- Home

- »

- Biotechnology

- »

-

U.S. Dried Blood Spot Collection Cards Market, Industry Report, 2030GVR Report cover

![U.S. Dried Blood Spot Collection Cards Market Size, Share & Trends Report]()

U.S. Dried Blood Spot Collection Cards Market Size, Share & Trends Analysis Report By Application (New Born Screening (NBS), Forensics), By Card Type (Whatman 903, FTA), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-264-1

- Number of Report Pages: 70

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

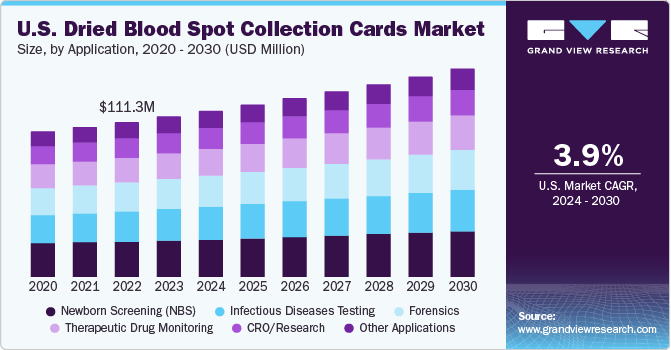

The U.S. dried blood spot collection cards market size was estimated at USD 115.3 million in 2023 and is projected to grow at a CAGR of 3.9% from 2024 to 2030. The expanding utilization of dried blood spot (DBS) cards in forensic toxicology and rising applications in newborn screening are the key drivers of the market. For instance, according to Monobind Inc. fact sheet, the company manufactures approximately 40 million in-vitro diagnostic tests annually, positioning it as one of the key players in the industry, implying the rising adoption of dried blood spot cards in the U.S

The market is growing significantly due to increasing applications in newborn screening. In March 2024, according to March of Dimes, in the U.S., all newborns undergo newborn screening, with approximately 4 million babies screened annually. Newborn screening conducted on infants aged 1 to 2 days is a set of specialized tests aiming to detect rare, yet severe and treatable health conditions at birth. This comprehensive evaluation involves blood, hearing, and heart screenings to ensure early identification and intervention for the well-being of newborns. This is one of the potential factors contributing to the market growth.

Dried blood spot cards are emerging as a valuable tool in forensic toxicology due to their ease of use, cost-effectiveness, and storage stability. The expanding utilization of DBS cards in forensic toxicology is attributed to several factors, including technological advancements, regulatory compliance, and growing importance of non-invasive sampling methods. Analytical techniques such as mass spectrometry and chromatography have evolved, enabling forensic toxicologists to extract and analyze smaller blood volumes from DBS cards effectively. This has led to an increased reliance on DBS cards for various forensic toxicology applications. In addition, the DBS cards are cost-effective and offer long-term storage stability, making them an attractive option for forensic toxicology laboratories. The cards are easily transported and stored for extended periods without compromising sample integrity, which is particularly beneficial in cases where results are needed months or even years after sample collection.

Furthermore, the DBS cards provide a painless, non-invasive method for collecting blood samples, particularly in cases involving infants, elderly individuals, or those with a fear of needles. This has led to a growing preference for DBS cards, as they offer a more comfortable and less intimidating sampling experience. Moreover, according to Hemaxis, a recent review highlighted that DBS sampling demonstrated remarkable performance compared to traditional blood sampling methods. This comprehensive analysis revealed over 2,000 distinct parameters for the analytical techniques that have been documented, showcasing the extensive range of medical applications that can benefit from DBS sampling.

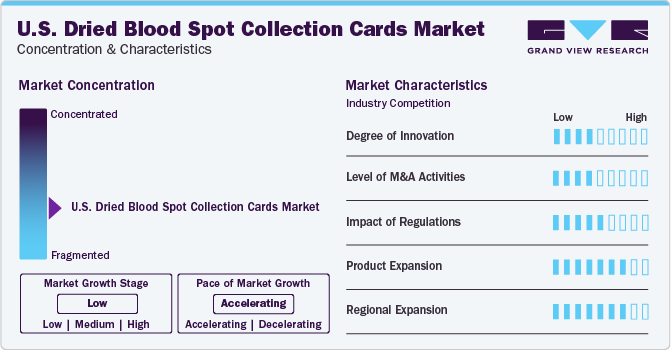

Market Concentration & Characteristics

The market growth stage is low, and the pace is accelerating. The U.S. dried blood spot collection cards market is characterized by a moderate degree of innovation owing to the research and development in in-vitro diagnostics driving it.

The impact of regulation is moderate and is expected to increase further depending upon changing U.S. population demands and government guidelines. According to CBS Interactive Inc., in September 2022, privacy concerns led several states of the U.S. to reevaluate the practice of storing heel blood samples from newborns. The DBS card analysis and testing facilities in the U.S. must adhere to the CLIA program, which sets quality standards for clinical laboratories. This ensures that DBS card testing is conducted in a standardized, accurate, and reliable manner.

The product expansion activity in the market is high, owing to factors such as diverse applications, including screening of newborns and forensic toxicology. For instance, in September 2022, Michigan State screened newborn babies for more than 50 diseases.

The regional expansion activity in the U.S. dried blood spot collection cards market is high, owing to factors such as mandatory newborn screening programs followed by all states of the U.S. as part of a government initiative. According to the U.S. Department of Health & Human Services, Health Resources & Services Administration (HRSA), NBS is mandatory as per state law in the U.S. unless refused by parents.

Application Insights

Newborn screening held the largest revenue share of 23.1% in 2023 and is expected to grow at a significant CAGR of 3.3% during the forecast period. This growth is attributed to the rising number of newborn screenings. According to the Network for Public Health Law, in 2023, each state health department in the U.S. had a newborn screening program. These programs enabled early detection of severe conditions in approximately 13,000 babies every year, proving to be a crucial public health initiative. Moreover, the state health department of U.S. manages a newborn screening program to assess newborns for specific genetic, endocrine, and metabolic disorders. These tests help safeguard the long-term health and survival of infants.

The forensics segment is estimated to witness the fastest growth of CAGR of 4.4% during the forecast period. This is attributed to the increasing applications of DBS collection cards in forensics and enhanced storage ability of DBS collection cards holding genetic information. For instance, according to the National Library of Medicine (NLM), in 2018, the Guthrie cards holding DBS samples could be economically transported via airmail across different continents. These cards could maintain the quality needed for gDNA extraction, enabling Sanger sequencing procedures to be carried out efficiently in overseas laboratories.

Card Type Insights

The Whatman 903 segment dominated the market with the largest share in 2023 and is expected to grow with the fastest CAGR throughout the forecast period due to its cost-effectiveness, ease of use, compatibility with various techniques such as ELISA, PCR, and spectrometry, and high binding capacity allowing efficient sample preparation. For instance, as of 2023, Tisch Scientific offered a Whatman 903 Protein Saver cards pack of 100 for around USD 200 on its online platform. The affordability of Whatman 903 cards is expected to impact its adoption rate positively. These cards also help preserve samples by preventing degradation and protecting them from environmental factors such as temperature and humidity, ensuring they remain stable during transportation and storage.

The FTA segment is expected to witness lucrative growth during the forecast period, due to its numerous benefits in various applications, such as stability, compatibility with multiple techniques involving DNA sequencing, low cost, RNA preservation, environmental friendliness, and sample elution capabilities. These features make FTA a valuable forensics, biology, and medical research tool.

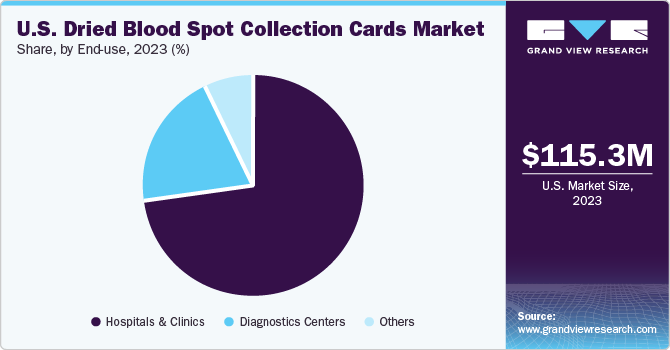

End-use Insights

The hospitals & clinics segment dominated the market and accounted for the largest revenue share in 2023, with a lucrative growth rate over the forecast period. DBS collection cards have gained significant importance in hospitals and clinics due to their convenience, cost-effectiveness, and versatility. These cards are primarily used for collecting, storing, and transporting small blood samples for various diagnostic tests and research purposes.

The others segment is estimated to witness the fastest growth during the forecast period. This is attributed to some benefits, such as affordability, ease of use, and ability to do sampling at home, which limits hospital-based sampling and increases patient compliance. In May 2022, according to the National Library of Medicine, blood sampling at home is expected to reduce hospital visits, reduce patient burden, increase compliance, and increase the quality of life of patients. This is one of the potential factors supporting the segment growth in the upcoming years. Furthermore, at-home DBS blood sampling is also expected to reduce healthcare costs.

Key U.S. Dried Blood Spot Collection Cards Company Insights

Some of the key players operating in the market include Whatman plc, QIAGEN LLC, GE Healthcare, PerkinElmer, MilliporeSigma, CENTOGENE N.V., and Roche.

-

Whatman plc provides FTA cards and DBS collection cards for various applications, including newborn screening, disease monitoring, vaccine research and development, and point-of-care testing. The notable brand names for FTA and DBS cards provided by Whatman plc include Whatman FTA Elute Cards, Whatman FTA Classic Cards, Whatman FTA NeoCard, Whatman FTA Plasma Card, Whatman FTA Card 903 Protein Saver, Whatman FTA Paper, and Whatman DBS Collection Cards.

-

QIAGEN LLC offers FTA cards and DBS collection cards under various brand names. Some of the recognized brand names for FTA and DBS cards provided by QIAGEN LLC include QIAGEN FTA Classic Cards, QIAGEN FTA Elute Cards, QIAGEN FTA NeoCard, QIAGEN FTA Plasma Card, QIAGEN FTA Card 903 Protein Saver, and QIAGEN DBS Collection Cards.

Key U.S. Dried Blood Spot Collection Cards Companies:

- Whatman plc (Cytiva)

- GE Healthcare

- MilliporeSigma

- QIAGEN LLC

- PerkinElmer

- Roche

- Shimadzu Corporation

- Ahlstrom-Munksjö

- Eastern Business Forms, Inc.

- CENTOGENE N.V.

Recent Developments

-

In February 2024, Cytiva and LevitasBio collaborated to provide an advanced single-cell methodology for genomics experts in both academic and commercial sectors.

-

In January 2024, Cytiva highlighted its ability and offering of custom solutions for diagnostic services as per the requirement.

U.S. Dried Blood Spot Collection Cards Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 149.9 million

Growth rate

CAGR of 3.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, card type, end-use, region

Country scope

U.S.

Regional scope

West; Midwest; Northeast; Southwest; Southeast

Key companies profiled

Whatman plc; GE Healthcare; MilliporeSigma; QIAGEN LLC; PerkinElmer; Roche; Shimadzu Corporation; Ahlstrom-Munksjö; Eastern Business Forms, Inc.; CENTOGENE N.V.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

U.S. Dried Blood Spot Collection Cards Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest vertical trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the U.S. dried blood spot collection cards market research report based on application, card type, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Newborn Screening (NBS)

-

Infectious Diseases Testing

-

Therapeutic Drug Monitoring

-

Forensics

-

CRO/Research

-

Other Applications

-

-

Card Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Whatman 903

-

Ahlstrom 226

-

FTA

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Diagnostics Centers

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

West

-

Midwest

-

Northeast

-

Southwest

-

Southeast

-

Frequently Asked Questions About This Report

b. The U.S. dried blood spot collection cards market size was estimated at USD 115.3 million in 2023.

b. The U.S. dried blood spot collection cards market is projected to grow at a compound annual growth rate (CAGR) of 3.9% from 2024 to 2030.

b. The newborn screening segment held the largest revenue share of 23.1% in 2023 owing to the larger number of newborn screenings in the U.S. According to the Network for Public Health Law, in 2023, each state health department in the U.S. had newborn screening programs which enable early detection of severe conditions in approximately 13,000 babies every year, proving to be a crucial public health initiative.

b. Some of the key players operating in the U.S. dried blood spot collection cards market include Whatman plc, QIAGEN LLC, GE Healthcare, Perkinelmer, MilliporeSigma, CENTOGENE N.V., and Roche, among others.

b. The expanding utilization of DBS cards in forensic toxicology and rising applications in newborn screening procedures are the key drivers of the U.S. dried blood spot collection cards market.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."