Clario (U.S.)

- Signant Health (U.S.)

- TransPerfect (U.S.)

- Cloudbyz (U.S.)

- linCapture (U.S.)

- Oracle Corporation (U.S.)

- Paraxel International Corporation (U.S.)

- eClinical Solutions LLC (U.S.)

- OmniComm Systems, Inc. (U.S.)

- CRF Health

Recent Developments

-

In September 2023, Thread Research announced the launch of a suite of new complexes (eCOA) comprised of the global library to its research platform. This new platform would help to reduce 100% of customized development activities for eCOA along with a 54 % cost reduction for eCOA implementation. Moreover, this would greatly increase compliance by removing unnecessary technology burdens.

-

In August 2022, Clario announced an investment in new translation service technology to help expedite the initiation of eCOA studies and improve patients’ access to clinical trials globally.

-

In June 2022, Medidata and Novotech expanded their partnership to continue advancements in clinical research. Utilizing Medidata's eCOA, Rave EDC, Rave RTSM, and eConsent technologies, Novotech is equipped with adjustable, adaptable tools that can scale up clinical research needs and speed up drug & device development in the U.S. and Asia Pacific region.

U.S. Electronic Clinical Outcome Assessment (eCOA) Solutions Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 698.9 million

Revenue forecast in 2030

USD 1.5 billion

Growth rate

CAGR of 13.6% from 2024 to 2030

Base year for estimation

2023

Actual estimates/Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Delivery mode, end-user

Country scope

U.S.

Key companies profiled

IBM Corporation; IQVIA; Medidata Solutions, Inc.; Clario; Signant Health; TransPerfect; Cloudbyz; linCapture; Oracle Corporation; Paraxel International Corporation; eClinical Solutions LLC; OmniComm Systems, Inc.; CRF Health

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electronic Clinical Outcome Assessment Solutions Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. electronic clinical outcome assessment solutions market based on delivery mode, and end user:

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Web & Cloud-based

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals/Healthcare providers

-

CROs

-

Pharmaceutical and Biotechnology Firms

-

Medical Device Companies

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. electronic clinical outcome assessment solutions market size was estimated at USD 625.3 million in 2023 and is expected to reach USD 698.9 million in 2024.

b. The U.S. electronic clinical outcome assessment (eCOA) solutions market is expected to grow at a compound annual growth rate of 13.6% from 2024 to 2030 to reach USD 1.5 billion by 2030.

b. The CROs dominated the U.S. eCOA solutions market with a share of 36.96% in 2023. This is attributable to the outsourcing of clinical research management by major biopharmaceutical and medical device companies.

b. Key players in the U.S. electronic clinical outcome assessment solutions market are IBM; IQVIA Inc.; Medidata Solutions, Inc.; Clario; ArisGlobal; Signant Health; TransPerfect; Cloudbyz; Clime do Health GmbH; ClinCapture.

b. Key factors that are driving the U.S. electronic clinical outcome assessment solutions market growth include rising adoption of eCOA by medical research professionals and the rising burden on pharmaceutical manufacturers to cut down overall costs for new drug development procedures has resulted in their rising inclination toward electronic data capturing from paper-based procedures.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.