- Home

- »

- Homecare & Decor

- »

-

U.S. Education Furniture Market Size, Industry Report, 2030GVR Report cover

![U.S. Education Furniture Market Size, Share & Trends Report]()

U.S. Education Furniture Market Size, Share & Trends Analysis Report By Product (Seating Furniture, Desks & Tables), By Application (Classrooms, Libraries), By End-user (Schools, Colleges & Universities), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-450-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

U.S. Education Furniture Market Trends

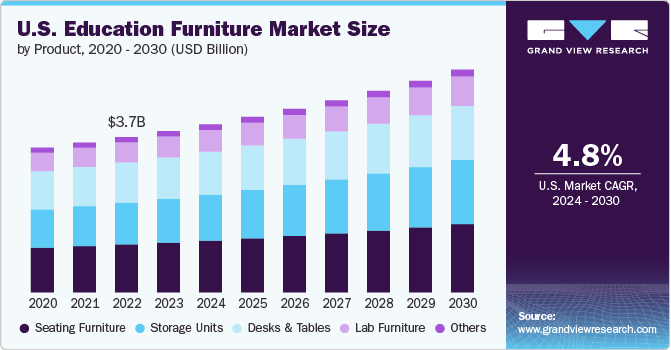

The U.S. education furniture market size was estimated at USD 3,793.7 million in 2023 and is projected to grow at a CAGR of 4.8% from 2024 to 2030. This growth is driven by increasing investments in educational infrastructure, evolving teaching methods, and a rising focus on flexible, ergonomic, and technology-integrated furniture solutions. In addition, the shift towards hybrid learning environments and the need for adaptable furniture to accommodate diverse learning settings further fuel market growth.

The growth of the market is driven by factors such as a rising student population, evolving educational reforms, increased emphasis on ergonomic seating, and technological advancements to support devices like laptops and tablets. According to the National Center for Education Statistics, the U.S. had over 129,000 public and private schools in the 2022-2023 academic year, and this expanding school network is expected to boost demand for education furniture.

Educational institutions are expanding to accommodate a growing student population, leading to higher demand for modern, durable, and ergonomic furniture. Schools are investing in high-quality desks, chairs, lab furniture, and storage solutions to create conducive learning environments, including specialized spaces like STEM labs and multimedia rooms.

Government spending also plays a key role, with the U.S. Department of Education receiving approximately USD 195.44 billion in FY23. The Biden administration's commitment to providing high-quality education is likely to fuel further market growth by increasing the number of students and driving investments in modern learning environments.

The market is witnessing a demand for ergonomic and versatile solutions designed to enhance comfort and adaptability across various educational settings, including classrooms, labs, and libraries. Schools are increasingly opting for multi-purpose tables and chairs alongside furniture made from innovative raw materials like molded plastic and high-pressure laminate, which offer greater durability and longevity.

Ergonomic furniture is gaining popularity for promoting student health by supporting proper posture, improving focus, and accommodating different body types, making it essential for modern, flexible learning environments. Research shows that when paired with technology, ergonomic furniture boosts student engagement, attendance, and academic performance.

The growing emphasis on sustainability is shaping the market, with educational institutions investing in eco-friendly furniture that aligns with green building certifications like LEED. These products, designed to minimize environmental impact and enhance indoor air quality, are increasingly being adopted by schools focused on sustainability.

Product Insights

Seating furniture sales accounted for a revenue share of 30.85% in 2023, largely due to heightened investments in educational infrastructure, a surge in new school constructions, and a growing focus on ergonomic design. As educational institutions place greater emphasis on student health and well-being, the demand for chairs that promote good posture has significantly increased, driving growth in this segment.

Student seating accounted for over 70% of the market's revenue share in 2023. Research from the University of Manitoba highlights that students spend nearly 80% of their time seated in classroom chairs, emphasizing the need for ergonomically designed furniture that supports movement and comfort, such as flexible-backed chairs.

The demand for storage units is expected to grow at a CAGR of 5.7% from 2024 to 2030. The market is experiencing growth due to the rising adoption of personal storage cabinets in schools, driven by increased student populations and new school constructions. Notable innovations include School Specialty, LLC's introduction of over 100 new furniture products, such as mobile bookshelves and lockers, designed for various educational settings. In addition, advancements in safety are highlighted by ProtectED’s bullet-resistant bookcases, which combine security with functionality by incorporating rapid-deployment features for emergencies.

Application Insights

Classroom furniture saw an increased demand, accounting for over 49% of revenue share of the market in 2023. The ongoing shift towards interactive and collaborative learning has fueled demand for versatile furniture that accommodates diverse teaching methods and group activities. Schools are increasingly investing in modern, ergonomic desks, chairs, and storage solutions to create more dynamic and comfortable learning environments, enhancing student engagement and well-being.

Laboratory furniture sales are expected to grow at a CAGR of 5.1% from 2024 to 2030, driven by the rising need for safe and functional learning environments in educational settings. Properly designed lab furniture, such as chemical-resistant countertops, ergonomic stools, and secure storage cabinets, play a crucial role in enhancing student safety and comfort during experiments. Key furniture items such as fume hoods and anti-vibration tables are essential for handling volatile substances and ensuring accurate measurements, contributing to a productive and secure educational experience. These factors will continue to propel the demand for durable, well-organized lab furniture in schools and colleges in the U.S.

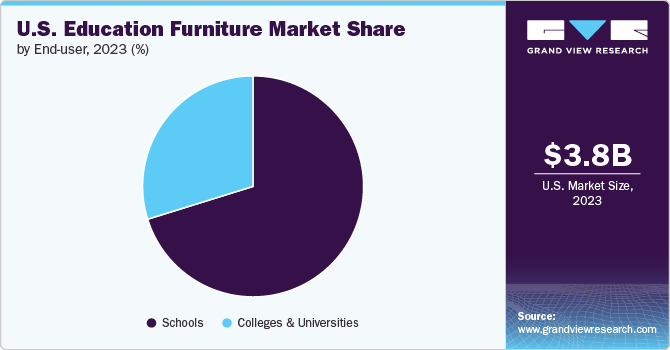

End-user Insights

Educational furniture sales in U.S. schools accounted for a revenue share of over 70% in 2023. This is largely due to the essential role schools play in the education system. The increasing student population and evolving educational standards are driving a steady demand for furniture upgrades and replacements to meet modern learning requirements.

The 2019 MDR report on the U.S. K-12 market revealed that a significant portion of schools across all sizes-small, medium, large, and very large-completed renovation projects in the past five years, with 43% focusing on entire school buildings and 31% on individual classrooms. These renovations, particularly in upper grades, were driven by the need to accommodate new technological advancements and improve student engagement. The focus on updating classrooms, technology labs, and library spaces reflects the increasing demand for school furniture in the U.S.

The demand for furniture in U.S. colleges & universities is expected to grow at a CAGR of 5.4% from 2024 to 2030. Colleges and universities in the U.S. are increasingly renovating campuses to enhance student engagement and academic success through modern, ergonomic furniture and versatile learning spaces. Stanford University's Classrooms Reimagined initiative showcases this trend, incorporating flexible furniture and advanced technology to foster active learning, collaboration, and inclusivity. Such upgrades improve mobility, accessibility, and engagement, aligning with the evolving educational needs of diverse learners. As institutions prioritize creating dynamic and adaptable environments, the demand for furniture in U.S. colleges and universities is expected to grow.

Key U.S. Education Furniture Company Insights

The U.S. education furniture market is highly fragmented, with numerous small and medium-sized enterprises. Key players, such as Artcobell, KI (Krueger International), WB Manufacturing LLC, FOMCORE, LLC, and Smith System, emphasize design aesthetics, offering a variety of styles and finishes to enhance classroom environments. These companies are expanding their market presence by establishing new distribution channels, opening showrooms, and acquiring local manufacturers. In addition, they focus on providing customized furniture solutions tailored to specific school needs, from functionality to color schemes, helping create effective and visually appealing learning spaces.

Key U.S. Education Furniture Companies:

- Artcobell

- KI (Krueger International)

- WB Manufacturing LLC

- FOMCORE, LLC

- Smith System

- Virco

- VS America, Inc.

- Paragon Furniture Inc.

- The HON Company

- Haskell Education

- Fleetwood Group

Recent Developments

-

In August 2024, KI (Krueger International) was honored with the 2024 Wisconsin 75 Distinguished Performer Award in the Sustainability category. This accolade recognized the company for its economic and community impact. KI’s award in Sustainability highlights its leadership in environmental responsibility and commitment to promoting a sustainable future.

-

In August 2024, Artcobell at Forest Park Elementary School in Winston-Salem revamped the media center into an engaging, flexible environment tailored to diverse learning styles. The renovation featured a cozy reading nook, comfortable lounge areas, mobile shelving, adaptable maker space tables, large configurable tables, and ample storage for educational materials, enhancing both comfort and collaborative opportunities.

-

In May 2024, Artcobell received a patent from the United States Patent and Trademark Office (USPTO) for its NXT MOV chair. Developed based on research indicating that micromovements can reduce student fatigue and enhance engagement, the NXT MOV chair allows students to move 360 degrees around the chair while the chair itself also rotates 360 degrees beneath them.

U.S. Education Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 3,950.7 million

Revenue forecast in 2030

USD 5.24 billion

Growth rate

CAGR of 4.8% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-user

Regional scope

U.S.

Key companies profiled

Artcobell, KI (Krueger International), WB Manufacturing LLC, FOMCORE, LLC, Smith System, Virco, VS America, Inc., Paragon Furniture Inc., The HON Company, Haskell Education, Fleetwood Group

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Education Furniture Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. education furniture market report based on product, application, and end-user:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Seating Furniture

-

Student Seating

-

Lounge Seating

-

Others

-

-

Desks & Tables

-

Student Desks

-

Multi-purpose Tables

-

Makerspace Tables

-

Others

-

-

Storage Units

-

Lab Furniture

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Classrooms

-

Libraries

-

Laboratories

-

Administrative Offices

-

Common Areas

-

-

End User Outlook (Revenue, USD Million, 2018 - 2030)

-

Schools

-

Colleges & Universities

-

Frequently Asked Questions About This Report

b. The U.S. education furniture market size was estimated at USD 3,793.7 million in 2023 and is expected to reach USD 3,950.7 million in 2024.

b. The U.S. education furniture market is expected to grow at a compound annual growth rate of 4.8% from 2024 to 2030 to reach USD 5,237.0 million by 2030.

b. Seating furniture sales accounted for a 30.85% share in 2023, owing to heightened investments in educational infrastructure, a surge in new school constructions, and a growing focus on ergonomic design.

b. Some of the key market players include Artcobell, KI (Krueger International), WB Manufacturing LLC, FOMCORE, LLC, and Smith System.

b. Key factors driving the U.S. education furniture market growth include increasing investments in educational infrastructure, evolving teaching methods, and a rising focus on flexible, ergonomic, and technology-integrated furniture solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."