- Home

- »

- Automotive & Transportation

- »

-

U.S. Earthmoving Equipment Market, Industry Report, 2030GVR Report cover

![U.S. Earthmoving Equipment Market Size, Share & Trends Report]()

U.S. Earthmoving Equipment Market (2024 - 2030) Size, Share & Trends Analysis Report By Engine Capacity (Up To 250 HP, 250-500 HP, And More Than 500 HP), By Drive Type (Electric, ICE), By Product, And Segment Forecasts

- Report ID: GVR-4-68040-311-4

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

U.S. Earthmoving Equipment Market Trends

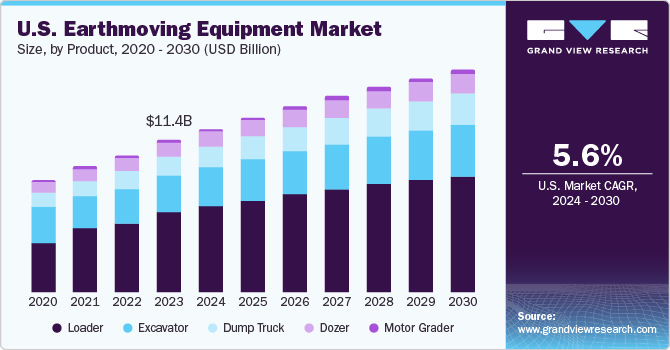

The U.S. earthmoving equipment market size was estimated at USD 11.4 billion in 2023 and is projected to grow at a CAGR of 5.6% from 2024 to 2030. Infrastructure projects and policies undertaken by the government are key factors driving the market growth. For instance, in November 2021, Congress enacted the Bipartisan Infrastructure Law, which is an act that reauthorized surface transportation programs for the timespan 2022-2026. The law authorizes up to USD 108 million to back federal public transportation programs. Additionally, the project focuses on rebuilding and repairing roads and bridges with sustainability and safety within the framework.

Growth in residential construction has been a notable factor that has aided the demand for earthmoving equipment. According to the United States Census Bureau, housing starts have gone up by 9% from 2022 to 2023. In November 2023, real estate companies built 1.1 million single-family houses and 1.56 million houses in total. Moreover, mortgage rates started declining in mid-December 2023 and dropped below 7% for 30-year fixed-rate mortgages, which have stayed there until recently. According to Bill Adams, chief economist for Comerica Bank, the drop in interest rates is expected to aid both multi-family and single-family construction.

The outbreak of the pandemic had a significant impact on the U.S. earthmoving equipment market. According to a survey carried out by the Associated General Contractors of America (AGC) in June, 68% of the contractors incurred project cancellations. Moreover, during the outbreak's timeline, a significant proportion of construction projects were postponed. These cancellations and postponements negatively affected the demand for earthmoving equipment and ultimately hampered the market through a demand and supply gap. In 2021, the construction industry started building a gradual momentum with sidelined projects receiving funding. Consequently, the earthmoving equipment market gradually began to gain traction.

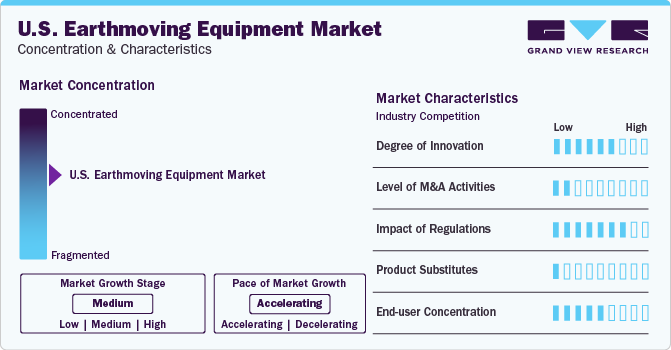

Market Concentration & Characteristics

The market growth rate is medium, and the pace of market growth is accelerating. The market is characterized as many companies making substantial investments in research and development with the objective of expanding their product lines to foster a higher level of demand. Companies are undertaking numerous strategic initiatives to expand their presence through new product launches, acquisitions, contractual agreements, and collaboration with other players. The market is fairly concentrated with major players such as Caterpillar and Deere & Company holding considerable shares of the market.

Companies are equipping their earthmoving machinery with technological capacities to enhance their performance. For instance, Tomahawk, a company engaged in the manufacture of earthmoving equipment, recently purchased autonomous capabilities for its dump trucks from Teleo, Inc., a company involved in the semi-automation of construction equipment.

The U.S. earthmoving equipment industry is subject to heavy regulatory exposure. The industry players have to meet carbon emission standards, standards of sustainable practices, safety standards, and comply with land use restrictions. These regulatory factors influence the design of these products, production costs of companies, and leeway of viable projects. For instance, the Environmental Protection Agency (EPA) sets emission standards for off-road diesel engines that are utilized in earthmoving machinery. Tier 4 diesel engine standards are currently the most stringent emissions requirement for off-road diesel engines. These standards regulate the amount of nitrogen oxides and particulate matter that can be emitted from such engines. These regulations, fully implemented in 2015, have been responsible for reducing nitrogen oxide and particulate matter levels by 99% compared to the emissions released in 1996.

Engine Capacity Insights

The Up to 250 HP sub-segment dominated the market in 2023, accounting for 45.64% of the market share, and is expected to grow considerably over the forecast period. Machines with engine capacity up to 250 HP are ideal for medium-scale projects requiring a balance between maneuverability and power. These machines are typically made to be versatile and compact to facilitate smooth maneuvering and transportation. These benefits associated with this engine capacity are expected to drive its growth over the forecast period.

The 250-500 HP sub-segment is projected to grow at the fastest CAGR from 2024 - 2030. These machines are highly effective in managing heavy loads and navigating rough terrains. Land clearing, timber handling, and road construction are the common applications of these machines. This applicability in different construction areas and the growing demand for materials such as timber is expected to drive the sub-segment over the forecast period. For instance, according to the Softwood Lumber Board (SLB), the demand for softwood lumber is estimated to increase by 600 million board feet due to mass timber panels predicted to be utilized in hybrid construction.

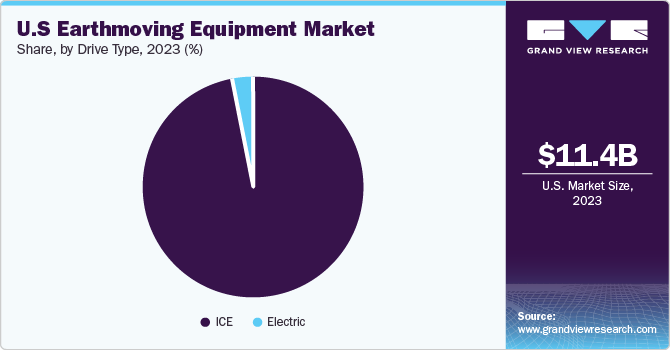

Drive Type Insights

The ICE segment held the majority of the market share in 2023. ICE engines have witnessed remarkable enhancements in fuel efficiency, integrating technologies such as turbocharging, electronic control systems, and direct injection. The ICE sub-segment’s growth is primarily driven by the need to meet torque and power demands while simultaneously ensuring optimal performance. Moreover, companies belonging to the market’s end-use industries have a variety of torque capacities and power outputs to choose from to match their performance needs. These benefits associated with the ICE drive type are predicted to propel its demand over the forecast period.

The electric segment is predicted to expand at the fastest CAGR over the forecast period. The growing limelight on sustainability is a key driver of the electric drive type. Regulations such as the Tier 4 diesel engine standards set by the Environmental Protection Agency (EPA), the Clean Air Act, which complements the Tier 4 diesel engine standards, and the overall growing emphasis on sustainable practices in the U.S. is expected to support the growth of electric engines for earthmoving equipment. For instance, according to a statement made on the White House website, the Biden administration aims to have 50% of all new vehicle sales comprised of electric engines by 2030.

Product Insights

The loader sub-segment accounted for the largest share in 2023. Loaders are projected to grow at a considerable CAGR during the forecast period from 2024 - 2030. This growth is attributed to the growth of construction activities. For instance, according to Verdict Media Limited, construction spending in the U.S. is rising, and figures indicate a 13.9% year-on-year increase from 1.84 trillion USD in 2022 to 2.09 trillion USD in 2023.

The dump truck sub-segment is estimated to witness the fastest CAGR during the forecast period. End-users in the mining industry heavily rely on dump trucks for transportation purposes from mining sites to processing facilities. The rising demand for gold is expected to be a contributing factor toward the growth of this sub-segment. For instance, according to the World Gold Council., total gold demand in the U.S. hit a record high in 2023 and is predicted to expand in the current year as the U.S. Federal Reserve moves in the direction of cutting interest rates.

Key U.S. Earthmoving Equipment Company Insights

Some of the key players operating in the U.S. earthmoving equipment market include Unicorn Construction Enterprises Inc., Caterpillar Inc., Deere & Company, and Hyundai Construction Equipment Co.

-

Caterpillar Inc., is a leading manufacturer of mining and construction equipment and other relevant products, such as industrial gas turbines, diesel-electric locomotives, and off-highway natural and diesel gas engines. The company is one of the top players in the earthmoving market and had a total revenue of 67.1 million USD in the year 2023. It owns several brands, such as Anchor, AsiaTrak, Cat, FG Wilson, MWM, MaK, and among others.

-

Deere & Company is a company with a broad portfolio of machinery that is used in variety of applications such as lawn & garden, agriculture, forestry & logging, golf & sports turf, landscaping & grounds turf, and construction. Regarding its construction customers, it offers dozers, excavators, articulated dump trucks, compact track loaders, crawler loaders, motor graders, wheel loaders, and more.

-

HD Hyundai Construction Equipment Co., Ltd. manufactures construction equipment and offers technological solutions such as their equipment management system called Hi MATE. With regard to the market, the company offers excavators and loaders for large-scale infrastructure projects and caters to multiple industries such as agriculture, forestry, and mining.

Key U.S. Earthmoving Equipment Companies:

- Unicorn Construction Enterprises, Inc.

- Caterpillar Inc.

- Deere & Company

- The Manitowoc Company, Inc.

- Oshkosh Corporation

- HD Hyundai Construction Equipment Co., Ltd.

- Manitou group

- Tomahawk

- AB Volvo

- New Holland Construction (CNH Industrial N.V.)

- Epiroc AB (Epiroc USA LLC)

- J. C. Bamford Excavators Ltd.

- Doosan Bobcat. (Doosan Corporation.)

Recent Developments

-

In March 2022, Manitou Group announced a new strategy to simplify product design and the management of its machine database. The company decided to implement the Teamcenter software developed by Siemens Xcelerator to tend to its overall product lifecycle in a streamlined manner. The software will be implemented in 10 production sites, including the U.S., India, France, and Italy. This move is part of the broader strategy of the Manitou Group to transform digitally. The company aims to use the benefits of virtual reality to modernize its tools and craft the same design across multiple production sites without the delay that is created due to the reworking of data. The productivity and effectiveness of 1,600 users at the company are expected to be positively impacted as a result of this move.

-

In April 2023, Oshkosh Corporation announced an investment in Baraja Pty Ltd., an Australia-based startup known for developing differentiated LiDAR (Light Detection and Ranging) solutions. LiDAR is remote sensing technology that uses pulsed laser to provide machines with an accurate visualization of the surveyed environment. The company made this move with the objective of enhancing its product portfolio in the areas of autonomy and safety. This move is expected to differentiate itself in the earthmoving market along with other sectors it is involved in.

-

In Feb 2024, Deere & Company announced a strategic partnership with Leica Geosystems AG (Hexagon AB) to develop and offer solutions to reduce material costs, enhance productivity, and reduce the number of passes required to improve safety levels by minimizing traffic on construction sites. John Deere SmartGrade, a compact track loader under the portfolio of Deere & Company., will be equipped with Leica Geosystems technology, and its sale will start this year.

-

In November 2023, Case Construction Equipment, a brand of CNH Industrial N.V., refurbished its wheel loader line by launching four updated models in its F-Series. The machines have an improved operator’s cab and travel at higher speeds than previous models. Moreover, they have refined electrohydraulic controls equipped with smart features and enhanced connectivity.

-

In October 2023, Husqvarna Construction, Volvo Construction Equipment, and Atlas Copco Group announced a partnership with the Sweden-US Green Transition Initiative to carve a pathway towards an electrified construction industry. This Sweden-US Green Transition Initiative is a collaborative program founded by Sweden’s innovation agency Vinnova, Business Sweden, Swedish Energy Agency, and Embassy of Sweden in USA. This newly formed consortium will initially focus on the development of EV charging infrastructure in the U.S.

-

In October 2022, Epiroc AB, announced an acquisition of the Wain-Roy business, a manufacturer of excavator attachments in the U.S. The former company aims to strengthen its presence in the North American Construction market and expand capacity to manufacture advanced attachments in the region.

U.S. Earthmoving Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.208.5 million

Revenue forecast in 2030

USD 16,656.1 million

Growth rate

CAGR of 5.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in units, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, company ranking, trends, and growth factors

Segments covered

Engine capacity, drive type, product

Country scope

U.S.

Key companies profiled

Unicorn Construction Enterprises Inc.; Caterpillar Inc.; Deere & Company; The Manitowoc Company Inc.; Oshkosh Corporation; Hyundai Construction Equipment Co.; Manitou Group; Tomahawk; AB Volvo; New Holland Construction (CNH Industrial N.V.); Epiroc AB (Epiroc USA LLC); J. C. Bamford Excavators Ltd.; Doosan Bobcat. (Doosan Corporation.)

Customization scope

Free customization of report (equivalent to up to 8 analysts working days) with purchase. Alteration or addition to country, regional & segment scope.

Purchase and pricing options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

U.S. Earthmoving Equipment Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. earthmoving equipment market report based on engine capacity, drive type, and product.

-

Engine Capacity (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Up to 250 HP

-

250-500 HP

-

More than 500 HP

-

-

Drive Type (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Electric

-

ICE

-

-

Product (Volume, Units; Revenue, USD Million, 2018 - 2030)

-

Dozer

-

Excavator

-

Loader

-

Motor Grader

-

Dump Truck

-

Frequently Asked Questions About This Report

b. The U.S. earthmoving equipment market size was estimated at USD 11.4 billion in 2023 and is expected to reach USD 12.208.5 million in 2024.

b. The U.S. earthmoving equipment market is expected to grow at a compound annual growth rate of 5.6% from 2024 to 2030 to reach USD 16,656.1 million by 2030

b. Based on engine capacity, the Up to 250 HP segment accounted for 45.6% in 2023. Machines with engine capacity up to 250 HP are ideal for medium-scale projects requiring a balance between maneuverability and power. These machines are typically made to be versatile and compact to facilitate smooth maneuvering and transportation. These benefits associated with this engine capacity are expected to drive its growth over the forecast period.

b. Some key players operating in the U.S. earthmoving equipment market include Unicorn Construction Enterprises, Inc., Caterpillar., Deere & Company., The Manitowoc Company, Inc., Oshkosh Corporation, Hyundai Construction Equipment Co.,, Manitou Group, Tomahawk ., AB Volvo, and New Holland Construction (CNH Industrial N.V.), Epiroc AB (Epiroc USA LLC), J C Bamford Excavators Ltd., and Doosan Bobcat (Doosan Corporation.)

b. Infrastructure projects and policies undertaken by the government and growth in residential construction are key factors driving the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.