- Home

- »

- Medical Devices

- »

-

U.S. Drug Discovery Outsourcing Market, Industry Report, 2030GVR Report cover

![U.S. Drug Discovery Outsourcing Market Size, Share & Trends Report]()

U.S. Drug Discovery Outsourcing Market Size, Share & Trends Analysis Report, By Workflow, By Therapeutic Area, By Drug Type (Small Molecules, Biopharmaceuticals), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-281-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

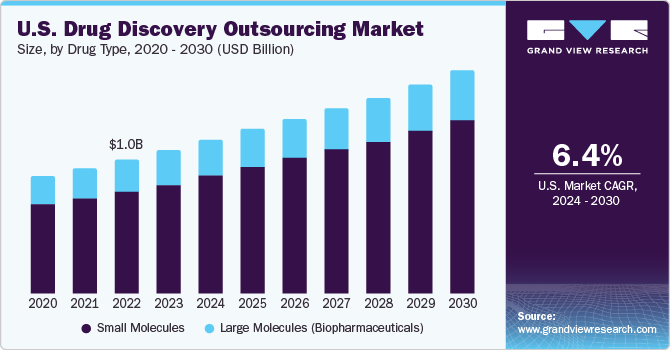

The U.S. drug discovery outsourcing market size was valued at USD 1.07 billion in 2023 and is anticipated to register a CAGR of 6.38% from 2024 to 2030. The growing need for innovative drug options, escalating disease prevalence, and the surge in public-private partnerships focused on developing new molecules have significantly fueled collaborations between drug developers and service providers. Consequently, these collaborations have contributed to the increased market size.

U.S. is amongst the key markets in the international pharmaceutical industry and is responsible for around 26.0% of global drug discovery outsourcing market. Factors such as advanced infrastructure, increased R&D investments, and a rise in occurrence of various diseases are propelling the expansion of drug discovery outsourcing market in the U.S.

Furthermore, public-private partnerships established for the purpose of creating innovative drug molecules are anticipated to influence market growth within this region substantially. A significant aspect that attracts pharmaceutical R&D investments in U.S. is the relative freedom in drug pricing. This flexibility allows companies to recover their R&D costs and fosters increased productivity, encouraging further investment in the industry.

Following the initial phase of COVID-19 pandemic, various initiatives were implemented to mitigate the adverse effects on businesses. Numerous companies adopted specific strategies to counter the global pandemic’s influence on their operations. For example, in July 2022, Wuxi AppTec announced that its small molecule drug discovery platform had provided over 180,000 custom-synthesized compounds to clients during the first half of the year, marking a 35.0% growth compared to the previous year. The substantial growth in drug discovery services can primarily be attributed to the escalating demand for novel therapeutics post-COVID-19 pandemic.

Market Concentration & Characteristics

U.S. drug discovery outsourcing industry is moderately fragmented and is marked by a significant level of innovation. Recent advances in compound screening instruments are expected to influence R&D. In May 2022, Charles River Laboratories and Valo Health, Inc announced the launch of Logica; an AI-powered integrated drug discovery platform to deliver optimized preclinical assets promptly. Logica leverages Charles River’s prominent preclinical expertise, and Valo’s Computational Platform, offering clients with novel drug discoveries.

The industry is highly competitive, experiencing frequent merger and acquisition activityto increase their offerings. Significant factors creating a competitive environment are quick adoption of advanced technologies for improved healthcare system in the country.

The industry is characterized by stringent regulations pertaining to market development processes as well as the requirement of manufacturing facilities to be in compliance with regulatory standards. Implementation of initiatives such as the new Drug Discovery Initiative (DDI) under which clinicians, researchers, and industry collaborate to develop promising drugs and delivery methods for improvement of human health is expected to influence industry growth positively.

Growing pressure on pharmaceutical companies to develop products within shorter timelines and limited budgets creates opportunities for contract service providers, thus opening up service expansions in the industry.

The U.S. pharmaceutical sector has consistently outperformed its European and Japanese counterparts in producing novel drug substances since 1965, with each five-year period witnessing greater achievements. Thus, the region has warranted internal expansion of prominent and emerging players to utilize the friendly regulatory framework for drug discovery outsourcing.

Workflow Insights

Lead identification & candidate optimization dominated the market in 2023 accounting for nearly 33.0% of the revenue share. Based on workflow, the market is segmented into target identification and screening, lead identification & candidate optimization, target validation and functional informatics, preclinical development, and other associated workflows. Presence of considerable tools for prediction of drug safety with the use of in silico techniques results in a larger share of segment in drug development informatics.

Other associated workflows in the market, including tools, software, molecule visualization & handling instruments, and database management systems, are anticipated to register the fastest growth from 2024 to 2030. Factors such as intensive research on novel drug candidates, increased investment for outsourcing, and wide array of services offered by private entities in drug discovery can be attributed to the segment growth.

Therapeutic Area Insights

The respiratory system segment led the market in 2023 with nearly 13.7% revenue share. Other prominent areas of therapy utilizing drug discovery outsourcing include pain and anesthesia, oncology, ophthalmology, hematology, dermatology, and more. The incidence of respiratory disorders in the U.S. is significant, with chronic lower respiratory diseases being a major concern. According to the CDC, there were 142,342 deaths due to COPD in 2018, which equates to 42.9 deaths per 100,000 population. High incidence of respiratory disorders, such as bronchitis, tuberculosis, COPD, and asthma, and increasing cases of drug resistance have supported the segment growth.

Anti-infective therapy segment is anticipated to register the highest CAGR over the forecast period. Medications such as antifungals, antibiotics, antibacterial agents, antiprotozoal substances, and antivirals are included in this segment. Notable collaborations, such as Charles River Laboratories partnering with British Columbia cancer agencies, Antabio, and Pcovery, aim to develop new drug candidates for cancer, antifungal diseases, and cystic fibrosis infections, funded by Wellcome Trust. These collaborative efforts for novel drug discovery are expected to drive market growth.

Drug Type Insights

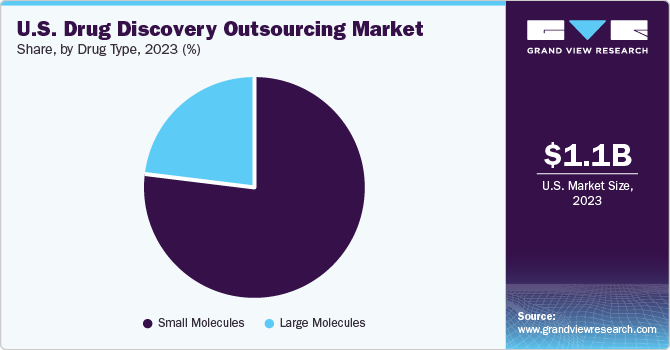

Small molecules are pivotal in fostering innovative treatments, accounting for over 75.0% of the market revenue share in 2023, owing to the highly specialized capabilities and extensive resources required for their development. The financial burden of maintaining such resources internally often leads companies to seek external expertise.

Large molecule (biopharmaceuticals) is protein-based class of drugs that consist of more than 1,300 amino acids essentially optimized by versions of endogenous human proteins. These molecules hold great promise for disease diagnosis and prevention as demonstrated by early phase clinical trials. Moreover, significant investment for drug development entities are anticipated to drive the segment in the coming years.

Key U.S. Drug Discovery Outsourcing Company Insights

Several small-to-medium-sized players are present in the U.S. drug discovery outsourcing market. Prominent companies in U.S. drug discovery outsourcing market include Albany Molecular Research Inc.; EVOTEC; Laboratory Corporation of America Holdings; GenScript; Pharmaceutical Product Development, LLC; and Charles River Laboratories International, Inc.

These players continuously focus on developing novel drug substances and diligently putting efforts to expand their manufacturing capabilities. For instance, in December 2021, Thermo Fisher Scientific completed the acquisition of PPD, enhancing its clinical research services. This acquisition expanded Thermo Fisher’s capabilities in bringing life-changing therapies to market, benefiting patients globally.

Key U.S. Drug Discovery Outsourcing Companies:

- Albany Molecular Research Inc.

- EVOTEC

- Laboratory Corporation of America Holdings

- GenScript

- Pharmaceutical Product Development, LLC

- Charles River Laboratories International, Inc.

- WuXi AppTec

- Merck & Co., Inc.

- Thermo Fisher Scientific Inc.

- Dalton Pharma Services

- Oncodesign

- Jubilant Biosys

- DiscoverX Corp.

- QIAGEN

- Eurofins SE

- Syngene International Limited

- Dr. Reddy Laboratories Ltd.

- Pharmaron Beijing Co., Ltd.

- TCG Lifesciences Pvt Ltd.

- Domainex Ltd.

Recent Developments

-

In December 2023, Jubilant Biosys Limited, a global pharma and biotech industry partner, announced the successful achievement of Inipharm’s, a biopharmaceutical company based in Bellevue, Washington and San Diego, California, asset, INI-822, an orally-delivered small molecule inhibitor of HSD17B13 for fibrotic liver disease, progressing to Phase 1 clinical trials.

-

In December 2023, MilliporeSigma,the U.S. and Canada Life Science business of Merck KGaA, Darmstadt Germany, launched AIDDISON™, a groundbreaking drug discovery software integrating virtual molecule design and real-world manufacturability.

-

In September 2023, Charles River Laboratories International, Inc. and Related Sciences collaborated to utilize Logica, an AI-powered drug solution, for drug discovery on previously unexplored targets. This partnership exemplified the growing trend in the US drug discovery outsourcing market towards leveraging AI technologies like Logica to enhance efficiency and innovation.

-

In March 2022,Thermo Fisher Scientific and Symphogen extended their collaboration to provide biopharmaceutical discovery and development laboratories with innovative tools and streamlined workflows for efficient characterization of complex therapeutic proteins.

-

In August 2021, Eurofins announced a new commercial agreement with Fusion Antibodies plc; a company dedicated to pre-clinical antibody engineering, discovery, and supply for both diagnostic applications and therapeutic drugs, thus boosting its drug discovery services.

U.S. Drug Discovery Outsourcing Market Report Scope

Report Attribute

Details

Market Size in 2024

USD 1.15 billion

Revenue forecast in 2030

USD 1.66 billion

Growth rate

CAGR of 6.38% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Workflow, therapeutic area, drug type

Country scope

U.S.

Key companies profiled

Albany Molecular Research Inc.; EVOTEC; Laboratory Corporation of America Holdings; GenScript; Pharmaceutical Product Development, LLC; Charles River Laboratories International, Inc.; WuXi AppTec; Merck & Co., Inc.; Thermo Fisher Scientific Inc.; Dalton Pharma Services; Oncodesign; Jubilant Biosys; DiscoverX Corp.; QIAGEN; Eurofins SE; Syngene International Limited; Dr. Reddy Laboratories Ltd.; Pharmaron Beijing Co., Ltd.; TCG Lifesciences Pvt Ltd.; Domainex Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Drug Discovery Outsourcing Market Report Segmentation

This report forecasts revenue growth at the country level and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the U.S. drug discovery outsourcing market report based on application, deployment, component, and end-use.

-

Workflow Outlook (Revenue, USD Million, 2018 - 2030)

-

Target Identification & Screening

-

Target Validation & Functional Informatics

-

Lead Identification & Candidate Optimization

-

Preclinical Development

-

Other Associated Workflows

-

-

Therapeutic Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Respiratory System

-

Pain and Anesthesia

-

Oncology

-

Ophthalmology

-

Hematology

-

Cardiovascular

-

Endocrine

-

Gastrointestinal

-

Immunomodulation

-

Anti-infective

-

Central Nervous System

-

Dermatology

-

Genitourinary System

-

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecules

-

Large Molecules (Biopharmaceuticals)

-

Frequently Asked Questions About This Report

b. The U.S. drug discovery market size was estimated at USD 1.07 billion in 2023 and is expected to reach USD 1.15 billion in 2024.

b. The U.S. drug discovery market is expected to grow at a compound annual growth rate of 6.38% from 2024 to 2030 to reach USD 1.66 billion by 2030.

b. On the basis of the workflow, the lead identification & candidate optimization segment dominated the U.S. drug discovery market with a share of 32.76% in 2023. This is attributable to advanced screening technologies and integration of bioinformatics and cheminformatics tools utilized in detailed analysis of biological and chemical data, improved assay techniques, etc.

b. Some key players operating in the U.S. drug discovery outsourcing market include Albany Molecular Research Inc., EVOTEC, LabCorp, GenScript, Thermo Fisher Scientific, Inc., Charles River Laboratories International, Inc., WuXi AppTec, Merck & Co., Inc., Dalton Pharma Services, Oncodesign, Jubilant Biosys, DiscoverX Corp., QIAGEN, Eurofins SE, Syngene International Limited, Dr. Reddy Laboratories Ltd., Pharmaron Beijing Co., Ltd., TCG Lifesciences Pvt Ltd., Domainex Ltd.

b. Key factors that are driving the market growth include adoption of advanced technologies, increasing outsourcing trends among biopharmaceutical companies, and rising R&D investment among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."