- Home

- »

- Homecare & Decor

- »

-

U.S. Dry-cleaning And Laundry Services Market, Report 2030GVR Report cover

![U.S. Dry-cleaning And Laundry Services Market Size, Share & Trends Report]()

U.S. Dry-cleaning And Laundry Services Market Size, Share & Trends Analysis Report By Service (Laundry, Dry Cleaning, Duvet Cleaning), By Application (Residential, Commercial), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-485-7

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

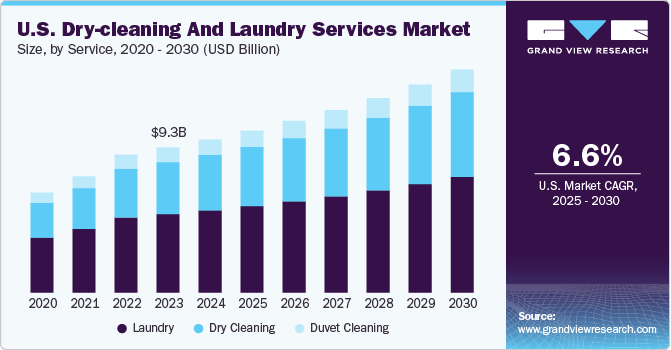

The U.S. dry-cleaning and laundry services market size was valued at USD 9.80 billion in 2024 and is expected to grow at a CAGR of 6.6% from 2025 to 2030. Increased demand for internet/on-demand laundry services, state cleanup programs, and the introduction of technologically enhanced equipment such as coin or card-powered machines are factors driving the U.S. dry-cleaning and laundry services industry.

Laundry is a time-consuming task and has become a burden for people, especially for those working full-time. Time constraints due to increasing work pressure and hours restrict people from doing their laundry. The working population has significantly increased over the past few years, thereby contributing to the rising demand for on-demand laundry services due to the convenience they offer. According to the “World Employment and Social Outlook - Trends 2021” report by the International Labour Organization (ILO), the global unemployment rate was estimated to reduce to 5.7% in 2022 from 6.3% in 2021.

The growth of the market is also driven by the increasing number of working women worldwide. According to statistics provided by the World Bank, the female labor force has been substantially increasing since 2012. In 2018, females accounted for a share of about 39.4% of the total labor force worldwide; the percentage increased to 39.5% in 2019. These factors are opening new avenues for laundry services and are likely to fuel the market growth during the forecast period.

The introduction of technologically advanced products such as coin or card-operated machines is anticipated to fuel the market growth over the forecast period. Some laundromat operators have migrated from traditional coin-operated machines to more modern card-operated machines as these systems offer detailed information about machine use and revenue and send alerts to property managers for maintenance. The advancements in machines, such as remotely checking machine availability and receiving automated text messages after completing laundry at the facility, are expected to propel the market growth in the coming years. According to the Coin Laundry Association, there were more than 35,000 laundromats in the U.S. in 2022.

Furthermore, professional wet cleaning is expected to boost market growth as several consumers prefer wet cleaning. This process includes the use of detergents and additives to reduce side effects on fabrics and special washing technology. The rise in consumer demand for environmentally friendly cleaning methods will encourage more establishments to implement wet cleaning. Wet cleaners also benefit from fewer regulatory compliance costs.

Service Insights

Laundry cleaning accounted for a share of about 53% in 2024 due to high demand from renters who often lack in-home washing machines, increasing reliance on laundry services. Rising numbers of renters and an expanding selection of online, on-demand services add convenience, fueling growth in the sector. Additionally, frequent mergers and acquisitions among startups, like Rinse’s acquisitions such as Chicago-based Dryv in 2020, Bay Area-based OffToYou in 2020, Cleanly's San Francisco operations in 2019, and the assets of Los Angeles-based Washio in 2016, further consolidate and enhance service availability across the U.S., driving the laundry services market forward.

Demand for dry cleaning services is expected to rise at a CAGR of 7.5% from 2025 to 2030. This is due to more people returning to offices and formal events, increasing the need for professional garment care. Higher-quality fabrics that require specialized cleaning and a focus on sustainability drive consumers to use dry cleaning to extend clothing life. Convenient, eco-friendly services also attract busy, environmentally-conscious urban customers.

Application Insights

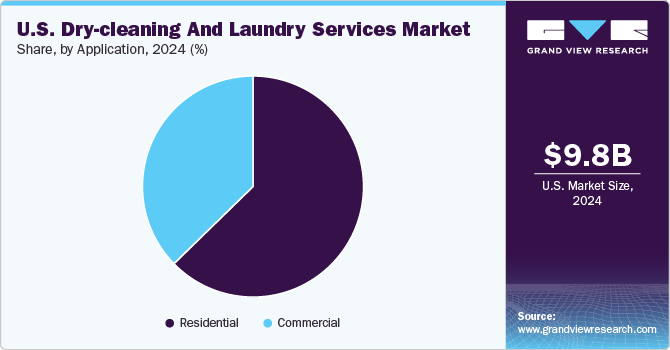

Dry-cleaning and laundry services’ demand in residential applications accounted for a share of about 57% in 2024. The residential application is growing due to urban population growth and more working women opting for convenient laundry solutions. Urban residents increasingly rely on laundry services, while innovative partnerships—like Rinse’s with OxiClean—expand service appeal and enhance stain-removal options, attracting more residential customers. In July 2021, the U.S.-based laundry service provider Rinse announced a limited-time partnership with the stain-remover product brand OxiClean. The partnership was aimed at bringing the stain-removing capabilities of OxiClean to Rinse’s customers.

Demand for dry-cleaning and laundry services in commercial application is expected to grow at a CAGR of 7.1% from 2025 to 2030. The need for consistent, high-quality cleaning solutions across industries with high standards for hygiene and appearance, such as hospitality, healthcare, and food services drive the market. Hotels and restaurants rely on commercial laundry services to maintain fresh linens, uniforms, and towels, which directly impacts customer satisfaction and operational efficiency. Healthcare facilities require rigorous sanitation for bedding, gowns, and other fabrics to meet strict hygiene protocols and prevent contamination, further fueling demand. Additionally, the shift toward outsourcing laundry services enables businesses to reduce labor, water, and energy costs, making commercial laundry an attractive option for maintaining both quality and cost efficiency.

Key U.S. Dry-Cleaning And Laundry Services Company Insights

The U.S. dry-cleaning and laundry services market is highly competitive, with a mix of large national chains, regional providers, and numerous independent operators, each vying for market share across various commercial segments like hospitality, healthcare, and corporate services. Smaller and regional providers often compete by offering specialized or niche services, focusing on customer loyalty and flexibility, while new entrants increasingly emphasize sustainable practices to attract environmentally conscious clients. Additionally, the growing trend toward outsourcing and automation is intensifying competition, with companies differentiating through digital platforms, pickup and delivery options, and custom laundry solutions that cater to specific industry needs.

Key U.S. Dry-Cleaning And Laundry Services Companies:

- Tide Cleaners

- Lapels Dry Cleaning

- Rinse, Inc.

- Bolt Laundry

- Laundry Care Express

- Sparklean Laundry

- Mulberrys Garment Care

- Laundry Genie

- CD One Price Cleaners

- ByNext

Recent Developments

-

In September 2024, Tide Cleaners and Tide Laundromats announced the expansion of their new locations in Florida. This growth reflects Tide's ongoing strategy to broaden its footprint in key markets, offering both dry-cleaning and laundry services. The new Florida locations aim to provide customers with convenient, high-quality garment care solutions backed by Tide's trusted brand. This expansion is part of the company's commitment to meeting the increasing demand for reliable and accessible laundry and dry-cleaning services across the region.

-

In July 2024, Lapels Cleaners announced the expansion of its operations in North Carolina by opening new locations, further growing its presence in the state. The company, known for its environmentally friendly cleaning services, continues to offer its signature dry-cleaning solutions, which focus on sustainability and customer convenience. This expansion is part of Lapels' broader strategy to increase its footprint in key regions, providing residents with access to eco-friendly garment care through its innovative processes and technology. The new locations aim to meet the rising demand for green cleaning services in the area.

-

In June 2024, ZIPS Cleaners announced a partnership with Mulberrys Garment Care in a strategic move to expand its service offerings. This partnership aims to combine ZIPS' affordable one-price dry-cleaning model with Mulberrys' premium, eco-friendly garment care services. By working together, the companies seek to provide a broader range of dry-cleaning and laundry solutions, appealing to customers who prioritize both cost-effectiveness and sustainability. The collaboration is set to enhance the reach and capabilities of both brands in the garment care industry.

U.S. Dry-cleaning And Laundry Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10.36 billion

Revenue forecast in 2030

USD 14.26 billion

Growth Rate (Revenue)

CAGR of 6.6% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, application

Country scope

U.S.

Key companies profiled

Tide Cleaners; Lapels Dry Cleaning; Rinse; Bolt Laundry; Laundry Care Express; Sparklean Laundry; Mulberrys Garment Care; Laundry Genie, CD One Price Cleaners; ByNext

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dry-cleaning And Laundry Services Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. dry-cleaning and laundry services market report based on service and application.

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

Laundry

-

Dry Cleaning

-

Duvet Cleaning

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Frequently Asked Questions About This Report

b. The U.S. dry-cleaning and laundry services market was estimated at USD 9.80 billion in 2024 and is expected to reach USD 10.36 billion in 2025.

b. The U.S. dry-cleaning and laundry services market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 14.26 billion by 2030.

b. Laundry cleaning dominated the U.S. dry-cleaning and laundry services market in 2024 with a share of about 53%. These services are becoming more and more popular as a result of their dependability, technical developments in the laundry sector, and an increase in urbanization, all of which are expected to drive the market forward throughout the projection period.

b. Key players in the U.S. dry-cleaning and laundry services market are Tide Cleaners; Lapels Dry Cleaning; Rinse; Bolt Laundry; Laundry Care Express; Sparklean Laundry; Mulberrys Garment Care; Laundry Genie; CD One Price Cleaners; ByNext.

b. Key factors that are driving the U.S. dry-cleaning and laundry services market growth include the rise in disposable income, consumer shift toward online and on-demand laundry care services, and automation in dry-cleaning and laundry service industry.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."