- Home

- »

- Medical Devices

- »

-

U.S. Electro-medical And Electrotherapeutic Apparatus Market, 2030GVR Report cover

![U.S. Electro-medical And Electrotherapeutic Apparatus Market Size, Share & Trends Report]()

U.S. Electro-medical And Electrotherapeutic Apparatus Market Size, Share & Trends Analysis Report By Product (Diagnostic, Therapeutic, Surgical), By Application (Cardiology, Oncology, Neurology), By End-use, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-490-4

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

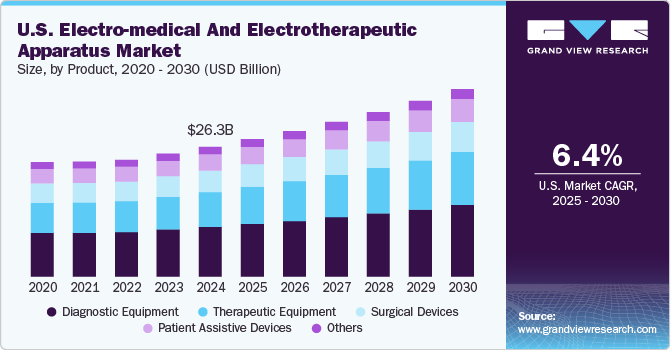

The U.S. electro-medical and electrotherapeutic apparatus market size was estimated at USD 26.25 billion in 2024 and is expected to grow at a CAGR of 6.4% from 2025 to 2030. The country’s expanding geriatric population, an increasing focus on non-invasive and minimally invasive treatment options, and the rising prevalence of chronic diseases are key drivers for the U.S. electro-medical and electrotherapeutic apparatus industry. For instance, according to the International Agency for Research on Cancer, the U.S. saw approximately 2.38 million new cancer cases in 2022, a number expected to reach 7.85 million within the next five years. For instance, according to the International Agency for Research on Cancer, the U.S. saw approximately 2.38 million new cancer cases in 2022, a number expected to reach 7.85 million within the next five years.

The U.S. is recognized as a leader in adopting advanced healthcare technologies, which has created a highly supportive environment for the growth of the U.S. electro-medical and electrotherapeutic apparatus industry. The presence of major industry players, including both established and emerging companies, further strengthens this market. These players are continuously investing in research and development, launching innovative products, and forming strategic partnerships to meet the rising demand for high-quality, non-invasive, and minimally invasive treatments.

By introducing advanced solutions designed to improve patient outcomes and support healthcare professionals, these companies are effectively driving market expansion. These companies drive market growth by introducing advanced solutions that enhance patient outcomes and support healthcare professionals. For instance, in October 2024, GE HealthCare announced the installation of its 100th Omni Legend digital PET/CT system in the United States and Canada at the newly opened UW Health Eastpark Medical Center in Madison. Moreover, less than a year after joining Wisconsin’s BioHealth Tech Hub, GE HealthCare is strengthening the region’s personalized medicine innovation and manufacturing ecosystem by establishing the first North American production line for the system in Waukesha, Wisconsin.

The shift to modern lifestyles in the U.S. has brought changes in diet, physical activity, stress levels, and work routines, which, while adding convenience, are also linked to an increase in chronic health conditions such as diabetes, cardiovascular diseases, and respiratory disorders. For instance, according to National Association of Chronic Disease Directors, in 2022, nearly 60% of adult U.S. citizens had at least one chronic disease. This shift highlights the growing need for advanced medical solutions to manage the growing healthcare burden posed by these conditions.

In addition, there is a rising demand for innovative medical devices that facilitate early diagnosis, proactive health management, and minimally invasive treatments. With increased public awareness of chronic diseases and the advantages of advanced healthcare technologies, both patients and healthcare providers are turning to electro-medical and electrotherapeutic devices to improve patient outcomes and enhance quality of care.

Market Concentration & Characteristics

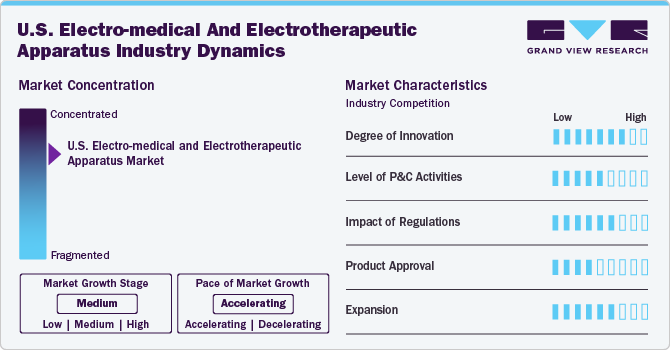

The U.S. electro-medical and electrotherapeutic apparatus industry is experiencing substantial growth, owing to continuous advancements in medical technology, growing public awareness of health management options, and favorable healthcare policies. As medical technology evolves, new electro-medical devices are emerging that offer improved precision, safety, and efficiency in diagnosis and treatment. These advancements are making treatments less invasive and more accessible, aligning with a growing patient preference for minimally invasive options. In addition, public awareness campaigns and health education initiatives have increased knowledge about the benefits of electro-medical devices, leading to higher demand and adoption.

Industry players are actively pursuing strategies to remain competitive, including initiatives such as expanding product reach, launching new solutions, and obtaining regulatory approvals. For instance, in September 2024, Abbott introduced the U.S. release of its Lingo system, marking the company's first continuous glucose monitoring (CGM) system available over-the-counter. The Lingo system features a biosensor paired with a mobile app designed to help consumers track glucose levels as part of their health and wellness goals, making it more accessible for individuals looking to enhance overall health.

The industry is experiencing a high degree of innovation, marked by rapid advancements in technology and a focus on improving patient outcomes. In January 2024, Abbott and Tandem Diabetes Care, Inc. announced that the t:slim X2 insulin pump with Control-IQ technology is now integrated with Abbott's FreeStyle Libre 2 Plus sensor, offering users in the U.S. the benefits of a hybrid closed-loop system that helps manage and prevent high and low blood sugar levels.

The industry is seeing a significant rise in partnerships and collaborations, as companies work to broaden their service offerings and reach a wider customer base. In November 2023, The University of Wisconsin School of Medicine and Public Health at UW–Madison and GE Healthcare have announced a significant 10-year strategic collaboration, further advancing a longstanding partnership that has endured for over 40 years. This new research collaboration marks an expansion beyond the realm of medical imaging, delving into innovative territories in digital technologies and disease-focused solutions.

Regulations have a strong influence on the U.S. electro-medical and electrotherapeutic apparatus industry, ensuring that products meet safety and quality standards. The FDA plays a key role in overseeing these devices, requiring them to undergo testing before they can be sold to the public. While following these regulations can be costly and time-consuming for manufacturers, it also helps them to improve the design and reliability of their products.

Market players are increasingly seeking product approval to ensure their devices meet regulatory standards and gain access to the market. In January 2024, Abbott announced that the FDA has approved expanded MRI labeling for its dorsal root ganglion (DRG) stimulation therapy, specifically for the Proclaim DRG neurostimulation system.

Industry players are actively engaged in expansion efforts to extend their reach and enhance service offerings. An example of this is the growing partnership between GE HealthCare and Tampa General Hospital (TGH), one of the leading academic health systems in the U.S. The two organizations have deepened their collaboration by announcing an agreement to deploy GE HealthCare’s advanced Imaging and Ultrasound technology solutions across TGH Imaging’s outpatient facilities throughout Florida.

Product Insights

Diagnostic equipment segment held the largest market share of about 38.2% in 2024. This dominance can be attributed to the rising prevalence of chronic disorders, which has led to an increased demand for advanced diagnostic tools and technologies. As chronic diseases such as cardiovascular conditions, diabetes, and cancer become more common, healthcare providers require more sophisticated and accurate diagnostic equipment to detect and manage these conditions effectively. According to the CDC, heart disease is the leading cause of death for men, women, and people across racial and ethnic groups in the U.S., with one death occurring every 33 seconds due to cardiovascular complications.

Therapeutic equipment segment is expected to grow at a fastest CAGR of 7.2% over the forecast period. Technological advancements are transforming this segment, enabling more personalized and effective therapeutic options. For instance, in February 2024, the FDA approved Boston Scientific's Spinal Cord Stimulator Systems specifically for managing non-surgical back pain.Therapeutic devices feature capabilities like customizable treatment settings, enhanced safety features, and even AI-driven adjustments based on real-time patient responses. These innovations are driving the adoption of therapeutic equipment across healthcare facilities.

Application Insights

The cardiology segment dominated the market by capturing a share of more than 25% in 2024. This dominance is primarily driven by the increasing prevalence of cardiovascular diseases and the growing demand for precise and effective diagnostic and therapeutic tools, which are fueling the adoption of electro-medical and electrotherapeutic devices in cardiology. In addition, market players are actively launching new products to maintain their competitive edge, often securing regulatory approvals for advanced devices. For instance, in October 2023, Medtronic received FDA approval for its extravascular defibrillator, designed to treat abnormal heart rhythms and sudden cardiac arrest.

The neurology segment is expected to grow at a CAGR over the forecast period. This is owing to the increasing incidence of neurological disorders such as stroke, epilepsy, and neurodegenerative diseases. The growing demand for advanced diagnostic tools and therapies, including brain stimulation devices, EEG monitors, and neuroimaging equipment, is propelling the market growth. In addition, innovations in neurotechnology, such as non-invasive treatments and personalized therapies, are enhancing the effectiveness of care and improving patient outcomes

End-use Insights

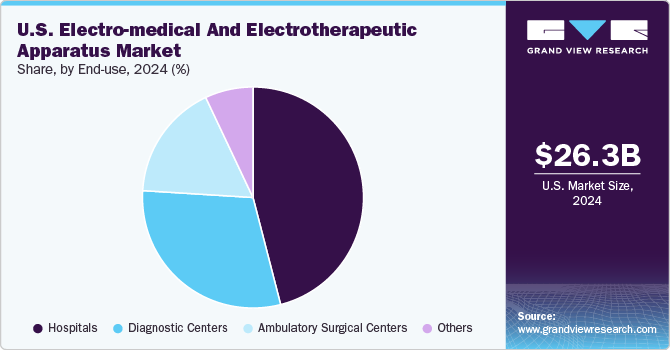

Hospitals segment dominated the market with a share of nearly 45% in 2024, driven by the increasing adoption of advanced electro-medical and electrotherapeutic devices within hospital settings. The demand for precise, high-quality medical equipment is particularly strong in hospitals, which rely on these devices for a wide range of diagnostic, monitoring, and therapeutic applications, such as treating chronic diseases, cardiovascular conditions, and neurological disorders. In addition, the growing focus on enhancing patient outcomes through early detection, accurate diagnostics, and more effective treatment strategies is driving the widespread use of advanced technologies in hospitals.

The diagnostic imaging centers segment is anticipated to experience the fastest growth over the forecast period. These centers are becoming increasingly popular among patients due to their advanced medical equipment and the ability to provide quicker results with minimal wait times. Equipped with advanced imaging technologies such as CT scanners, MRI machines, ultrasound devices, and advanced laboratory testing tools, diagnostic imaging centers can offer accurate and efficient diagnostic services. This combination of technology and speed is driving their growing preference in the healthcare industry.

Key U.S. Electro-medical And Electrotherapeutic Apparatus Company Insights

The presence of major players in the U.S. electro-medical and electrotherapeutic apparatus market is a key factor influencing market dynamics, as these companies actively work to capture a larger market share and expand their customer base. To achieve this, leading industry players are making significant investments in research and development to innovate and introduce new products that address the evolving needs of healthcare providers and patients. In addition to innovation, these companies are pursuing strategic activities such as partnerships, collaborations, mergers, and acquisitions. These initiatives not only enhance their product offerings but also enable them to strengthen their market position, broaden their reach, and access new customer segments.

Key U.S. Electro-medical And Electrotherapeutic Apparatus Companies:

- GE HealthCare

- Koninklijke Philips N.V.

- Siemens Healthineers AG

- Medtronic

- Abbott

- Boston Scientific Corporation

- Fujifilm Holdings Corporation

- Zimmer Biomet

- Nihon Kohden Corporation

- OMRON Healthcare, Inc.

- Invacare Corporation

Recent Developments

-

In July 2024, Fujifilm Holdings Corporation, announced the U.S. launch of APERTO Lucent, a high-performance open 0.4T MRI system designed to enhance imaging capabilities.

-

In July 2024, Nihon Kohden Corporation announced that Houston Methodist, a prominent healthcare institution in the Greater Houston area, has become a new client for its patient monitoring solutions. This partnership represents a substantial expansion of Nihon Kohden’s footprint in the Texas healthcare market.

-

In June 2024, Fujifilm Holdings Corporation announced that it has received FDA 510(k) clearance for its new compact 128-slice computed tomography (CT) system, the FCT iStream.

-

In October 2023, Boston Scientific Corporation announced that the FDA has approved an expanded indication for the WaveWriter Alpha Spinal Cord Stimulator (SCS) Systems, allowing its use in the treatment of painful diabetic peripheral neuropathy (DPN), a complication of diabetes that affects the lower extremities.

U.S. Electro-medical And Electrotherapeutic Apparatus Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 27.79 billion

Revenue forecast in 2030

USD 37.91 billion

Growth rate

CAGR of 6.4% from 2025 to 2030

Actual period

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use

Key companies profiled

GE HealthCare; Koninklijke Philips N.V.;Siemens Healthineers AG; Medtronic; Abbott; Boston Scientific Corporation; Fujifilm Holdings Corporation; Zimmer Biomet; Nihon Kohden Corporation; OMRON Healthcare, Inc.; Invacare Corporation

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electro-medical And Electrotherapeutic Market Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. electro-medical and electrotherapeutic apparatus market report on the basis of product, application and end-use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostic Equipment

-

Therapeutic Equipment

-

Surgical Devices

-

Patient Assistive Devices

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Neurology

-

Oncology

-

Orthopedics

-

Gynecology

-

Urology

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Diagnostic Centers

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. electro-medical and electrotherapeutic apparatus market size was estimated at USD 26.25 billion in 2024 and is expected to reach USD 37.91 billion in 2025.

b. The U.S. electro-medical and electrotherapeutic apparatus market is expected to grow at a compound annual growth rate of 6.4% from 2025 to 2030 to reach USD 37.91 billion by 2030.

b. The diagnostic equipment segment dominated the U.S. electro-medical and electrotherapeutic apparatus market with a share of 38.2% in 2024. This is due to the rising prevalence of chronic disorders, which has led to an increased demand for advanced diagnostic tools and technologies.

b. Some key players operating in the U.S. electro-medical and electrotherapeutic apparatus market include GE HealthCare; Koninklijke Philips N.V.;Siemens Healthineers AG; Medtronic; Abbott; Boston Scientific Corporation; Fujifilm Holdings Corporation; Zimmer Biomet; Nihon Kohden Corporation; OMRON Healthcare, Inc.; Invacare Corporation

b. Key factors that are driving the U.S. electro-medical and electrotherapeutic apparatus market growth include expanding geriatric population, an increasing focus on non-invasive and minimally invasive treatment options, and the rising prevalence of chronic diseases

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."