- Home

- »

- Healthcare IT

- »

-

U.S. eHealth Market Size & Share, Industry Report, 2030GVR Report cover

![U.S. eHealth Market Size, Share & Trends Report]()

U.S. eHealth Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Telemedicine, Health Information Systems, mHealth, ePharmacy), By End Use (Providers, Payers, Patients), And Segment Forecasts

- Report ID: GVR-4-68040-339-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. eHealth Market Size & Trends

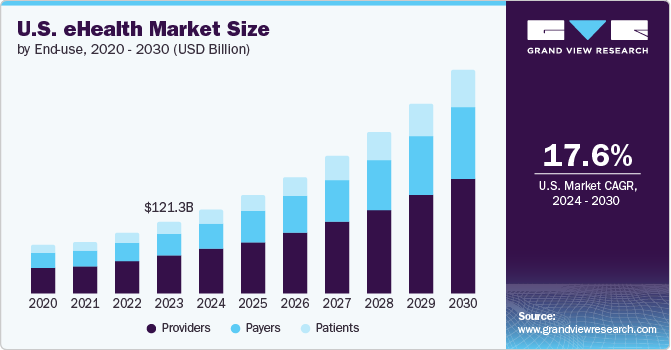

The U.S. eHealth market size was estimated at USD 121.3 billion in 2023 and is expected to grow at a CAGR of 17.6% from 2024 to 2030. The market growth is attributed to the growing demand for remote monitoring solutions and telehealth solutions, rapid digitalization in the healthcare industry, technological advancements, such as AI integration, and strategic initiatives undertaken by the market players. For instance, in January 2022, Francisco Partners acquired IBM's healthcare data and analytics assets. They include diverse and extensive products and data sets, including Clinical Development, Social Program Management, Health Insights, Micromedex, MarketScan, and imaging software offerings.

The growing need to promote efficient hospital functioning by optimizing operations is contributing to the market growth. For instance, in March 2024, Eagle Telemedicine introduced the Eagle MedWorks Connect, a modular telemedicine cart system designed to reduce hospital telemedicine delivery costs. This all-in-one cart integrates advanced video, audio, and computing technology with industry-compliant telemedicine software, streamlining telemedicine implementation and rollout processes efficiently.

In addition, integrating AI in eHealth solutions is beneficial in numerous domains of the healthcare industry. For instance, in April 2024, U.S. San Diego Health published a study revealing improvements in physician-patient communication using AI. To address the increasing volume of patient inquiries, UC San Diego Health initiated a pilot program in April 2023, in collaboration with electronic health record provider Epic Systems, to deploy generative AI technologies for creating responses to non-emergency patient questions.

Furthermore, eHealth for remote patient monitoring leverages digital technologies to track patients' health data from a distance, facilitating continuous health management and timely interventions. This approach integrates wearable devices, mobile apps, and cloud-based platforms to collect and analyze real-time health metrics such as heart rate, blood pressure, and glucose levels. By enabling healthcare providers to monitor patients' conditions remotely, e-health enhances chronic disease management, reduces hospital readmissions, and improves patient outcomes. For instance, in March 2024, TELUS Health secured a contract to deliver an advanced Remote Care Management (RCM) solution in Ontario. This solution empowers healthcare practitioners with continuous remote patient monitoring tools, marking a significant milestone in leveraging technology for improved healthcare outcomes.

Case Study Insights

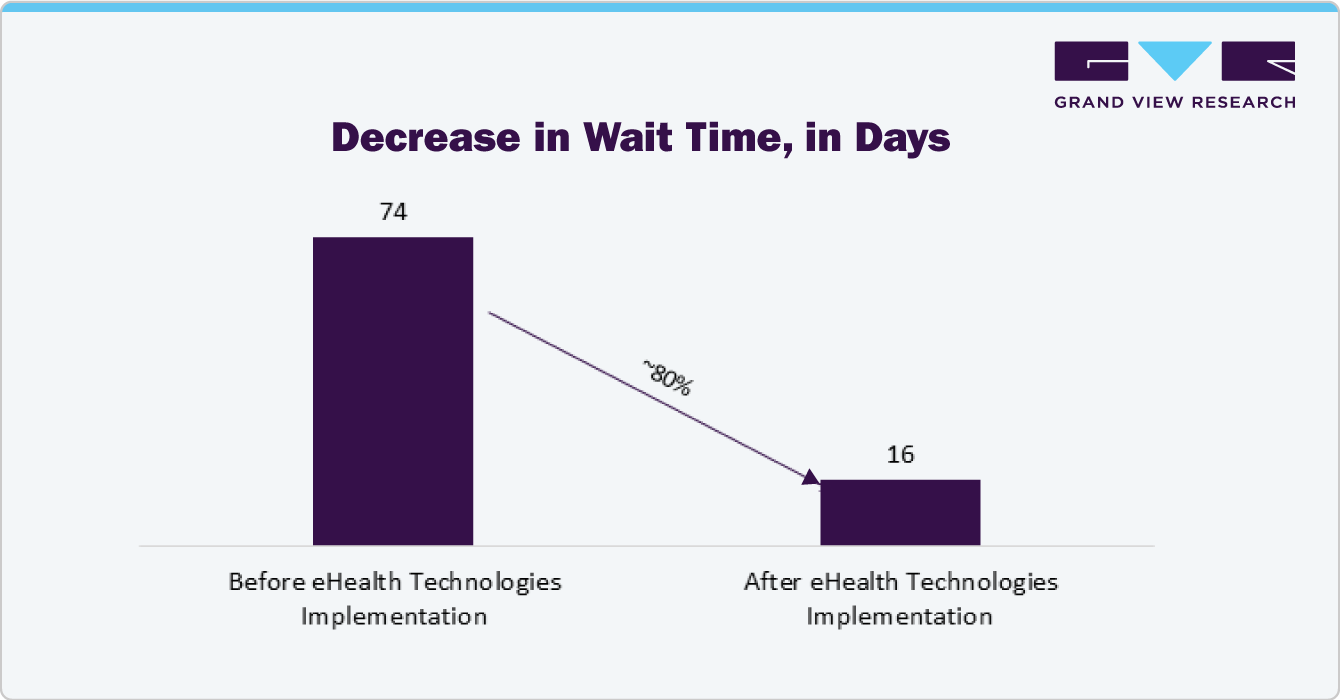

One of the Northern California Cancer Centers implemented eHealth Connect, a solution by eHealth Technologies, to reduce wait time.

Aim:

- Optimize patient appointments by reducing waiting time.

Solution:

- The cancer center chose eHealth Technologies' eHealth Connect solution to retrieve patient records from different locations and systems. The solution delivered the patient's comprehensive medical history in a user-friendly format. The records collection was handled electronically, with the information being delivered in a single document organized into categories. Important terms were highlighted for easy searching. Using eHealth Connect, healthcare providers could easily access the critical clinical information required for a patient's initial consultation.

Result:

- Around 80% decrease in wait time from referral to treatment

AI Integration in the U.S. eHealth Market Insights

Case Study Insights

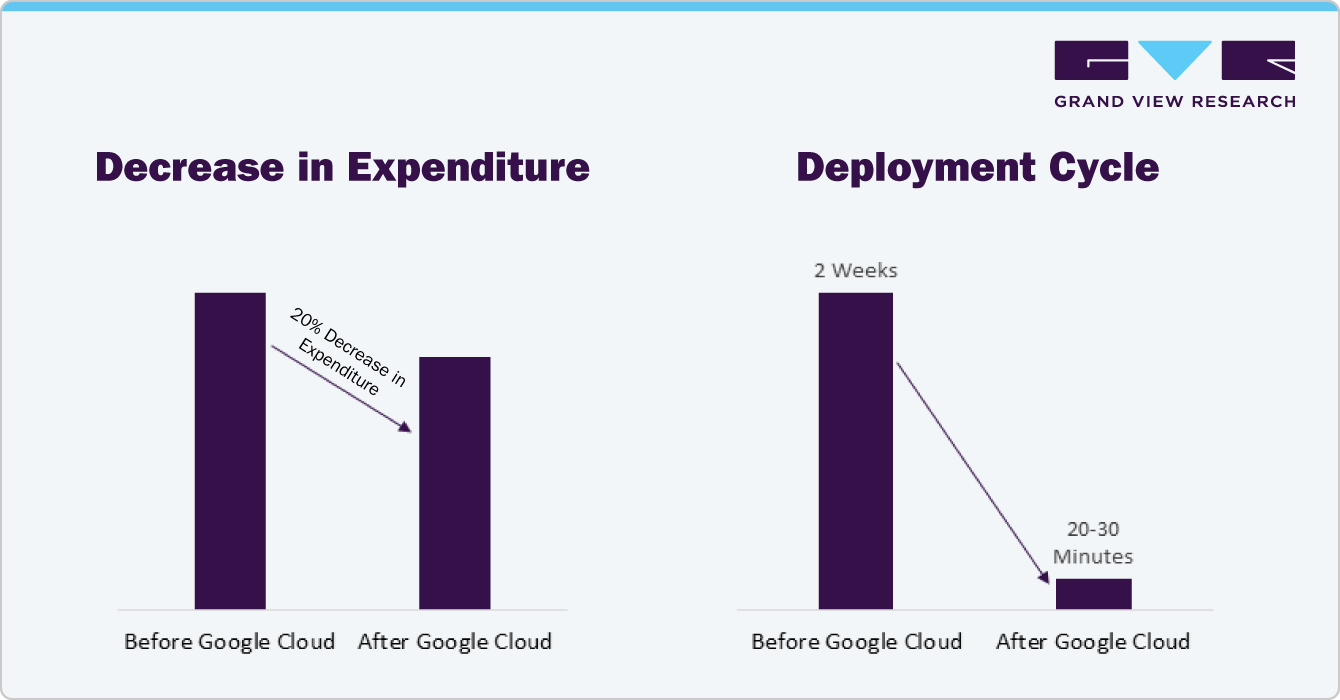

- Portal Telemedicina, a rural healthcare provider, encountered issues in its delivery systems, including fragmented care, inefficiencies, and siloed healthcare systems.

Solution:

- Portal Telemedicina collaborated with Google Cloud to improve data aggregation, storage, and analysis.

-

Utilizing Cloud SDK, the team routed medical data to Cloud Storage, employing it and BigQuery as a data lake for various tasks.

-

This system processes 500,000 exam diagnostics in about 2 seconds.

-

Portal Telemedicina used AI for classifying medical findings and recommending treatment urgency, relying on Google Cloud ML Engine and TensorFlow to enable convolutional neural networks for computer vision processing.

Result:

Industry Dynamics

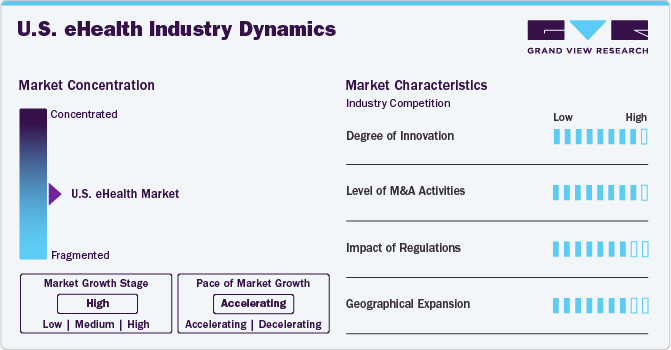

The degree of innovation in the U.S. eHealth industry is high. Technological innovation in the U.S. eHealth industry is transforming healthcare delivery. Advancements include telemedicine platforms for remote consultations, mHealth apps for mobile health management, interoperable EHR systems, AI/ML for decision support, IoT for remote monitoring, blockchain for data security, and VR/AR for immersive experiences.

For instance, in March 2024, Nextech introduced several advanced AI solutions within its software lineup. These innovations are designed to enhance customer, patient, and provider interactions, offering a comprehensive approach that caters to the diverse needs of specialty practices. This strategic framework ensures product development, facilitating high-impact AI applications that boost operational efficiency and elevate clinical processes and patient engagement.

The M&A activities, such as mergers, acquisitions, and partnerships, enable companies to expand geographically, financially, and technologically.

In December 2023, mPulse acquired HealthTrio and Decision Point Healthcare Solutions. The acquisition strengthens mPulse’s patient and member engagement offerings and simultaneously enhances health outcomes.

The impact of regulations is high in the industry. Regulatory bodies are crucial in influencing the eHealth market, setting forth guidelines, standards, and policies that govern the utilization of digital health technologies while safeguarding patient interests. Some of the key entities in the eHealth sector include regulatory bodies and organizations such as:

The FDA regulates the safety and efficacy of medical devices, software, and apps used in healthcare. It ensures compliance with standards and guidelines, promoting trust in digital health technologies among healthcare providers and patients. The FDA's oversight helps drive innovation while maintaining patient safety, influencing the development and adoption of eHealth solutions in the healthcare industry

It significantly influences the market by overseeing reimbursement policies and promoting the adoption of digital health technologies in healthcare delivery. CMS initiatives drive the integration of telehealth services, electronic health records (EHRs), and other eHealth solutions into Medicare and Medicaid programs, incentivizing healthcare providers to embrace digital innovation. CMS also sets standards for data exchange, interoperability, and patient engagement, facilitating a more connected and efficient healthcare ecosystem that uses technology to improve patient outcomes and reduce costs

Companies in the U.S. eHealth market undergo geographic expansion strategies to maintain their position in emerging markets and customer base from these regions. For instance, in February 2024, Aptar Digital Health acquired Healint, a digital health company based in Singapore. The acquisition helped Aptar Digital Health in expanding its business in Singapore

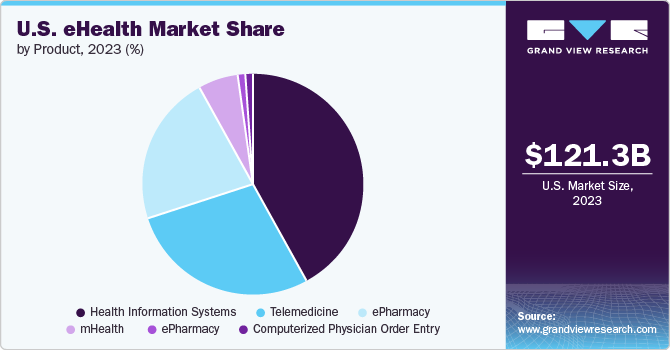

Product Insights

The health information systems (HIS) segment dominated the market with the largest share of 42.0% in 2023. HIS significantly contributes to the eHealth market's growth by streamlining health data management, storage, and exchange. These systems enhance the efficiency and accuracy of healthcare delivery through electronic health records (EHRs), electronic medical records (EMRs), patient engagement solutions, and population health management.

By facilitating seamless data integration and interoperability among various healthcare providers, HIS improves patient care coordination, reduces medical errors, and supports informed decision-making. Hence, numerous healthcare facilities opt for advanced HIS to optimize their functioning. For instance, in May 2024, eClinicalWorks, an ambulatory cloud EHR provider, announced that Stone Mountain Health Services in Virginia chose an AI-based medical scribe, Sunoh.ai, to streamline clinical workflows, increase practice efficiency, and enhance patient care.

The e-prescribing segment is expected to witness the fastest CAGR throughout the forecast period. It boosts the market by enhancing prescription accuracy, reducing errors, and improving patient safety. It streamlines the medication management process, increasing efficiency for healthcare providers. In addition, it facilitates better medication adherence through automated refill reminders. Furthermore, numerous companies are enhancing their product portfolio by offering e-prescribing solutions. For instance, in April 2024, VieCure, a company specializing in cancer care, announced the integration of medication management and e-prescribing solutions from DrFirst, a health technology provider, into its clinical decision support system.

End Use Insights

The providers segment led the market with the largest share of 53.1% in 2023. They are increasingly integrating electronic health records (EHR) and telemedicine platforms to streamline patient care, enhance accessibility, and improve the efficiency of healthcare delivery. In addition, healthcare providers use remote patient monitoring and e-prescription tools to facilitate better patient outcomes and support preventive care measures. For instance, in March 2024, Teladoc Health, Inc. enhanced capabilities to assist employers and health plans in addressing increased requests for anti-obesity medications like GLP-1 agonists. The new features focus on aiding plan sponsors and pharmacy benefit managers in navigating the growing intricacies and expenses linked to obesity management while facilitating care coordination with external physicians and laboratory testing.

The payers segment is expected to witness the fastest CAGR during the forecast period. This can be attributed to the increasing investment in the telemedicine platforms, remote patient monitoring solutions, and electronic health records systems to enhance patient care delivery. Moreover, increasing initiative to promoting value-based care models, incentivizing providers for telehealth services, and streamlining reimbursement processes for digital health services would likely drive the segment growth.

For instance, in November 2023, eHealth Exchange, a prominent health information exchange (HIE) linking federal agencies and healthcare providers, has introduced an incentive program to boost the adoption of HL7 Fast Healthcare Interoperability Resources (FHIR) among healthcare payers and providers. As part of this initiative, the network will waive the annual fee for the first year for the initial 15 non-federal healthcare providers or HIEs that effectively exchange electronic patient data with healthcare payers according to the standards set forth in the HL7 Da Vinci Project implementation guides.

Key U.S. eHealth Company Insights

The U.S. eHealth market is competitive, and some notable participants include CVS Health, Teladoc Health, Inc., IBM, and others. These players engage in new product launches, partnerships, and acquisitions to gain a competitive edge over each other.

Key U.S. eHealth Companies:

- CVS Health

- Teladoc Health, Inc.

- American Well

- Veradigm LLC

- UNITEDHEALTH GROUP

- Medtronic

- Epocrates

- Telecare Corporation

- Medisafe

- Set Point Medical

- IBM

- Doximity, Inc.

- LiftLabs

Recent Developments

-

In February 2024, American Well (Amplar Health) partnered with Amplar Health to expand its presence in Australia. Through the Amwell Automated Care platform, Amplar Health customers gain access to a digital companion to navigate their care paths, whether automated or directed to a health coach or care team member. This hybrid strategy empowers Australians to establish health goals and adopt lasting lifestyle changes, promoting healthier outcomes.

-

In October 2023, Veradigm partnered with FDB Vela ePrescribing Network to enhance options and cost transparency for prescribers and patients. This collaboration will broaden Veradigm Network's diverse ecosystem of companies offering innovative insights, technology, and data-driven solutions.

-

In October 2023, Teladoc Health made a reseller agreement with Sword Health, authorizing Teladoc clients to use Sword Health's pain treatment platform, which features digital pelvic health care and physical therapy. This partnership enables Teladoc Health clients to expand their virtual care services, simplifying contracting and management processes for employee healthcare.

-

In October 2023, the U.S. Defense Health Agency (DHA) chose American Well (Amwell) and Leidos to support the Digital First initiative for the U.S. Military Health System. The Amwell Converge platform facilitated DHA healthcare teams to provide integrated virtual, automated, and in-person care services.

-

In July 2023, Teladoc Health expanded its partnership with Microsoft, integrating Microsoft Azure Cognitive Services, Azure OpenAI Service, and Nuance Dragon Ambient eXperience into the Teladoc Health Solo platform. This collaboration aims to automate clinical documentation during virtual exams, alleviating the healthcare workforce's workload while enhancing the quality of medical information sharing and the resulting patient care.

U.S. eHealth Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 142.4 billion

Revenue forecast in 2030

USD 376.6 billion

Growth rate

CAGR of 17.6% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use

Key companies profiled

CVS Health; Teladoc Health, Inc.; American Well; Veradigm LLC; UNITEDHEALTH GROUP; Medtronic; Epocrates; Telecare Corporation; Medisafe; Set Point Medical; IBM; Doximity, Inc.; LiftLabs

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. eHealth Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. eHealth market report based on product, and end use:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Telemedicine

-

Health Information Systems

-

Electronic Health Record

-

Electronic Medical Record

-

Patient Engagement Solution

-

Population Health Management

-

-

mHealth

-

Monitoring services

-

Diagnosis services

-

Healthcare Systems Strengthening Services

-

Others

-

-

ePharmacy

-

E-Prescribing

-

Computerized Physician Order Entry

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Patients

-

Providers

-

Payers

-

Frequently Asked Questions About This Report

b. The U.S. eHealth market size was estimated at USD 121.3 billion in 2023 and is expected to reach USD 142.4 billion in 2024.

b. The U.S. eHealth market is expected to grow at a compound annual growth rate of 17.6% from 2024 to 2030 to reach USD 376.6 billion by 2030.

b. Health information systems (HIS) segment dominated the U.S. eHealth market with a share of 42.0% in 2023. This is attributable to rising healthcare the increasing adoption of electronic health records (EHRs) by healthcare providers is a major contributor, as it enhances the efficiency and accuracy of patient data management. In addition, the rising demand for integrated healthcare systems that enable seamless data exchange and interoperability among different healthcare entities is fueling HIS adoption.

b. Some key players operating in the U.S. eHealth market include CVS Health, Teladoc Health, Inc., American Well, Veradigm LLC, UNITEDHEALTH GROUP, Medtronic, Epocrates, Telecare Corporation, Medisafe, Set Point Medical, IBM, Doximity, Inc., and LiftLabs

b. Key factors that are driving the market growth include the growing demand for remote monitoring solutions and telehealth solutions, rapid digitalization in the healthcare industry, technological advancements such as AI integration, and strategic initiatives undertaken by the market players.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.