- Home

- »

- Automotive & Transportation

- »

-

U.S. Electric UTV And ATV Powertrain Market Report, 2030GVR Report cover

![U.S. Electric UTV And ATV Powertrain Market Size, Share & Trends Report]()

U.S. Electric UTV And ATV Powertrain Market (2023 - 2030) Size, Share & Trends Analysis Report By Vehicle Type (Neighborhood Electric Vehicle, All-terrain Vehicle, Utility Task Vehicle), By Powertrain Type (2 In 1, 3 In 1), And Segment Forecasts

- Report ID: GVR-4-68040-152-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

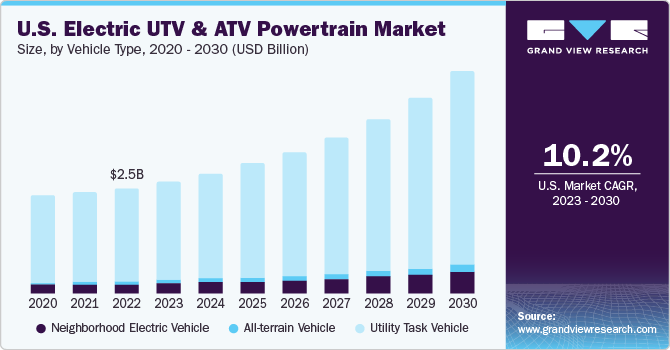

The U.S. electric UTV and ATV powertrain market size was estimated at USD 2.46 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 10.2% from 2023 to 2030. The growth is attributed to the growing concern for environmental sustainability. As awareness about the impact of carbon emissions on the environment increases, there has been a noticeable shift toward cleaner energy alternatives. The advancement of electric UTV and ATV powertrains aligns with the global trend of promoting eco-friendly transportation solutions. With the increasing focus on sustainable practices, there is a rise in demand for electric-powered vehicles that can operate efficiently without compromising performance. This shift in consumer preference to offer robust and reliable electric powertrains has been a significant driving force of the market’s growth. Besides, automotive manufacturers are also investing in the development and production of advanced electric UTV and ATV powertrain systems.

The increasing availability of government incentives and subsidies for electric vehicles (EVs) such as neighborhood vehicles, ATVs, and UTVs has further increased the demand for electric ATV and UTV powertrain. The substantial cost saving associated with the operation and maintenance of electric UTVs and ATVs compared to their conventional internal combustion engine counterparts is gaining consumers traction in the market. For instance, in July 2022, the Iowa State Government permitted ATV users to traverse all 99 counties of the state. This permit was influenced by a survey undertaken by the state government, which polled 4,600 individuals. Thus, riders freely operate their vehicles on state roadways which is poised to influence more enthusiasts to own new gasoline-powered and battery-powered ATVs.

Electric ATVs are convenient and accessible for people, they are increasing consumer preference for electric ATVs has a cascading effect on the demand for electric ATV and UTV powertrain market. However, their growth in the U.S. is restrained by the development of electric powertrains that can effectively provide the necessary power-to-weight ratios crucial for maneuvering rugged terrains. Unlike conventional vehicles, electric ATVs and UTVs require robust powertrains that can deliver substantial torque to tackle challenging landscapes, including steep inclines, rocky surfaces, and muddy tracks. Achieving this balance between power and weight in rough terrains remains challenging for electric ATVs and UTVs, thus hindering their widespread adoption.

The advancements in electric powertrain technology, including battery efficiency, have enhanced the performance and appeal of electric ATVs and UTVs. As the technology continues to evolve, EVs are becoming capable of handling rough terrains and offering comparable performance to their traditional counterparts. This development caters to the growing demand for sustainable recreational vehicles and provides an opportunity for manufacturers to tap into a market with the potential for substantial growth and innovation. In July 2023, DRR USA, an RTV manufacturer partnered with BRITE Energy Innovators, an electric powertrain and battery solution provider, to improve the BMS and controls for electric ATVs. DRR USA aimed to increase the driving range and reduce the maintenance of its electric ATVs through this partnership. As a result, the integration of electric powertrains in the ATV and UTV sectors is poised to drive significant expansion and transformation within the market, shaping the future of off-road recreational vehicles in the U.S.

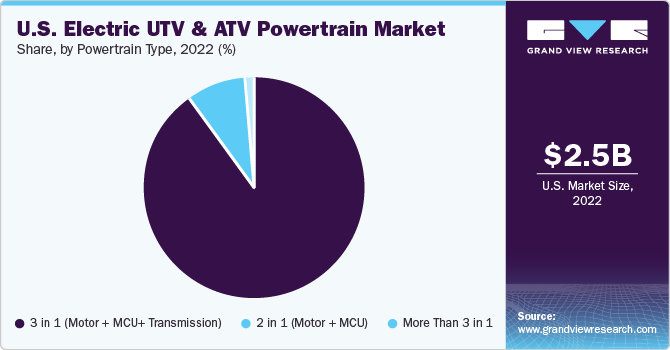

Powertrain Type Insights

The 3 in 1 (Motor + MCU+ Transmission) segment accounted for the largest market share of over 90.0% in 2022. The increasing demand for ATVs and UTVs for outdoor recreational activities has significantly fueled the demand for 3 in 1 powertrain type in the U.S. The integration of sophisticated MCUs has enabled better control over vehicle performance, leading to improved traction, stability, and overall handling. In September 2021, General Motors introduced its new electric motors series, named Ultium, which included a 62-kW all-wheel drive assist induction motor, compatible with all-wheel, rear-wheel, and front-wheel drive propulsion combinations. They improve off-road and high-performance capabilities of the drivetrain. As a result, the combination of a powerful motor and a smart transmission system, managed by the MCU, has significantly enhanced the vehicle's overall capabilities, making it more adaptable to various terrains and tasks.

The more than 3 in 1 segment is expected to register the highest CAGR over the forecast period. The increasing trend of customization and personalization among UTV and ATV enthusiasts has contributed significantly to the demand for more complex and integrated systems. Consumers are seeking vehicles that offer a seamless blend of power, agility, and technological advancements to meet their specific requirements for various recreational and utility activities. For instance, BorgWarner, Inc. offers EV transmission possessing a wide range of gear ratios such as 6.54, 7.17, 8.28, 8.76, and 9.07, and adaptable to an extensive range of electric vehicles. As a result, such factors are expected to provide the segment’s growth opportunities for the U.S. electric UTV and ATV powertrain industry over the forecast period.

Vehicle Type Insights

The Utility Task Vehicle (UTV) segment accounted for the largest market share of over 89.0% in 2022. The growing popularity of UTVs in the U.S. can be attributed to the development of advanced battery technologies that have improved the overall performance and range of electric UTVs, addressing previous concerns regarding limited battery life and performance capabilities. This has further boosted consumer preferences in the feasibility and reliability of electric UTVs for a wide range of applications, including recreational use, agricultural work, and industrial operations. Moreover, UTVs tend to be highly customizable as they come with a variety of accessories and upgrades to cater to the demands of individuals and businesses.

The All-terrain Vehicle (ATV) segment is anticipated to register the highest CAGR over the forecast period. The growing popularity and adoption of electric ATVs in the U.S. can be attributed to the increasing concern over environmental sustainability. The need to reduce carbon emissions has witnessed a significant shift toward cleaner and more eco-friendly transportation options. In addition, the advancements in EV technology, such as improvements in battery capacity and charging infrastructure, have significantly enhanced the feasibility and practicality of electric ATVs. With the development of more efficient and powerful batteries, electric ATVs are capable of delivering comparable performance to their conventional counterparts, providing a viable alternative for off-road enthusiasts and commercial users.

Key Companies & Market Share Insights

The competitive landscape within the market has intensified, prompting manufacturers to invest significantly in R&D to gain a competitive edge. As a result, technological innovations in powertrain systems have become crucial in catering to the evolving demands of enthusiasts. These advancements enhance the overall performance and durability of the vehicles and are also crucial in addressing the growing emphasis on safety features, driving comfort, and adaptability to diverse operational requirements. In May 2023, American Axle & Manufacturing, Inc. partnered with Stellantis, an automotive manufacturer, to supply electric beam axles for Stellantis's electric vehicles.

Key U.S. Electric UTV And ATV Powertrain Companies:

- American Axle & Manufacturing, Inc.

- BorgWarner Inc.

- Curtis Instruments, Inc.

- DANA Limited

- GKN Automotive Limited

- HyperCraft

- NIDEC CORPORATION

- Robert Bosch GmbH

- Tesla

- Yamaha Motor Co., Ltd.

U.S. Electric UTV And ATV Powertrain Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 5.18 billion

Growth rate

CAGR of 10.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Vehicle type, powertrain type

Key companies profiled

American Axle & Manufacturing, Inc.; BorgWarner Inc.; Curtis Instruments, Inc.; DANA Limited; GKN Automotive Limited; HyperCraft; NIDEC CORPORATION; Robert Bosch GmbH; Tesla; and Yamaha Motor Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Electric UTV And ATV Powertrain Market Report Segmentation

The report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. electric UTV and ATV powertrain market report based on vehicle type and powertrain type.

-

Vehicle Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Neighborhood Electric Vehicle

-

All-terrain Vehicle

-

Utility Task Vehicle

-

-

Powertrain Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2 in 1 (Motor + MCU)

-

3 in 1 (Motor + MCU+ Transmission)

-

More than 3 in 1

-

Frequently Asked Questions About This Report

b. The U.S. electric UTV and ATV powertrain market size was estimated at USD 2.46 billion in 2022 and is expected to reach USD 2.62 billion in 2023.

b. The U.S. electric UTV and ATV powertrain market is expected to grow at a compound annual growth rate of 10.2% from 2023 to 2030 to reach USD 5.18 billion by 2030.

b. Utility Task Vehicle (UTV) dominated the U.S. electric UTV and ATV powertrain market owing to the development of advanced battery technologies that have improved the overall performance and range of electric UTVs.

b. Some key players operating in the U.S. electric UTV and ATV powertrain market include American Axle & Manufacturing, Inc.; BorgWarner Inc.; Curtis Instruments, Inc.; DANA Limited; GKN Automotive Limited; HyperCraft; NIDEC CORPORATION; Robert Bosch GmbH; Tesla; and Yamaha Motor Co., Ltd.

b. Key factors that are driving the U.S. Electric UTV and ATV Powertrain market growth is owing to growing concern for environmental sustainability and advancements in electric powertrain technology across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.