U.S. Electric Vehicle Charging Infrastructure Market Size, Share & Trends Analysis Report By Charger Type (Slow Charger, Fast Charger), By Connector Type, By Level Of Charging, By Connectivity, By Application, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-3-68038-309-6

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

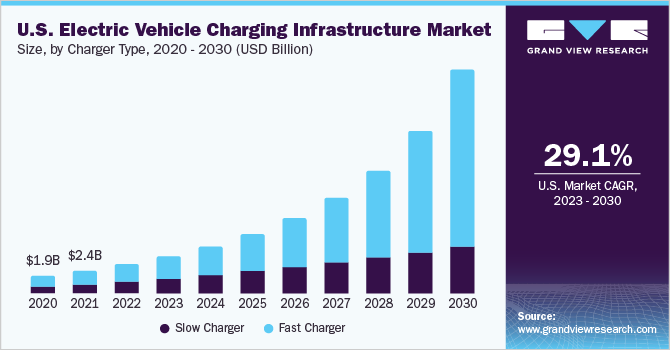

The U.S. electric vehicle charging infrastructure market size was valued at USD 5.09 billion in 2024 and is projected to grow at a CAGR of 30.3% from 2025 to 2030. The market growth can be attributed to the growing initiatives taken by both the public as well as private sectors to encourage the adoption of Electric Vehicles (EVs). These initiatives have promoted the sale of electric vehicles and have also spread consumer awareness about the benefits of using these vehicles. Moreover, the development of technologies like portable charging stations, smart charging with load management, automated payment technology, and bi-directional charging is further expected to create new growth opportunities for the market over the forecast period.

Numerous electric vehicle charging station providers are focusing on developing new products that provide customers with better charging infrastructures. For instance, in January 2023, Leviton Manufacturing Co., Inc. announced plans to introduce EV Series charging stations compatible with the My Leviton application. The series comprises Level 2 charging stations with 32-, 48-, and 80-amp capacities, capable of charging any electric vehicle model in North America. This development underscores Leviton Manufacturing Co., Inc.’s commitment to providing advanced EV charging solutions to meet the growing demand for electric mobility. Such initiatives are expected to create more growth opportunities for the market over the forecast period.

The U.S. government’s incentives and policies aimed at promoting EV adoption are further boosting the market’s growth. Federal and state governments are increasingly offering tax credits, rebates, and grants for EV purchases and charging station installations. The Infrastructure Investment and Jobs Act has allocated substantial funding for expanding the charging network, which is expected to accelerate the deployment of charging stations across urban and rural areas. This supportive regulatory environment is encouraging both private and public investments in charging infrastructure, enhancing accessibility and convenience for EV users.

Technological advancements such as fast charging and increased vehicle range are anticipated to transform the U.S. automotive industry over the forecast period. The major trends driving the adoption of Electric Vehicles (EVs) are the emergence of self-driving vehicles and the growth of shared mobility. Both of these factors have a significant impact on U.S. EV vehicle sales. The growth of ride-hailing and ridesharing services will enable users to increase their utilization rate which in turn will provide economical transportation facilities to commuters. The growing popularity of the mobility-as-a-service (MaaS) model is also anticipated to lead to increased adoption of electric vehicles, thereby propelling the growth of the U.S. electric vehicle charging infrastructure market.

High costs of infrastructure and initial set-up are emerging as major factors hampering market growth. Even though electric vehicle adoption is increasing at an increasing rate, costs incurred for research & development activities are highly significant since they require a dedicated workforce. The need for financial and human resources to develop innovative charging equipment is expected to restrain market growth during the forecast period. Moreover, the shortage of lithium-ion batteries, the issue of disposing of electric vehicle batteries, and the potential wastage that it would create, are expected to hinder the market’s growth.

Charger Type Insights

The fast charger mode segment accounted for the largest share of 60.36% in 2024. The growth of the segment is attributed to the rising demand for fast charging for long-distance travel, which has led to the deployment of fast chargers across the highways. Moreover, in February 2022, the federal government in the U.S. planned to provide USD 5 billion to its states for five years to build a nationwide network of fast chargers. This plan focuses on the interstate highway system and directs states to build a charging station every 50 miles, which must be capable of charging at least four electric vehicles simultaneously at 150 kW.

The slow charger segment is expected to witness moderate growth during the forecast period. Slow chargers are often more cost-effective compared to their fast-charging counterparts, making them an attractive option for both consumers and businesses. The demand for slow chargers is significantly driven by vehicle owners who prefer charging vehicles at home using a standard electricity outlet. The segment is expected to witness remarkable growth over the forecast period attributed to the rise in the popularity of EVs and the inclination of users toward buying plug-in hybrid electric vehicles.

Connector Type Insights

The combined charging system (CCS) segment held the largest market in 2024. The CCS is a standard for charging electric vehicles (EVs) that combines both AC and DC charging capabilities in one connector. The increasing electrification and support by major manufacturers and OEMs, including Daimler AG; Ford Motor Company; General Motor Company; and Volkswagen is driving the segment growth. A CCS connector supports slow and fast charging since it uses the Programmable Logic Controller (PLC) protocol, which is a part of smart grid protocols.

The CHAdeMO segment is expected to register a significant CAGR during the forecast period. Easy integration with smart grid infrastructure and bi-directional charging capability is anticipated to drive the growth of the CHAdeMO segment over the forecast period. Moreover, research & development initiatives and investments by electric vehicle manufacturers such as Nissan Motor Co., Ltd. and Mitsubishi Motors Corporation for developing DC fast charging networks to support long-range travel is expected to drive the demand for CHAdeMO in the U.S. market.

Level of Charging Insights

The level 2 charging segment dominated the market in 2024. Level 2 charging provides a middle ground in terms of cost and charging speed as it charges at a faster speed than level 1 chargers and is less costly as compared to level 3 chargers. The growing adoption of level 2 charging can be attributed to its lower costs and fast charging capabilities. Moreover, level 2 charging systems operate based on battery capacity and the state of its charge, which extends the vehicle range, driving its adoptions. Such features are expected to drive the market’s growth over the forecast period.

Level 3 charging is expected to grow at the highest CAGR during the forecast period. Level 3 chargers can provide an average of 100 miles of charge per hour by utilizing a 480-volt higher direct current. Since the level 3 charger has a fast charging capacity, it reduces waiting time for electric vehicle users. Moreover, having a robust network of level 3 chargers will lead to a larger range and lower range anxiety for drivers, which is expected to drive the adoption of level 3 charging.

Connectivity Insights

The non-connected charging stations segment dominated the market in 2024. Non-connected charging solutions are also known as non-networked or stand-alone charging solutions. Without the bother of ongoing fees associated with a charging network, non-connected charging options provide consumers with safe and secure charging options. Consumers can pay for the charging facilities on a per-user basis with non-connected charging systems, which replicate the user experience of conventional fuel pumps. Some of the non-connected charging solutions combine their hardware with software platforms so that users may access comprehensive diagnostic information and keep track of the health of their chargers. Additionally, since there are no activation or other ongoing networking fees, non-connected chargers have reduced initial and ongoing costs. Low infrastructure costs for owners and hassle-free charging experience for consumers are expected to drive the segment’s growth.

The connected charging stations segment is expected to grow at the highest CAGR during the forecast period. A network charger, often known as a connected charging solution, is a charging network that is controlled by network software. Electric vehicles are equipped with features that are beneficial to hosts and drivers. Site hosts, for example, can gain network access features like remote administration, advanced analytics, energy management capabilities, and round-the-clock customer assistance, while drivers can access it for a variety of uses, including location and reservation via applications. These characteristics will become increasingly important as the number of drivers of electric vehicles rises over the next years, which is anticipated to drive the adoption of connected charging solutions over the forecast period.

Application Insights

The residential segment dominated the market in 2024. The residential segment is further bifurcated into private houses and apartments. Electric vehicle chargers for residential spaces can also offer significant growth potential as they provide a cheaper and more convenient mode for charging electric vehicles as compared to commercial charging stations. Since users prefer charging their vehicles at home owing to ease and convenience, they opt for AC charging stations for EVs, as the cost of installation is reasonably low compared to DC charging stations. Hence, DC charging stations have a lower adoption rate in the residential segment due to the significant costs involved in their installation.

The commercial segment is anticipated to grow rapidly during the forecast period. The commercial segment is further bifurcated into destination charging stations, highway charging stations, bus charging stations, fleet charging stations, and other charging stations. Favorable government initiatives to deploy charging stations on highway projects such as the Trans-Canada highway project and the Norway to Italy Electric Highway, are driving the growth of the segment.

Key U.S. Electric Vehicle Charging Infrastructure Company Insights

Some of the key companies in the U.S. electric vehicle charging infrastructure market include ChargePoint, Inc., Leviton Manufacturing Co., Inc., and Tesla Inc., among others. Organizations are focusing on developing EV charging solutions to gain a competitive advantage. Therefore, key players are taking several strategic initiatives, such as new product launches, mergers and acquisitions, and partnerships, among others.

-

ChargePoint, Inc. is a provider of charging technology solutions for electric vehicles, with a focus on creating a comprehensive charging network that promotes the use of electricity in the transportation sector. The company offers networked charging solutions for commercial use, fleets, and residential use in North America and Europe.

-

Blink Charging Co. offers a range of residential and commercial charging equipment and networked services for EV owners. The company's subsidiaries handle manufacturing, ownership, operation, and provision of these services, catering to the growing demand for EV charging in the U.S. and international markets.

Key U.S. Electric Vehicle Charging Infrastructure Companies:

- ChargePoint, Inc.

- Leviton Manufacturing Co., Inc.

- SemaConnect, Inc.

- Tesla, Inc.

- ClipperCreek, Inc.

- General Electric Company

- Delta Electronics, Inc

- Webasto Group

- ABB Ltd.

- bp pulse

Recent Developments

-

In February 2023, bp pulse unveiled plans to invest USD 1 billion in the development of electric vehicle (EV) charging stations in the U.S. by 2030, with a significant aspect of the investment dedicated to collaborating with The Hertz Corporation on the construction of fast-charging infrastructure at The Hertz Corporation’s facilities in prominent cities such as Austin, Atlanta, Boston, Denver, Chicago, New York City, Houston, Miami, Phoenix, Orlando, San Francisco, and Washington, DC.

U.S. Electric Vehicle Charging Infrastructure Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 6.41 billion |

|

Revenue forecast in 2030 |

USD 24.07 billion |

|

Growth rate |

CAGR of 30.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Charge type, connector type, level of charging, connectivity, application |

|

Key companies profiled |

ChargePoint, Inc., Leviton Manufacturing Co., Inc., SemaConnect Inc., Tesla, Inc., ClipperCreek, Inc., General Electric Company, Delta Electronics, Inc., Webasto Group, ABB Ltd., bp pulse |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

U.S. Electric Vehicle Charging Infrastructure Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. electric vehicle charging infrastructure market report based on charger type, connector type, level of charging, connectivity, and application.

-

Charger Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Slow Charger

-

Fast Charger

-

-

Connector Type Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

CHAdeMO

-

Combined Charging System

-

Others

-

-

Level of Charging Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Level 1

-

Level 2

-

Level 3

-

-

Connectivity Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Non-connected Charging Stations

-

Connected Charging Stations

-

-

Application Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Destination Charging Stations

-

Highway Charging Stations

-

Bus Charging Stations

-

Fleet Charging Stations

-

Other Charging Stations

-

-

Residential

-

Private Houses

-

Apartments

-

-

Frequently Asked Questions About This Report

b. The global U.S. electric vehicle charging infrastructure market size was estimated at USD 5.09 billion in 2024 and is expected to reach USD 6.41 billion in 2025.

b. The global U.S. electric vehicle charging infrastructure market is expected to grow at a compound annual growth rate of 30.3% from 2025 to 2030 to reach USD 24.07 billion by 2030.

b. Fast Chargers dominated the U.S. electric vehicle charging infrastructure market with a share of 60.36% in 2024. This is attributable to the consumer's preference as it's easily accessible with minimal time.

b. Some key players operating in the U.S. electric vehicle charging infrastructure market include ChargePoint, Inc., Leviton Manufacturing Co., Inc., SemaConnect, Inc., Tesla, Inc., ClipperCreek, Inc., General Electric Company, Delta Electronics, Inc, Webasto Group, ABB Ltd., bp pulse

b. Key factors that are driving the U.S. EV charging infrastructure market growth include government regulations and investments for developing infrastructure for Electric Vehicles (EVs), including charging spots in parking and charging stations.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."