- Home

- »

- Clinical Diagnostics

- »

-

U.S. Drug Of Abuse Testing Services Market, Report, 2030GVR Report cover

![U.S. Drug Of Abuse Testing Services Market Size, Share & Trends Report]()

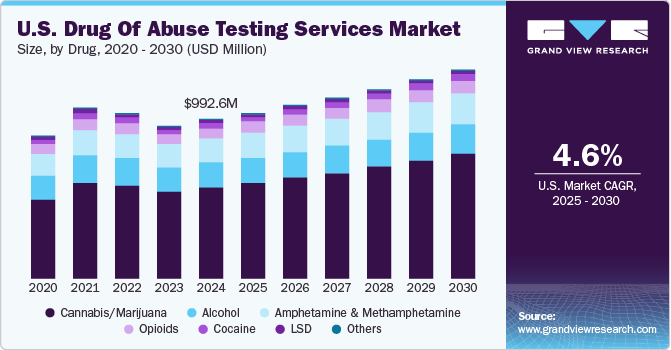

U.S. Drug Of Abuse Testing Services Market Size, Share & Trends Analysis Report By Drug (Alcohol, Cannabis/Marijuana, Cocaine, Opioids, Amphetamine & Methamphetamine, LSD), And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-489-0

- Number of Report Pages: 74

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

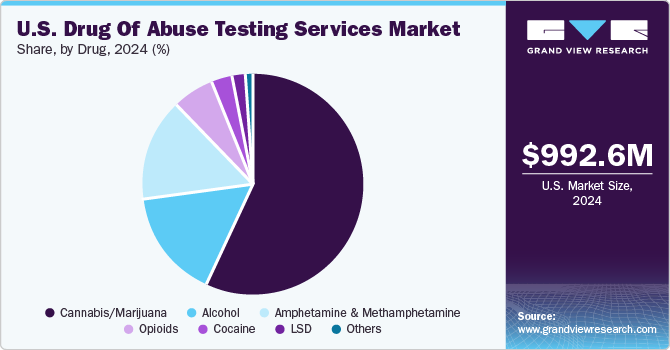

The U.S. drug of abuse testing services market size was estimated at USD 992.57 million in 2024 and is projected to grow at a CAGR of 4.65% from 2025 to 2030. Rising incidence of substance abuse, particularly with opioids, cannabis, and synthetic compounds, has led to a greater demand for services across various sectors, including healthcare, workplaces, and law enforcement.

Government efforts to address the opioid crisis, alongside policies encouraging regular substance screening in workplaces, have significantly driven the growth of the U.S. drug of abuse testing services industry. Furthermore, technological advancements, such as the development of rapid and highly sensitive tests, have simplified the detection of various substances, increasing the adoption of these services. Growing public awareness of the risks associated with substance abuse, coupled with stricter workplace screening regulations, has also fueled demand. Additionally, the availability of affordable testing solutions, including at-home test kits, has improved accessibility and further propelled the industry's expansion.

The increase in accidents and fatalities linked to alcohol and substance abuse among drivers has emerged as a major public safety issue in the U.S., fueling the demand for roadside substance screening. Law enforcement and public health agencies are prioritizing efforts to address impaired driving and improve road safety. The widespread prevalence of substance abuse in the U.S. has contributed to a rise in substance-impaired driving incidents. Data from the National Highway Traffic Safety Administration (NHTSA) reveals that alcohol-impaired drivers are involved in nearly 30% of all traffic-related fatalities, a figure that has remained consistently high. Additionally, the growing use of prescription drugs, recreational marijuana, and illicit substances has intensified the issue, leading to an alarming increase in substance-related accidents and deaths. These trends highlight the critical need for robust detection and prevention strategies to reduce impaired driving.

The industry is evolving rapidly, focusing on improving the accuracy, efficiency, and user-friendliness of substance screening methods. A prominent trend is the widespread adoption of Point-of-Care Testing (POCT), which provides immediate results in environments such as workplaces, clinics, and law enforcement settings, catering to the need for swift decision-making in critical scenarios. Additionally, the integration of advanced technologies, including immunoassay screening, mass spectrometry, and High-Performance Liquid Chromatography (HPLC), has significantly enhanced the sensitivity and specificity of testing. Noninvasive methods, such as saliva, hair, and breath tests, are also gaining traction due to their convenience and effectiveness in detecting recent substance use, making them increasingly favored across various applications.

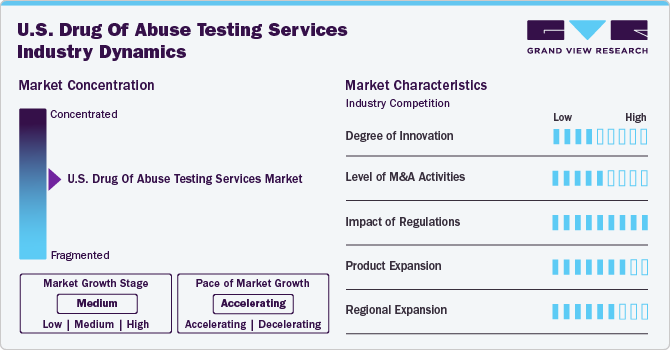

Market Concentration & Characteristics

The indstry showcases a high degree of innovation, driven by advancements in technology and increased demand for rapid, accurate, and non-invasive testing. Innovations include improved immunoassay techniques, multiplex testing platforms, and the integration of artificial intelligence for enhanced data analysis. Mobile testing units and telemedicine applications have expanded access, while laboratory automation enhances efficiency. The push for point-of-care devices and home-based testing kits further highlights the market’s focus on convenience and scalability.

The industry has witnessed a moderate to high level of mergers and acquisitions (M&A) activities, fueled by the need for market consolidation and technological enhancement. Key players acquire smaller firms to expand their service portfolios, enhance geographic reach, and gain access to advanced testing technologies such as lab automation and AI-driven platforms.

Regulations significantly impact the industry, shaping its operations, technologies, and compliance protocols. Stringent guidelines from bodies like the Substance Abuse and Mental Health Services Administration (SAMHSA) and the Department of Transportation (DOT) enforce quality assurance, lab certifications, and adherence to drug testing protocols.

The industry is driven by evolving consumer needs and advancements in testing technologies. Providers are broadening their offerings to include diverse test panels for synthetic drugs, opioids, and emerging substances. The introduction of rapid point-of-care kits, home testing solutions, and saliva-based tests reflects a focus on convenience and accessibility.

Regional expansion is fueled by increasing demand in underserved areas and the growth of industries requiring mandatory testing. Providers are establishing new collection sites and mobile testing units in rural and suburban regions to enhance accessibility. Partnerships with regional healthcare systems and employers drive localized service penetration. Expansion is also supported by state-specific regulatory adaptations, particularly in areas with stringent workplace drug policies, ensuring a broader geographic footprint for market players.

Drug Insights

The cannabis/marijuana segment dominated the market with largest revenue share of 57.32% in 2024. The legalization and decriminalization of marijuana in many states has reduced the stigma around its use, leading to more widespread consumption, including workplaces, transportation, and safety sensitive industries. Moreover, advancements in testing technologies, such as saliva, urine, and hair testing, have made detecting cannabis use more accurate and widespread. This has further boosted the U.S. drug of abuse testing services industry as businesses, healthcare providers, and law enforcement agencies increasingly adopt these methods for monitoring and managing marijuana consumption.

According to an article published by National Library of Medicine in January 2024; Many states in the United States are seeing a rise in cannabis-related emergency room visits as marijuana legalization moves forward. The 2022 National Survey on Drug Use and Health (NSDUH) revealed that about 70.3 million people aged 12 and older, accounting for 24.9% of the total population, used illicit substances in the previous year. Marijuana was the most popular drug, with 22% of those aged 12 and older, which is 61.9 million people, reporting their use during the year. This trend is likely to fuel demand for advanced drug testing solutions as employers strive to maintain a safe and productive work environment amidst evolving substance use patterns.

The amphetamine & methamphetamine segment is projected to grow at a CAGR of 4.65% over the forecast period. These substances, classified as central nervous system stimulants, are increasingly contributing to various societal and workplace challenges, including elevated absenteeism, diminished productivity, and heightened safety risks. As the misuse of amphetamines and methamphetamines continues to rise, the demand for drug testing services is expected to grow significantly, reflecting the need for effective monitoring and prevention strategies.

Key U.S. Drug Of Abuse Testing Services Company Insights

The industry is characterized by the presence of several key players offering a range of innovative products for various substances. Mature players are adopting several strategic approaches to maintain their competitive edge, enhance profitability, and meet regulatory requirements. Key operating strategies include innovation and product development, strategic initiatives such as partnership & collaboration, and others. Emerging players are focusing on innovative, effective testing solutions and leverage advanced technologies like AI & mobile platforms.

Key U.S. Drug Of Abuse Testing Services Companies:

- Quest Diagnostics

- Abbott

- Clinical Reference Laboratory (CRL), Inc

- Laboratory Corporation of America Holdings

- Cordant Health Solutions

- Legacy Medical Services

- DrugScan

- Omega Laboratories, Inc.

- Psychemedics Corporation

- Millennium Health, LLC

View a comprehensive list of companies in the U.S. Drug Of Abuse Testing Services Market

Recent Developments

-

In September 2024, Quest Diagnostics acquired select laboratory assets from Allina Health. The objective of the agreement is to give patients and physicians in Minnesota and western Wisconsin better access to reasonably priced, high quality laboratory services.

-

In May 2024, Omega Laboratories announced a partnership with Cannabix Technologies Inc. to integrate Cannabix’s advanced THC breathalyzer into Omega’s drug testing services. This collaboration made Omega the exclusive provider of laboratory services for Cannabix, enhancing its substance testing accuracy & efficiency.

-

In October 2023, Psychemedics Corporation revealed its Advanced 5- Panel Drug Screen, a U.S. FDA-cleared test designed to identify fentanyl. This new panel addresses the increasing prevalence of fentanyl and includes tests for PCP, cocaine, amphetamines, and opioids. It significantly improves accuracy, being 25 times more effective at detecting opioids, 23 times more for cocaine, and 13 times more for amphetamines compared to conventional tests.

-

In December 2022, Omega Laboratories introduced urine drugs of abuse testing services in its innovative facility in Ontario, Canada. The laboratory will begin to provide urine drug testing in addition to its molecular testing services from January 2023.

U.S. Drug Of Abuse Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.03 billion

Revenue forecast in 2030

USD 1.29 billion

Growth rate

CAGR of 4.65% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug

Country scope

U.S.

Key companies profiled

Quest Diagnostics; Abbott; Clinical Reference Laboratory (CRL), Inc.; Laboratory Corporation of America Holdings; Cordant Health Solutions; Legacy Medical Services; DrugScan; Omega Laboratories, Inc. ; Psychemedics Corporation; Millennium Health, LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Drug Of Abuse Testing Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the U.S. drug of abuse testing services market report based on the drug:

-

Drug Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcohol

-

Cannabis/Marijuana

-

Cocaine

-

Opioids

-

Amphetamine & Methamphetamine

-

LSD

-

Others

-

Frequently Asked Questions About This Report

b. The U.S. drug of abuse testing services market size was estimated at USD 992.57 million in 2024 and is expected to reach USD 1.03 billion in 2025.

b. The U.S. drug of abuse testing services market is expected to grow at a compound annual growth rate of 4.65% from 2025 to 2030 to reach USD 1.29 billion by 2030.

b. Cannabis/Marijuana dominated the U.S. drug of abuse testing services market with a share of 57.32% in 2024. This is attributable to the increasing consumption of cannabis and its legalization across the country

b. Some key players operating in the U.S. drug of abuse testing services market include Quest Diagnostics; Abbott; Clinical Reference Laboratory (CRL), Inc.; Laboratory Corporation of America Holdings; Cordant Health Solutions; Legacy Medical Services; DrugScan; Omega Laboratories, Inc.; Psychemedics Corporation; Millennium Health, LLC

b. Key factors that are driving the market growth include increasing consumption of illicit substances, stringent regulations from employers for routine drug testing, and increasing awareness regarding substance abuse

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."